Big Banks Are Stifling Economic Growth & Taxing Consumers

Stock-Markets / Credit Crisis 2010 Dec 06, 2010 - 08:01 AM GMTBy: Dian_L_Chu

Have you noticed the price of oil lately? It’s $90 a barrel in a dismal economy with unemployment hovering around 10%. The problem with Fed chairman Bernanke`s latest QE 2 initiative is that he has just given more access of cheap money to the big banks.

Have you noticed the price of oil lately? It’s $90 a barrel in a dismal economy with unemployment hovering around 10%. The problem with Fed chairman Bernanke`s latest QE 2 initiative is that he has just given more access of cheap money to the big banks.

Non-Productive Use of QE Money

And what are they doing with all this cheap money? Nothing productive from an economic standpoint. Instead of lending the money to entrepreneurs, business projects, and venture capital initiatives which actually create jobs and foster much needed economic growth, the big banks are just taking this cheap money and pouring it into commodities like crude oil, copper and grains.

Taxing Consumers by Bidding Up Commodities

So not only are the big banks doing nothing productive with the latest QE2 capital, but they are in essence dragging down economic growth with a counterproductive tax on consumers when they can least afford it. The last thing the economy needs with 10% unemployment is to be paying a hefty tax on food and energy products, especially given the fact that these markets are well supplied, and are necessity items for consumers.

Actually, Mr. Bernanke would have been better served by taking liquidity out of the system, as commodities would be much cheaper with higher rates, and the economy would be much more inclined to spur economic growth and job creation with lower food and energy prices.

Deflaton Fear - Theory vs. Reality

The entire notion that we have to worry about a Japan-style deflation is completely overblown, and the manifestation of over the top theoretical academic postulating. Sure, the US is just coming out of a recession, and we are growing slowly, but the differences between Japan and the United States in terms of resources, demographics, economic diversity, monetary policy, and how the US handled losses in the banking sector makes any comparison between the two countries a wild stretch by any standard.

This is the problem with having too many academics in the Fed, and absolutely no one with any market experience who understands how markets actually function. Mr. Bernanke even admitted in open proceedings in front of Congress that he didn`t understand the dynamics of the Gold market--a pretty telling inadequacy as the head of our monetary policy.

Exporting Inflation via Commodity Plays

But there is more to the story of how big banks are actually hurting global growth if we analyze the emerging markets and their burgeoning inflation problem. The emerging market economies like China, for example, have gone into tightening mode in order to fight what is starting to appear as a runaway inflation problem with a CPI reading of 4.4%, and talk of a 5% reading on the next CPI report.

Meanwhile, crude oil is up $10 and gasoline prices are up 25 cents per gallon since Bernanke’s QE2 announcement, and this doesn`t even factor in the run-up in commodity prices since QE2 was up for debate starting in August.

China Tightening Bad For All

How is this going to slow global growth? Well, because China needs to fight inflation, and the big banks are exporting inflation even further by pumping more money into commodities, artificially raising prices beyond any fundamental basis for these commodities, China has a more severe inflation fight on their hands, which means even more severe tightening measures and monetary policy controls.

So, what do these severe monetary measures do for growth in China? It starts putting downward pressure on the economy, i.e., results in slower growth. In essence, not only does big banks’ propensity to take government cheap capital and ineffectively invest it stifle growth in the US, but also is exported in the form of higher input costs and increased inflation dynamics for the emerging economies, which had previously been the one bright spot keeping the global economy afloat.

CFTC – No Action

The CFTC as part of the financial reform bill are supposed to come out with some new position limits for the big banks which might be helpful in reducing some of the speculative inflows into these commodities. But they keep dragging their feet on the issue, and since the big banks have historically obfuscated these rules in the past, I wouldn’t hold my breath on that one.

Take Physical Delivery or Else

However, it would be interesting to see this rule passed for the crude oil market--All market participants have to take physical delivery. Then, literally overnight, you would see the price of oil drop to $40-$50 a barrel as very few market participants actually take physical delivery.

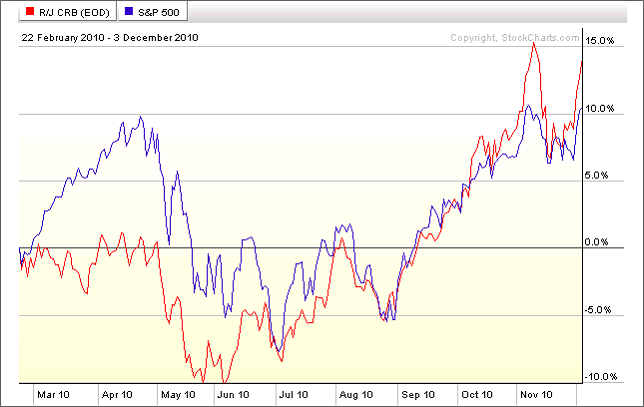

Commodity generally has an inverse relationship with equity. But crude oil these days trades more in line with the S&P 500 as an asset class (see Chart) rather than as a commodity subject to supply and demand dynamics where producers and users like airlines actually hedge their interests.

Actually if the big banks like Goldman Sachs, Morgan Stanley, J.P. Morgan, HSBC and Bank of America got out of the business of pumping of commodity prices like oil, there would be a lesser need to hedge in the first place by actual producers and users.

Price Distortion = Lower Producer Profit

It’s the price distortion practices of the big banks that provide for so much volatility and instability in the market which needs to be curtailed so that the underlying fundamentals of supply and demand dynamics that embodies free markets can actually occur.

Producers are even hurt by this volatility and market price distortions as many have both upstream and downstream exposure, and with 10% unemployment and a sluggish economy, you can only pass so much of the gasoline price onto consumers and businesses, so the price of crude rises higher than the price of the products, which really hurts their refining margins.

QEs Should Be Conditional

The QE2 initiative is not the end of the world, but if you are going to go down this road, you need to have some kind of disincentive and/or penalty for the big banks to just take this extra cheap liquidity, and go and pile this capital into commodities like food and energy futures, and provide some sort of incentive for actually get this capital to directly support job creating business activity. After all, isn`t the business of lending supposed to be their primary business in the first place?

Even the I-Banks like Goldman Sachs and Morgan Stanley could better serve the Fed`s purpose of fostering economic growth and job creation if they used this cheap money for fueling venture capital initiatives and underwriting business expansion activities for corporations as opposed to taxing consumers through their investment in commodities like food and energy.

The Fed can also put some kind of ground rules for the big banks in what they can invest this essentially zero percent capital into so that the productive utilization of this capital occurs thereby stimulating job creation and economic growth, versus the counterproductive use of this cheap capital which actually stifles the economy and hinders job creation through higher input costs, and an effective tax on consumption in higher commodity prices.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.