American Retirement Funds at Serious Risk of Being Seized

Personal_Finance / Pensions & Retirement Dec 07, 2010 - 09:44 AM GMTBy: Jeb_Handwerger

The news of Hungary effectively seizing private pension fund assets to pay for the debt obligations of the state last week should come as yet another reminder of the urgent need to get tax-sheltered retirement savings away from the clutches of the state before it's too late. Hungary is just the latest country to decide that it's citizens retirement savings are the property of the state.

The news of Hungary effectively seizing private pension fund assets to pay for the debt obligations of the state last week should come as yet another reminder of the urgent need to get tax-sheltered retirement savings away from the clutches of the state before it's too late. Hungary is just the latest country to decide that it's citizens retirement savings are the property of the state.

The last major country to use similar tactics was Argentina who confiscated about $3.2 billion of pension savings in 2001 before the country stopped servicing its debt and then nationalized the $24 billion industry two years ago to compensate for falling tax revenue after a 2005 debt restructuring.

On November 24th the Hungarian government gave its citizens an ultimatum: move your private-pension fund assets to the state or lose your state pension. Economy Minister Gyorgy Matolcsy announced the policy, escalating a government drive to bring 3 trillion forint ($14.6 billion) of privately managed pension assets under state control to reduce the budget deficit and public debt. Workers who opt against returning to the state system stand to lose 70 percent of their pension claim.

Americans who think "this can't happen here" may want to think again.

In September of this year the US Treasury investigated the possibility of requiring retirement funds to hold a percentage of government securities in their investment portfolio. That, in effect, would be a nationalization of 401ks and IRAs.

And don't think for a second that the US is in better financial shape than Hungary.

The moves in Hungary were prompted by large annual budget deficits and a large debt to GDP ratio. So, let's compare Hungary's deficit and debt to that of the US.

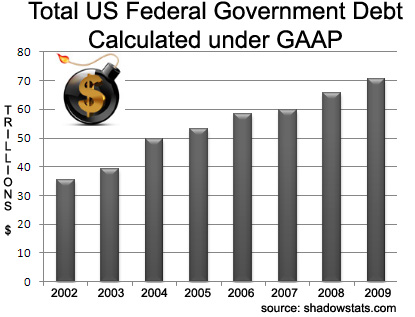

First, a warning: Accept the US governments own financial statistics at your own risk. Federal debt, unemployment and CPI, just to name a few, bear no resemblance to reality.

The federal debt, as proclaimed by the US government is stated to be $13.8 trillion but just subjecting federal government numbers to Generally Accepted Accounting Principles (GAAP) shows a true debt, if accounted for properly, of $71 trillion as of 2009.

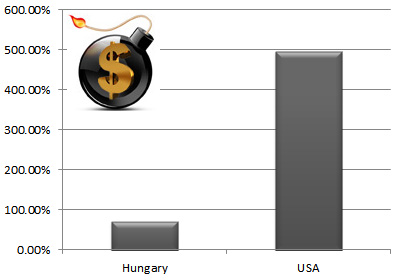

In 2009 the US GDP was $14.26 trillion. Therefore, the debt to GDP ratio of the US is 497.89%.

Hungary's 2009 GDP was $128.96 billion and their national debt was $93.36 billion for a debt to GDP ratio of 72.4%.

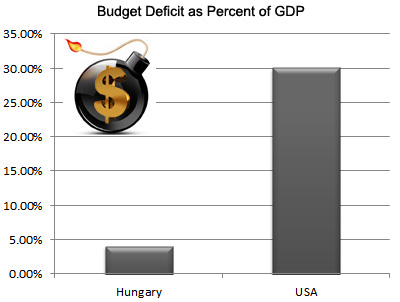

That doesn't look so good for the US. How about the budget deficit as a percentage of GDP?

Hungary posted a budget deficit of 4% in 2009. Meanwhile, when accounted by GAAP standards, as calculated by Shadowstats.com, the total deficit in 2009 was $4.3 trillion. Compared to a GDP of $14.26 trillion the 2009 budget deficit as a percentage of GDP was 30.15%.

Considering that Hungary was downgraded today by Moody's to Baa1, close to a "junk" rating, and the US' debt to GDP ratio is five times worse than Hungary's and the US budget deficit as a percentage of GDP is more than 7 times worse, those with retirement savings in the US should quite easily see the writing on the wall.

Gold made an all-time high of $1423.40 today, also clearly showing the writing is on the wall for the entire US dollar based financial system.

Keeping retirement funds inside of tax-sheltered accounts, which the US government will soon look to as the next source of funds to try to pay off its mountain of debt and keeping retirement funds in US dollar based "assets" is putting your retirement and future at great risk.

Grab your free 30-day trial of my Members-Only Premium Stock Analysis Service NOW at:

http://goldstocktrades.com/premium-service-trial

© 2010 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.