Bernanke Caught Out in Massive Lie on Money Printing

Politics / Central Banks Dec 09, 2010 - 02:06 AM GMTBy: Mike_Shedlock

Leave it to the Daily Show to express in a humorous way the blatant lies of Fed Chairman Ben Bernanke about "Printing Money". The amazing thing is Bernanke exposed himself, in his own words.

Leave it to the Daily Show to express in a humorous way the blatant lies of Fed Chairman Ben Bernanke about "Printing Money". The amazing thing is Bernanke exposed himself, in his own words.

The clip notes an interesting discrepancy with what Ben Bernanke told 60 Minutes in his first infomercial on 60 Minutes in March of 2009 and what he said Sunday December 5, 2010.

Flashback March 15, 2009: Ben Bernanke on 60 Minutes- Complete Transcript

PELLEY Is that tax money that the Fed is spending?

BERNANKE It's not tax money. the banks have-- accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. so it's much more akin to printing money than it is to borrowing.

PELLEY You've been printing money?

BERNANKE Well, effectively. And we need to do that, because our economy is very weak and inflation is very low. when the economy begins to recover, that will be the time that we need to unwind those programs, raise interest rates, reduce the money supply, and make sure that we have a recovery that does not involve inflation.

Flash Forward December 2010: Lies, Half-Truths, and 100% Hubris on 60 Minutes; Deficit-Chicken Republicans; Middle-Class Crucifixion; Ron Paul Needs Your Support

Bernanke: "One myth that's out there is that what we're doing is printing money. We're not printing money. The amount of currency in circulation is not changing. The money supply is not changing in any significant way. What we're doing is lowing interest rates by buying Treasury securities. And by lowering interest rates, we hope to stimulate the economy to grow faster. So, the trick is to find the appropriate moment when to begin to unwind this policy. And that's what we're gonna do."

This is exactly why we need Ron Paul as chairman of the Monetary Policy subcommittee. Here is the Email I sent John Boehner who will replace Nancy Pelosi as the next Speaker of the House.

Dear Mr. Speaker

As Speaker of the House, you have a duty to watch out for all citizens of the United States, not just your own Ohio constituency or the bank lobby.

As such I kindly ask you honor the will of the people and appoint Ron Paul as chairman of the Monetary Policy subcommittee.

Thank you.

Mike "Mish" ShedlockNote: Ron Paul got that Subcommitte - See Addendum 3

Please email House Speaker Boehner Regarding Ron Paul to let him know how you feel. That link will put in a subject line of Ron Paul for Monetary Policy Chairmanship.

Please email House Speaker Boehner Regarding the Budget. The second link will put in a subject line of $900 Billion Budget Compromise.

Just click on the links and type away to your heart's content. If your browser does not interface with email, then simply email Boehner at AsktheLeader@mail.house.gov

Addendum:

Reader "JD" writes ...

I watched the most recent Bernanke interview on 60 Minutes and was startled by one of Bernanke's responses to the interviewer. When asked how certain he was that QE2 would work, Bernanke replied: "100%!"

That reminded me of the preface to Nobel Prize-winning author Czeslaw Milosz's The Captive Mind:

"When someone is honestly 55% right, that’s very good and there’s no use wrangling. And if someone is 60% right, it’s wonderful, it’s great luck, and let him thank God. But what’s to be said about 75% right? Wise people say this is suspicious. Well, and what about 100% right? Whoever say he’s 100% right is a fanatic, a thug, and the worst kind of rascal."I talked about the concept of being 100% certain previously as well. Here is the snip from Lies, Half-Truths, and 100% Hubris on 60 Minutes; Deficit-Chicken Republicans; Middle-Class Crucifixion; Ron Paul Needs Your Support

100 Percent Hubris

What if this does not spur hiring but instead spurs gasoline prices and food prices? Oh not to worry ....

Pelley: You have what degree of confidence in your ability to control this?

Bernanke: One hundred percent.

Bernanke is a man with 100% confidence who did not see the housing bubble, who did not see a recession, whose worst case scenario for unemployment was 8.5% when it was already over 8%. Bernanke cannot find his ass with both hands and a roadmap, yet he is one hundred percent certain about his ability to control things.

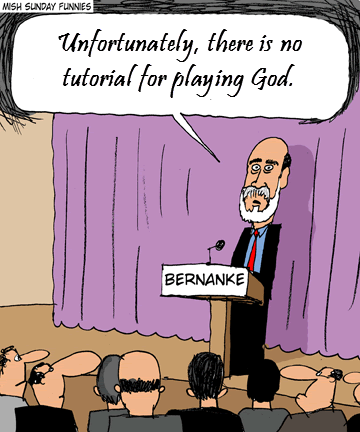

After everything blows sky high we just may hear a statement like this.

Addendum #2:

Caroline Baum has some interesting comments regarding 100% certainty in Bernanke’s 21-Month Conversion Takes 60 MinutesHe probably wishes he hadn’t said it, the part about the Federal Reserve not printing money and his 100 percent confidence in his ability to raise interest rates at the appropriate time to prevent an acceleration of inflation.

But he did. The Fed does (print money). And nothing is 100 percent certain in this world, except death and taxes.

So what on earth was Ben Bernanke thinking when he talked to Scott Pelley on CBS’s “60 Minutes” Sunday night?

Compare and Contrast

Let’s compare the Bernanke of March 2009, working on little sleep and lots of adrenalin to keep the markets functioning and economy afloat, to the Bernanke of December 2010.

Back then, Bernanke conceded that “It’s hard to forecast where we’re going.” It is hard -- in both good times and bad. The uncertainty principle applies to both phases of the business cycle, not just a contracting economy.

Now, asked by Pelley what degree of confidence he had in his ability to act at the appropriate time to prevent inflation from accelerating, Bernanke said, “A hundred percent.”

What’s so troubling about the Sunday interview is that it wasn’t Bernanke, the media-shy economist, talking. It was a politician attempting to bolster confidence in his constituents and support for his policies. That’s not an ideal character trait for a central banker at a time when official interest rates, already close to zero, can only go up.

In the March 2009 interview, Bernanke said that the biggest risk was that the U.S. wouldn’t have the “political will” to fight the crisis and would withdraw support for the economy too early.

After Sunday’s interview, we no longer have to worry about the Fed’s commitment to doing whatever it takes to promote a self-sustaining recovery. The real concern is policy makers won’t know when they’ve done enough. If history is any guide, we can be almost 100 percent certain that they won’t.Addendum 3:

Proving that on occasion the little guy can occasionally win, Ron Paul announced to tonight that he will be named Chairman of the Monetary Policy Subcommittee.

For details, please see Ron Paul Claims Chairmanship of Monetary Policy Subcommittee, Prepared to Subpoena FedClick Here To Scroll Thru My Recent Post ListBy Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.