Gold and Silver Upate

Commodities / Gold and Silver 2010 Dec 10, 2010 - 03:38 AM GMTBy: Bob_Kirtley

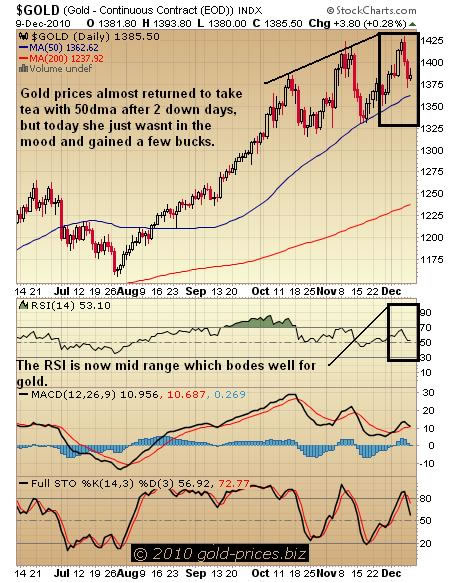

Gold prices almost returned to take tea with the 50dma after 2 down days, but today she just wasn’t in the mood and gained a few bucks just to keep us all guessing at where next for gold. The RSI is now mid range, standing at 53.10 today, which bodes well for future higher gold prices. The STO is heading south so short term we may see gold go a tad lower, however, the MACD is no longer dancing on the ceiling, which takes some of the pressure off and leaves some room for gold to go higher.

Gold prices almost returned to take tea with the 50dma after 2 down days, but today she just wasn’t in the mood and gained a few bucks just to keep us all guessing at where next for gold. The RSI is now mid range, standing at 53.10 today, which bodes well for future higher gold prices. The STO is heading south so short term we may see gold go a tad lower, however, the MACD is no longer dancing on the ceiling, which takes some of the pressure off and leaves some room for gold to go higher.

Now, taking a scan of the air waves we have a couple items that just might capture your interest. The first is a few comments from Nick Barisheff ofwww.bmgbullion.com fame, during in an interview on BNN which you can watch in full by clicking this link.

He touched on China were gold imports were 50 tonnes last year, however, during the first nine months of this year they have imported 200 tonnes, so they are really stepping up to the plate. The worry for the Chinese people is inflation, where food is running at double digit figures, there is also a general distrust of the financial markets and real estate is experiencing a bit of a bubble. So precious metals are coming into focus as an alternative.

Nick also give his opinion of gold relative to global financial assets excluding real estate which is valued at $200 trillion.

The value of above ground gold is $6 trillion made up as follows:

$3.0 trillion in jewelry and religious items, such as those held in the Vatican, etc, which is unlikely to enter the market anytime soon.

$1.5 trillion is held by the central banks, who are no longer sellers of gold.

$1.5 trillion is held privately by wealthy families on a multi-generational basis and will probably remain in their hands.

Nick then posed the question: What if 10% of those who are currently holding global financial assets decided to move into gold?

The mind boggles at this point, we would have $20 trillion chasing just how much available gold!

Moving on, we have this snippet from King World News:

The contact out of London has updated King World News on the massive Asian buyers which have been accumulating both gold and silver. The London source stated,

“A bunch of the weak hands are now on the short side of this market. We are very close to a floor because of the massive Asian buying. People have to remember these Asian buyers are now controlling the gold and silver markets, it is not the little guy.” Money flowing out of bonds is going into precious metals. So what they are doing is trying to paint the tape and make it look like a double-top in gold, with silver also retreating. Open interest went up into the decline, this is a gift (the decline). Asian buyers are laughing, we’re like a cartoon to them. They cannot believe how orchestrated this is.”

What about gold?

“As far as the gold market is concerned, gold will be $150 higher from here within five weeks.”

So that would take us to $1536.00 by about the 15th January 2011.

A few things to chew on as you battle through your working day.

And now a quick look at Silver:

Silver prices closed at $28.33/oz and gold prices closed at $1381.30 as both of these precious metals suffered from a bought of profit taking that sometimes accompanies the big number wobbles. The bears will argue that it is a lot more serious then mere profit taking and that this is a meaningful reversal. However, we do not agree with this stance and remain just as bullish as we ever have been on both gold and silver going higher, with silver prices outperforming gold prices.

A quick look at the above chart of silver prices and we can see that they appear to have undergone a reversal, we think it is down to profit taking, but as always it could be more serious so take care with your trading activities. The gap between the price and the 200dma is also fairly wide which makes us a tad uncomfortable as we have mentioned from time to time. However, as we understand it physical silver is in short supply and hard to come by, so the fundamentals of supply and demand come into play and we believe that they will once again over rule the technical analysis that we derive from the charts. The fizz has been taken out of the RSI as it trades at 58.22, but the MACD and the STO are still high, a week of sideways consolidation would be fine by us.

With regard to the taking of physical delivery we have this snippet from King World News:

Since King World News broke the news with Jim Rickards that a Swiss bank client was refused his $40 million of gold and had to threaten the bank to get it, the story has been going viral. KWN interviewed James Turk out of London today to get his comments on the situation. Turk responded by citing another example, “I found that Jim Rickards comments about the individual who had difficulty getting $40 million of gold out of the Swiss bank where he had it stored very interesting. I could tell you several stories of similar experiences.”

It may only be anecdotal evidence but there are few of these stories knocking around, so once again you just might want to give some consideration to having your metal in your own hands rather than holding a paper receipt from a highly respected custodian.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.