The Stock Markets are Celebrating but Commodities are Clueless

Stock-Markets / Stock Markets 2010 Dec 13, 2010 - 02:03 PM GMTBy: Bari_Baig

The optimism today moved east to west as Chinese stocks which rose on Friday, rose the second day after Peoples Bank of China opted not to increase the interest rate as the street expected a hike however PBoC increased the reserve requirement on six of the largest banks of China. Nonetheless, no interest rate hike meant a green signal for the bulls to begin their rampage and this too is now visible in the U.S market.

The optimism today moved east to west as Chinese stocks which rose on Friday, rose the second day after Peoples Bank of China opted not to increase the interest rate as the street expected a hike however PBoC increased the reserve requirement on six of the largest banks of China. Nonetheless, no interest rate hike meant a green signal for the bulls to begin their rampage and this too is now visible in the U.S market.

As we wrote in our article [The quite Equity Days] dated December 9th on www.marketprojection.net that “Equity markets all over the world are enjoying a peace time. This quiet phase now seems to be running towards its end as in a day or more likely with the start of new week shall be a turning point as the consolidation phase ends”.

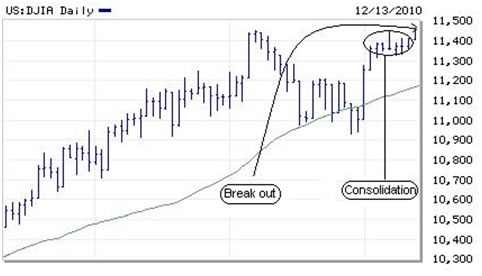

So, for now it seems Dow has broken free of the consolidation phase and could very well post a new high for 2010. Would we be surprised? Not at all, a bull run upwards after clearing the plausible jitters between the previous peak and 11,550 could give way to new highs of mid 11,700s.

Looking at the chart below we can clearly see the Dow has clearly given a breakout. The secondary confirmation is that Dow is currently trading above the highest peak within the consolidation phase and as we write it is close to trading November 5th high. At this point one might assume the break over new high would be followed by all “new” buying, logical and makes sense nonetheless, to us Dow faces medium turbulence upwards to 11,550 or 100 points from the November 5th peak, only after that the climb becomes smoother.

The RSI is neither overbought nor oversold and is above the neutral territory therefore as Dow advances the jitters would be caused primarily due to a shift in sentiment.

Now looking at FTSE which seems to be leading the way and is more likely to post a new high and continue its winning streak much more comfortably than Dow. The Chart below shows an upward consolidation and the previous peak high at 5,900.

What we find interesting is how quiet the Euro Zone debt issues have been in last few sessions and therefore equity markets are pressing ahead. German Finance Minister Mr. Wolfgang said in “Bild” newspaper on Sunday that “no country can be ejected from the euro zone”. This further added strength to the European equities in general. We remain bullish of equities but at first sign of “crisis” news starting to surface which could be around the end of week or beginning of next week, we’d surely be the first to run.

A look at Crude and Gold: As we write Crude is trading $88.50s per barrel. But earlier in the session, it seemed it would be breaking the top of $90 per barrel as it traded a high of $89.99. What we find interesting is that regardless of the green back being badly thrashed today on basis of U.S probably losing its AAA rating, the energy has not responded in the typical of inverse correlation. Crude after marching ahead has been gradually easing off.

The OPEC meeting which took place over the weekend and as we suggested would be the least known meeting, ended as it started and it seemed it was more of a leisure trip for the members than anything else. The only meaningful and interesting thing which we could take out from the meeting was some of the comments from the members regarding currencies fluctuation. Yes, the Oil Cartel seemed more focused on currencies than the energy market much like everyone else nowadays.

The move upward by Crude has somewhat changed the trend as what seemed like a clear top before now after today’s violation as Crude today trumped Thursday’s high of 89.85 is looking more in a sideways consolidation band than anything else. We shall continue to eye the downside until a decisive break is not given to either side. For now there is no material change in the contango and the spread between Brent and WTI seems to be holding rather well at about $2.5 therefore not making the latter at a discount to former. Weather for now is the key factor which seems to be supporting energy more than any other factor.

Now coming to Gold after forming two intraday bottoms on Friday Gold now seems to be much more stable and now has a well defined neckline at $1,393. Currently as we write Gold is trading above it by $4 which is supportive of our bullish view on the yellow precious metal. We stressed last time about the significance of consolidation which Gold overlooked and consequently came under serious selling however, we feel this time the Gold Bulls would be a lot more careful.

Gold has been choppy today with bias towards the upside. We feel, a break over $1,400 would not be as smooth as it was last time around. Regardless of being inches away from $1,400 gold could take as much as two trading session to fully clear the resistance level and establish a bottom around $1,400. The news of U.S losing its AAA rating added more volatility to the metal as the bulls and bears couldn’t decide which direction to head to. We continue to maintain our bullish stance and do not see new record highs posted this week.

By Bari Baig

http://www.marketprojection.net

© 2010 Copyright Bari Baig - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.