Gold Over $1,400/oz Again, Supported by Inflation and Paper Currency Concerns

Commodities / Gold and Silver 2010 Dec 14, 2010 - 06:40 AM GMTBy: GoldCore

Gold has risen in major currencies again today on continuing concerns about the dollar and paper currencies, and growing concerns about the emergence of inflation internationally. Commodity prices remain strong with bellwether copper rising to new record nominal highs and oil continuing to hover near $90 a barrel.

Gold has risen in major currencies again today on continuing concerns about the dollar and paper currencies, and growing concerns about the emergence of inflation internationally. Commodity prices remain strong with bellwether copper rising to new record nominal highs and oil continuing to hover near $90 a barrel.

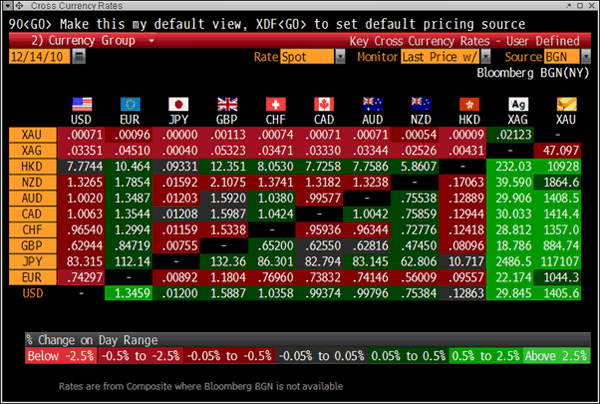

Gold is currently trading at $1,405.35/oz, €1,044.48/oz and £886.04/oz.

Cross Currency Table

Market focus has shifted from the Eurozone debt crisis to the massive fiscal challenges facing the US. The extension of the Bush tax cuts by the Obama administration may be positive for economic growth in the short term but will do nothing to help the very poor fiscal situation of the US with budget deficits of around 10% forecast for the next two years.

Credit rating agency Moody's has warned that the poor fiscal situation poses a threat to the US' important AAA credit rating. This led to a slump in the dollar yesterday and the outlook for the dollar, the world's reserve currency, remains bleak given the scale of the fiscal crisis challenging it.

Gold in USD - 30 Day (Tick)

Gold rose in major currencies yesterday and was particularly strong in sterling (up from £878/oz to £887/oz – see chart below). Sterling came under pressure after very poor housing data raised concerns about the property market and on concerns that the UK may soon embark on QE2 if economic growth weakens due to the Eurozone crisis.

Gold in GBP - 30 Day (Tick)

SILVER

Silver is currently trading $29.80/oz, €22.16/oz and £18.79/oz.

Continuing allegations of concentrated short positions and market manipulation of the silver market as alleged by GATA, other analysts and now many investors in lawsuits, was covered in the Financial Times today. Unnamed sources familiar with the matter said that JP Morgan (JPM) had reduced their large position in the silver market. While the JP Morgan silver allegations are widely known internationally having gone viral on the internet, it is the first time that the story has entered the mainstream financial press. It is important as it will alert large investors and embolden those who already scent blood in the silver pits and increases the possibility of a short squeeze which would propel prices much higher.

Given the conduct of many Wall street banks in recent months and years it is prudent to have an open mind as it is far from beyond the realms of possibility that there has been manipulation and artificial capping of the silver price - both for profit but also in order to maintain faith in the dollar.

The gold/silver ratio continues to fall and is now at 47.14. Silver remains more than 30% below its nominal price in 1980 and given the very sizeable quantities of silver used in industrial applications in the last 30 years and in the 20th century, the ratio is likely to continue to revert to the historical long term average of 15 to 1. Meaning that 15 ounces of silver should in time be able to buy 1 ounce of gold. This makes sense from a supply perspective as geologically there are 15 parts of silver to every 1 part of gold in the earth's crust.

Gold/Silver Ratio (1970 - 2010)

PLATINUM GROUP METALS

Platinum is currently trading at $1,707.25, palladium at $758.00/oz and rhodium at $2,225/oz.

NEWS

(Financial Times) -- JPMorgan has quietly reduced a large position in the US silver futures market that had been at the centre of a controversy about its impact...(see News on Home page)

(Bloomberg) -- JPMorgan Chase & Co. reduced a large position in the U.S. silver futures market, the Financial Times said, citing an unidentified person familiar with the matter. The decision was made to try to deflect public criticism of its dealings in silver, the FT said. The bank's silver positions would from now on be "materially smaller" than in the past, according to the paper. Two calls and an e-mail to Jennifer Zuccarelli, a New York-based spokeswoman at JPMorgan, were not immediately answered outside of office hours.

Comex silver surged 77 percent this year, extending the 49 percent rally in 2009. Prices climbed to a 30-year high of $30.75 an ounce on Dec. 7 as investors sought precious metals as a store of value.

(Bloomberg) -- The Chinese Gold & Exchange Society, Hong Kong's only bourse for spot precious metals, said it will introduce a yuan-denominated gold contract next year.

(Bloomberg) -- Gold demand in South Korea is set to increase as consumers buy more bars and boost investments as currencies weaken, according to Korea Exchange Inc., which expects increased trading in its so-called mini futures contract.

"Koreans have more interest in gold than other commodities, regarding it as an investment tool," Kim In Soo, an executive director at the operator of equities and futures markets, said in an interview yesterday. Korea Exchange is set to start a spot market for bullion in 2012, Kim said, confirming an earlier plan. (Bloomberg) -- European Central Bank purchases ensured Irish and Portuguese bonds beat their euro-region peers this month even as Deutsche Bank AG predicted Portugal will be the next country forced to seek aid.

Irish bonds handed investors a 6.9 percent return since the end of November, trimming losses this year to 10.3 percent. Portuguese debt advanced 3.7 percent, compared with a gain of 1 percent for Spanish securities and 1.04 percent for Italian bonds. Investors lost money on AAA rated German and French debt, according to data compiled by Bloomberg and the European Federation of Financial Analysts Societies.

This update can be found on the GoldCore blog here.

GOLDCORE LAUNCHES THE GOLDSAVER ACCOUNT

The GoldSaver Account allows anyone to buy and save gold online from just €150 per month.

GoldSaver gold holdings are purchased from the Perth Mint of Western Australia. It is stored in their secure vaults, insured and government guaranteed by the AAA rated Western Australian government. Deposits and gold holdings are also independently verified by our auditor on a monthly basis. Find out more about GoldSaver or sign up here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.