U.S. Retailers Canary in the Coal Mine

Companies / Sector Analysis Dec 14, 2010 - 12:52 PM GMTBy: James_Quinn

Some people have contested my statement that there are thousands more retail stores in the US today than there were in 2007. Yes, many mom and pop stores have gone out of business, but the big boys continued to expand in the face of reality. The mall based mega-retailers dominate the retail landscape in this country. Here is a partial list of the biggest retailers in the US and their store counts.

Some people have contested my statement that there are thousands more retail stores in the US today than there were in 2007. Yes, many mom and pop stores have gone out of business, but the big boys continued to expand in the face of reality. The mall based mega-retailers dominate the retail landscape in this country. Here is a partial list of the biggest retailers in the US and their store counts.

Just these nine well known retailers alone, have added 6,435 stores since 2007. Some of the stores were international, but the vast majority were opened in the U.S. This increase in store counts in the face of reality is the ultimate in CEO hubris. Inflation adjusted retail sales since 2007 in the U.S. are down 19%. This is a recipe for disaster. Americans must deleverage over the next decade. They have no choice. Their retirement savings levels are pitiful. They will be forced to stop buying crap. The boomers are leaving their high spending years and entering the forced saving phase of their lives, whether they like it or not. Every retail CEO in the country should recognize these facts. But still, they relentlessly expand. A fool and his company are soon parted.

The lifeblood of retail expansion is same store sales. If same store sales do not increase, any store count expansion becomes a death march. Below is a chart of the same store sales increases/(decreases) for November of each of the years listed for six of the largest well known retailers in America. With a base year of 2006, I've shown what the sales level for comparable stores is today versus 2006. This includes the outstanding growth year of 2007, before the financial crisis. Even a CNBC anchor should be able to realize that the "Best" retailers in America have lower sales today than they did in 2006.

Now for the kicker. Inflation since 2006 according to the BLS has been 10%. Therefore, on an inflation adjusted basis, sales for these retailers since 2006 are down by 7% to 17%.

Today, Best Buy reported atrocious 3rd quarter sales figures. Best Buy is rightly considered one of the best run retailers in America. The Apple iPad is a mass sensation. Consumers are supposedly spending again. The age of austerity is over according to the mainstream media. Best Buy's biggest competitor, Circuit City, went out of business two years ago. The world was its oyster. But somehow, the yellow brick road turned from gold to piss.

In the U.S., Best Buy’s same-store sales dropped 5%, while total sales fell 3% to $8.7 billion. The company estimated that its market share declined 1.1 percentage points, losing traction in TVs and gaming software, and it also expects its share for the year to decline. By categories, U.S. sales of consumer electronics, which make up more than a third of Best Buy’s total domestic business, fell 11%, while entertainment software sales, which make up 15% of the total, slid 14%.

It seems that the storyline being sold to the American public by the media is a load of bull. Best Buy is the first of many retailers to be blindsided by reality. Americans are running out of money. They've used up all the equity in their houses. The credit cards are maxed out. Wages are stagnant. Retirement years in a brown cardboard box awaits delusional Boomers unless they stop spending and start saving.

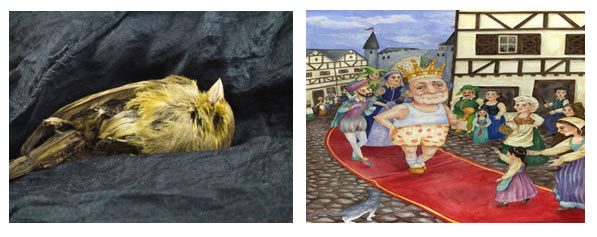

Best Buy's results are the canary in the coal mine. Delusional retail CEO emperors across America need someone to step forward and tell them they have no clothes. Continued expansion in this environment will lead to financial ruin, massive layoffs and bankruptcies.

Based upon history and the known hubris of most CEOs, there will ultimately be thousands of vacant rotting rat infested big box eyesores dotting the landscape over the next ten years. Maybe they can be converted to shelters for homeless delusional Boomers who forgot to save for their retirement. Ask the former CEOs of Montgomery Ward, Circuit City or Blockbuster if it can't happen.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2010 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.