The Gold Sleeper Trend You Need to Know About

Commodities / Gold and Silver 2010 Dec 15, 2010 - 02:58 AM GMTBy: Casey_Research

Louis James, Senior Editor, Casey’s International Speculator writes: In the midst of any long-term trend, like the secular bull market for metals we’re in now, there will be trends within the trends. You could think of them as being like eddies, whorls, and side-channels in a great torrent. We see one such developing that could benefit junior gold stock investors in the near- to mid-term.

Louis James, Senior Editor, Casey’s International Speculator writes: In the midst of any long-term trend, like the secular bull market for metals we’re in now, there will be trends within the trends. You could think of them as being like eddies, whorls, and side-channels in a great torrent. We see one such developing that could benefit junior gold stock investors in the near- to mid-term.

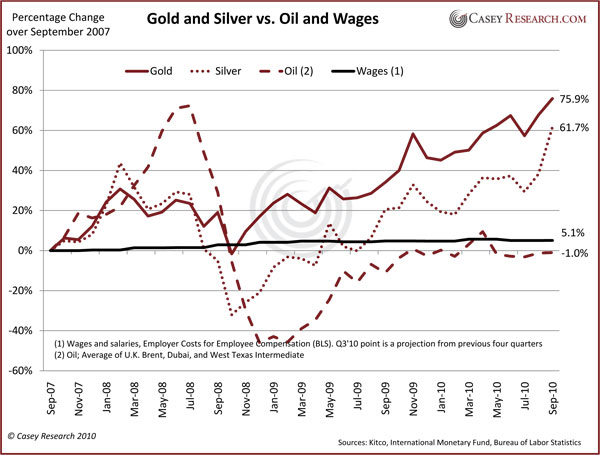

Here’s the basic idea: metals prices, especially precious metals prices, have been increasing at a faster rate than mining costs. Gold and silver are up 75.9% and 61.7% respectively over the last three years, while the cost of things like power, equipment, and wages have not risen as much (-1.0% for oil, and 5.1% for wages, as examples). Obviously, this is good for producing companies, and we have seen the market’s reaction in their share prices.

What may not be so obvious is that companies with major, low-grade discoveries in hand that are preparing economic studies on their projects may enjoy a particular window of opportunity. Sometimes 300-day trailing averages are used to project prices used in estimating mining project economics, sometimes 3-year averages are used. In either case, the top line is going to look great, especially since many costs have risen little or even gone down as a result of the crash of 2008.

Here at Casey Research, we’re predicting more economic turmoil ahead, as the global economy exits the eye of the storm. As that happens, many costs could drop substantially, with economic activity in general. That would hurt the top line for base metal projects (copper, nickel, etc.), but would probably drive it even higher for gold projects (and silver ones that don’t rely too heavily on base metal credits).

For instance, Osisko Mining (T.OSK), one of the big winners among our recent speculations was able to take advantage of the crash of 2008 to greatly improve its cost projections, and even to order big-ticket items at lower prices and with shorter wait periods. This added wind in the company’s sails and helped them to wow the market and raise the capital needed to build their mine with no hedging and little debt.

Of course, margins will look better for all projects studied during a period when revenues are rising faster than costs, but that improvement will be an added benefit for high-margin operations, whereas it could be the difference between life and death for lower-margin operations.

In other words, known large, low-grade deposits are being discounted because the grades make their economic viability questionable – and that discount will seem overdone while mining margins are unusually high.

For example, a company called Geologix Explorations (T.GIX) has a large but low-grade deposit in Mexico. The project has been around for a while, not getting much love from mine analysts – myself included – because the low grade didn’t seem to promise robust economics. However, the company reported a preliminary economic assessment recently, with a startling 28% internal rate of return (IRR) at $900 gold, and a terrific 49% IRR at $1,200 gold. The net present value (NPV) -5% figure came in at $258 million at $900 gold ($555 million at $1,200 gold), which was about 650% of the company’s market capitalization at the time. The market responded, and the company’s stock chart now looks like a hockey stick.

Now, over the life of a large mine, which can be 15, 20, 30, or more years, I doubt margins like those that can be reported at this time will be maintained. Does that make IRRs and NPVs published over the next year or two lies? Not necessarily; if the economics are good enough, the project might be able to pay back the capital expenditures needed to build the mine while margins are high. After that, even a low-grade operation might be able to continue operating profitably for decades.

And it must be said that whether or not a low-grade projects actually becomes a mine, its owner’s share price may still soar, if the company reports credible, robust, and substantial economics.

In today’s frothy market, in which the obvious winners are all getting huge premiums from the market, it’s hard to find anything worthwhile selling cheap. Large projects trading at discounts because of their low grades – but with chances of delivering exceptionally strong numbers while this window of opportunity is open – are just what the doctor ordered. Be careful, however, to do your due diligence, as not all low-grade projects will have what it takes, even with higher metals prices.

[“Due diligence” is Louis James middle name. For years, has been picking the best small-cap metals juniors as the Metals Strategist at Casey Research… beating the S&P 500 by more than 8 times and physical gold by 3 times for his subscribers. For a very limited time, you can save $300 on the annual subscription fee for Casey’s International Speculator– plus receive Casey’s Energy Report FREE for a year! To learn more, click here now.]

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.