Where have all the mortgages gone?– 40% less products available than three months ago!

Housing-Market / UK Housing Oct 19, 2007 - 11:25 AM GMTBy: MoneyFacts

Julia Harris, Mortgage Expert at Moneyfacts.co.uk – the leading independent financial comparison site, comments:“The mortgage market saw an extremely buoyant start to 2007, both in terms of the number of products to choose from – growing 22% in the first six month, but also as new lenders had recently entered the market and existing players explored new lending areas. But since its peak in July, products have been flying off the shelves.

Julia Harris, Mortgage Expert at Moneyfacts.co.uk – the leading independent financial comparison site, comments:“The mortgage market saw an extremely buoyant start to 2007, both in terms of the number of products to choose from – growing 22% in the first six month, but also as new lenders had recently entered the market and existing players explored new lending areas. But since its peak in July, products have been flying off the shelves.

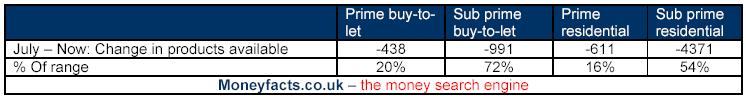

“Overall, taking account of both prime and sub prime deals, the total number of buy-to-let and residential mortgage products available has fallen a staggering 40% in just the last three months. While most of this change can be attributed to the sub prime market, seeing a 72% reduction in the buy-to-let market and a 54% cut in residential deals, the 16% fall in prime residential products is worth noting.

Sub prime

“Within three months, what was the fastest growing mortgage market is now suffering the biggest decline. In general it’s the higher risk products, which have been pulled, while many existing products have also seen more conservative limits applied.

“The maximum LTVs have fallen, self certification products have seen a decline, and borrowers are now less likely to find a sub prime lender that will accept extra heavy or unlimited adverse credit.

Prime

“While a 16% drop may not sound much in comparison to the sub prime market, within a historically static market this is certainly unusual and the reasoning much less clear cut. Northern Rock slashing its 230+ product range to just 70 products has certainly played a role, as has the merger of Nationwide BS and Portman BS.

“The rest can only be attributed to many lenders making more minor changes to their ranges. Some are withdrawing their higher risk products, for example those over 100% LTV or their more specialist deals such as self-cert. Others are simply streamlining their ranges.

What does this mean?

“Clearly an overall 40% reduction in products available will mean less choice for borrowers, particularly for those with bad credit, irregular incomes or those looking for high LTV products. But equally as worrying is the fact that lenders seem to be allowing the market to stagnate, very few new launches are being made, rate changes are slow and there is a discernable lack of innovation. It would appear nobody is prepared to pop their heads over the parapet and make distinctive changes, it’s a wait and see game.

“Lenders are taking a cautious approach, taking preventative action based on what they have learnt from the US. Only time will tell the true extent of the UK mortgage troubles. If housing prices continue to fall or arrears begin to rise, these could be a catalyst for trouble far worse.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.