Bankers Secret Meeting to Control the World?

Stock-Markets / Market Manipulation Dec 16, 2010 - 03:26 AM GMTBy: PhilStockWorld

Revisiting the massive global oil scam... Last year, Phil calculated that this $2.5 Trillion dollar operation was 50 times the size of the Bernie Madoff ponzi scheme. "It's a number so large that, to put it in perspective, we will now begin measuring the damage done to the global economy in "Madoff Units" ($50Bn rip-offs). That's right - $2.5Tn is 50 TIMES the amount of money that Bernie Madoff scammed from investors in his lifetime, yet it is also LESS than the MONTHLY EXCESS price the global population has to pay for a barrel of oil..."

Revisiting the massive global oil scam... Last year, Phil calculated that this $2.5 Trillion dollar operation was 50 times the size of the Bernie Madoff ponzi scheme. "It's a number so large that, to put it in perspective, we will now begin measuring the damage done to the global economy in "Madoff Units" ($50Bn rip-offs). That's right - $2.5Tn is 50 TIMES the amount of money that Bernie Madoff scammed from investors in his lifetime, yet it is also LESS than the MONTHLY EXCESS price the global population has to pay for a barrel of oil..."

If you want to know why the powers that be hate the New York Times – read this!

"The Paper of Record," one of the few remaining news entities not controlled by Rupert Murdoch or some other Billionaire or major corporation, still has the guts to tell it like it is as they are actually pointing a finger right at the Gang of 12 (well 9 of them) and those not-so-secret meetings they have been having for years where they sit down and think of new and exciting ways to control the World. It takes a lot of guts to write an article like this, especially one which actually names ICE (I got my ass handed to me with legal BS when I dared mention them in conjunction with the word "manipulation." Fortunately they straightened me out and we now know that clearly there is no manipulation in the energy markets – can I have my Grandma back now?).

"The Paper of Record," one of the few remaining news entities not controlled by Rupert Murdoch or some other Billionaire or major corporation, still has the guts to tell it like it is as they are actually pointing a finger right at the Gang of 12 (well 9 of them) and those not-so-secret meetings they have been having for years where they sit down and think of new and exciting ways to control the World. It takes a lot of guts to write an article like this, especially one which actually names ICE (I got my ass handed to me with legal BS when I dared mention them in conjunction with the word "manipulation." Fortunately they straightened me out and we now know that clearly there is no manipulation in the energy markets – can I have my Grandma back now?).

Anyway, those fools at the NY Times have thrown caution to the wind without naming specific names using the phrase "giants LIKE JPM, GS and MS" – something I have learned to do as well because, if you don’t – THEY WILL GET YOU! And what are they saying about our friendly Banksters?:

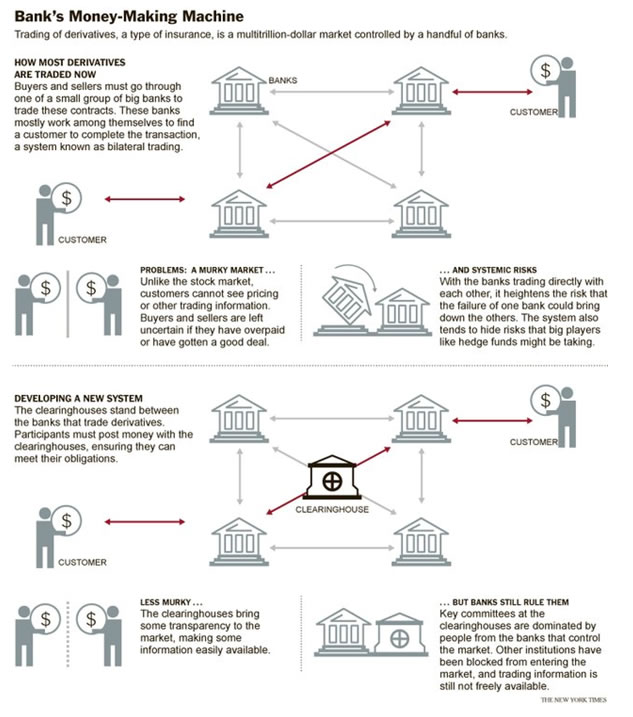

In theory, this group exists to safeguard the integrity of the multitrillion-dollar market. In practice, it also defends the dominance of the big banks. The banks in this group, which is affiliated with a new derivatives clearinghouse, have fought to block other banks from entering the market, and they are also trying to thwart efforts to make full information on prices and fees freely available. Banks’ influence over this market, and over clearinghouses like the one this select group advises, has costly implications for businesses large and small,

According to the Times, the marketplace as it functions now “adds up to higher costs to all Americans,” said Gary Gensler, the chairman of the Commodity Futures Trading Commission, which regulates most derivatives. More oversight of the banks in this market is needed, he said. Big banks influence the rules governing derivatives through a variety of industry groups. The banks’ latest point of influence are clearinghouses like ICE Trust, which holds the monthly meetings with the nine bankers in New York.

According to the Times, the marketplace as it functions now “adds up to higher costs to all Americans,” said Gary Gensler, the chairman of the Commodity Futures Trading Commission, which regulates most derivatives. More oversight of the banks in this market is needed, he said. Big banks influence the rules governing derivatives through a variety of industry groups. The banks’ latest point of influence are clearinghouses like ICE Trust, which holds the monthly meetings with the nine bankers in New York.

Really? Gosh, I had no idea. The ICE people told me that wasn’t true at all. I have many, many pages of correspondence to that effect… “When you limit participation in the governance of an entity to a few like-minded institutions or individuals who have an interest in keeping competitors out, you have the potential for bad things to happen. It’s antitrust 101,” said Robert E. Litan, who helped oversee the Justice Department’s Nasdaq investigation as deputy assistant attorney general. Better say goodbye to Grandma, Mr. Litan…

Critics have called these banks the “derivatives dealers club,” and they warn that the club is unlikely to give up ground easily. The Times points out "Perhaps no business in finance is as profitable today as derivatives. Not making loans. Not offering credit cards. Not advising on mergers and acquisitions. Not managing money for the wealthy."

The secrecy surrounding derivatives trading is a key factor enabling banks to make such large profits and the banks guard that secrecy very closely. In theory, the Dodd-Frank bill will eliminate much of the abuse that is going on in the derivatives market but already, the newly-elected House and Senate Republicans are looking to turn back to clock, which is apropos because, as Barry Ritholtz points out: it was the dreaded Commodity Futures Modernization Act that allowed the rampant shadow banking system to develop.

Source: A Secretive Banking Elite Rules Trading in Derivatives by LOUISE STORY, NY Times

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.