The Economic Reality of the Obama Republican Tax Deal

Economics / Economic Theory Dec 16, 2010 - 09:16 AM GMTBy: Robert_Murphy

Economists and other pundits have been discussing the deal struck between Obama and the Republicans. It is an interesting topic because it showcases the enormous gulf between what makes good political sense and what policies are economically beneficial.

Economists and other pundits have been discussing the deal struck between Obama and the Republicans. It is an interesting topic because it showcases the enormous gulf between what makes good political sense and what policies are economically beneficial.

Paging Orwell: Baseline Budgeting

Paging Orwell: Baseline Budgeting

Perhaps the single biggest oddity in this affair has been the popular reference to it as a "tax cut deal." Now it's true, under this proposal the federal payroll tax rate on workers' incomes (to fund Social Security "contributions") will be lower in January than it was in December.

But even before this particular element was crystallized, people were referring to the whole debate as one over "tax cuts." In reality, the issue was whether current tax rates — which had been in place since 2003 — would stay the same, or whether they would go up in 2011. From this perspective, then, this has been a debate over a tax hike.

Yet in the twisted "baseline budgeting" world of Congress, since the "Bush tax cuts" were set to expire in 2011, "keeping taxes the same" would have meant raising the rates. And thus, keeping the rates the same is actually referred to as "cutting taxes."

Keynesian versus Supply-Side Analysis

For a long time (e.g., item #3 here), promarket economists have been urging a cut in the payroll tax in order to spur employment. Because a key provision in the Obama/Republican deal is a one-year, 2-percentage-point reduction on the employee portion of the tax, one might think that promarket economists would be happy. Yet George Mason economist Bryan Caplan points out that the politicians couldn't even get this right:

With perfectly flexible wages, it doesn't matter whether tax law says "employees pay" or "employers pay." Tax incidence depends on supply and demand elasticity, not legislative intent. If wages are nominally rigid, however, the law matters. If you cut a tax on employers, this reduces labor costs, increases the quantity of labor demanded, and reduces surplus labor. If you cut a tax on employees, in contrast, this increases worker compensation, increases the quantity of labor supplied, and increases surplus labor. …

That's why Obama's proposed payroll tax holiday botches an idea of truly Singaporean cleverness. Instead of giving the tax cut to employers, where it would do the maximum good, or splitting it evenly, where it would do intermediate good, he's giving all of it to employees, where it does the minimum good.

Caplan's analysis at first sounds counterintuitive, but, as we'll see, it's grounded in elementary microeconomics. Keynesian economists — as well as the general public, who have been brought up on Keynesian nostrums — reach the opposite conclusion. From their "demand-side" perspective, the reason a payroll tax cut provides "stimulus" is that it puts more money in the hands of people who might go out and spend it.

From a Keynesian perspective, if the government has, say, $80 billion it wants to devote to stimulus, then the "safest" thing to do is have Congress spend it. Then there's no danger of the money being saved. However, if the government decides to give the $80 billion to the private sector by lowering the tax bite, we get the most bang for the buck (again, from a Keynesian perspective) if the tax cuts go to poor or middle-class people, who are likely to spend most of the rebate.

So we see that the demand-side economists would prefer that a rate reduction of the (currently 6.2 percent) Social Security payroll tax fall on employees. If the government foolishly cut the rate falling on employers, then (so the Keynesians would worry) that money might be saved and "leak" out of the income stream.

To repeat, Bryan Caplan's analysis reaches the opposite conclusion from the Keynesians', because Caplan is focusing on the direct effects of the tax cut on the labor market.

To contrast Caplan's arguments with the Keynesian approach, it is tempting to call Caplan's a "supply-side analysis." However, that's a bit of a misnomer, because Caplan's argument refers to both the supply and the demand for labor.

A Picture Is Worth a Thousand Words

It will be instructive to walk through Caplan's analysis graphically. As I explain in my new principles of economics textbook, much of mainstream economics is filled with superfluous or downright misleading curves and diagrams.

However, supply-and-demand graphs are indispensable for teaching basic price theory. This topic of the payroll tax holiday is a great illustration of the power of these simple diagrams. (The reader who wants a quick refresher on how to interpret these graphs should consult Lesson 11 of the pdf.)

In a Normal Economy, Either Tax Cut Will Do

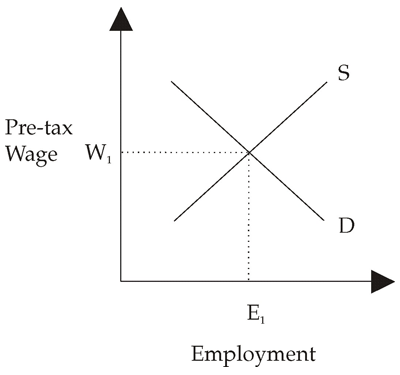

First, let's consider a scenario where we start in a full-employment equilibrium. With the status quo tax rates on employers and employees, we can draw our initial supply-and-demand curves for labor. At the intersection point, we have the initial equilibrium wage rate, denoted W1, and the initial level of employment, E1:

I think most people believe that if the government were to cut the employee side of the payroll tax, it would certainly make the employees better off.[1] In the interest of brevity, then, we won't bother with that case.

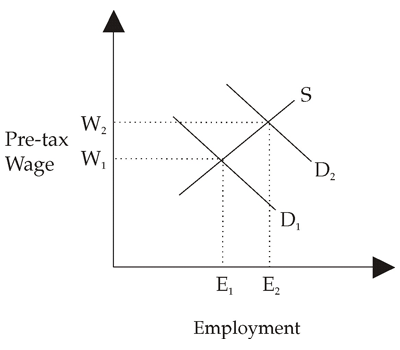

Instead, suppose the government — starting in this initial case of full employment — cuts the payroll tax on employers. What happens then? Well, because they have to cut a smaller check to the government for every dollar in wages that they pay out, the new policy makes employers more willing to hire workers at a given wage rate. In other words, the demand for labor increases, i.e., shifts to the right:

As this second diagram illustrates, the increase in employer demand to hire workers has increased both the wage rate (from W1 to W2) and the total amount of employment (from E1 to E2). Note that the "unemployment rate" doesn't change; the increased wages brought new people into the labor force who previously weren't looking for a job. Both before and after the policy change — in this opening scenario — we are assuming that there was "full employment," meaning that everybody who wanted a job at the going market rate could obtain one.

So we see that in a normal, healthy economy, a cut in either the employee or employer side of the payroll tax would help both the workers and the employers. Which side of the labor market reaps the lion's share of the benefits depends on (what economists call) the elasticity of supply and demand.[2]

Let's now turn to the more complicated scenario, where the economy starts off with a high rate of unemployment. As our simple diagrams will show us, Caplan is correct that, in this second scenario, the government's decision of one tax cut versus the other will have opposite effects on the unemployment rate.

In a Recession, It May Matter Which Side Gets the Tax Cut

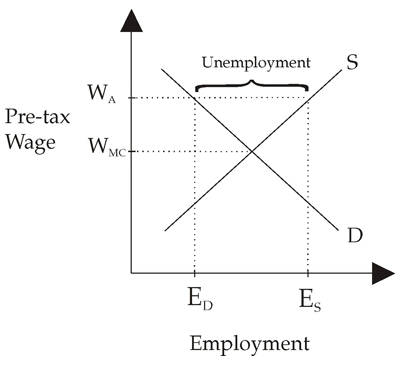

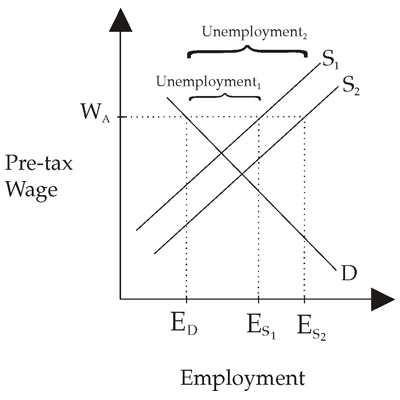

If we want to analyze the impact of employer versus employee payroll tax cuts in the context of a severe recession, our first problem is to figure out how to depict high unemployment with our simple charts. What Caplan has in mind is something like this:

The diagram above is similar to our first diagram, with one major difference: The wage rate that equates the quantity of labor supplied and demanded is WMC, standing for "market-clearing wage." But the actual wage — denoted by WA — is higher. At this higher wage — above the market-clearing level — workers want to supply more labor hours than employers want to buy. This gap between the quantity supplied and the quantity demanded of labor represents unemployment.

Different economists have different explanations for why it should be so, but the simple fact is that in modern market economies, high unemployment can persist for a long time. In terms of our simple supply-and-demand curves for the labor market, it is common to depict this as we have done in our third diagram above, where the actual wage rate is "stuck" (for some reason) above the market-clearing level.

Now then, what happens if the government cuts the payroll tax on employers (as Caplan wants)? As before, this will increase the demand for labor, because (at any given pretax wage rate) the employer now gets the same amount of labor hours for a lower out-of-pocket expense. Our next diagram shows what happens when we increase the demand for labor, starting from an initial position of high unemployment:

As the above diagram illustrates, a modest increase in labor demand doesn't make wages rise. However, it does lead to an increase in the total number of employed, from ED1 to ED2, and it shrinks the gap between the quantity supplied and demanded of labor. In other words, the tax cut on employers reduces the unemployment rate.

But what if, instead, the government had given the entire payroll tax cut to the employees — as the Obama/Republican deal suggests? In this case, things are entirely different:

Because workers get to keep a larger fraction of their pretax wage, the supply curve of labor moves to the right. That is, for a given pretax wage, more people want a particular job than before, because now the government is letting workers keep an extra 2 percent.

Normally, the market would accommodate the increased labor turnout by a falling (pretax) wage rate, which would induce employers (moving along their original demand curve) to hire the newcomers.

But by assumption we are in a recession, and for some reason, wages are "stuck" at the floor of WA. Therefore, the increased labor supply simply adds more people to the ranks of the unemployed. To be sure, the people who originally had jobs — i.e., the portion ED of the population — are definitely better off, because of the payroll tax cut. But the official unemployment rate, as measured by the Bureau of Labor Statistics and reported by the financial press, will paradoxically go up.

This result might strike some as odd, so let's switch to concrete numbers to make it clearer. Suppose that initially, there are 90 million people with jobs that pay an average pretax salary of $50,000 per year. At that level of pay, and given the status quo Social Security tax rate of 6.2 percent on employees, there are an additional 10 million people who would love to have such a job but can't seem to find an opening. Therefore the measured unemployment rate is 10 percent (because 10 million people out of a total labor force of 100 million can't find work).

Now, the government slashes the employee tax rate down to 4.2 percent. On a $50,000 salary, the average worker sees his take-home pay go up by $1,000 per year. Because having a job is now more attractive than it was before, even more people want to get a job. But employers don't see any reason to hire more people than before; they don't directly benefit from a cut in the employee side of the tax. So although the 90 million people who had jobs initially now pocket an extra $1,000 per year and are clearly happier, the ranks of the officially unemployed swell to, say, 14 million. The unemployment rate rises to about 13.5 percent (14 million seeking work / 104 million total in the labor force).

Conclusion

As Caplan himself acknowledges in his post, we are of course completely ignoring the Keynesian mechanisms in our analysis above. For example, regarding our last numerical example, Paul Krugman would probably say, "When those 90 million people with jobs get an extra $1,000 per year in take-home pay, they will go out and spend a big chunk of it. This extra demand for goods and services will boost employers' demand for more labor, and that's how we can put more people back to work."

However, note that this is a secondary effect of the policy; as we have shown, the direct effect on the labor market from a cut in the employee payroll tax will be to increase unemployment. Now perhaps the secondary, Keynesian effect will overwhelm the direct effect, but the direct aspect of the analysis is rarely even mentioned.

Furthermore, as Caplan and others have argued, when the employer is given the incentive to hire more workers (because of a lowering of the employer share of the payroll tax), his total "wage bill" goes up, even in the case of a severe recession when the pretax wage rate doesn't budge. This is obvious, because the employer ends up hiring more workers at the original rate (denoted WA in our diagrams above). With our numerical example, this isn't a mere $1,000 increase (times the number of original workers), but rather a $50,000 increase (times the number of new hires). So it's not at all clear, even on Keynesian terms, which policy will actually do the most to "boost spending."

Despite these quibbles, one thing is clear: Most of the pundits — let alone the politicians — debating the tax cut deal have no idea of the impact a payroll tax cut on employees could have on labor supply. Consequently, if the deal goes through, many people may be surprised to see the headline unemployment rate "stubbornly" refuse to fall — or even increase — despite all the "stimulus."

Robert Murphy, an adjunct scholar of the Mises Institute and a faculty member of the Mises University, runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to Man, Economy, and State with Power and Market, the Human Action Study Guide, and The Politically Incorrect Guide to the Great Depression and the New Deal. Send him mail. See Robert P. Murphy's article archives. Comment on the blog.![]()

© 2010 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.