Offshore Savings Rates Regain Some Appeal – But Are Your Savings Safe!

Personal_Finance / Savings Accounts Oct 19, 2007 - 02:57 PM GMTBy: MoneyFacts

Rachel Thrussell, Head of Savings at Moneyfacts.co.uk - the leading independent financial comparison site, comments: “In the wake of the onshore savings rate war, first in the fixed rate market and subsequently with variable rate products, the offshore market has stolen the march in the last week, offering rates to win the battle hands down.

Rachel Thrussell, Head of Savings at Moneyfacts.co.uk - the leading independent financial comparison site, comments: “In the wake of the onshore savings rate war, first in the fixed rate market and subsequently with variable rate products, the offshore market has stolen the march in the last week, offering rates to win the battle hands down.

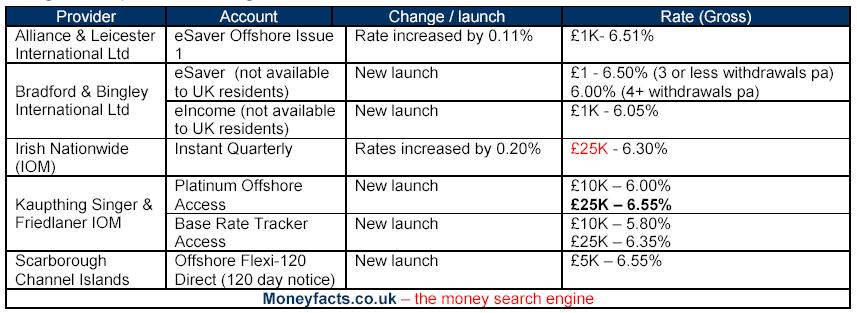

“The table below highlights the more recent changes and some of the headline grabbing deals now on offer. A 6.55% rate cannot be found on onshore accounts, unless you are prepared to take one of the few deals, which are specifically designed for child benefits or a house deposit, for example. This is particularly impressive when looking at the virtually ‘strings free’ account from Kaupthing Singer & Friedlander IOM. The Platinum Offshore Access account does require a minimum deposit of £25K to qualify for this higher rate and minimum withdrawals are limited to £1K, but is otherwise restriction free – a good, simple, hard working account.

“With the only remaining tax advantage to saving offshore being deferred interest accounts, and with previously little difference between the rates available on-or offshore, the attractiveness of offshore banking may have faded for some. But there is another issue, perhaps more real in today’s unsettled savings market that savers should bear in mind.

“While it is very unlikely that you would need to call upon depositor protection schemes, as the Northern Rock crisis has highlighted it is not impossible for a bank to suffer financial difficulties. While many of the offshore providers are household names, many subsidiaries of our well known banks and building societies, the protection on offer in some cases cannot be more different.

“The depositor rules are based upon where your money is held, so bank in either Jersey or Guernsey and you will receive no cover at all, whereas the Isle of Man does have its own scheme, regulated by Banking Business (Compensation of Depositors) Regulation 1991 which covers 75% of the first £15K per individual. With offshore savings typically associated with larger balances, and in fact many providers insisting on a minimum balance of £10K to £25K, should any problems ever occur it could present a real threat.

“There is no doubt that there are some great offshore savings deals to be found, but make sure you do your homework. Find out the tax implications, protection rights and make sure you get the right deal for your circumstances.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.