The Stocks Bull Market Trend and the Improving Economy

Stock-Markets / Stock Markets 2010 Dec 18, 2010 - 11:33 AM GMTBy: Tony_Caldaro

Economic reports for the week were quite good: 13 improving, 3 lower and 2 unchanged. Yet the SPX traded the entire week 7 points above and 7 points below where it had closed last friday. On the economic front, the current account deficit increased, building permits declined and weekly mortgage applications were lower. The NAHB housing index remained flat, as did the weekly jobless claims. On the positive side, the NY FED and Philly FED both improved, as did, industrial production, capacity utilization, housing starts, the BEA leading indicators, the monetary base and the WLEI.

Economic reports for the week were quite good: 13 improving, 3 lower and 2 unchanged. Yet the SPX traded the entire week 7 points above and 7 points below where it had closed last friday. On the economic front, the current account deficit increased, building permits declined and weekly mortgage applications were lower. The NAHB housing index remained flat, as did the weekly jobless claims. On the positive side, the NY FED and Philly FED both improved, as did, industrial production, capacity utilization, housing starts, the BEA leading indicators, the monetary base and the WLEI.

Remaining positive were the CPI/PPI, retail sales and business inventories. Also, President Obama signed the $858 bln tax package after the close on friday. For the week the SPX/DOW were +0.5%, and the NDX/NAZ were +0.2%. Asian markets gained 0.6%, European markets lost 0.1%, the Commodity equity group gained 0.3%, and the DJ World index was +0.3%. Bonds were +0.1%, Crude gained 0.7%, Gold lost 0.7%, and the USD was +0.4%. Next week’s economic reports will include Q3 GDP, Home sales and Personal income/spending.

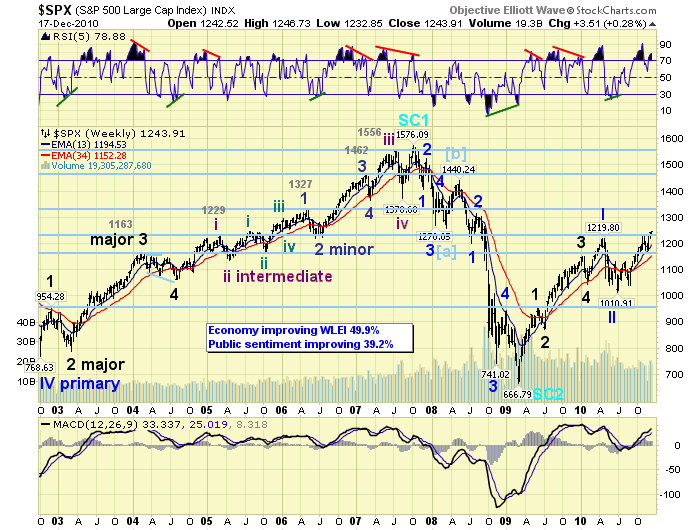

LONG TERM: bull market

After 21 months of rising prices, the SPX hit a new bull market high this week, the general consensus appears to have finally shifted to accepting this long term uptrend as a bull market. This usually occurs in the third wave of a bull market. In this case Primary wave III. Economic reports have been improving for months, Bond yields remain low, Commodities continue to rise, Corporate profits remain good, Currencies have been rising against the USD, and the Stock market has been rising. Eventually the public will re-enter the stock market, exiting Bond funds, but this is likely to occur in the latter part of Primary wave III through Primary wave V. Hopefully, for those following this blog, you have been a year to 21 months ahead of the crowd.

Our long term count, and bull market projection, remain the same. Five Major waves up from the Mar09 SPX 667 low into the Apr10 SPX 1220 high completing Primary wave I. Then a three month 17% correction into the July10 SPX 1011 low to complete Primary wave II. Primary wave III began at that point. The current uptrend is only Major wave 1 of the five Major waves during Primary wave III. Then we’re expecting a Primary wave IV correction near year end (2011), and then Primary wave V to complete this bull market. The potential bull market projection, published in Sept10, remains on track: http://caldaro.wordpress.com/2010/09/26/spx-bull-market-projection/.

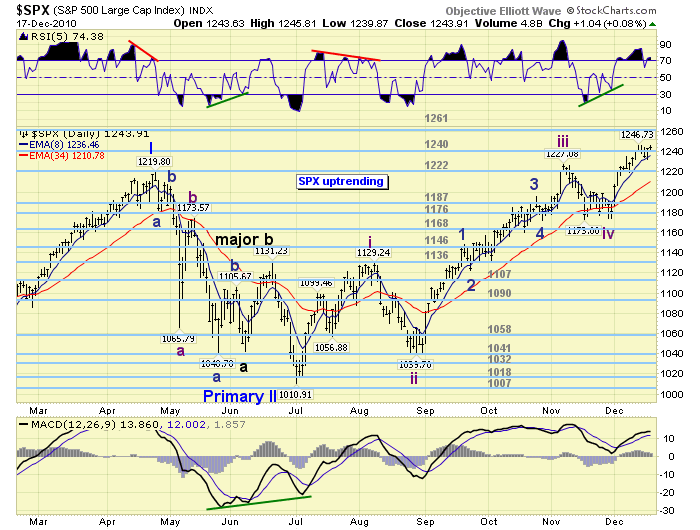

MEDIUM TERM: uptrend hits SPX 1247

The current uptrend, which started at the 4-year Presidential cycle low in July, had a bit of a volatile beginning. The SPX rallied five waves from 1011 to 1129 in August to complete Intermediate wave one. Then a sharp 7.9% zigzag pullback to SPX 1040 by the end of August, coinciding with the 2-year Tech product cycle low, completed Intermediate wave two. Intermediate wave three then rallied steadily in five waves into a November SPX 1227 high. A lesser decline of 4.4% followed, taking the form a of flat, completed Intermediate wave four by the end of November. The month of December kicked off Intermediate wave five, which has been a steady advance with only two small pullbacks of 15 and 14 points respectively.

With Intermediate wave five meeting the minimum advance requirements: five waves up, new highs, and Int. five = 0.618 Int. one @ SPX 1246. A review of the surrounding market technicals is in order. The monthly chart displays a rising RSI, barely overbought, and the MACD just crossed into positive territory for the first time in this bull market. These two indicators have a lot fourther to go before looking for any type of bull market top. The weekly chart displays a nice bullish MACD pattern, but a RSI that could be starting to form a negative divergence at these new highs. The daily chart displays a nice rising MACD, and a slightly overbought RSI. This chart suggests five smaller waves were completed to form Minor wave 1 at the recent SPX 1247 high, and Minor wave 2 is still ongoing or ended at SPX 1233. If the uptrend were to end at SPX 1247, Intermediate wave five would be uncharacteristically short compared to the previous Intermediate waves in this bull market. All charts can be found with the link below.

In review of some other charts. Eight of the nine SPX sectors are in uptrends, no weakness appearing here. The NYAD has yet to make a new high during Intermediate wave five, which suggests this rally is selective, typical of a fifth wave. Six of the 15 world markets we track are in downtrends. Only one of these six needs just a 1% or 2% rally to confirm an uptrend. The other five indices would require a more significant rally to confirm an uptrend. These five include the fast growing emerging economies of Brazil, China, Hong Kong and India. Going forward it appears we need to monitor the NYAD and these four indices. Should they continue lower the US uptrend could end prematurely.

SHORT TERM

Support for the SPX remains at 1240 and then 1222, with resistance at 1261 and then 1291. Short term momentum ended the week declining from a slightly overbought condition at friday’s high.

When Intermediate wave five got underway we posted some fibonacci projections for this fifth wave of the Major wave 1 uptrend: @ SPX 1246 Int. five = 0.618 Int. one, @ SPX 1289 Int. five = 0.618 Int. three, @ SPX 1290 Int. five = Int. one, and @ SPX 1306 Int. five = 0.618 Int. waves one through three. This week the first target was hit and the high for the week was SPX 1247. Since we can count five small waves into this high, and the market has usually pulled back after 2010 FOMC meetings, we tightened uptrend support from the SPX 1207 break out level to the OEW 1222 pivot range. Thus far, as noted above, the SPX has been vacillating above and below the OEW 1240 pivot and staying within its range (1233-1247).

Should the SPX break below the OEW 1240 pivot range a test of the OEW 1222 pivot is likely. If that pivot range were to fail then we may have seen the high for this five month uptrend. A breakout above the 1240 pivot range would suggest the uptrend is heading to the next OEW pivot at 1261. While we expect the latter, and this uptrend to challenge the OEW 1291 pivot in January, we aim to remain objective by providing these parameters. Best to your trading!

FOREIGN MARKETS

Asian markets were mostly higher on the week for a net gain of 0.6%. China, Hong Kong and India remain in downtrends.

European markets were mixed on the week for a net loss of 0.1%. Spain and the STOX 50 remain in downtrends.

The Commodity equity group was mixed on the week for a net gain of 0.3%. Only Brazil is in a downtrend.

The DJ World index remains uptrending and gained 0.3% on the week.

COMMODITIES

Bonds were +0.1% on the week while its downtrend continues. 10YR rates hit 3.566% on thursday their highest level since May.

Crude gained 0.7% on the week as its uptrend continues.

Gold slipped 0.7% on the week, remains in an uptrend, but the action has been choppy. Uptrending Silver has been leading both.

The uptrending USD gained 0.4% on the week. Looks like it’s preparing to move higher.

NEXT WEEK

The US markets will be closed on friday, Christmas eve, this year. As a result all economic reports will be jammed into wednesday and thursday. On wednesday Q3 GDP, FHFA home prices and Existing home sales. Then on thursday, weekly Jobless claims, Personal income/spending, the PCE, Durable goods orders, Consumer sentiment and New home sales. The FED has an H.8 statistical release of all asset and liabilities of all commercial US banks scheduled for thursday, no speeches yet. Best to you and yours this holiday season!

CHARTS: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID1606987

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2010 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.