Gold's 2011 Bullish Outlook as US at Risk of Joining Eurozone in Debt Crisis

Commodities / Gold and Silver 2011 Dec 21, 2010 - 07:19 AM GMTBy: GoldCore

Gold is up slightly after yesterday's 0.5% gain and appears to be consolidating just below $1400/oz. Gold is being supported by growing energy and food inflation and continued sovereign debt concerns. Recent days have seen the cost of insuring French debt rise to record levels and France's AAA rating is now at risk due to the spreading Eurozone debt contagion. Nor is the US immune to the debt crisis as many US cities are at risk of defaulting in 2011 (see news below). Gold may be anticipating problems in this regard in 2011 - as it has done in recent years.

Gold is up slightly after yesterday's 0.5% gain and appears to be consolidating just below $1400/oz. Gold is being supported by growing energy and food inflation and continued sovereign debt concerns. Recent days have seen the cost of insuring French debt rise to record levels and France's AAA rating is now at risk due to the spreading Eurozone debt contagion. Nor is the US immune to the debt crisis as many US cities are at risk of defaulting in 2011 (see news below). Gold may be anticipating problems in this regard in 2011 - as it has done in recent years.

Gold is currently trading at $1,386.25/oz, €1,053.70/oz and £894.53/oz.

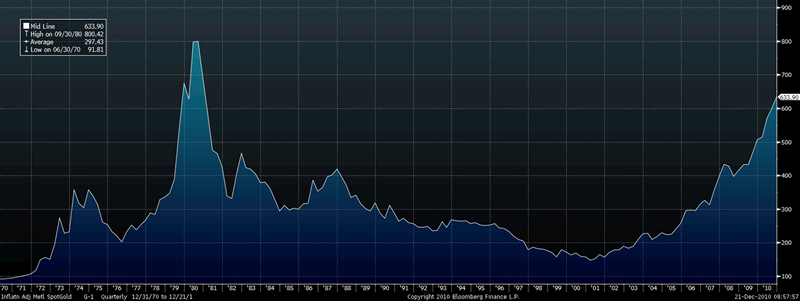

Gold Inflation Adjusted Index - 40 Year (Quarterly)

The 'Bloomberg Composite Gold Inflation Adjusted Spot Price' is derived from the monthly US Urban consumers price index

Commodity prices have surged to record nominal highs in recent days and oil continues to consolidate near the $90 a barrel mark (NYMEX $89.68 and BRENT $92.92). It is important to realise that while most commodities are at record nominal highs, they remain well below their inflation adjusted highs seen over 30 years ago during the stagflation of the 1970s.

Despite gold's 27% increase so far in 2010, it remains 35% below its inflation adjusted high of January 1980 which was $2,300/oz (using US CPI). Bloomberg's Composite Gold Inflation Adjusted Spot Price Chart shows gold below its quarterly inflation adjusted high (CPI-U) - see chart above.

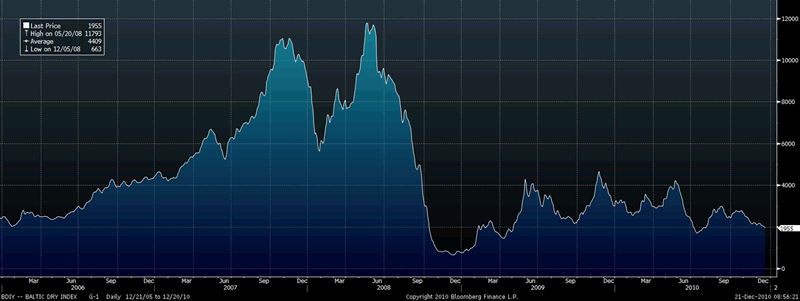

Continuing weakness in the Baltic Dry Index (see chart below) is a cause of concern and suggests that the global economic recovery remains fragile and economic growth may come under pressure in the coming months.

Baltic Dry Index - 5 Years (Daily)

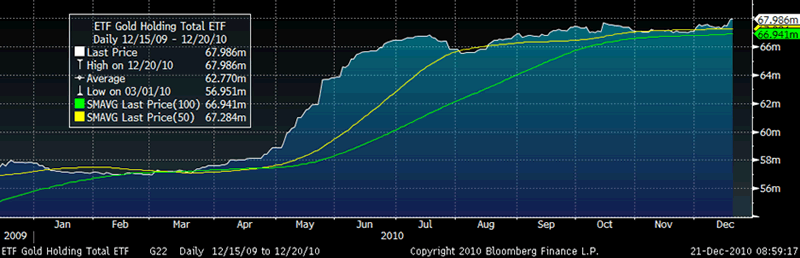

ETF gold or gold in exchange-traded products, or ETPs, reached a record 2,114.6 metric tonnes as of yesterday (see chart below). Holdings gained 18 percent this year as fiat currencies have come under pressure. The majority of the gains took place between March and July and there has been consolidation in recent months. While the holdings sound very large in tonnage terms - in dollar terms they remain very small when compared to the massive capital flows seen in equity, bond, currency and derivative markets.

ETF Gold Holdings - 1 Year (Daily)

SILVER

Silver is currently trading $29.30/oz, €22.27/oz and £18.91/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,709.25, palladium at $747.00/oz and rhodium at $2,225/oz.

NEWS

(The Guardian) -- $2tn debt crisis threatens to bring down 100 US cities

Overdrawn American cities could face financial collapse in 2011, defaulting on hundreds of billions of dollars of borrowings and derailing the US economic recovery. Nor are European cities safe - Florence, Barcelona, Madrid, Venice: all are in trouble

(Financial Times) -- Sugar and coffee hit multi-year highs

Sugar and coffee prices hit multi-year highs on Monday, further boosting food inflation concerns as supply problems mounted after a string of lower-than-expected harvests due to unfavourable weather, analysts said. The surge in sugar and coffee prices comes as other agricultural commodities - from corn and wheat to soyabean and barley - trade near a two-year high. The European Union has delayed a decision about allowing further export licences, with officials in Brussels saying the priority is to supply the internal market. Last week, Portugal ran out of sugar briefly, the first European country to suffer a sugar shortage in at least 30 years.

(Bloomberg) -- Cotton Surges by Exchange Limit to Record on Supply Shortfall

Cotton futures in New York jumped to a record, gaining by the daily limit for a second day, on speculation that global demand led by China will surpass supply.

(Bloomberg) -- Rubber Climbs to Record on Tire Demand, Production Disruptions

Rubber futures climbed to a record on speculation that a global shortage will worsen as tire demand increases and wet weather hurts supplies from producers including Thailand, the biggest grower. The cash price also surged to an all-time high.

(Bloomberg) -- Euro Rises as China Says Taken 'Concrete Action' to Help Europe

The euro rose, ending a two-day decline, after Chinese Vice Premier Wang Qishan said the nation had taken "concrete action" to help the European Union with its debt problems.

(Bloomberg) -- Uranium prices have risen about 20 percent since October because of a limited supply of the nuclear fuel being available to utilities, producers and traders on the spot market, according to data provided by Ux Consulting Co. Uranium oxide concentrate for immediate delivery reached $62.50 a pound in the week through to yesterday, the Roswell, Georgia-based UxC said in a report. That compares with $52 a pound in the week through Oct. 25.

(Telegraph) -- Pimco says 'untenable' policies will lead to eurozone break-up

Pimco, the world's largest bond fund, has called on Greece, Ireland and Portugal to step outside the eurozone temporarily and restructure their debts unless the currency bloc agrees to a radical change of course.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.