Premiums on British Gold Sovereigns and Eagle Demand Show Lack of "Irrational Exuberance"

Commodities / Gold and Silver 2010 Dec 23, 2010 - 06:16 AM GMTBy: GoldCore

Gold has fallen marginally in all major currencies today. Market participants are winding down before the holiday break and further profit taking and year end book squaring is seeing volume fall and gold remain in a tight range. Gold will likely get direction from the durable goods orders, consumer sentiment and new home sales data later today.

Gold has fallen marginally in all major currencies today. Market participants are winding down before the holiday break and further profit taking and year end book squaring is seeing volume fall and gold remain in a tight range. Gold will likely get direction from the durable goods orders, consumer sentiment and new home sales data later today.

Gold is currently trading at $1,382.43/oz, €1,055.37/oz and £897.97/oz.

NYMEX Crude Oil - 5 Year (Daily)

Gold is being supported by oil and commodities remaining strong and by growing risks to the fragile recovery as seen in the UK and US GDP figures being revised down. Inflationary pressures are growing (especially in the food and energy sectors) despite anaemic economic growth and this is a combination that could make for a challenging 2011.

Equities have risen to 2 year highs on continuing risk appetite despite significant risks still challenging the global economy. Asian equities showed weakness overnight and European bourses are directionless this morning. Oil prices have had a long period of consolidation in 2009 and 2010 since the massive sell off in 2008 (see chart above). Given limited supplies and strong demand, especially from China and Asia, and concerns about debasement of the dollar, oil prices appear to be targeting $100 a barrel again (see News below). Geopolitical risk in the Middle East and between Israel and Iran and other countries in the region remain a risk and should not be ignored.

Gold in Australian Dollars - 5 Year (Daily)

The top performing currencies in the world in the last year and since 2006 and the early beginnings of the financial crisis are the Japanese yen, the Swiss franc and the Australian dollar (see chart above). Over the 5 year period (since January 1st 2006), against the dollar, they have risen 42%, 38% and 37% respectively.

Gold in Swiss Francs - 5 Year (Daily)

However, they have all fallen against gold both over the same 5 year period and in the last year. Remarkably, the safest fiat currencies in the world in the last 5 years, the Japanese yen, the Swiss franc and the Australian dollar have all fallen some 50% against gold in the last 5 years (49.12%, 49.93% and 50.003% respectively).

This shows how the dollar is gradually losing its safe haven status and how gold is reasserting its role as a safe haven and monetary asset.

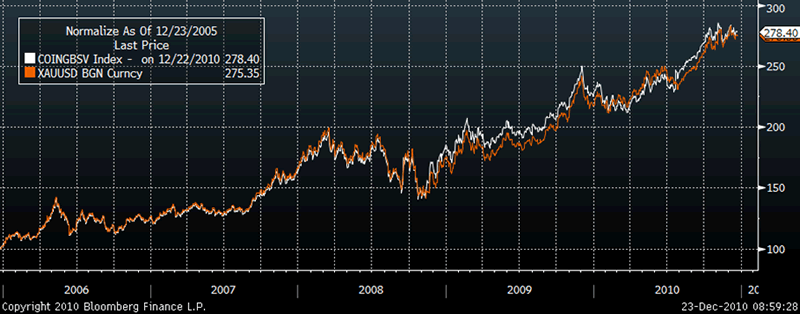

Gold in USD and British Gold Sovereigns – 5 Year (Daily)

The chart above shows how the price of British gold sovereigns (0.2354 oz) has remained correlated with the price of gold throughout the crisis. This shows that premiums for these gold bullion coins have risen and fallen but remained very close to the gold price. This is another indication of the lack of any irrational exuberance or mania in the gold market. A mania will likely lead to a huge demand for sovereigns and all bullion coins which will see premiums rise significantly above spot or melt value.

Today, as in 2006, sovereigns can be bought for 10% to 20% over spot gold (depending on volume). This is in marked contrast to jewelry which generally has a premium or mark up of between 200% and 400%.

Gold sovereigns are a favourite with British gold buyers due to capital gains tax (CGT) not being applicable and are favoured by investors internationally as they are known internationally and are therefore highly liquid. Also, many gold buyers like owning sovereigns due to their 'divisibility' and do not see them as investments rather they use them as stores of value and as financial insurance against continuing systemic risk in the global financial system.

The lack of any 'gold mania' or 'gold rush' is further seen in the greatly reduced demand seen for gold American Eagles (1 oz) seen recently. American Eagle gold coin sales have fallen considerably in December according to the US Mint. There were just 51,500 oz of 1oz gold coins sold so far in December. December looks set to be the second-poorest month in terms of sales this year. For December (as of today) sales are 53% behind those in all of November. They are some 72% less than the record sales month of May 2010 - 190,000 1 ounce bullion coins. December was the best month for American Eagle sales in 2009 which shows that this is not simply a case of seasonality.

Bull markets do not end with such a lack of buying enthusiasm and 'animal spirits'. Gold buying is not being done by the "man in the street" rather by large institutional investors and central banks.

SILVER

Silver is currently trading $29.20/oz, €22.29/oz and £18.96/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,724.25, palladium at $749.00/oz and rhodium at $2,400/oz.

NEWS

(Financial Times ) -- Dwindling US supplies keep oil above $90

Oil rose to a fresh 26-month high on reports that crude stocks shrank and the economy accelerated in the US, the world's largest petroleum consumer. Nymex February West Texas Intermediate crude rose 66 cents to $90.48 a barrel, trading above $90 for the third time this year. ICE February Brent rose 45 cents to $93.65. The gains came as the US government reported commercial crude inventories fell by 5.3m barrels last week, largely along the Gulf of Mexico and Pacific coasts. US refineries were processing 6.4 per cent more crude than a year ago, while demand for petrol and distillate fuels showed annual growth.

(Financial Times ) -- Mexico hedges against corn inflation

Mexico has taken the unusual step of insuring itself against the effect of rising corn prices on tortilla, a food staple for millions in the country, in the latest sign of growing concern about food inflation in emerging countries. Rising food inflation has become a big headache in countries from Mexico to China and India as bad weather has ruined crops, forcing prices up. Food accounts for up to half of all household spending in emerging countries, compared to just 10 to 15 per cent in Europe and the US. The move by Mexico, disclosed by its economic minister, came as the quoted price of corn in Chicago hit a two-year high on the back of a smaller-than-expected harvest in the US, which accounts for more than half of the world's exports.

(Bloomberg) -- Gold, little changed, may advance on concern that the European debt crisis is set to linger, boosting demand for a haven to protect investors' wealth. Silver, palladium and platinum climbed.

(Bloomberg) -- Gold may peak at an average of $1,490 an ounce in the third quarter, Barclays Capital said.

Gold is favored for the "near term" and palladium and platinum for the "longer term," Barclays analyst Gayle Berry wrote in a report e-mailed today. Aluminum is the "most attractive" of the industrial metals for the short term, she wrote.

(PTI) -- International Monetary Fund has completed the sale of 403.3 tonnes of gold, as part of its two-year efforts to bolster the lender's finances that also saw India's central bank purchasing 200 tonnes of the precious metal last year.

The multilateral lender's executive board in April 2008 proposed to sell 403.3 tonnes of its gold holdings and the proceeds would be utilised to offer concessional loans to low income nations, among others.

On Tuesday, the International Monetary Fund (IMF) said it has completed the limited gold sales programme, which was approved by the executive board in September 2009.

"All gold sales were at market prices, including direct sales to official holders," the lender said in a statement without disclosing details of final sales.

"These sales are a central element of the new income model for the IMF... They will also increase the Fund's capacity to support low-income countries," it added.

India bought 200 tonnes of gold from the IMF late last year for about USD 6.7 billion. The transaction was carried out over two weeks from October 19-30, 2009.

As part of the programme, other countries that bought gold include Bangladesh, Sri Lanka and Mauritius. Each of these nations had purchased ten tonnes of the precious metal.

In the wake of the global financial turmoil in 2008-09, IMF has been playing a key role in rejuvenating the system and has extended billions of dollars worth assistance to countries such as Greece and Ireland.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.