Variable and Fixed Rate Mortages at the Same Price – That Can’t Be Right!

Personal_Finance / Mortgages Oct 22, 2007 - 10:08 AM GMTBy: MoneyFacts

Julia Harris, Mortgage Expert at Moneyfacts.co.uk - the leading independent financial comparison site, comments:“The sub prime sector continues to see most of the action in the mortgage market, with still rising rates and tightening credit criteria. By comparison the prime mortgage market, albeit slowly, is reacting to the stable base rate and falling swap rates, bringing the market into an unusual equilibrium whereby fixed and variable deals are priced similarly.

Julia Harris, Mortgage Expert at Moneyfacts.co.uk - the leading independent financial comparison site, comments:“The sub prime sector continues to see most of the action in the mortgage market, with still rising rates and tightening credit criteria. By comparison the prime mortgage market, albeit slowly, is reacting to the stable base rate and falling swap rates, bringing the market into an unusual equilibrium whereby fixed and variable deals are priced similarly.

“With a year of base rate rises just behind us and the shock impact of the credit crisis, the mortgage market has fallen into a lull. The volume of rate changes has fallen dramatically and very few providers are launching any products to differentiate themselves.

“Gradually the market has moved back into the state we saw almost 18 months back, whereby fixed rate deals no longer come at a premium, and can sometimes cost less than a discounted deal. With surprising variable rate increases of late, combined with the more important reduction in fixed rates, there is little or no difference between the cost of a fixed rate or variable rate.

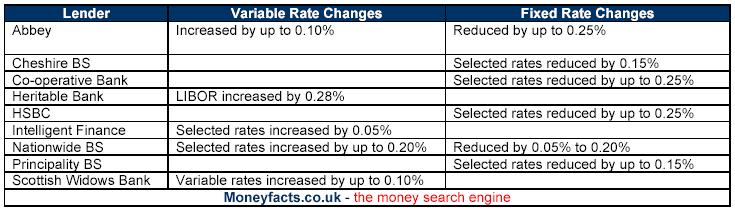

“Here are just a few of the changes we have seen this month:

“With rates almost certain to fall in the forthcoming months, or at the very least to remain on hold at 5.75%, the current mortgage market is reflecting this. With falling rates comes increased demand and benefit to be had from variable products - a variable rate may seem more attractive than it has done over the past couple of years.

“While swap rates rose, lenders were reacting immediately, but now that the shoe is on the other foot and rates are falling, it seems lenders are more reluctant to reduce their rates than they were to put them up.

“Perhaps the levelling of cost between fixed and variable rates is not what Alistair Darling wants to see. His solution to housing affordability sits strongly with encouraging long term fixed deals. With the difference in cost now not even a consideration when choosing between a fixed or variable deal, it’s an ideal opportunity for borrowers to choose a deal based on their individual needs and predictions of future rate changes.

“However should any external influence hit the market, particularly with a rate change, the scales will tilt and this equilibrium is sure to be short lived.”

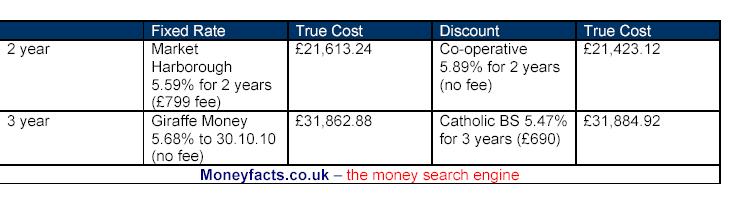

Best deals based on True Cost of £140K remortgage over 25 years (property price of £200K).

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.