Economists Can't Forecast for Toffee, In Defense of the “Old Always”

Economics / Economic Theory Jan 05, 2011 - 01:39 AM GMTBy: John_Mauldin

Long time readers of Outside the Box are familiar with the name of James Montier, who is now with GMO in their London office. Today, James, with his usual acerbic wit, takes on the notion of the "New Normal" and offers us a defense of the "Old Always." James is a value investor and sees mean reversion as still alive and kicking, where some proponents of the New Normal think we should throw out all of the old aphorisms. While I am in the New Normal camp, I also agree with James. This makes for some quick and thought-provoking reading.

Long time readers of Outside the Box are familiar with the name of James Montier, who is now with GMO in their London office. Today, James, with his usual acerbic wit, takes on the notion of the "New Normal" and offers us a defense of the "Old Always." James is a value investor and sees mean reversion as still alive and kicking, where some proponents of the New Normal think we should throw out all of the old aphorisms. While I am in the New Normal camp, I also agree with James. This makes for some quick and thought-provoking reading.

James Montier is a member of GMO's asset allocation team. Prior to that, he was the co-Head of Global Strategy at Société Générale and has been the top-rated strategist in the annual Thomson Extel survey for most of the last decade. Montier is the author of four market-leading books including the recent The Little Book of Behavioral Investing: How not to be your own worst enemy (Little Book, Big Profits) for which I wrote the forward.

It is good to be back into the swing of things, and this looks to be an exceptionally full year for your humble analyst, but one that offers us both opportunity and some times for enjoyment with friends. I am nearly always optimistic at this time of year, and it seems even more so this year. My annual forecast issue, to be written next Friday, will reflect some of that optimism. The future is showing some bright spots here and there. Now let's enjoy some wisdom from James.

Your putting his sun glasses on analyst,

John Mauldin, Editor Outside the Box

In Defense of the "Old Always" by James Montier

The concept of the "new normal" abounds in markets these days. It seems I can't open the Financial Times without at least one headline proclaiming the importance of the new normal. But what does it mean for the way we invest?

Part of the difficulty in answering that question is the plethora of meanings that have become associated with the term "new normal." For some, it is an environment of subdued growth in the developed markets (the result of ongoing deleveraging - similar in essence to the "seven lean years" that Jeremy Grantham, among others, has previously described). For others, it encapsulates a prolonged period of high volatility (in either economies or asset markets).

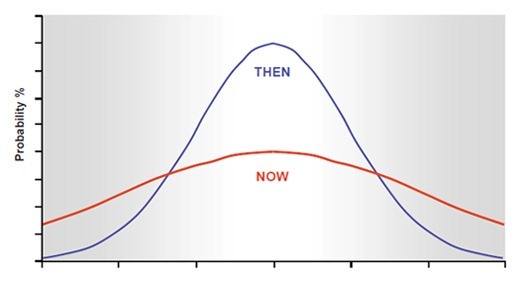

According to PIMCO, the coiners of the term, the new normal is also explained as an environment wherein "the snapshot for 'consensus expectations' has shifted: from traditional bell-shaped curves - with a high likelihood mean and thin tails (indicating most economists have similar expectations) - to a much flatter distribution of outcomes with fatter tails (where opinion is divided and expectations vary considerably)." That is to say, the distribution of forecasts has become more uniform (as per Exhibit 1).

Exhibit 1: The New Normal: A Flatter Distribution with Fatter Tails

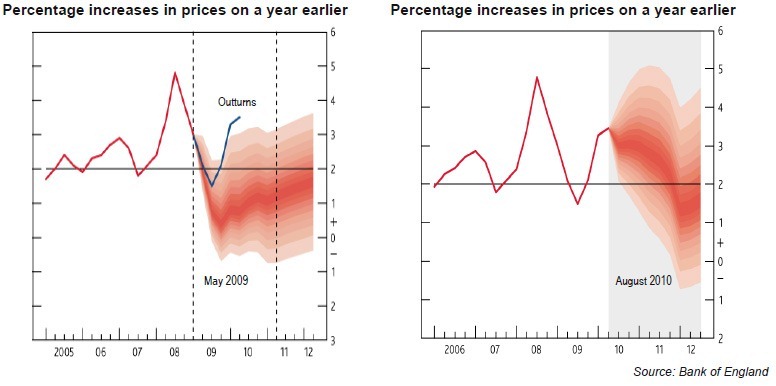

For some economic variables, this is certainly an accurate description. The Bank of England provides us with a good example. It is one of the few central banks brave (or foolhardy) enough to provide us not only with their forecasts, but the ranges around those forecasts (the so-called fan graphs shown in Exhibit 2).

The first chart in Exhibit 2 shows the range of forecasts as of May 2009 going from -0.4% to around 3.5% annually. Fast forward to August 2010 (the second chart in Exhibit 2), and we see a wider distribution of outcomes, which range from -0.6% to approximately 4.5% annually. This is evidence that is clearly consistent with the description of the new normal provided above.

Exhibit 2: Bank of England's Inflation Forecasts (May 2009 and August 2010)

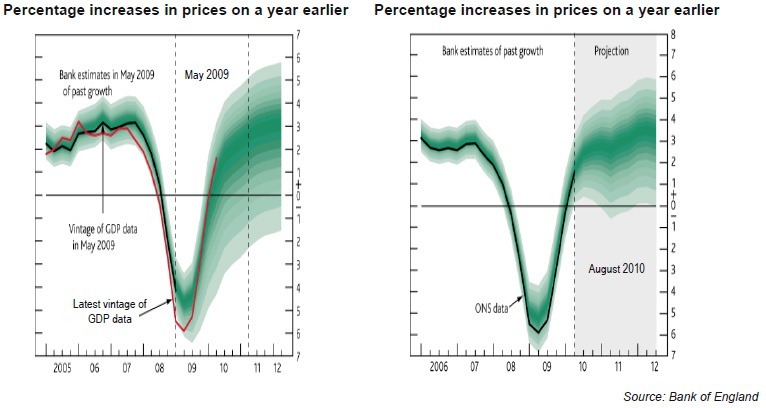

However, the flatter distribution with fatter tails version of the new normal shouldn't be taken as a universal truth. For instance, if we turn our attention from the Bank of England's inflation forecasts to its GDP forecasts, we see something very different (Exhibit 3). The May 2009 forecast has a significantly wider distribution than that of August 2010. This is the antithesis of the new normal. Ergo, the concept should not be applied unconditionally.

But what concerns me more than this are some of the implications that proponents of the new normal seem to draw when it comes to investing. For instance, Richard Clarida of PIMCO wrote the following earlier this year, "Positioning for mean reversion will be a less compelling investment theme in a world where realized returns cluster nearer the tails and away from the mean."

This certainly isn't the first premature obituary written for mean reversion. During pretty much every "new era," someone proclaims that the old rules simply don't apply anymore ... who could forget Irving Fisher's statement that stocks had reached a "permanently high plateau" in 1929?

Mean reversion is in some august company in being well enough to read its own obituary. Men as varied as Samuel Taylor Coleridge, Ernest Hemingway, Steve Jobs, Rudyard Kipling, and Mark Twain were all recipients of the news of their own demise. Personally, I think Kipling's response was among the best. Upon learning of his departure from the mortal coil while reading a magazine, he wrote to its editors, "I've just read that I am dead. Don't forget to delete me from your list of subscribers." With respect to mean reversion, I can't help but say, in the spirit of Mark Twain, that reports of its death are premature and greatly exaggerated.

Exhibit 3: Bank of England's GDP Forecasts (May 2009 and August 2010)

Why do I think that mean reversion is still very much alive and well? First, I fear that the concept of the new normal confuses the distribution of economic outcomes (and forecasts thereof) with the distribution of asset markets. As I pointed out above, for some (although not all) economic variables the new normal offers a good description of the current state of play. So, perhaps the world of forecasts will be characterized by a flatter distribution with fatter tails.

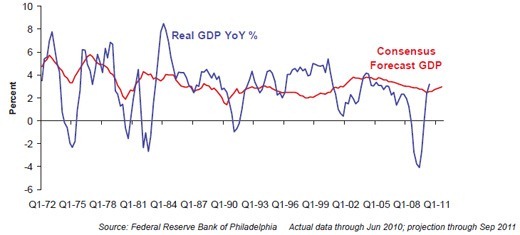

However, attempting to invest on the back of economic forecasts is an exercise in extreme folly, even in normal times. Economists are probably the one group who make astrologers look like professionals when it comes to telling the future. Even a cursory glance at Exhibit 4 reveals that economists are simply useless when it comes to forecasting. They have missed every recession in the last four decades! And it isn't just growth that economists can't forecast: it's also inflation, bond yields, and pretty much everything else.

Exhibit 4: Economists Can't Forecast for Toffee (GDP % YoY, 4q ma)

If we add greater uncertainty, as reflected by the distribution of the new normal, to the mix, then the difficulty of investing based upon economic forecasts is likely to be squared!

In contrast, we have long known of the existence of fat tails in asset markets. Mandelbrot was writing about the presence of fat tails in the 1960s. From the perspective of mean reversion, fat tails help to create some of the best opportunities. That is to say, fat tails often create fat pitches.

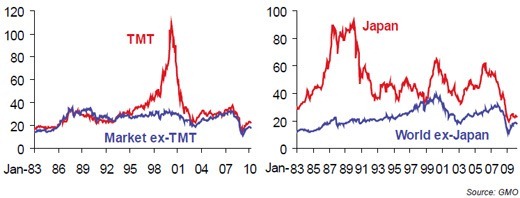

For instance, a sequence of "good" fat tail returns often results in extreme overvaluation (witness Exhibit 5, with TMT stocks trading at over 100x 10-year trailing earnings in the late 1990s and Japan trading at over 90x 10-year trailing earnings almost exactly a decade earlier), whilst a series of "bad" fat tail returns can result in severe undervaluation (see Exhibit 6, with the U.S. market trading at 5x 10-year trailing earnings in 1932).

Exhibit 5: Fat Tails and Fat Pitches (Graham and Dodd P/Es)

It is also worth noting that in order for mean-reversion-based strategies to work, it is not required that the mean be realized for long periods of time, but that markets continue to behave as they always have, swinging pendulum like between the depths of despair and irrational exuberance, or, from risk-on to risk-off. As long as markets display such bipolar disorder and switch from periods of mania to periods of depression, then mean reversion should continue to merit worth as an investment strategy.

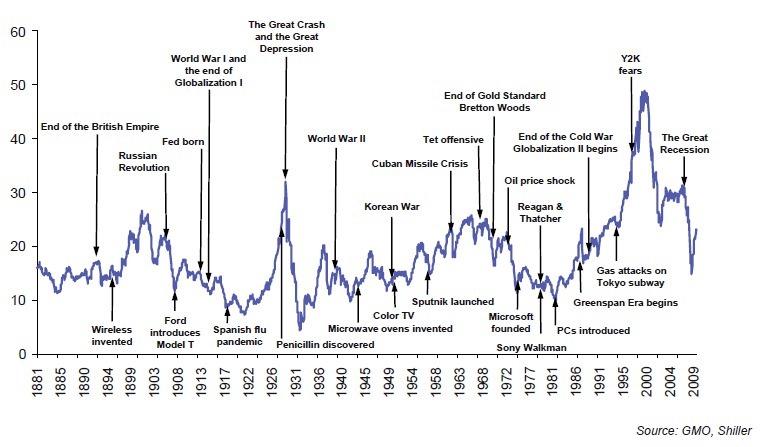

History is littered with the remains of proclaimed, but unfulfilled, new eras. Exhibit 6 shows the long-run history for the Graham and Dodd P/E for the U.S. market. Over this time, we have witnessed some quite remarkable, and quite appalling, things - the deaths of empires, the births of nations, waves of globalization, periods of deregulation, periods of re-regulation, World Wars, revolutions, plagues, and huge technological and medical advances - and yet one thing has remained true throughout history: none of these events mattered from the perspective of value!

As Ben Graham wrote, "Let me conclude with one of my favourite clichés - the French saying: 'The more it changes the more it's the same thing.' I have always thought this motto applied to the stock market better than anywhere else. Now the really important part of this proverb is the phrase 'the more it changes.' The economic world has changed radically and it will change even more. Most people think now that the essential nature of the stock market has been undergoing a corresponding change. But if my cliché is sound - and a cliché's only excuse, I suppose, is that it is sound - then the stock market will continue to be essentially what it always was in the past - a place where a big bull market is inevitably followed by a big bear market. In other words, a place where today's free lunches are paid for doubly tomorrow. In the light of experience, I think the present level of the stock market is an extremely dangerous one."

I simply couldn't have put it any better!

Exhibit 6: The Only Constant Is Change! The Graham & Dodd P/E for the S&P 500

So, rather than throwing out the handbook of investment, investors may well be better advised to stay true to the principles that have guided sensible investment since time immemorial. What I believe those principles to be will be the subject of my next missive in a few weeks. Until then, have a very happy New Year!

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.