QE2 & Stock Market Breadth Still Question the ‘Smart Money’

Stock-Markets / Stock Markets 2011 Jan 05, 2011 - 10:55 AM GMTBy: Chris_Ciovacco

The ‘smart money’ has been calling for a correction for over six weeks now, often citing extended sentiment to build their case. We looked at sentiment recently and agree it raises yellow flags that need to be respected, but sentiment alone is not a reason to head for the exits (yet).

On the Fed front, here is Bloomberg’s read of yesterday’s Fed minutes:

Federal Reserve officials signaled they’ll probably push ahead with unprecedented stimulus until the recovery strengthens and many of the 15 million unemployed Americans find work…“Right now it looks like the unemployment rate is the whole ball of wax,” said Ward McCarthy, chief financial economist at Jefferies & Co. in New York. “The majority just wants to keep going full throttle, and keep policy as accommodative as possible.” …The Fed’s Open Market Committee “emphasized that the pace and overall size of the purchase program would be contingent on economic and financial developments,” according to the minutes. “However, some indicated that they had a fairly high threshold for making changes to the program,” the minutes added.

We believe those who have been calling for a reduction in the scale of the Fed’s second quantitative easing program (QE2) based on recent economic strength are underestimating the Fed’s focus on asset prices and employment. If the Fed stops the printing presses now, it will surely impact asset prices in a negative manner, which in turn would place additional pressure on an already fragile employment situation. The housing market also continues to need all the help it can get with another wave of foreclosures due in early 2011. As we outlined back in October in Why is the Fed Printing Money?, QE2 is primarily about asset prices and balance sheets, not interest rates.

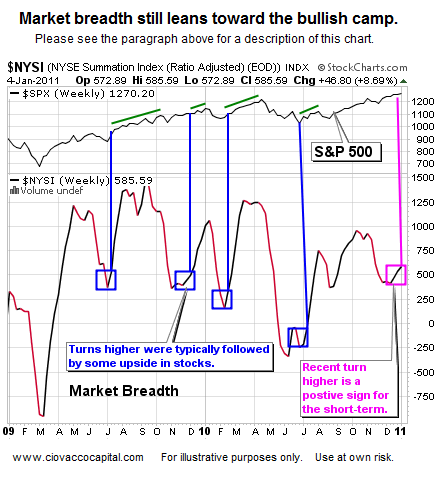

On December 28, 2010, we made some comments related to stock market breadth. Breadth can turn at any time, but the current position of the Summation Index ($NYSI) does not scream ‘a correction is imminent’. The updated look at market breadth below shows turns in the Summation Index similar to what we have seen recently (see blue boxes). The top portion of the chart shows the S&P 500’s performance after similar positive turns in market breadth (see green lines at top).

A pullback in stocks can occur at any time, but the current market appears to have, at a minimum, a little more leeway to move higher. If the Summation Index were to turn lower and make a lower low, it would be of concern to the bulls.

The smart money will look smart again, sometime maybe in the coming weeks, but for now they have missed an 8% move in stocks off the November 2010 lows. We share many of the smart money’s concerns, but we prefer to monitor the markets looking for bearish signals, rather than try to anticipate a move down that may or may not be in the cards.

You can add the U.S. dollar to the list of concerns for the bulls, but rather than expand on that now, we need to get back to our asset allocation study and our client’s accounts.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2010 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.