Not Owning Gold is a Form of Insanity

Commodities / Gold and Silver 2011 Jan 11, 2011 - 07:23 AM GMTBy: GoldCore

Gold remains well supported in all major currencies this morning, especially the euro, pound, yen and the New Zealand and Australian dollar. Concerns about inflation, credit bubbles and the growing likelihood that the Eurozone debt crisis will deepen is leading to continuing safe haven demand for gold – particularly in India, China and wider Asia.

Gold remains well supported in all major currencies this morning, especially the euro, pound, yen and the New Zealand and Australian dollar. Concerns about inflation, credit bubbles and the growing likelihood that the Eurozone debt crisis will deepen is leading to continuing safe haven demand for gold – particularly in India, China and wider Asia.

Gold is currently trading at $1,382.05/oz, €1,067.63/oz and £887.37/oz.

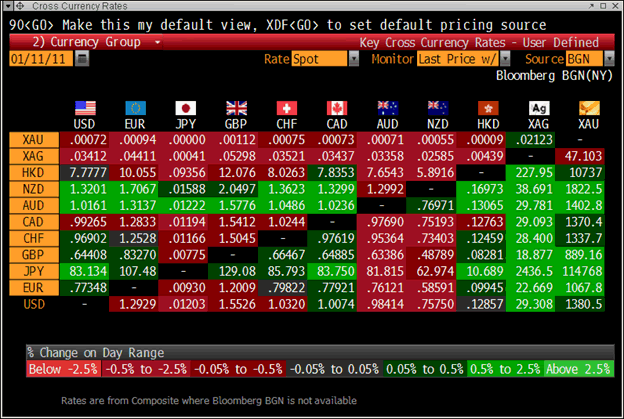

Cross Currency Table

Chinese demand ahead of Chinese New Year remains robust as seen in the record volumes on the Shanghai Gold Exchange and by higher premiums for gold bars in Hong Kong and Singapore.

Silver is even stronger and has risen against all fiat currencies today. There are growing concerns that the tightness seen in the small coin and bar market in recent years is spreading into the larger bar market. Sprott Asset Management have warned about the increasing “illiquidity” in the physical silver market and warned of the disconnect between the paper (COMEX and futures market price) and physical silver markets.

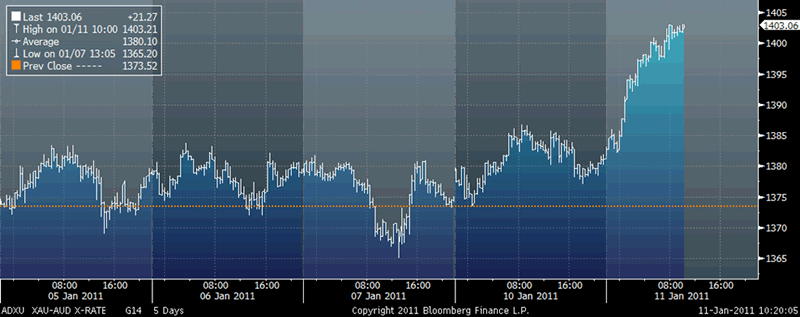

Gold in Australian Dollars – 5 Day (Daily)

Interviewed yesterday by CNBC, Cazenove Capital's technical strategist, Robin Griffiths, remarked that gold is still in a "linear trend" but eventually will "go exponential" as fiat currencies are "printed into oblivion," and so not owning gold is "a form of insanity."

Cazenove Capital is one of the oldest investment houses in the world tracing its origins back to the 17th century and the company was founded in 1823. It manages money on behalf of blue blooded clients and is widely believed to manage some of the British Royal family’s wealth.

According to the Guardian J.P. Morgan Cazenove was purchased by JP Morgan for £1 billion in 2009; the company continued to be called J.P. Morgan Cazenove.

Robin Griffiths is highly respected. He was chief technical strategist with HSBC for over 20 years and has 44 years investment experience and is considered to be one of the top strategists in the world. Robin developed his own system, analyzing stock and market trends. He is followed globally because of his ground breaking work on world stock markets, bonds, currencies and commodities.

Griffiths said that not owning gold “may even show unhealthy masochistic tendencies, which might need medical attention." (Interview can be watched on our homepage)

SILVER

Silver is currently trading $29.37/oz, €22.68/oz and £18.86/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,754.50, palladium at $766/oz and rhodium at $2,375/oz.

NEWS

(Reuters) Premiums for gold bars jump to 2-year high, Chinese buy

Premiums for gold bars jumped to their highest in two years on Tuesday as worries about inflation in China, the world's second-largest consumer of the precious metal after India, drove investors to bullion ahead of the Lunar New Year. Gold bars were offered at premiums of $3 an ounce to the spot London price in Hong Kong, physical dealers said, matching a similar level seen in late 2008. Refiners were running out stocks and some even quoted premiums at as high as $6, they said. "There's a sudden surge in demand. Demand from China is very good and they are paying very high premiums. Refiners can’t meet the demand," said a dealer in Singapore. "I would think people are buying gold as a hedge against inflation. Food prices are expensive, for instance." Determined to reign in price increases that have risen to the fastest in two years and become a source of public discontent, China declared late last year that it would shift to a tighter monetary policy stance. Inflation worries and limited investment options have fuelled demand for gold from Chinese investors, especially as the precious metal staged a stellar record-breaking rally in 2010. China's Lion Fund Management, which last month launched the first gold fund in the world's biggest producer of the metal, has met its goal of raising $500 million for the fund, the company said in a statement. "Demand is high ahead of the Chinese New Year. The jewellery sector is gearing up, and giving gold bars as a gift has been getting very popular," said an independent investor in China. "If you look prices in Shanghai, they are even at higher premiums to London prices," said the analyst, adding that the current premiums stood at around $10. Spot gold was steady at $1,375.25 an ounce on Tuesday, just over $50 dollars off the record over $1,430 hit in early December, on persistent worries about a debt crisis in Europe. Gold of 99.99 purity on Shanghai Gold Exchange was last quoted at 299.75 Yuan a gram.

(Zero Hedge) Virginia Creates Subcommittee To Study Monetary Alternatives In Case Of Terminal Fed "Breakdown", Considers Gold As Option

In what may one day be heralded as the formal proposal that proverbially started it all, the Commonwealth of Virginia introduced House Resolution No. 557 to establish a joint subcommittee to "to study whether the Commonwealth should adopt a currency to serve as an alternative to the currency distributed by the Federal Reserve System in the event of a major breakdown of the Federal Reserve System." In other words, Virginia will study the fallback plan of a "timely adoption of an alternative sound currency that the Commonwealth's government and citizens may employ without delay in the event of the destruction of the Federal Reserve System's currency" and avoid or "at least mitigate many of the economic, social, and political shocks to be expected to arise from hyperinflation, depression, or other economic calamity related to the breakdown of the Federal Reserve System." Most importantly as pertain to the currency in question, "Americans may employ whatever currency they choose to stipulate as the medium for payment of their private debts, including gold or silver, or both, to the exclusion of a currency not redeemable in gold or silver that Congress may have designated 'legal tender'." Whether this resolution will ever get off the ground, and actually find that the world is at great risk should gold not be instituted as a backstop currency, is irrelevant. The mere fact that it is out there, should provide sufficient impetus to other states to consider the ultimate Plan B.

(Bloomberg) India to Boost South African Imports of Gold, Coal, Gems, Metals

MMTC Ltd., India’s largest state-run trading company, will boost imports of South African gold, coal, nickel and chrome after opening its first office in the country. MMTC agreed with South Africa’s FirstRand Ltd. to buy 15 metric tons of gold for about $70 million in 2011 and may boost coal imports to about 15 million tons from 12 million tons last year, Marketing Director Ved Prakash said today. The company also plans to build a diamond-cutting factory in South Africa. Indian demand for South Africa’s coal contributed to Asia overtaking Europe in 2009 as the largest shipping destination for the fuel used in power plants. Last year, Richards Bay Coal Terminal Ltd., which ships most of South Africa’s coal, sent 59 percent to Asia and a quarter to Europe. India imported about 800 tons of gold last year, making it the world’s largest buyer. Indian consumption of gold is “insatiable,” the country’s Commerce and Industry Minister Anand Sharma said at the opening of the office in Johannesburg. In addition, five of every six diamonds produced in the world go to India, Sharma said. MMTC’s move into South Africa, the largest platinum and ferrochrome maker, will boost trade with India and cut costs, South African Trade and Industry Minister Rob Davies said. AngloGold Ashanti Ltd., Gold Fields Ltd. and Harmony Gold Mining Co. are South Africa’s largest gold producers, while Anglo American Plc, BHP Billiton Ltd., Exxaro Resources Ltd. and Xstrata Plc are among the largest coal producers.

(Bloomberg) China’s First Overseas Gold Fund Raises $483 Million, Lion Says

Lion Fund Management Co. has raised more than 3.2 billion yuan ($483 million) for China’s first gold fund to be invested in overseas exchange-traded products, the company said. The fund, which will be operated under the Qualified Domestic Institutional Investor program, was the biggest of its kind in the past three years, according to a statement e-mailed today. The company in November said it aimed to raise up to $500 million. The QDII policy allows Chinese investors to have exposure to overseas financial markets and products. China, the world’s largest gold producer, doesn’t have a gold-backed exchange-traded funds, or ETFs. Investors usually choose to buy physical gold, or invest through contracts traded on the Shanghai Gold Exchange, the Shanghai Futures Exchange or through banks. “The recent retreat in gold prices offered a very good opportunity for us to enter the market,” Song Qing, head of international business department, said in the statement. The quantitative easing in the U.S., the weakening dollar, and inflation concerns will provide persistent support to gold prices, Song said. Gold for immediate delivery has fallen about 3.9 percent from a record $1,431.25 an ounce on Dec. 7 and traded at $1,375.82 per ounce at 2:20 p.m. in Shanghai. The metal gained 30 percent last year, marking the 10th consecutive annual gain.

(The Washington Times) EDITORIAL: Only $279,950,956,705.59 left to spend

Within the next few months, America will reach its credit limit. After blowing through $2.6 trillion in tax dollars, the government will only be able to charge a mere $280 billion extra to future generations - a horrifying prospect that has sent the White House into a panic. Treasury Secretary Timothy F. Geithner yesterday urged Senate Majority Leader Harry Reid, Nevada Democrat, to restore the president's ability to spend beyond the nation's means. If the new Republican House majority concedes on this point, it will have lost the only hope of restoring fiscal sanity.

Hard choices have to be made to save the nation. Any deal over the debt ceiling must include reform of an entitlement system that places $2.1 trillion in spending on autopilot. Unnecessary cabinet departments and programs need to be terminated. Civil service rules have to be re-written so that lifetime employment and automatic raises are no longer guaranteed for bureaucrats.

Anything less will perpetuate the "live for today" philosophy that brought America to the brink of financial ruin. It's time to cut the national credit card.

(Bloomberg) Gold May Climb as Recovery Concerns Spur Demand for Alternative

Spot gold, little changed, may advance for a second day as concerns about the strength of the U.S. economic recovery spurs demand for the metal as an alternative asset. Silver and platinum increased. Bullion for immediate delivery was at $1,374.85 an ounce at 10:17 a.m. in Seoul. The price yesterday rose by the most in a week on concerns that Europe’s sovereign-debt crisis may worsen. The February-delivery contract climbed 0.2 percent $1,376.10 an ounce on the Comex in New York. “Those concerns about the U.S. economic recovery as well as Europe’s problems are helping gold hold on to gains,” said Hwang Il Doo, a senior trader at Korea Exchange Bank Futures Co. in Seoul. “Bullion will probably be able to rise further in the next couple of days.” The dollar traded close to a week low against the yen after Atlanta Federal Reserve Bank President Dennis Lockhart yesterday said he saw further “headwinds” for the U.S. economy in 2011. The greenback yesterday lost 0.2 percent against a basket of other six counterparts. Precious metals typically move inversely to the dollar. “The market is reassessing how long it will take for the economy to fully recover,” said Toshiya Yamauchi, a senior analyst in Tokyo at Ueda Harlow Ltd., which provides foreign- exchange margin-trading services. “Those concerns may weigh on the dollar.” The cost of insuring European sovereign debt against default increased to a record yesterday before Portugal’s bond sale on Jan. 12 and Spain’s the following day. Gold gained 30 percent last year as bailouts of Greece and Ireland sent the euro down 6.5 percent against the dollar. Spot gold climbed to a record $1,431.25 an ounce on Dec. 7 and reached an all-time high priced in Euros last month. Investors in China and India may boost gold purchases to hedge against inflation, said Bayram Dincer, an analyst at LGT Capital Management in Pfaeffikon, Switzerland. Silver for immediate delivery rose 0.2 percent to $29.1587 an ounce after yesterday climbing 1.5 percent, the biggest gain since Dec. 31. The price tumbled 7.3 percent last week. Platinum for immediate delivery increased 0.3 percent to $1,746.13 an ounce, and cash palladium gained 0.2 percent to $754.25 an ounce. Palladium lost 6.3 percent last week, and platinum slid 2.1 percent.

(CNBC) Not Owning Gold Is Insane - Cazenove's Griffiths

Gold will eventually rally exponentially and investors who don't own the precious metal are "insane," and may be showing "masochistic tendencies," Robin Griffiths, technical strategist at Cazenove Capital, told CNBC.

"I think not owning gold is a form of insanity, it may even show unhealthy masochistic tendencies, which might need medical attention," Griffiths said.

Gold, along with other metals such as copper, has been making new all time highs, which is a strong buying signal, according to Griffiths.

"Although it's been a top performer for each of the last ten years, it's still in a linear trend. Eventually it will go exponential and make more in the last little bit than the whole of the ten year trend," he said.

Griffiths said that any short-term declines in the price of gold represent a buying opportunity and the asset is still not an "over-owned trade".

"Real assets hedge paper money being printed into oblivion, so you've got to own gold and you've got to own other commodity-related investments still," he said.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.