Full Spectrum Dominance, The Pathology of U.S. and Global Monetary Policy

Interest-Rates / Credit Crisis 2011 Jan 13, 2011 - 05:26 AM GMTBy: Rob_Kirby

The purpose of this paper is to demonstrate how the Federal Reserve – through its proxy money centre banks – has taken complete control of the interest rate complex enabling them to arbitrarily price capital at or near zero. This has only been possible with accommodation of the ruling elite who mutually benefit from these policies.

The purpose of this paper is to demonstrate how the Federal Reserve – through its proxy money centre banks – has taken complete control of the interest rate complex enabling them to arbitrarily price capital at or near zero. This has only been possible with accommodation of the ruling elite who mutually benefit from these policies.

Author’s Comment:

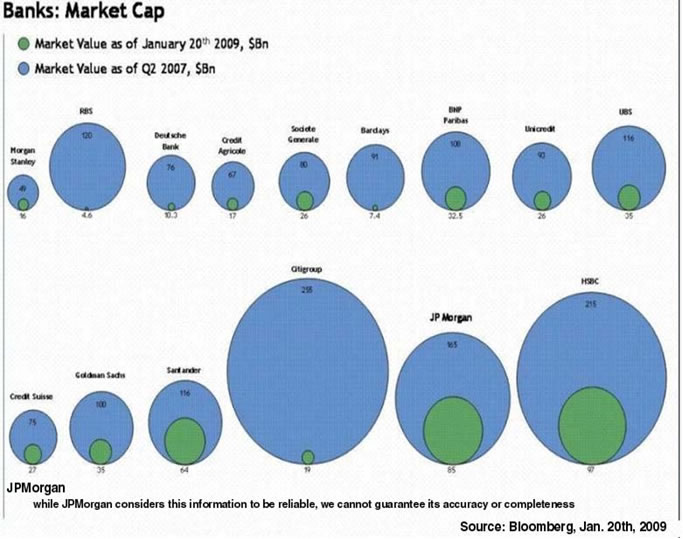

The market caps of financial institutions post 2008 crash while substantially diminished would have been overwhelmingly negative [i.e. bankrupt] had the accounting rules for banks not been “suspended” by edict.

Question:

Would any rational human being accept a $2,500.00 bet from somebody who only had 1 dollar in their pocket to lose?

Answer:

Under the watchful eye of the U.S. Federal Reserve, this occurs more than you’d think in the U.S. banking system with the likes of Morgan Stanley, with a market cap. Of a mere 16 billion at Jan. 20, 2009 versus a derivatives book in excess of 39 Trillion in notional. Why do you suppose this is allowed to happen?

source: Office of the Comptroller of the Currency [OCC] table 2, pg. 33

Some general commentary regarding the OCC data above:

* 84 % of the gross amounts are interest rate derivatives

- By the OCC’s own admission, there are virtually NO END USERS for any of these products:

source: Office of the Comptroller of the Currency, Graph1. pg, 9

Question:

So what do you suspect was the motivation in the mid 1990s – absent any customer [end user demand] - for 5 banks to begin “STRAPPING ON” what would become hundreds of trillions of dollars worth of interest rate derivatives anyway?

Hint:

These 5 money centre banks all have close ties to [or are perhaps extensions of] the Federal Reserve.

Answer:

The creation of this nuclear waste heap of derivatives was to give the Fed, via proxy, TOTAL control of the interest rate complex. Historically, the Fed only had ‘control’ of the short-end-of-the-interest-rate-curve through maintenance of the Fed Funds Rate [overnight rate]. The proliferation of interest rate swaps in the mid 1990’s marked the beginning of the Fed’s “capture” of the long end of the interest rate curve – thus ‘exterminating the bond vigilantes’ - using proxy institutions’ derivatives books to execute U.S. [and global] monetary policy.

Interest rate swaps of duration between 3 and 10 years – because they trade on ‘spread’, have government bond trades ‘embedded in them’. This means that GROWTH in the int. rate swap complex has created MASSIVE ARTIFICIAL DEMAND for U.S. Government bonds. This explains why – despite RECORD issuance of U.S. Government bonds in recent years – ‘fails to settle’ [because there aren’t enough bonds] in the bond complex have often run in the range of 600 - 800 billion/month.

The economist who has done the key work on this issue is Dr. Susanne Trimbath, who heads STP Advisory Services in Omaha, Nebraska. She previously worked for the Depository Trust Co, a subsidiary of Depository Trust and Clearing Corp, the U.S. clearing house for stocks and bonds.

Dr. Trimbath said, "In fall of 2008, about two trillion dollars in Treasury bonds were sold but undelivered for six weeks, more than 20 percent of the daily trading volume, up from 8.6 percent in the first five months of 2008." It was a spike from 1.2 percent in the first five months of 2007……..

…..The latest figures on failures to deliver are 600-800 billion dollars. Dr. Trimbath said, "The numbers look better now because the Fed threw two trillion at the market, which was used to cover these fails."

Expanding on this thought – this also means that the pricing of capital itself has little to NOTHING to do with economics – IT IS NOW ARBITRARY.

With the means to arbitrarily price capital, the parasitic Private Federal Reserve then went about engineering interest rates to ZERO so they could continue feeding off the otherwise bankrupt corpse of the host [i.e. the U.S. Government].

This contrived, un-natural outcome in interest rates has been facilitated by data manipulation on the part of government agencies i.e. inflation, employment and GDP data. The results of this contrivance are evidenced by the scorching hot Dot Com boom / bust as well as the super-heated real estate bubble and bust. The Fed’s zero interest rate policy and unbridled money printing has created the FALSE appearance of abundance in a FINITE world.

This is the legacy of the Federal Reserve; usury itself – for everyone on this planet - has been rendered a complete sham in the name of the citizens of the United States of America.

Stand up and take a bow Messrs. Greenspan and Bernanke – you’ve accomplished something with a printing press that none other could have – in the truest sense of the word, due to your connivance - America is now viewed globally as a rogue state.

[End of Public Article…more for subscribers, including how this plays out and what you can do about it] Subscribe here.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2010 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.