Bullish Sentiment in Gold Abates

Commodities / Gold and Silver 2011 Jan 13, 2011 - 05:46 AM GMTBy: Jordan_Roy_Byrne

An upward sloping consolidation in Gold that began in October has, despite a lack of any real losses, been enough to improve various sentiment indicators.

An upward sloping consolidation in Gold that began in October has, despite a lack of any real losses, been enough to improve various sentiment indicators.

Mark Hulbert of MarketWatch gives an update on his Gold sentiment indicator:

Consider the average recommended gold market exposure among a subset of short-term gold market timers tracked by the Hulbert Financial Digest (as reflected by the Hulbert Gold Newsletter Sentiment Index, or HGNSI). This average currently stands at 33.6%, which means that the average short-term gold timer is allocating two-thirds of his or her gold-oriented portfolios to cash. Six weeks ago, in contrast, the HGNSI stood at 40.3%.

A similar pattern to what we’ve experienced over the last six weeks is the declining bullishness witnessed since mid-September, some four months ago. At the time, with gold bullion trading below $1,300 — more than $100 below its current price — the HGNSI stood at 59.2%. That’s nearly double where it stands today, despite bullion today being much higher.

In other words, in the face of a four-month net increase in gold’s price of over $100 per ounce, the average gold timer is today only slightly more than half as bullish.

Babak (who is an excellent analyst of market sentiment) opines at TradersNarrative:

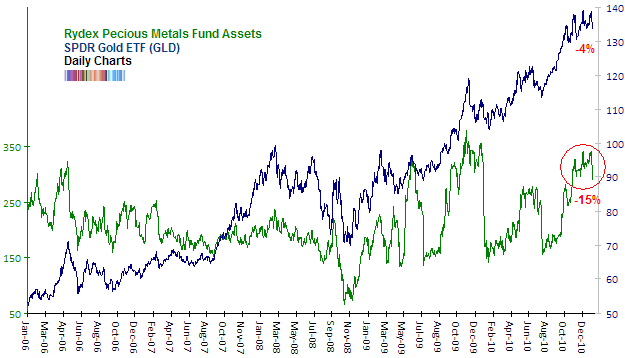

The small correction (or more accurately, sideways consolidation) has actually provided wrung out a surprising amount of bullish sentiment. If we check in with the Rydex traders, we see that they have dramatically reduced their dedication to the precious metals sector:

The chart above compares the total assets of the sector fund (in millions) with the SPDR Gold ETF (GLD). The most recent correction is just the start of what is usually a much more protracted decline in assets. So far, we haven’t seen a real abandonment of the sector from Rydex traders.

On the plus side, the SPDR Gold ETF (GLD) is down about 4% from its recent high. In contrast, the total assets of the Rydex Precious Metals fund is down about 15% from its recent high. So we are seeing an asymmetrical reaction. But from a contrarian viewpoint that’s just a good start.

As well, the Bloomberg sentiment poll has also reacted to the fall in gold price. The bull ratio adjusted this week to 42% from more than double that the previous week. The last time it was lower was on December 17th 2010.

Stealth Correction

The composite sentiment indicator from SentimenTrader is relatively low at 69.63%. Frankly, I’m surprised that it isn’t higher since gold is trading very close to highs – or at least it was. So here the gold bugs have some vindication that bullish sentiment isn’t as high as it merits, considering the strength of gold.

Finally, the COT data looks very healthy if you are a gold bull. During the sideways consolidation, commercial short positions (or speculative long positions) have decreased by 16% in the last three months while open interest has fallen 9% in the last two months.

Although Gold has essentially failed to make a sustained new high in the last several months, sentiment indicators show a clear improvement from a contrary point of view. The speculators in the futures market have reduced their long positions, retail money has sold some and market timers are less bullish and only slightly bullish despite the fact that Gold is less than 5% off its high.

Gold could be setting up for a big leg higher. What are the targets? How should you play it? Consider a free 14-day trial to our premium service. Our junior portfolio was up 86% in 2010 and we have new prospects who are potentially the big winners of 2011!

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.