Gold Price Manipulation?

Commodities / Gold and Silver 2011 Jan 13, 2011 - 10:34 AM GMTBy: GoldCore

Gold and silver have fallen by less than 1% in all major currencies today. Asian equities were mixed with strong selling seen in India and European equities and US index futures are tentatively higher. Eurozone periphery bonds yields have fallen as have those in Germany (10 year) after rising above 3% in recent days.

Gold and silver have fallen by less than 1% in all major currencies today. Asian equities were mixed with strong selling seen in India and European equities and US index futures are tentatively higher. Eurozone periphery bonds yields have fallen as have those in Germany (10 year) after rising above 3% in recent days.

Gold is currently trading at $1,385.30/oz, €1,046.24/oz and £875.67/oz.

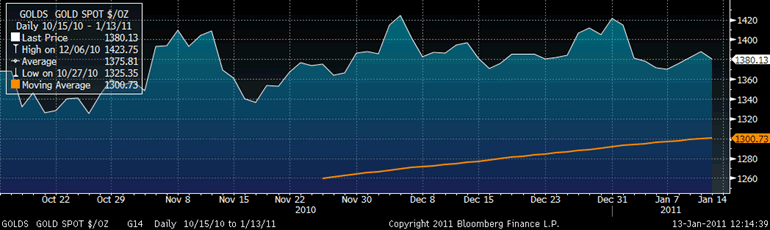

Gold in USD – 3 Month (Daily)

The primary driver of gold is very robust physical demand - especially from Europe and Asia. With inflation surging internationally especially in the essentials of life (food and energy), this demand is not going to abate any time soon. The demand is leading to consolidation close to record nominal highs in all fiat currencies. Prices today are close to the levels seen 3 months ago and the chart above clearly shows consolidation.

The 50 day moving average is at $1,383/oz and below that there is strong support at the 100 day moving average at the $1,300/oz mark (see first chart above). Given the extent of physical demand from Asia, Europe and internationally, we would be surprised if gold fell to this level of support.

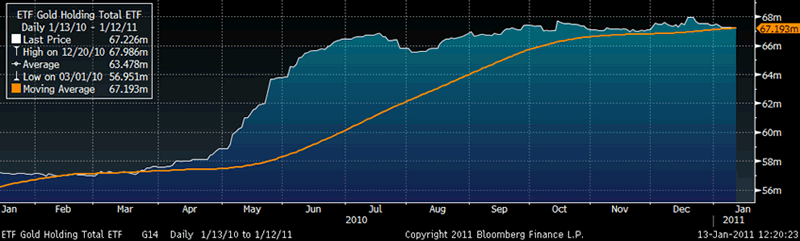

ETF Gold Holdings – 1 Year

However, as ever in the short term anything is possible and momentum-driven traders in the gold pits could push gold lower. Cornered institutional shorts could attempt to again squeeze the longs and engineer a selloff in the futures market.

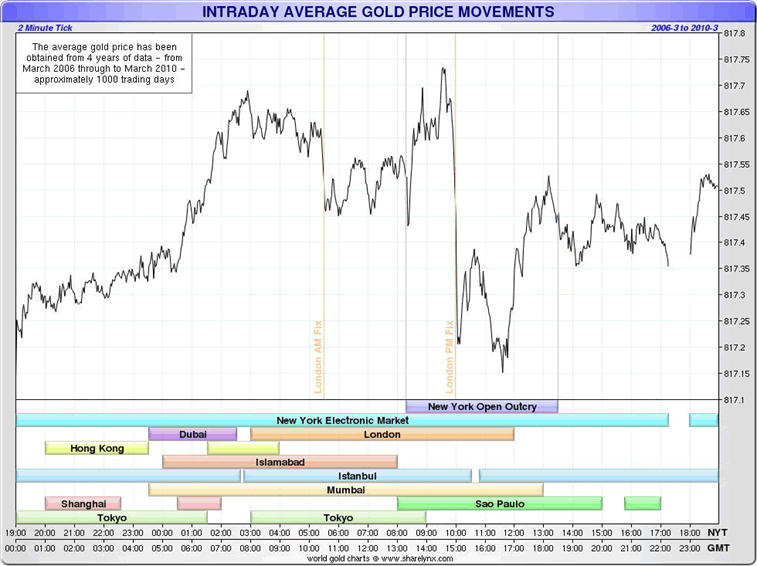

1000 Days of Average Gold Intraday Price Movement

The above chart from Nick Laird of ShareLynx and shown on Casey Research is remarkable. It shows how gold is sold consistently close to the London PM Fix. The majority of physical gold is bought on the London AM Fix. For more than 10 years the Gold Anti-Trust Action Committee (GATA) and a growing number of analysts have alleged manipulation and claim that sharp sell offs in the gold and silver futures markets are engineered.

They allege that this may be a way for the Plunge Protection Team or President's Working Group on Financial Markets to affect the “mood music” at the start of each day on Wall Street. The opening on Wall Street is eagerly watched by the global financial markets. GATA has some evidence (including admissions by officials and sworn testimony) and their allegations have yet to be examined or rebuffed by those who they accuse, by the media or many analysts.

Besides the mood music and maintaining confidence in US markets and the US dollar – another motivation may be the number one motivation of many Wall Street players – to make money or the profit motive. Large institutions with close ties to the US government, Treasury and Federal Reserve may have access to information not available to other market players which they can press to their financial advantage.

Given some of Wall Street’s far from ethical behavior in recent years it is incumbent on us all to keep an open mind on such matters rather than resorting to name calling or dismissing without investigation as “conspiracy theory”. Indeed, after many years of investigating this matter, the CFTC itself has not come to a conclusion.

A paper-driven sell off in the futures market (whether natural or manipulated) will likely be greeted lustily by physical buyers who continue to buy on all dips.

Concerns about wholesale liquidation of the gold ETF (see chart above) is overdone despite it being the latest “reason” the bears are putting forward for a fall in gold prices. Indeed George Soros himself seemed to have hinted at this – in the usual cryptic way he speaks about the gold market.

This latest bear’s argument is again very weak as much of the buyers of the gold ETF are passive in nature and not the leveraged short term players on futures markets. Many, including hedge funds such as David Einhorn’s Greenlight Capital, are value-oriented funds and have bought to hedge the “fiscal pathology” in the US today. This was warned by Federal Reserve Bank of Dallas President Fisher overnight.

Many pension funds today are beginning to allocate capital to gold, have small allocations to gold and they are buying passively to hedge inflation and for diversification purposes.

Federal Reserve Bank of Dallas President Fisher might want to examine the “monetary pathology” that he, Ben Bernanke and his colleagues are creating which is leading to currency debasement and inflation soaring internationally (affecting the poorest people in the world – see News below).

Allied to these hedge funds and pension funds - central bank and investment demand internationally will more than compensate for any possible ETF gold liquidation.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

SILVER

Silver is currently trading $29.44/oz, €22.23/oz and £18.61/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,820.50, palladium at $814.50/oz and rhodium at $2,375/oz.

NEWS

(Bloomberg) Gold Buying Shows RBI Losing `Never Ending' Inflation Battle: India Credit

Record imports of gold by India show the central bank may be losing the battle to tame inflation, spurring investors to sell government bonds.

Shipments into Asia’s third-biggest economy may have increased to 800 metric tons from 557 tons in 2009 and exceeding the previous all-time high of 769 in 2007, according to Ajay Mitra, managing director for India and the Middle East at the World Gold Council. Mumbai-based brokerage Nirmal Bang Commodities Pvt. forecasts purchases from overseas markets may rise to as much as 810 tons this year.

“Gold is being used as a store of value to protect against never-ending inflation,” Ritesh Jain, the Mumbai-based head of fixed income at Canara Robeco Asset Management Ltd. who oversees $1.5 billion, said in an interview on Jan. 7. “Inflation is the biggest concern in the minds of investors and savers.”

India’s government bonds have lost 0.5 percent this month, Asia’s worst performance after Indonesia, according to indexes compiled by HSBC Holdings Plc. Annual inflation in December was probably 8.40 percent, accelerating for the first time in three months, according to the median forecast of 30 economists in a Bloomberg survey ahead of official data tomorrow.

(Full article can be read in News section of www.GoldCore.com)

(Bloomberg) India Must ‘Copy’ China Policy to Curb Food Prices, Adani Says

India, facing the highest food inflation in six months, should emulate China in building strategic stockpiles of staples to cool prices, according to Adani Enterprises Ltd., the nation’s biggest farm goods trader.

(Bloomberg) Steel Output in India May Drop on Australia Floods, Analysts Say

Tata Steel Ltd., Steel Authority of India Ltd. and local rivals may cut output and raise prices as floods in Australia disrupt coking coal supplies and boost costs, RBS Equities India Ltd. and Macquarie Group Ltd. said.

(Bloomberg) NAB Cuts Australia Cotton Outlook by 10% After Floods

National Australia Bank Ltd. cut its cotton production estimate for Australia, the fourth-largest exporter, by about 10 percent after more than 75 percent of Queensland state was declared a disaster zone because of floods.

(Bloomberg) Corn Surges to 30-Month High After USDA Cuts Supply Estimates

Corn surged to an almost 30-month high and soybeans advanced after the U.S. government cut forecasts for domestic inventories, tightening global food supplies after adverse weather slashed harvests. Wheat rose.

(Bloomberg) Palm Oil Gains After USDA Cuts Global Soybean Inventory Estimate

Palm oil gained for the first time in five days after the U.S. government lowered forecasts for global soybean inventories. Futures for March delivery advanced as much as 2 percent to 3,724 ringgit a metric ton on the Malaysia Derivatives Exchange.

(Bloomberg) Sri Trang to List in Singapore After Rubber Gains to Record

Sri Trang Agro-Industry Pcl, Thailand’s biggest publicly traded rubber producer, refiled a prospectus to list on the Singapore stock exchange after rubber prices jumped to a record.

(Bloomberg) Australia Price Risk Seen in 20% Tomato Jump as RBA to Pause

Reserve Bank of Australia Governor Glenn Stevens can glimpse the inflation threat he faces from the nation’s floods at the produce shop near his Sydney home in Sylvania Waters.

(Bloomberg) Coal at 28-Month High to Beat Oil, Gas on Floods: Energy Markets

Coal for producing power may beat oil and natural gas this year as disruptions from Australia to South Africa drive prices for the fuel to a 28-month high.

(Bloomberg) World Bank Sees Capital-Flow Risks, Global Growth Slowing to 3.3% in 2011

Capital inflows, a driving force of the recovery in emerging countries, now pose risks to global growth as they can trigger abrupt currency fluctuations that may do "lasting damage" to some nations, the World Bank said. The Washington-based institution today left a growth forecast for the world´s economy this year unchanged at 3.3 percent, from a revised 3.9 percent in 2010. It predicted that the slowdown, which reflects capacity constraints in developing nations and restructuring in developed economies, will be followed by faster growth of 3.6 percent in 2012. "The pickup in international capital flows reinforced the recovery in most developing countries," Hans Timmer, the World Bank´s director of development prospects, said in a press release today. "However, heavy inflows to certain middle-income economies may carry risks and threaten medium-term recovery, especially if currency values rise suddenly or if asset bubbles emerge." While the recovery is "broad-based" and "solid," the growth rates "are not strong enough to undo the damage that was done during the crisis in all parts of the world," Timmer said on a conference call today.

(Bloomberg) Trichet Faces `Annus Horribilis' as Crisis Tests One-Size-Fits-All Policy

Jean-Claude Trichet´s final year at the helm of the European Central Bank may be his toughest yet as widening economic divergences within the euro area strain the bank´s one-size-fits all monetary policy. With the sovereign debt crisis threatening to engulf Portugal and bond yields in debt-strapped nations near euro-era highs, Trichet must decide when to stop buying government assets, withdraw unlimited liquidity provision for banks and possibly even raise interest rates to stem inflation risks. His response to those challenges may shape his legacy by helping to determine the euro´s future. "2011 could be another annus horribilis for the ECB," said Ken Wattret, chief euro-area economist at BNP Paribas in London. "Stress in debt markets hasn´t diminished and the divergence between euro-area countries is getting bigger. It´ll be a big challenge for the ECB and a tough job for its president to negotiate an appropriate path for monetary policy." Trichet, who chairs an ECB policy meeting today, has been forced to take unprecedented steps to buy time for the euro as governments struggle to agree on how best to shore up confidence in the monetary union. The decision to buy government bonds split the ECB´s Governing Council, and some policy makers have warned that price stability, the bank´s primary goal, could be compromised if emergency measures are left in place too long

(Bloomberg) Federal Reserve Bank President says monetary policy can’t cure US “fiscal pathology”

Federal Reserve Bank of Dallas President Richard Fisher said monetary policy isn’t a “salve for the nation’s fiscal pathology” and that Congress should focus on reducing the federal deficit and creating incentives for companies to grow.

“There are limits to what we can do on the monetary front to provide the bridge financing to fiscal sanity,” Fisher, 61, said in a speech in New York today. “The Fed has done much, in my words, to provide the bridge financing until the new Congress gets to work restructuring the tax and regulatory incentives American businesses need to confidently expand their payrolls and capital expenditures here at home.”

(Bloomberg) Commodities Touch Two-Year High on Economic Growth Speculation

Commodity prices jumped to the highest in more than two years on expectations for global economic growth and lower U.S. forecasts for agricultural inventories. Grains, oilseeds and coffee led gains.

(Bloomberg) -- ECB Has ‘Gold Buffer’ to Absorb Losses on Debt Bought, UBS Says

The European Central Bank ’s gold holdings earned 100 billion euros ($130 billion) in 2010, adding to a “gold buffer” that may absorb losses in its program of sovereign debt purchases, UBS AG said.

The profit will go into a eurosystem “revaluation account” valued at 331 billion euros at the end of last year, UBS economist Stephane Deo said in a report dated Jan. 7. Gold prices jumped 30 percent last year.

“Our understanding is that if the ECB were to take a loss on its portfolio, this would feed into the ‘revaluation account’ just like the ups and downs of the gold portfolio do,” Deo wrote.

The ECB’s Securities Markets Program started in May to intervene in the sovereign market, Deo wrote. The ECB has bought 73.5 billion euros of sovereign securities through the end of 2010 and losses may total 10 billion euros, according to Deo. The ECB bought Portuguese, Irish and Greek securities yesterday, a trader said.

The European Central Bank’s gold holdings earned 100 billion euros ($130 billion) in 2010, adding to a “gold buffer” that may absorb losses in its program of sovereign debt purchases, UBS AG said.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.