Silver Bar Shortages to Lead to Price "Tipping Point"?

Commodities / Gold and Silver 2011 Jan 18, 2011 - 09:44 AM GMTBy: GoldCore

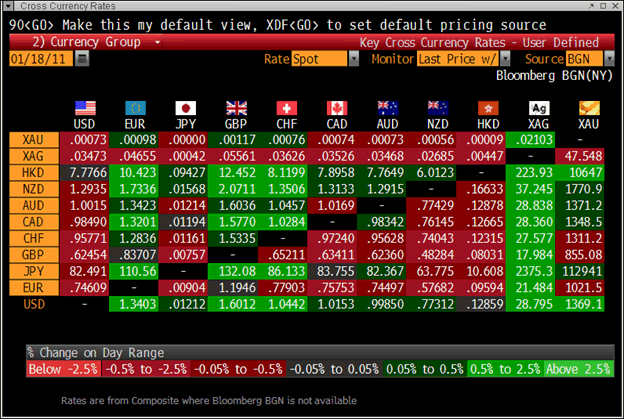

Gold is mixed while silver is higher in all currencies today, especially in the weaker US dollar. European sovereign bond yields are higher and the UK 10-year has risen to 3.66% and is close to breaking out after inflation figures surprised the majority of analysts who remain complacent about inflation.

Gold is mixed while silver is higher in all currencies today, especially in the weaker US dollar. European sovereign bond yields are higher and the UK 10-year has risen to 3.66% and is close to breaking out after inflation figures surprised the majority of analysts who remain complacent about inflation.

Gold is currently trading at $1,370.75/oz, €1,022.11/oz and £856.57/oz.

Equities in Asia were higher as are those in Europe so far today. US equity index futures are mixed with Apple leading to weakness in the Nasdaq; the S&P 500 is flat.

SILVER

Silver is currently trading $28.81/oz, €21.48/oz and £18.01/oz.

Reports of shortages of silver bullion continue to grow. While there are no widespread shortages in this area and dealers with extensive supplier networks (mints and large refiners) are not experiencing difficulties sourcing bullion inventory, it would be wise to keep an eye on this.

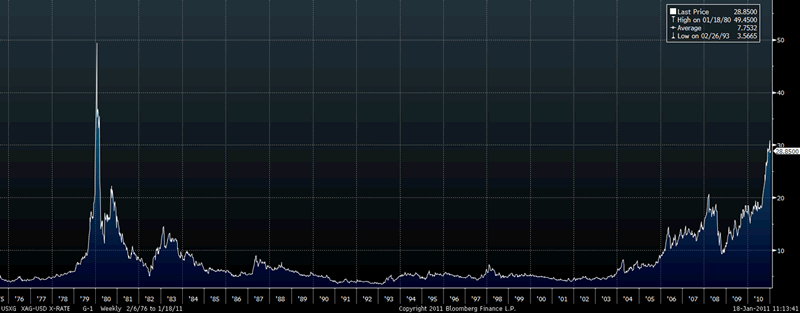

Silver in USD – 35 Years – (Weekly).

Reuters reported shortages of 1 kilo gold bars in Asia last week. Sprott Asset Management reported that it was experiencing difficulty sourcing 1,000 oz silver bars. Sprott said they were concerned about the “illiquidity in the physical silver market" and said delays in being able to source physical silver highlights the “disconnect that exists between the paper and physical markets for silver."

Zero Hedge reported that Bullion Vault, the digital gold provider, had run out physical silver inventories in Germany (and possibly elsewhere) and was advising clients to buy silver from other sources.

Zero Hedge also reported yesterday that some smaller bullion dealers in the UK were having difficulty sourcing all silver bars and had delayed delivery of silver bars (including 1 kilo silver bars) until February.

This comes at a time when the US Mint has reported huge demand in the first two weeks of January for their very popular US Silver Eagle 1 oz bullion coins.

At about $33, €25 or £20 a coin, collectors and those seeking financial insurance have been buying silver in very significant quantities. The 2011 minted coins were first issued on January 3 and in just the first two weeks, 3.5 million coins were sold, according to numismatic web site Coin News.

In January 2009, the silver coins first topped the 3 million sales mark, with record sales totaling 3.59 million for the entire month.

If sales continue at these levels, that record should be surpassed this week. The all time monthly record of 4.26 million silver coins, which was set last November, is clearly in sight.

A recent report by analyst Adrian Douglas of GATA warns of forthcoming shortages of gold and silver bullion coins and bars, and that a “tipping point” will soon be reached that could lead to a COMEX default and a short squeeze which leads to much higher prices. Douglas himself has shown in Le Metropole Café how Comex silver inventories are shrinking and are not far from ten year lows.

The “bear raids” by the large concentrated shorts being investigated by the CFTC, are only leading to increased physical off-take. Indeed, the selling raids may be leading some participants on the COMEX (including large hedge funds) to take delivery or sell futures and buy bullion in allocated accounts.

None of the factors, in and of themselves, suggest that widespread shortages of silver (or gold) bullion are imminent in the immediate future. However, much circumstantial evidence suggests, especially the bona fide reports of difficulty in sourcing large silver bars, that the supply and demand balance in the silver market is very tight.

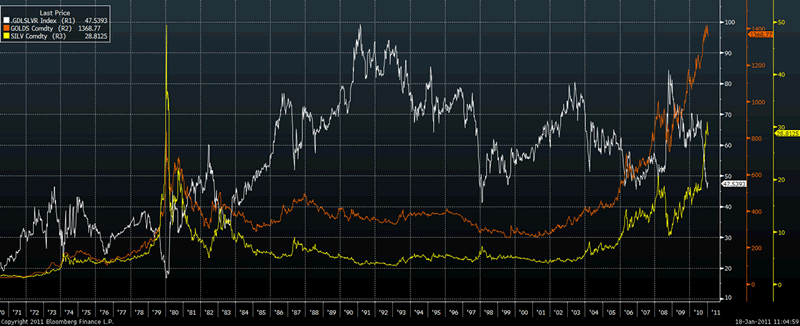

The more than 80% increase in the silver price seen in 2010 is not leading to an increased supply of silver but rather to a continuing and possibly increasing demand.

This is not surprising as silver is a byproduct of base metals and therefore its price increase will not have led to any material increase in silver mine production. This fact is known by most buyers of silver coins and bars and many of them continue to hold and add to their silver holdings in anticipation of much higher prices.

Silver at $50 per ounce and the 1980 adjusted for inflation price of $130 per ounce are conservative estimates for some silver enthusiasts. They have been proved right in recent years and the extremely delicate supply and demand equation in silver could see them proved right again in the coming months.

Since 2003, GoldCore have written research articles pointing out that the very small size of the silver bullion market would likely see its inflation adjusted high of $130/oz reached in the long term.

Interestingly, were gold to reach its adjusted for inflation 1980 price of $2,300 per ounce, and silver revert to its long term gold/silver ratio of 15:1 (geologically there are 15 parts of silver to every one part of gold in the Earth’s crust) then silver would reach over $150 per ounce.

While this seems über bullish to those who know little about the silver market, some silver enthusiasts - and there are many - believe that in time, silver will be valued at the same price as gold as huge quantities of silver have been used up in industrial applications since the Industrial Revolution of the 19th Century and throughout the 20th Century and into this millenium.

In these unprecedented financial and economic times, it is important to have a long term perspective.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

PLATINUM GROUP METALS

Platinum is currently trading at $1,817.25, palladium at $802/oz and rhodium at $2,375/oz.

NEWS

(Bloomberg) -- Gold dropped for a third day in London as gains in equity markets and the dollar may be eroding demand for precious metals as an alternative investment.

Assets in 10 gold exchange-traded products including exchange-traded funds have dropped for four weeks to about 2,078 metric tons, the lowest since Sept. 15, according to data compiled by Bloomberg. The dollar has climbed 0.7 percent against the euro this year and the MSCI World Index of shares advanced 2.1 percent. Gold is down 4.2 percent, heading for the first monthly drop since July.

“For some people, the stock market has done well and that may have attracted some people out of gold and the dollar is higher,” said Mark O’Byrne, executive director of brokerage GoldCore Ltd. in Dublin. “While there could be liquidation in ETFs, I don’t think you’re going to see massive wholesale liquidation that would result in prices falling sharply because most of the ETF investors are in there for the long-term diversification.”

Gold for immediate delivery declined 22 cents to $1,361.50 an ounce by 4:51 p.m. in London. Prices have dropped 1.9 percent in three sessions. The futures for February delivery gained 40 cents to $1,360.90 an ounce on the Comex in New York.

A decline in ETF holdings may be a sign of investors taking delivery of the gold instead of liquidating their holdings. More than 100 customers at GoldCore have taken advantage of a service offered in the last three months to store gold in a separate allocated account at Via Mat Management AG, O’Byrne said.

“They want to own the bullion themselves, and avoid any counterparty risk,” he said. “A few hedge fund managers sold their ETFs and put the gold in an allocated account.”

(Bloomberg) -- Silver to Outperform Gold in 2011 on Real Demand, UBS Says

Silver is likely to outperform gold in 2011, supported by industrial demand, according to UBS Securities Co.

As the real economy continues improving, silver has the advantage as 30 percent of consumption is from industrial use, whereas in gold it only accounts for 10 percent to 20 percent of consumption, said Lin Haoxiang, associate director of China equity research.

The average cash copper price on the London Metal Exchange may rise 23 percent to $9,149 a metric ton, Lin said at a media briefing today.

(Bloomberg) -- Morgan Stanley raised its copper and gold forecasts through 2015, the bank said in a report today. It expects copper to average $4.45 a pound in 2011, up 24 percent from an earlier estimate. It expects gold to average $1,400 an ounce this year, up 6 percent from a previous forecast.

(Bloomberg) -- Estonia signed an agreement that limits how much gold European central banks can sell until 2014, according to the European Central Bank.

The five-year agreement announced August 2009 that was signed by the ECB and 18 other countries will remain unchanged over the period of the agreement, the ECB said in a statement on its website today. That agreement started Sept. 27, 2009 and limited gold sales to 400 tons a year for five years.

Estonia owned 0.2 metric ton of gold as of last month, according to the World Gold Council. As of Nov. 30, the gold sales under the agreement for 2010-11 total 0.9 ton by an unidentified country in the eurozone, according to the World Gold Council.

(Bloomberg) -- Makishi Rokugawa says he’s installing the first gold vending machines in central Tokyo so Japanese consumers can invest in “something real.”

Space International Ltd., a company started by Rokugawa with funds from selling novelty USB flash drives, is offering gold or silver to the world’s biggest vending machine market, where consumers can buy anything from drinks and candy to lingerie and fortune-telling printouts.

In a nation where deflation has cut consumer prices for 21 straight months through November, salaries are the smallest since 1990, bond yields are the world’s lowest, and the stock market is 40 percent below its December 1989 peak, “ordinary Japanese need a way to invest in something they can touch,” Rokugawa, 35, said yesterday at a media conference.

“What if you wake up one day and your money is just a piece of paper?” Rokugawa asked reporters at the $410-a-night Imperial Hotel, where he plans to place a second gold vending machine after one in his Tokyo office building. Rokugawa plans to take his business “nationwide” next year and is considering entering the Hong Kong market, he said.

The machine offered 1 gram of gold for 6,800 yen ($82.30) yesterday. Gold traded at $1,362.45 per troy ounce at 10:52 a.m. in Tokyo, or about $44 a gram. The vending machine sells the precious metal in the form of coins and ingots, with weights ranging from a gram to a quarter of an ounce.

Vending Mania

Japan has a vending machine for every 32 people, according to Bloomberg calculations. The nation posted 5.15 trillion yen in vending machine sales in 2009, about 45 percent more than the $42.9 billion revenue in the U.S., according to the Japan Vending Machine Manufacturers Association.

Germany’s Ex Oriente Lux AG, which says it was the first to install a gold-vending machine, operates 11 machines domestically and five abroad, including in Spain and Italy. TG- Gold-Super-Markt in June 2009 installed its first gold bar vending machine at Frankfurt airport, while a similar machine was unveiled at Abu Dhabi’s Emirates Palace hotel in May 2010.

The most expensive item available in Rokugawa’s machine yesterday was a quarter-ounce gold coin issued by the Canadian central bank, retailing for about $410. Rokugawa declined to say how much gold will be kept in the machine at any one time.

Price Updates

Prices will be updated once a day and relate to the gold market price, Rokugawa said. Gold for immediate delivery has gained in each of the last 10 years, rising 30 percent in 2010. The metal’s biggest one-day jump in the last 12 months was 3.3 percent and the biggest decline was 4.1 percent.

Silver coins will range from 15.5 grams to 62.2 grams, or 2 troy ounces, in weight, according to the company’s catalog distributed at the opening event. Precious metal coins from the central banks of China, Australia, and Canada will be on offer, the catalog showed.

Rokugawa may expand the business to platinum and other precious metals in time, he said. The entrepreneur said he was encouraged by the gold-vending business in Europe, which has seen client numbers climb since introduction in 2009.

Ex Oriente Lux, which makes bullion vending machines under the “Gold to Go” brand, said in September it plans to more than triple the number of the devices in operation. The Reutlingen, Germany-based company sells gold bars and coins weighing from 250 grams (8.8 ounces) to as little as 1 gram and updates the price of bullion every 10 minutes.

(Bloomberg) -- Record Food Prices Causing Africa Riots Stoke U.S. Farm Economy

The same record food prices causing riots in Algeria and export bans in India are allowing President Barack Obama to combine the biggest-ever U.S. farm exports with the tamest inflation since the 1960s.

(Bloomberg) -- Gold May Gain as Europe Debt Concern, Price Drop Spur Demand

Gold may gain as concerns that the European sovereign-debt crisis may linger boost demand for precious metals as a protector of wealth, and as a price drop in the past two weeks spurs physical buying. Platinum gained.

(Bloomberg) -- India’s rupee fell for a third day, the longest streak of losses since November, as gold traders bought dollars to cover purchases of the metal following Greece’s credit-rating downgrade. Fitch Ratings on Jan. 14 cut its assessment for Greece to below investment grade of BB+ as European finance ministers meet this week to discuss the euro-area debt crisis. The rupee declined to the lowest level in almost a week. “Traders bought gold late Friday in New York trade and they are now covering those positions,” said Paresh Nayar, Mumbai-based head of currency and money markets at the Indian unit of FirstRand Ltd. “This led to demand for the rupee in the morning hours.”

(PTI) -- Former Tunisian Prez's wife 'flees country with 1.5 ton gold'

Tunisia's ousted President Zine al-Abidine Ben Ali's wife has fled the riot-torn country with 1.5 tons of gold worth more than 45 million Euros, according to a French media report.

Leila Trabelsi, the wife of the 74-year-old former president now in exile in Saudi Arabia, went to the Central Bank of Tunisia to fetch the gold bars, France's 'Le Monde' newspaper quoted the French secret service as saying.

The governor of the bank is reported to have refused to give them to her, so 53-year-old Trabelsi rang her husband who personally intervened, and she flew out with the bullion as she joined him in exile in Saudi Arabia, the daily said.

"It seems that the wife of Ben Ali left with some gold, 1.5 tons or 45 million euros worth," the British media quoted a French politician as telling the French newspaper.

But a central bank official denied receiving verbal or written orders for gold withdrawals, adding that the country's gold reserves "have not moved", 'Le Monde' said.

However, an official from the Elys e Palace told 'Le Monde' that "this information comes directly from Tunisia, in particular the Central Bank. It seems to be pretty much confirmed."

After 23 years of dictatorship, the former President Ben Ali fell to a wave of student protests on Friday, fleeing into exile from the Arab nation that had descended into blood -soaked chaos and riots.

The French government also believes that the Libyan secret service may have helped Ben Ali flee in order to avoid violence, the newspaper said

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.