The Politics of Deflation

Economics / Deflation Jan 19, 2011 - 10:00 AM GMTBy: Vijay_Boyapati

The reason that political establishments have always been biased against monetary deflation[1] can be found in the manner in which wealth transfer occurs under inflationary and deflationary environments.

The reason that political establishments have always been biased against monetary deflation[1] can be found in the manner in which wealth transfer occurs under inflationary and deflationary environments.

During an inflationary credit expansion, wealth is transferred from the public in general to the earliest recipients of the newly created credit money. In practice, the earliest recipients are interest groups with the strongest political connections to the state and, in particular, the state institutions that control monetary policy (i.e., the Federal Reserve in the United States). Importantly, the wealth transfer that takes place during an inflation is hidden and largely unrecognized by the majority of the population. The population is unaware that the supply of money is increasing and the attendant rise in prices, ostensibly beneficial to business, initially

produces [a] general state of euphoria, a false sense of wellbeing, in which everybody seems to prosper. Those who without inflation would have made high profits make still higher ones. Those who would have made normal profits make unusually high ones. And not only businesses which were near failure but even some which ought to fail are kept above water by the unexpected boom. There is a general excess of demand over supply — all is saleable and everybody can continue what he had been doing.[2]

produces [a] general state of euphoria, a false sense of wellbeing, in which everybody seems to prosper. Those who without inflation would have made high profits make still higher ones. Those who would have made normal profits make unusually high ones. And not only businesses which were near failure but even some which ought to fail are kept above water by the unexpected boom. There is a general excess of demand over supply — all is saleable and everybody can continue what he had been doing.[2]

In an inflationary environment, wealth transfer proceeds insidiously and is masked by a perceived prosperity. The unmasking finally occurs at the end of the credit boom when the market's tendency to clear prior losses takes hold. Failed businesses are liquidated and their capital is transferred, usually through bankruptcy, to creditors who must acknowledge losses on these misguided investments. Unemployment soars and social unrest replaces the former sense of euphoria attending the credit boom. Professor Hülsmann summarizes the differences between the transfers of wealth occurring under inflation and deflation as such:

In short, the true crux of deflation is that it does not hide the redistribution going hand in hand with changes in the quantity of money. It entails visible misery for many people, to the benefit of equally visible winners. This starkly contrasts with inflation, which creates anonymous winners at the expense of anonymous losers. …

[Inflation] is a secret rip-off and thus the perfect vehicle for the exploitation of a population through its (false) elites, whereas deflation means open redistribution through bankruptcy according to the law.[3]

And here lies the answer to why the state prefers a policy of controlled inflation. Only in an inflationary environment can state largesse be conferred to the politically well-connected without raising public ire. The widespread and visible transfers of property through bankruptcy that must take place during a deflation are often politically destabilizing and thus highly unappealing to any regime. A sense of injustice grows within the population as banks are saved from the folly of their misguided investments with taxpayer-funded bailouts, while debtors with no political clout have property seized in bankruptcy.

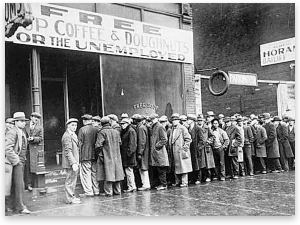

Deflation and Social Unrest

The sense of public outrage sometimes flares in acts of violence and antiestablishment rioting — a fact cited frequently in history as a rationale for preventing deflations from running their full course. In 1931, Lord Keynes took part in writing the Macmillan report for the British government, which warned that a reduction in wages resulting from an unimpeded deflation "might be expected to produce social chaos."[4]

On January 7, 1811, economist Mathew Carey published a series of letters he had sent to Congressman Adam Seybert warning that the failure to renew the charter for the Bank of the United States, and the resulting destruction of credit, would produce "an awful scene of destruction, the consequences or termination of which elude the power of calculation."[5]

On January 7, 1811, economist Mathew Carey published a series of letters he had sent to Congressman Adam Seybert warning that the failure to renew the charter for the Bank of the United States, and the resulting destruction of credit, would produce "an awful scene of destruction, the consequences or termination of which elude the power of calculation."[5]

The scaremongering and agitation of the past is echoed in warnings that followed the housing bust and global recession of 2008. For instance, the International Monetary Fund's managing director, Dominique Strauss-Kahn, warned that the rise in unemployment following the US housing bust might cause "an explosion of social unrest."[6]

Should We Expect a Helicopter Drop of Money?

The dire sociopolitical consequences attributed to an untrammeled deflation superficially suggest that the Federal Reserve would do everything in its power to force the resumption of a credit expansion. For example, it was a political analysis that led Austrian economist Peter Schiff to conclude that a hyperinflation may be on the horizon:

If the Fed drops enough money from helicopters it will eventually reverse the nominal declines in asset prices. Unfortunately, that road leads to hyper-inflation and disaster. … The big problem politically is that hyper-inflation may superficially appear to be the lesser evil. If asset prices are allowed to collapse, ownership of those assets will pass to our creditors. If instead we repay our debts with debased currency, we retain ownership of our assets and shift the losses to our creditors. Since American debtors can vote in US elections and foreign creditors cannot, the choice seems obvious.

Schiff errs in his analysis by implying that monetary policy in the United States is directed by the democratic voting mechanism; it is not. The Federal Reserve is an independent, quasi-private institution within the state that is nominally overseen by Congress. In practice, however, the Fed directs the passing of legislation pertaining to monetary policy rather than being directed by it.[7]

The Importance of Who Controls Monetary Policy

To elucidate the importance of who controls monetary policy, it will be useful to define two classes that operate within the institution of the state: There is the class of people whose power derives from popular mandate, which we will call the political class. In the United States the political class includes members of Congress, the president, and appointees to the executive branch of the US government. There is also the class of people whose interests are aligned with and whose main constituency is the banking industry, which we will call the banking class. In the United States this is the Federal Reserve.

It has been asserted that it does not matter which class controls monetary policy. In his widely used textbook, Economics, Paul Samuelson declares with almost childish naïveté that "whenever any conflict arises [in the Federal Reserve] between making a profit and promoting the public interest, it acts unswervingly in the public interest."[8] The ludicrous notion that an institution granted a monopoly to counterfeit money could ever act in the public interest does not warrant scrutiny in an Austrian analysis.

However, the more specific question of whether monetary policy controlled by the banking class is indistinguishable from monetary policy controlled by the political class is of critical importance to a settlement of the inflation-versus-deflation debate. In What Has Government Done to Our Money, Murray Rothbard contends,

The American Continentals, the Greenbacks, and Confederate notes of the Civil War period, the French assignats, were all fiat currencies issued by the Treasuries. But whether Treasury or Central Bank, the effect of fiat issue is the same: the monetary standard is now at the mercy of the government.[9]

In other words, Rothbard claims it is of no consequence whether the political class or the banking class controls monetary policy. Yet Rothbard undermines his own argument by recognizing that in all the cited instances of hyperinflation monetary policy was controlled by a treasury — i.e., by the political class.

Furthermore, in tracing the origins of the Federal Reserve Rothbard reveals the difference between the monetary ideologies of the banking class, which agitated for the creation of a central bank, and the populists of the day:

The Morgans were strongly opposed to Bryanism, which was not only populist and inflationist, but also anti–Wall Street bank; the Bryanites, much like populists of the present day, preferred Congressional, greenback inflationism to the more subtle, and more privileged, big bank–controlled variety.[10]

The key difference between the motivation of the banking class and the political class, which is hinted at by Rothbard, is that the former prefers a monetary policy that allows them to profit from the economic activity of the population in a subtle and insidious manner. A policy of open inflation conducted by the political class is the path to hyperinflation, the breakdown of the division of labor, and the destruction of the monetary system itself.

Unlike the political class, the banking class is savvy enough to recognize policies that will lead to mass inflation and the death of the monetary system from which it parasitically profits. A clear illustration of the different motivations of the two classes can be found in the history of the Weimar Republic's hyperinflation.

The Weimar Hyperinflation: The Banking Class versus the Political Class

The Reichsbank of Germany was established in 1876 and from its inception was directly controlled by the chancellor of the nation.[11] The importance of the political class's controlling monetary policy became manifest in 1914, "when Germany dropped the gold standard at the outbreak of the First World War," whereupon the "government demanded from the Reichsbank practically unlimited lender-of-last-resort financing, first of war then of postwar expenditures."[12]

The drain of capital to fund reparations demanded by the Allies in the punitive peace settlement of Versailles made it politically unfeasible for the German state to fund itself through taxation. Instead the state turned to the printing presses to cover the shortfall in revenue,[13] leading to a massive rise in prices and the famous hyperinflation of the Weimar Republic.

On May 26, 1922, the Reichsbank was nominally granted autonomy as a condition of the Allies for granting a moratorium on reparations. However, the Reichsbank remained under the direction of its president, Rudolph Havenstein, who had been appointed when the central bank was still controlled by the chancellor. A letter from the Reichsbankdirektorium to the minister of finance shows that as late as August 23, 1923, in the last months of the hyperinflation, the Reichsbank was still beholden to the political class within the German state. The letter stated that despite the impending destruction of the German currency the bank could not "be deaf to the conviction that necessities of state were involved and must be satisfied."[14]

It was only the appointment of Hjalmar Schacht, "who enjoyed the full backing of the international financial world," that arrested the Weimar hyperinflation. Schacht, who was a product of the banking class, was able to finally assert the independence of the Reichsbank from the political class. According to German economic historian Carl-Ludwig Holtfrerich, the "Reichsbank under Schacht has even been called a Nebenregierung, a supplementary government, due to its successes in imposing its will on the regular government and its legislators, and thereby creating a state-within-the-state situation."[15]

Japan's Deflation

In light of the historical example of the Weimar hyperinflation and how the actions of the two classes shaped its beginning and denouement, we may turn with new understanding to the case of Japan during the 1990s.

For almost two decades after the collapse of its asset bubble in 1991 Japan has suffered stagnant growth and experienced low or negative growth in aggregate prices. While the Bank of Japan had the theoretical power to create enough money to force the resumption of an inflationary credit expansion, as any central bank does, it did not follow this path. Observing that the Bank of Japan had the same tools at its disposal as the Federal Reserve, Ben Bernanke, then a professor at Princeton, suggested that "Japan's deflation problem is real and serious; but, in my view, political constraints, rather than a lack of policy instruments, explain why its deflation has persisted for as long as it has."[16]

In fact, the disinclination to monetize enough debt to spur a resumption of a credit expansion can be explained by the banking class maintaining control of monetary policy in Japan. The differing motivations of the banking class and the political class, and the fact that the banking class maintains control of monetary policy, is illustrated by the refusal of the head of the Bank of Japan to accede to the request of the Japanese prime minister to employ a massive monetary stimulus to devalue the Yen:

Mr. Kan [the prime minister] would like to see a repeat of such "shock and awe" action but has failed to convince Mr. Shirakawa [the bank's governor] that the risks are worth it. Bank officials fear that a monetary blast might disturb a fragile equilibrium, bringing unwelcome attention on Japan's debts. Haunted by memories of Japan's hyperinflation, the bank is moving gingerly.[17]

Bernanke, the Deflation Fighter

Much has been made of Chairman Ben Bernanke's criticism of Japan's response to the deflation it suffered in the wake of its own real-estate bubble. Bernanke's academic expatiation on the dangers of deflation has been taken as proof that he will "not allow [the US economy] to go into deflation."[18]

Further, many Austrian economists have taken Bernanke's musing on a theoretical helicopter drop of money to stimulate inflation as an ominous warning that mass inflation will probably be the policy path chosen by the Federal Reserve. Yet it would be misleading to conflate the beliefs and motivations of Ben Bernanke as academic with the actions of Ben Bernanke as Federal Reserve chairman.

For instance, Chairman Bernanke's predecessor, Alan Greenspan, wrote trenchantly on the need for a gold standard, explaining that "[in] the absence of the gold standard, there is no way to protect savings from confiscation through inflation."[19] One might have concluded that from his personal desire for a gold standard Greenspan would have used his influence as Federal Reserve chairman to agitate toward that end. Yet no such thing ever occurred. In Congressional testimony he confessed,

I am one of the rare people who have still some nostalgic view about the old gold standard, as you know, but I must tell you, I am in a very small minority among my colleagues on that issue.[20]

Greenspan's admission suggests that the Federal Reserve's institutional structure is likely to be more significant in determining monetary policy than the economic doctrine espoused by its chairman. Given that the Federal Reserve was created by and for the benefit of the banking class,[21] it is unlikely to pursue a policy that would be detrimental to that class. It is therefore unlikely that the Federal Reserve will monetize enough debt to completely paper over the losses caused during the housing boom. For, as Ludwig von Mises explained,

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

Conclusion

While the Federal Reserve has the theoretical power to force the resumption in credit expansion by monetizing enough public debt that the losses from the housing bust are wiped away, it is unlikely to do so. The Fed was created for the benefit of the banking class, and while it remains under the control of that class it will not pursue a policy that would lead to a breakdown in the monetary system from which the banking class profits.

However, the Fed is also unlikely to allow an untrammeled deflation to run its full course, given the risk of political unrest that might arise. Therefore, the Federal Reserve's most likely course of action is to keep the mortgage market, in which most of the losses are concentrated, in a sort of stasis where losses are acknowledged slowly over time. Such a policy, which might well be called "controlled deflation," would lead to a prolonged period of high unemployment and slow growth, as capital is only slowly reallocated to satisfy consumer preferences.

Further, the insufficient or barely sufficient creation of new credit to make up for debt paid down — or defaulted on — would cause a low growth in aggregate prices; in fact, these prices might occasionally become negative. Not until the losses of the housing boom are fully cleared — which might take years under a policy of controlled deflation — should we expect an inflationary credit expansion and a significant rise in prices.

Notes

[1] Mises, L. Human Action. p. 573: "Public opinion has always been biased against creditors. It identifies creditors with the idle rich and debtors with the industrious poor. It abhors the former as ruthless exploiters and pities the latter as innocent victims of oppression. It considers government action designed to curtail the claims of the creditors as measures extremely beneficial to the immense majority at the expense of a small minority of hardboiled usurers."

[2] Hayek, F.A. "Can We Still Avoid Inflation?" Lecture to the Foundation for Economic Education at Tarrytown, New York, on May 18, 1970.

[3] Hülsmann, J.G. Deflation and Liberty. p. 27.

[4] Keynes, J.M. et al. Macmillan Report. 1931. p. 195.

[5] Carey, M. Letters to Dr Adam Seybert, Representative in Congress for the City of Philadelphia, on the Subject of the Renewal of the Charter of the Bank of the United States. Second Edition, January 7, 1811.

[6] Pritchard. A.E. "IMF Fears 'Social Explosion' From World Jobs Crisis." September 13, 2010.

[7] As Liaquat Ahmed trenchantly observed, "senators and congressmen are rarely informed enough to be persuasive advocates for changes in monetary policy." Lords of Finance, Penguin Press, 2009, p. 278.

[8] Economics, p. 495.

[9] Rothbard, M. What Has Government Done To Our Money? P. 77.

[10] Rothbard, M. "Origins of the Federal Reserve." Quarterly Journal of Austrian Economics, Vol. 2, No. 3 (Fall 1999), pp. 3–51.

[11] The United States National Monetary Commission. The Reichsbank 1876–1900. Government Printing Office, Washington, 1910. p. 42.

[12] Holtfrerich, C.-L. "Monetary Policy in Germany Since 1948: National Tradition, International Best Practice or Ideology?" In Central Banks as Economic Institutions, edited by Jean-Philippe Touffut, 2008. p. 24.

[13] Holtfrerich explains the preference of the political class to fund the operation of the state using the printing press rather than taxation, with a 1919 quote from a Hamburg bank director, Friedrich Bendixen: "The same citizen who would react to tax exactions on this scale with complaints of victimization at the hands of authorities hostile to property will accept the doubling of prices with demur if he be spared new tax demands, even though the government's monetary policy is manifestly to blame. Only in taxation do people discern the arbitrary incursions of the state; the movement of prices, on the other hand, seems to them sometimes the outcome of traders' sordid machinations, more often a dispensation which, like frost and hail, mankind must simply accept. The statesman's opportunity lies in appreciating this mental disposition."

[14] Holtfrerich, C.-L. The German Hyperinflation 1914–1923: Causes and Effects. 1986. pp. 168−169.

[15] "Monetary Policy in Germany Since 1948: National Tradition, International Best Practice or Ideology?" p. 24.

[16] Bernanke, B. "Deflation: Making Sure 'It' Doesn't Happen Here." Speech Before the National Economists Club, Washington, DC, November 21, 2002.

[17] Pritchard. A.E. "Japan Renews QE as Recovery Falters." August 30, 2010.

[18] Lynch, D.J. "Bernanke May Discuss New Techniques to Revive Economy." USA Today, August 26, 2010.

[19] Greenspan, A. "Gold and Economic Freedom." In Capitalism: The Unknown Ideal. Signet, July 15 1986. p. 107.

[20] Hearing before the US House of Representatives Committee on Financial Services, July 22, 1998.

[21] Rothbard, M. "Origins of the Federal Reserve." Quarterly Journal of Austrian Economics 2, no. 3 (Fall 1999), pp. 3–51: "The financial elites of this country, notably the Morgan, Rockefeller, and Kuhn, Loeb interests, were responsible for putting through the Federal Reserve System as a governmentally created and sanctioned cartel device to enable the nation's banks to inflate the money supply in a coordinated fashion, without suffering quick retribution from depositors or noteholders demanding cash."

Vijay Boyapati is a former Google engineer. In 2007 he started Operation Live Free or Die, a grassroots organization to help Ron Paul's 2008 presidential campaign. Since 2009 he has devoted himself to studying Austrian Economics. Send him mail. See Vijay Boyapati's article archives. Comment on the blog. ![]()

© 2011 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.