Using Double Calendar Options Spreads to Capitalize on Corporate Earnings

InvestorEducation / Options & Warrants Jan 19, 2011 - 10:17 AM GMTBy: J_W_Jones

IBM will reported earnings after the closing bell on Tuesday, January 18. For traders maintaining a position in common stock during earnings releases and the frequent price gyrations can result in uncomfortable moments.

IBM will reported earnings after the closing bell on Tuesday, January 18. For traders maintaining a position in common stock during earnings releases and the frequent price gyrations can result in uncomfortable moments.

Earnings releases for the options trader do not force us to take a position in which we must correctly predict the direction of price action stemming from the earnings release. By exploiting the typical changes in option pricing that reliably and reproducibly occur as earnings approach, it is possible to establish a broad potential range of profitability that extends for a considerable distance both above and below the current price of the underlying.

The core point of understanding is to recognize that implied volatility (IV) reproducibly increases in the series of options that will expire after the impact of earnings has been reflected in the price of the stock. Using the standard option pricing models, IV is directly correlated with option prices being “rich” or “lean”. In the specific case under consideration, IBM monthly options will expire this Friday, January 21. A further predictable characteristic of this IV increase is that this juiced IV will drop substantially and rapidly following the release of the earnings and the reaction of price of the stock to this event.

Armed with this knowledge of the characteristic behavior of IV, let us consider a trade to exploit this predicted sequence of events. The trade structure we will use is that of the “double calendar spread”. This spread is established by selling the front month options with the juiced IV and buying longer dated options with lower IV. The fundamental rationale for this trade is that we are going to sell “rich” option premium and buy normally priced premium.

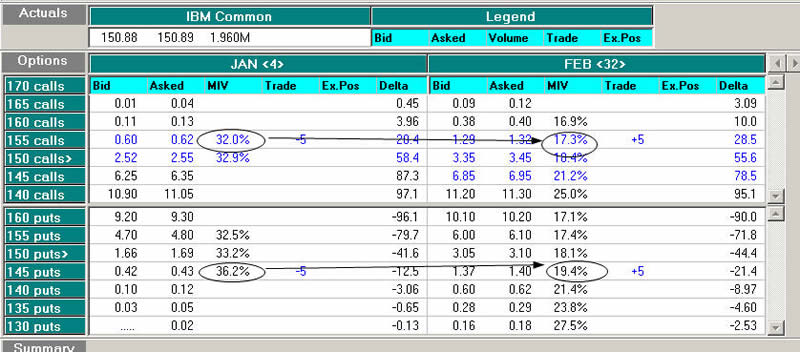

As a first step, consider this option pricing matrix for IBM from this morning (IV is labeled MIV in this proprietary software):

As highlighted by the ellipses and horizontal arrows, it is clear that the predicted increase in IV has occurred and there currently exists a horizontal volatility skew.

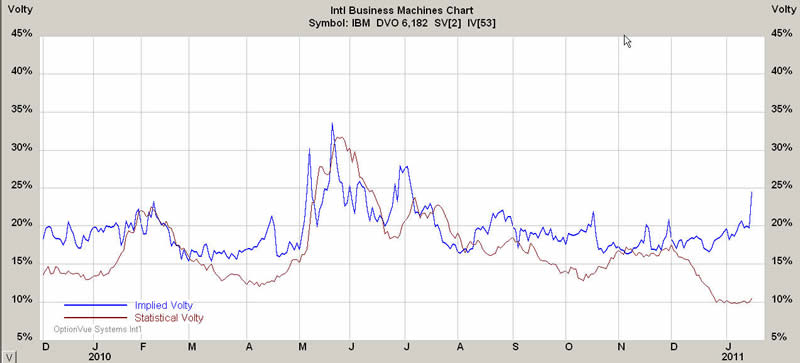

The next step in understanding this trade is to check to be sure the historic range of volatilities which are typical for this underlying. Below is an embedded daily chart of the implied volatility. When considered together with the first chart of current pricing, it is clear that we are selling rich premium and buying more normally priced premium.

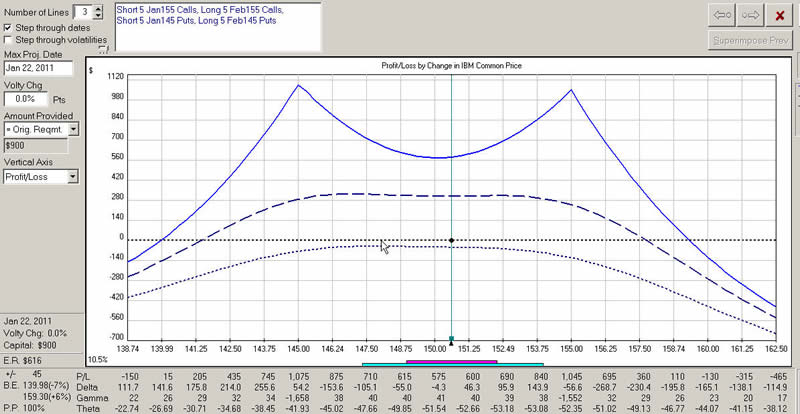

With this understanding, we can now consider the performance graph of this double calendar trade. It is constructed with four individual legs which are executed by “buying” two individual calendar spreads. It should NOT be executed in four individual trades. The specific trades are to sell the January 155 calls, buy the February155 calls, sell the January 145 puts, and buy the February 155 puts. The expected performance graph is embedded below:

As can be seen from the graph, the trade has breakeven points of 139.98 to 159.30. The magnitude of the predicted move can be imputed from the price of the at-the-money option straddle. That analysis gives a range of 145.90 to 154.10, price values well within the profitable zone of the trade.

What are our points of risk on the trade? Risk comes from two sources in a trade such as this: price and IV. If price exceeds our breakeven points, the trade will be unsuccessful. If IV of the long legs collapses more than projected, the trade will produce losses. Risk is crisply limited to the amount paid for the trade; you cannot lose more than the capital invested.

This is an example of a controlled risk trade seeking to capitalize on well recognized relationships between an earnings release and option pricing. This is not a “gimmee” trade, but represents a reasonable risk:reward situation. As with all trades, it is presented for educational purposes only and does not constitute a recommendation.

If you would like to continue learning about the hidden potential options trading can provide please join my FREE Newsletter: www.OptionsTradingSignals.com

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.