Gold and Silver continue to Sell off Despite Shortage in Hong Kong

Commodities / Gold and Silver 2011 Jan 25, 2011 - 05:56 AM GMTBy: GoldCore

Gold and silver's sell off has continued this morning. Despite gold's 3.75% and silver's nearly 8.4% fall in January and the continued sell off in futures markets, physical demand remains robust and supply tight. While speculators are taking profits and some shorting, investors and those who see gold as a store of value continue to accumulate physical. This is particularly the case in China, India and Asia but western demand also remains robust as seen in the record demand for US Silver Eagles from the US Mint in January and continuing reports of dealers not being able to secure certain bullion products. Dealers in Hong Kong overnight report that "there doesn't seem to be enough supply in the physical market." (see News)

President Vladimir Putin holds a gold bar at a mineral resources exhibition in Madagan in the Russian Far East, Nov. 22, 2005. (Itar-Tass photo).

Asian equities were higher except for the CSI 300 in China which has lagged notably recently. European indices have opened tentatively and US Equity Index Futures are slightly in the red.

President Barack Obama's State of the Union address to Congress later today will be observed but no surprises are expected. Market participants appear to again be over optimistic about Obama's ability to help the US emerge from the economic crisis. Indeed, most continue to underestimate the scale and depth of the crisis in the US where a large minority of the population now survive on food stamps and real unemployment is likely over 20% and not below 10% as reported in the bogus Bureau of Labour Statistics figures.

The bombing in Russia, which is being blamed on terrorists, is another sign that geopolitical risk remains high and markets remain complacent about threats posed by terrorism, state sponsored terrorism and war.

Russian central bank demand for gold is set to remain high and they intend buying 100 tonnes of gold every year in the coming years, according to their central bank. They will acquire the bullion from domestic production according to the bank's first deputy chairman. This contradicts the statement by Vladmir Putin that Russia would buy gold on the international market. It is another underlying bullish fundamental for the market and shows Russia's long term intent of positioning the Russian ruble as a competing global reserve currency to the US dollar.

GOLD

Gold is trading at $1,327.35/oz, €976.21/oz and £841.43/oz.

SILVER

Silver is trading at $26.65/oz, €19.60/oz and £16.89/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,782.50/os, palladium at $782.00/oz and rhodium at $2,400/oz.

News

(Reuters) Gold hits 10-week low; strong physical demand supports

Spot gold hit a ten-week low on Tuesday, as support from safe-haven demand diminished on strong economic data out of Europe, but strong physical buying and tight supply in Asia are expected to provide a floor for prices.

Euro zone industrial new orders rose more than expected in November, confirming the strength of recovery in industry in the economic union.

The improved economic data, combined with speculation that the European central bank might raise interest rates, pushed the euro to a two-month high. The single currency held near the peak on Tuesday.

"The gold market is a bit negative for the time being," said Ronald Leung, a physical trader at Lee Cheong Gold Dealers, adding that talks on more tightening moves from China before the Lunar New Year holiday also adds to the bearish sentiment.

"But on the physical side, people are still buying. There doesn't seem to enough supply in the physical market."

India's central bank raised key interest rates on Tuesday in a bid to clamp down on resurgent inflation and warned that higher food prices could become entrenched if steps to boost output are not taken.

Spot gold fell below $1,330 for the first time in about ten weeks. It recovered to $1,332.85 an ounce by 5 a.m. EST, but remains on course for a fourth consecutive day of decline.

The Relative Strength Index fell to 32.675, its lowest since late October 2008 and close to the oversold level at 30.

U.S. gold futures fell nearly one percent to $1,332.2.

A bearish target at $1,322 per ounce remains unchanged for spot gold, based on its wave pattern and a triangle pattern, said Wang Tao, a Reuters market analyst.

"I don't see prices drop much further, as the strong physical demand is supportive. But around the Chinese New Year, market in Asia will be a bit quiet," said a Hong Kong-based dealer.

The strong hold for gold prices would be around $1,320, he added.

This year's Lunar New Year falls on Feb 3. China, a key player in the region's gold market, kicks off a week-long holiday on Feb 2.

Holdings in the SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, fell 10.926 tons, its biggest one-day loss since early October, to 1,260.843 tons by Jan 24.

Spot silver fell to $26.64 an ounce, its lowest in nearly two months. It was trading at $26.78, down half a percent. The RSI fell to 33.152, its lowest since early February last year.

(ITAR-TASS) Central Bank Plans to Buy Over 100 Tons of Gold Every Year

MOSCOW -- The Central Bank of Russia plans to buy more than 100 tonnes of gold to renew the country's gold and foreign exchange reserves (or international reserve assets) every year, the bank's first deputy chairman, Georgy Luntovsky, told reporters on Monday, giving no details pertaining to the terms.

Earlier, in an interview to the Prime Tass economic news agency, the first Deputy chairman of the bank, Alexei Ulyukayev, said the central bank would increase the share of gold in the national reserves.

In the middle of October 2010, the bank's director of the financial operations, Sergei Shvetsov, said the bank did not import gold in 2010. The bank buys gold on the domestic market, in Russian banks.

According to the central bank, the reserves of gold in the Russian international reserve assets increased by 23.9 percent (152.4 tonnes) in 2010 to reach 25.4 million net troy ounces (790 tonnes) as of January 1, 2011, Prime Tass said.

As of January 1, 2009, the amount of monetary gold in Russia's international reserves was at 16.4 million ounces (510.1 tonnes), the economic news agency said.

In 2009, the central bank's gold reserves increased by 4.1 million ounces (127.5 tonnes) to reach 20.5 million ounces (637.6 tonnes) as of January 1, 2010, Prime Tass said

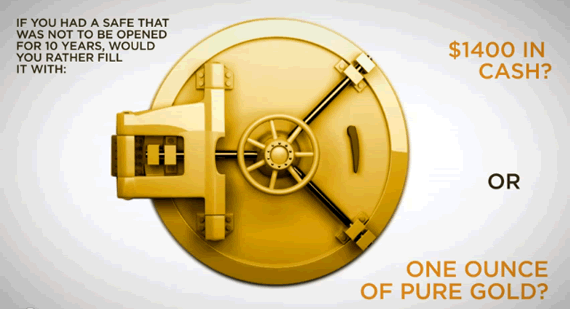

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.