Q4 Real Gross Domestic Product Shows U.S. Economy is on Expansion Path

Economics / Economic Recovery Jan 29, 2011 - 12:33 PM GMTBy: Asha_Bangalore

Real gross domestic product of the U.S. economy rose at an annual rate of 3.2% in the fourth quarter of 2010 after slower growth in the second and third quarters of the year. In 2010, on an annual average basis, the economy grew 2.9% after a 2.6% decline in 2009 and a steady reading in 2008. The level of real GDP in the fourth quarter ($13,382.6 billion) exceeds the peak registered in the fourth quarter of 2007 ($13,363.5billion). Effectively, the economic recovery phase is history and the U.S. is on a path of economic expansion (see Chart 2).

Real gross domestic product of the U.S. economy rose at an annual rate of 3.2% in the fourth quarter of 2010 after slower growth in the second and third quarters of the year. In 2010, on an annual average basis, the economy grew 2.9% after a 2.6% decline in 2009 and a steady reading in 2008. The level of real GDP in the fourth quarter ($13,382.6 billion) exceeds the peak registered in the fourth quarter of 2007 ($13,363.5billion). Effectively, the economic recovery phase is history and the U.S. is on a path of economic expansion (see Chart 2).

In the fourth quarter, consumer spending advanced at an impressive annual rate of 4.4% (see Chart 3). Outlays of durables (+21.6%) and non-durables (+5.0%) made the more significant contributions while the gain in purchases of services (+1.7%) remains below the historical median (+3.4%)

Expenditures on business structures (+0.4%) and equipment and software (+5.8%) moved up in the fourth quarter; with the latter showing a decelerating trend after four quarters of strong growth (see Chart 4).

Residential investment expenditures increased 3.4% in the fourth quarter, the third quarterly gain since 2006 (see Chart 5). Residential investment expenditures typically have led economic recoveries unlike the current recovery.

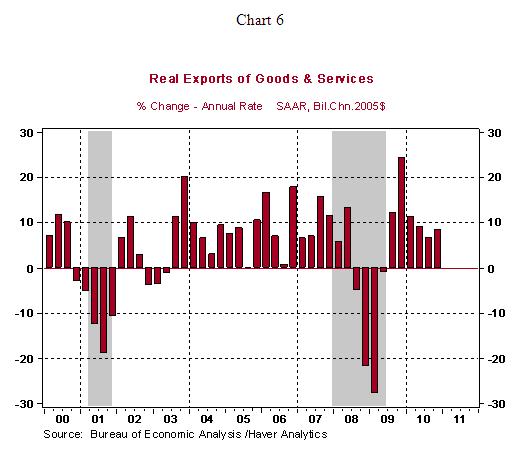

A noticeable increase in exports (+8.5% vs. +6.8% in Q3) also helped to raise overall GDP in the fourth quarter. Imports fell 13.6% after five consecutive quarterly declines. As a result of an increase in exports and a drop imports, the trade deficit narrowed to $392.2 billion from $505 billion in the third quarter. Offsetting a part of the gains in consumer spending, residential and non-residential investment expenditures were declines in government spending and inventories. Inventories increased only $7.2 billion in the fourth quarter after a gain of $121.4 billion in the third quarter, which setback real GDP growth by 3.7 percentage points. A reversal of this trend is strongly likely in the first quarter.

Real final sales of the economy rose a hefty 7.1% in the fourth quarter, reflecting the underlying improvement in demand conditions.

The overall GDP price index (+0.3%) and core GDP price index, which excludes food and energy (+1.1%) present a stable price situation. The Fed's preferred price indexes - the personal consumption expenditure price index (+1.8%) and the core personal consumption expenditure price index (+0.4%) - also point to a favorable inflation picture (see chart 8).

The outliers in today's report (the change in final sales, inventories, imports) are unlikely to be repeated in the near term, but the fact remains that details of today's report underscore noteworthy improvements in economic conditions and benign inflationary conditions. This favorable combination allows the Fed to focus on promoting full employment.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.