Gold Bar Premiums Hit 17-Year High in Hong Kong On Safe Haven Bid on Inflation and Egypt Concerns

Commodities / Gold and Silver 2011 Jan 31, 2011 - 08:22 AM GMTBy: GoldCore

The geopolitical ramifications of the revolution in Egypt and the likelihood that it will spread throughout the Middle East, North Africa and possibly further afield is leading to volatility in markets. Equity indices in the Middle East and Far East were mostly down (except for China) overnight. European bourses were under pressure this morning but have recovered somewhat.

The geopolitical ramifications of the revolution in Egypt and the likelihood that it will spread throughout the Middle East, North Africa and possibly further afield is leading to volatility in markets. Equity indices in the Middle East and Far East were mostly down (except for China) overnight. European bourses were under pressure this morning but have recovered somewhat.

Gold and silver are marginally lower after their strong showing Friday which resulted in silver closing the week 1.7% higher and gold being tentatively lower (-0.14%). Remarks by a People’s Bank of China advisor that the Chinese should diversify into gold and silver are very important (see below).

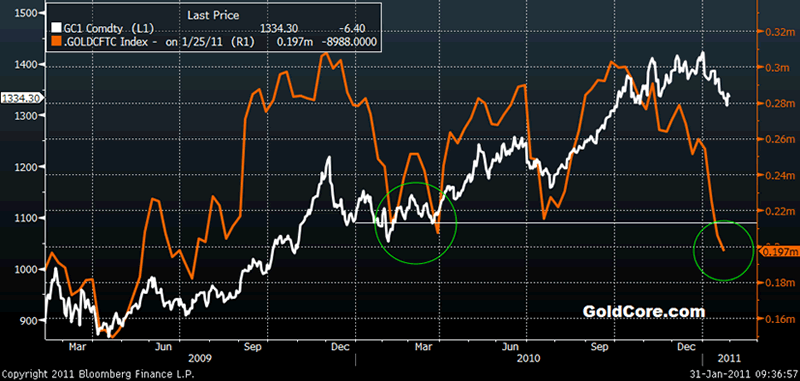

Gold in USD and CFTC Gold Open Interest - 2 Years (Daily)

NYMEX crude is up some 0.4% to just over $90.00 (see long term chart below) and Brent crude remains close to $100 a barrel this morning. Oil’s nearly 5% surge on Friday to end the week higher was ominous and the possibility of unrest spreading to other oil rich dictatorships such as Saudi Arabia is making investors nervous. The Middle East and North Africa produce more than a third of the world's oil and OPEC has warned of a possible oil “shortage”.

Any speculative froth seen when gold recently rose above $1,400/oz has been removed from the gold market as can be seen in the gold futures open interest numbers. Open interest has fallen by more than a third since early September. Those short the market have once again managed to flush out the weak paper longs who have been shaken out of positions.

Open interest levels are now well below those seen after the last period of correction and consolidation in the first quarter of 2010 (see first chart above) and we may now have seen capitulation.

Short positions remain high and concentrated with a few market players, especially JP Morgan, and they are vulnerable to a short squeeze, should prices begin to move up again. This seems likely given the tight physical demand situation in the market internationally.

Further evidence of this was seen in the fact that premiums for gold bars in Hong Kong are at their highest levels in 17 years (since 1994) as Chinese, Indian and wider Asian buying continues. Deepening inflation has led to strong demand and the geopolitical instability in Egypt and the possibility that it could spread throughout the Middle East and North Africa will lead to safe haven buying.

China Should Buy More Gold, Silver for Reserves – Chinese Central Bank Advisor

People's Bank of China adviser Xia Bin told the Economic Information Daily today that China should steadily increase its holdings of gold, silver and other precious metals. In an interview with the paper Xia said that “holdings of gold and silver can help establish the yuan as an international currency by increasing China's "final payment capacity." He advised buying precious metals on the dips and while gold and silver are marginally lower today, the remarks are another long term positive for the gold market.

Only last month, Xia made similar comments saying that the People’s Bank of China should diversify their massive $2.7 trillion foreign exchange reserves away from US dollars and increase their gold reserves as a long term strategy in order to help internationalise the yuan. The Chinese wish to make the yuan an accepted international reserve currency and establish it as a currency that will be used for payment and settlement in international trade.

China’s gold holdings, at 1,054 tonnes, remain miniscule compared to the over 8,000 tonnes held by the US Federal Reserve (gold only accounts for 1.6 percent of China’s massive currency reserves). With the supply and demand equation already tight due to international investment demand and central banks having become net buyers rather than net sellers, even a small amount of diversification out of their US dollar holdings and into gold should lead to much higher gold prices.

The reference to silver was important as it marks the first time in modern times that a central bank advisor or official has spoken about diversifying currency reserves into silver. It shows how the Chinese view silver as money rather than as simply a commodity to be consumed. Indeed, the Chinese like most of the world, used silver as currency for most of their history.

The comments may signal the start of a growing shift from seeing silver purely as an industrial commodity to seeing silver more like gold – as both an industrial commodity but more importantly as a store of value and as money. As Milton Friedman pointed out, the major monetary metal throughout history was silver, rather than gold.

GOLD

Gold is trading at $1,326.87/oz, €970.57/oz and £835.14/oz.

SILVER

Silver is trading at $27.71/oz, €20.27/oz and £17.44/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,782.00/oz, palladium at $803.50/oz and rhodium at $2,450/oz.

NEWS

(Bloomberg) -- China Should Buy More Gold, Silver for Reserves, Daily Reports

China should increase its gold and silver reserves, the Economic Information Daily reported today, citing an interview with central bank adviser Xia Bin.

Increasing gold reserves at the “appropriate time” is in line with the strategy of internationalizing the yuan, the report cited Xia as saying. “Related departments” should employ a “buy in the dip” strategy over a very long period of time, Xia said.

Bullion soared nearly 30 percent in 2010, advancing for the 10th year, as the dollar dropped and investors sought a store of value amid currency debasement. China is allowing greater use of its currency for cross-border transactions, seeking to reduce reliance on the dollar.

The report is “a positive factor for gold prices in the mid-and-long term,” Hwang Il Doo, a senior trader at Seoul- based Korea Exchange Bank Futures Co., said today. Still “it didn’t have immediate impact on prices as gold’s gain has more to do with the unrest in Egypt at the moment.”

Total gold consumption in China, the second-largest buyer, may gain 15 percent in the first half, fueled by growing demand for alternative investments and a hedge against inflation, the China Gold Association said last week.

Imports of gold by China jumped almost fivefold in the first 10 months of last year from the entire amount shipped in 2009, the Shanghai Gold Exchange has said. Shipments were 209 metric tons compared with 45 tons for all of 2009, said exchange Chairman Shen Xiangrong.

The country increased gold reserves by 454 tons to 1,054 tons since 2003, the State Administration of Foreign Exchange said in April 2009. The metal only accounts for 1.6 percent of the nation’s reserves held by the People’s Bank of China, according to the World Gold Council. China doesn’t regularly publish gold-trade figures and rarely comments on its reserves.

Immediate-delivery bullion gained as much as 0.7 percent to $1,346.27 an ounce, and was at $1,339.25 at 12:53 p.m. in Seoul. The price rose 2.5 percent on Jan. 28, the biggest intraday increase since Nov. 4 as escalating tensions in Egypt fanned concern that unrest may spread to other parts of the Middle East, increasing demand for an investment haven.

(Reuters) -- Gold premiums highest since 2004; India, China stock up

Premiums for gold bars were at their strongest level since at least 2004 on Monday on tight supply, short covering before the festive season in India and China as well as physical buying driven by the deadly protests in Egypt, dealers said on Monday.

Gold bars were quoted at a premium of $4 an ounce to the spot London prices in Hong Kong, its highest level since Reuters began compiling the data in 2004, up from $3 last week. .

Physical dealers have seen a pick up in demand in recent weeks ahead of the Lunar New Year later this week and the wedding season in India in February, although any increase in cash gold prices also triggered selling from speculators.

There's a lot of interest from India, but it's just that we can't meet their demand. Everybody is snatching the available stocks," said a dealer in Singapore. "We are seeing some light selling from Thailand, but there's also buying at lower levels."

Spot gold fell $4.45 to $1,333.85 an ounce on Monday, having posted its biggest gain in eight weeks on Friday on buying related to fears the deadly chaos in Egypt could spread throughout the Middle East.

Gold should build on last year's stellar gains in 2011 to hit record highs, boosted by low interest rates, dollar weakness and lingering worry over growth in major economies, a Reuters poll showed.

Premiums for gold bars in Singapore remained firm at $3 an ounce, also their highest since at least 2004, partly driven by demand from top consumer India ahead of the wedding season, when parents give gold jewellery to their daughters.

India's January gold imports are seen rising on softer prices and as food inflation boosts farm incomes, fuelling demand for the precious metal, a poll showed.

"My clients offered to buy gold bars at $5 premium, but I have no gold. Nowadays, gold is booked and sold even before they leave the refinery," said another dealer in Singapore.

"There's some selling back in the gold market, but the premiums are still high. I do see light selling by the Thais too, but one consumer just called to sell me back the gold in transit."

WEEK AHEAD

Looking ahead, dealers expected steady purchases from India before the wedding season, while some consumers in Hong Kong could be stocking while waiting for the market in China to reopen after the Lunar New Year.

"I think people will keep on hand, just in case the problems in Egypt can't be solved, and then gold prices will go up," said a dealer in Hong Kong.

Egyptian protesters were camped out in central Cairo on Monday and vowed to stay until they had toppled President Hosni Mubarak, whose fate appeared to hang on the military as pressure mounted from the street and abroad.

(Bloomberg) -- Gold Bulls ‘Not Scared’ as 150-Day Holds: Technical Analysis

Gold may rebound from its worst start to a year since 1997 and surge 21 percent to a record by the end of June after staying above its 150-day moving average, according to technical analysis by the Hightower Report.

Gold in New York rose 1.7 percent today, the biggest gain since Nov. 4. Earlier, the price dropped to $1,309.10 an ounce, the lowest since Oct. 1. The 150-day moving average is currently about $1,306. Today’s bounce is a sign that prices are poised to rally, said David Hightower, the president of the research firm based in Chicago. The metal may climb to $1,630 by the end of June, he said.

Prices rebounded from the 150-day moving average three other times in the past year, data compiled by Bloomberg show. The last time gold traded near the average was in late July. Since Aug. 1, prices have advanced 13 percent. They touched a record $1,432.50 on Dec. 7. The metal has not fallen below the average since January 2009.

“People take these longer moving averages as a key measure of confidence,” said Hightower, who correctly forecast that gold would rally above $1,400 last year. “Gold has respected the 150-day average in the past. By repelling from that level, it suggests that gold has value, and that the bull camp was not scared and forced out of their positions.”

Egypt Unrest

Prices jumped today as escalating political unrest in Egypt boosted demand for the precious metal as a haven. Tens of thousands of marchers chanted “liberty” and “change” as rallies began today at points across Cairo in the biggest challenge to Egyptian President Hosni Mubarak’s 30-year rule.

Hedge funds and other money managers have trimmed bets on gold’s rally for four straight weeks. Net-long positions, or wagers or rising prices, have tumbled 24 percent in January to the lowest level since May 2009.

Gold has slumped 5.6 percent this month, heading for the biggest January drop since 1997, as accelerating U.S. growth and rising company profits curbed demand from investors who buy precious metals as protection from financial turmoil. The U.S. economy expanded at a 2.9 percent annual rate in 2010, the most in five years, Commerce Department data showed today.

The metal’s decline this month is “a healthy break,” Hightower said. “Gold has cleaned up its act and washed out the weak hands.”

Gold prices have rallied for 10 straight years as a sliding dollar and record low U.S. interest rates boosted demand. Investors have snapped up the metal, sending global holdings in exchange-traded products backed by bullion to a record 2,114.6 metric tons in late December. Money managers including John Paulson’s Paulson & Co. and George Soros’s Soros Fund Management LLC have invested in gold through ETPs.

(Bloomberg) -- Gold Traders Trim Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators decreased their net-long position in New York gold futures in the week ended Jan. 25, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 160,589 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions fell by 4,404 contracts, or 3 percent, from a week earlier.

Gold futures fell this week, dropping 0.1 percent to $1,341.70 a troy ounce at today's close.

Miners, producers, jewelers and other commercial users were net-short 197,483 contracts, down 8,988 contracts, or 4 percent, from the previous week. Each Friday the CFTC publishes aggregate numbers for long and short positions for speculators such as hedge funds and institutional investors, as well as commercial companies that buy or sell futures to protect against price moves. Analysts and investors follow changes in speculators' positions because such transactions can reflect an expectation of a change in prices.

The J.P. Morgan View: Commodities are showing off their diversification value

• Economics –– Our Japan growth forecast is raised, but the UK is cut. Our global growth forecast for 2011 is unchanged at 3.5%.

• Asset allocation –– Our top performers for 2011 should be equities and high-yield. But do include commodities on tight supplies and their good diversification value against certain inflation and political risks.

• Fixed Income –– We go short duration in Treasuries, with yields near the bottom of their recent range.

• Equities –– Rising geopolitical and inflation risks favours an OW in Commodity sectors and an UW in EM equities.

• Credit –– Overweight high quality CMBS as property prices recover and vacancy rates decline

• FX –– Be long EUR/USD, and short GBP versus EUR, SEK and CAD.

• Commodities –– OPEC likely to increase production gradually from here, but we still expect Brent to break well over $100 this year.

(Bloomberg) -- Morgan Stanley Says Gold, Silver Will Benefit From Inflation

Gold and silver will benefit over the next 12 months “on solid investment demand in the face of rising fears of inflation,” Morgan Stanley said in a report.

(Bloomberg) -- Gold Rises After Egypt Tensions Drive Increased Demand for Haven

Gold for immediate delivery rallied 0.4 percent to $1,342.68 an ounce at 10:08 a.m. Melbourne time after advancing on Jan. 28 on demand for a haven amid escalating tensions in Egypt.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.