Silver Bullion Backwardation Suggests Supply Stress

Commodities / Gold and Silver 2011 Feb 11, 2011 - 09:33 AM GMTBy: GoldCore

Gold and silver are higher against all currencies (except the Canadian dollar) in the wake of the worse than expected trade deficit number ($40.6 billion). Sterling and euro are particularly weak against gold and the US dollar today.

Gold and silver are higher against all currencies (except the Canadian dollar) in the wake of the worse than expected trade deficit number ($40.6 billion). Sterling and euro are particularly weak against gold and the US dollar today.

Silver backwardation continues and while spot silver is at $30.09/oz, the March 2011 contract is at $30.07/oz and April at $30.01/oz. Incredibly, the July 2012 contract is trading at $29.93/oz and the December 2013 contract at $29.91/oz.

Backwardation is when the market quotes a higher price for spot delivery or a more nearby delivery date, and a lower price for a distant delivery date in the futures market. It indicates that buyers are concerned about securing supply in the future and are willing to pay a premium for spot delivery. It suggests that silver bullion in volume is difficult to buy and that the physical market is stressed and becoming less liquid.

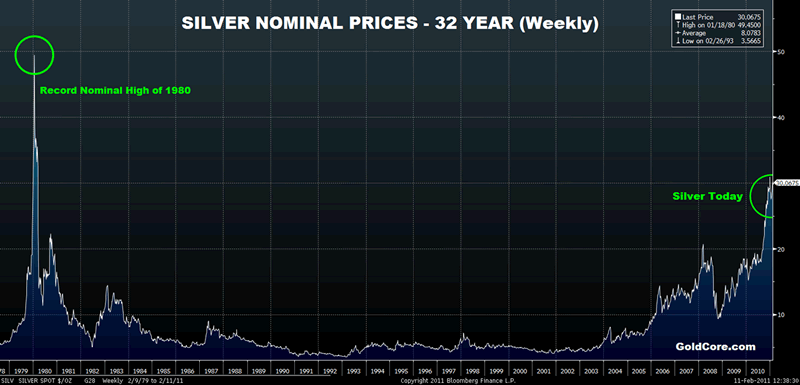

Silver in USD – Long Term

Backwardation starts when the difference between the forward price in the futures market and the spot price for physical delivery is less than the cost of carry, or when there can be no delivery arbitrage. This is generally because the asset is not currently available for purchase or is increasingly illiquid.

It can end in default, failure to make delivery, and in sharply higher prices.

Backwardation rarely happens in the gold and silver bullion markets. Since gold futures first started to be traded in 1972 (on the Winnipeg Commodity Exchange), there have only been momentary backwardations of a few short hours.

The extent of the backwardation in silver is unprecedented. It suggests that retail investment and industrial demand internationally is very robust and the small silver bullion market cannot cater to the level of demand for refined coin and bar product.

This is not surprising considering the massive increase in demand, especially from Asia and China in recent months. In China alone, demand increased a huge four fold in just the last year to 3,500 tonnes.

Table Courtesy of Mitsui

Investment demand for silver both as a store of value and as a hedge against inflation continues to surprise the bears. Many buyers in Asia have experienced stagflation and hyperinflation.

The demand is also very strong on the industrial side where the increasing range of industrial applications is leading to very significant demand that the silver market does not appear to be able to accommodate at these prices.

Solar energy demand has risen massively from a near zero base and Barclays estimates that this equates to more than 800 tonnes of silver being employed in cells in 2009, which translates to about 8% of silver industrial demand and 4% of global silver supply.

Barclays estimates that silver usage in solar panels could more than double and reach 2,000 tonnes by 2012. This would consume 7% of global silver output.

This is just the solar energy sector. There remains a huge range of industrial applications for silver. While demand from the photography sector has declined, demand from the medical, solar energy, water purification and many other sectors continues to rise significantly.

Importantly, this silver is consumer and because tiny filaments are used, most of this silver will not come back into the silver market. A small amount may, but only at dramatically higher prices.

Those with concentrated short positions in the silver market (as identified in the CFTC investigations), such as JP Morgan, will be very nervous about the extent of this demand. Any effort by them to extricate themselves from these substantial short positions may lead to the squeeze that has been anticipated for months.

This means that silver’s nominal high of $50/oz will likely be seen soon rather than later. As we have been saying since 2003, the long term inflation adjusted high of $130/oz remains a viable long term price target.

Gold

Gold is trading at $1,363.85/oz, €1,007.87/oz and £852.83/oz.

Silver

Silver is trading at $30.08/oz, €22.23/oz and £18.81/oz.

Platinum Group Metals

Platinum is trading at $1,821.50/oz, palladium at $820.00/oz and rhodium at $2,450/oz.

News

(Bloomberg) -- Gold Futures in New York Rise, Heading for Third Weekly Advance Gold for April delivery in New York gained 0.1 percent to $1,364.20 an ounce at 10:05 a.m. Melbourne time, heading for a weekly advance. Bullion for immediate delivery fell 10 cents to $1,363.70 an ounce.

(Bloomberg) -- Gold May Gain on Federal Reserve Policy Outlook, Survey Shows Gold may advance on speculation the Federal Reserve’s plans to maintain near-zero interest rates will spur investment demand, a survey found.

Twelve of 15 traders, investors and analysts surveyed by Bloomberg, or 80 percent, said the metal will rise next week. One predicted lower prices and two were neutral. Gold for April delivery was up 0.9 percent for this week at $1,361.80 an ounce at 11:15 a.m. yesterday on the Comex in New York.

While a lower jobless rate gives “some grounds for optimism,” unemployment will take “several years” to return to a “more normal level,” Federal Reserve Chairman Ben S. Bernanke said on Feb. 9. The U.S. needs faster employment growth for a sufficient time before policy makers can be assured the economic recovery has taken hold, he said last week. The Fed has kept plans to buy $600 billion of Treasuries through June and hold borrowing costs “exceptionally low.”

“The Federal Reserve will continue its quantitative easing of monetary policy as planned, and there are no signs yet that the Fed could raise interest rates any earlier than assumed,” said Daniel Briesemann, an analyst at Commerzbank AG in Frankfurt. “Both are positive news for gold prices.”

As of last week, futures indicated that traders expected the Fed to begin raising rates in a year’s time.

The weekly gold survey that started six years ago has forecast prices accurately in 198 of 349 weeks, or 57 percent of the time.

This week’s survey results: Bullish: 12 Bearish: 1 Neutral: 2

(Bloomberg BusinessWeek) -- Carlos Slim Beats Out Buffett and Gates Mexican billionaire Carlos Slim topped Bill Gates and Warren Buffett in the money game for the second straight year. The value of Slim's publicly disclosed holdings, in industries ranging from mining to telecommunications, surged about 37 percent, to $70 billion, in 2010, according to data compiled by Bloomberg. The 22 percent jump in Berkshire Hathaway (BRK.A) shares wasn't enough for Buffett to catch up, and Gates's Microsoft (MSFT) stock fell 8.4 percent, hurting his returns even as he spread his investments to other companies.

Slim's best-performing asset last year was holding company Grupo Carso, which almost doubled in value as it prepared for this year's spinoff of its mining operations amid soaring gold and silver prices.

(Commodity Online) -- Marc Faber: Gold, Silver prices to fall [may fall in the short term] Legendary investor, economist and commodities analyst Marc Faber says that prices of precious metals, especially gold and silver, could fall, but investors need not worry because the dip in the prices of these commodities will be shot term.

In his February outlook on commodities, Faber who is better known as the editor and publisher of the Gloom Boom and Doom report said that commodities have reached the parabola stage.

Warning that investors should prepare for some downside volatility in commodities, Faber said that long term he is still bullish on the metals.

But Faber said that precious metals, especially gold and silver could fall in the short term with the general market.

Gold could fall to the $1,100-1,200 area, Faber said.

For investors this should not cause any alarm because with the fiscal problems of the US and further monetization, the future for gold is still bright, he said.

Faber would use any decline in precious metals to add to his positions.

Faber is concerned about commodities, as they are currently very overbought by almost any measure. He goes on to say that commodities seem to have reached the parabola stage--going straight up, which is usually the very end of the move. Yes, it could last longer than anyone expects, but at some point prices will collapse again, as they did back in 2008.

This cycle, Faber notes, always occurs as higher prices lead to an increase in supply, which eventually overwhelms the market causing prices to fall. The cycle is longer for industrial commodities compared to agricultural prices as it is harder to build a new copper mine than it is for a farmer to plant more soybeans.

This cycle will play out even with the Fed's money printing. Investors should prepare for some downside volatility in commodity prices.

(FT) -- EU plans to lift import curbs on soaring food commodities Europe has moved to loosen import restrictions on important agricultural commodities in response to tightening domestic markets and skyrocketing prices.

The European Commission’s agriculture committee proposed suspending import duties on feed wheat and barley – as well as allowing additional sugar imports at lower tariffs than usual. The proposals are only in draft form and will need to be voted on at forthcoming committee meetings, which are held twice a month.

The measure is the clearest acknowledgement yet of the tightness in European agricultural markets.

Cairo (AP) -- Investors Shift Money From Gold to Riskier Assets Greater confidence in the economy is leading investors to move money out of gold and into riskier assets in search of bigger profits.

Gold prices have fallen 4.2 percent since the beginning of the year as more evidence surfaced that the economy is strengthening.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.