Silver Bullion COMEX Stocks at 4-Year Low as Backwardation Deepens

Commodities / Gold and Silver 2011 Feb 14, 2011 - 07:45 AM GMTBy: GoldCore

Gold and silver are higher after last week’s 1% and 3.5% gains in dollars. Silver is particularly strong again this morning and the euro has come under pressure as bonds in Ireland, Spain, Portugal and Greece continue to rise. While Asian equity markets were higher, European indices have given up early gains.

Gold and silver are higher after last week’s 1% and 3.5% gains in dollars. Silver is particularly strong again this morning and the euro has come under pressure as bonds in Ireland, Spain, Portugal and Greece continue to rise. While Asian equity markets were higher, European indices have given up early gains.

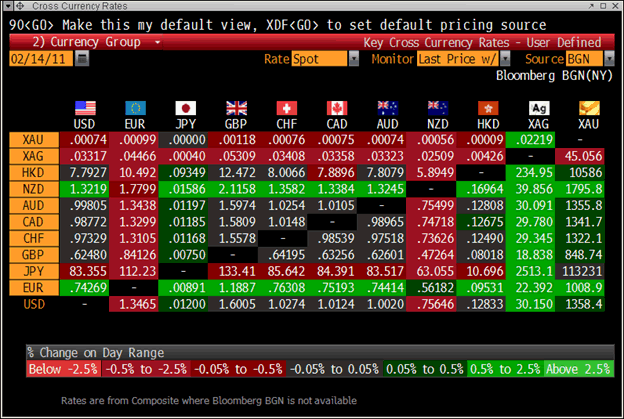

Silver’s backwardation has deepened with spot silver at $30.16/oz, March 2011 contract at $30.13/oz and April’s at $30.00/oz. While spot silver has risen nearly 1% so far today, the July 2012 futures contract was down 0.187% to $29.81/oz.

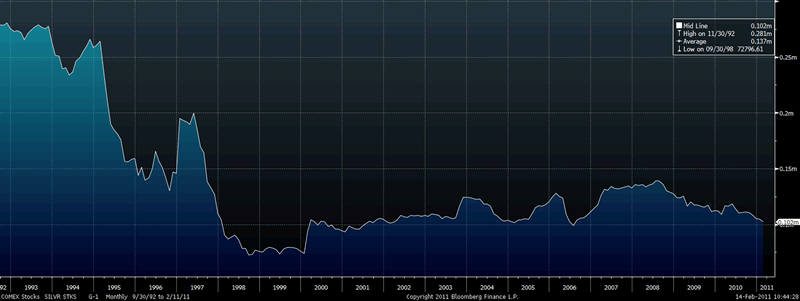

The gradual drain of COMEX silver inventories seen in recent months continues and COMEX silver inventories are at 4 year lows. Total dealer inventory is now 42.16 million ounces and total customer inventory is now at 60.68 million ounces, giving a combined total of 102.847 million ounces.

The small size of the physical silver market is seen in the fact that at $30 per ounce, the COMEX silver inventories are only worth some $3 billion. The US government is now paying some $4 billion a day merely on the interest charges for the national debt. It is also the same value as Twitter’s new venture round of financing or Ford’s debt pay down in the first quarter.

Comex Silver Inventory Data

Talk of a default on the COMEX is premature but the scale of current investment demand and industrial demand, especially from China, is such that it is important to monitor COMEX warehouse stocks.

The Hunt Brothers were one of a few dozen billionaires in the world in 1979 when they attempted to corner the market. Today there are thousands of billionaires in the world, any number of whom could again corner the silver market. Also, today unlike in the 1970s, there are sovereign wealth funds and hundreds of hedge funds with access to billions in capital.

The possibility of an attempted cornering of the silver market through buying and taking delivery of physical bullion remains real and would likely lead to a massive short squeeze which could see silver surge as it did in the 1970s.

Gold

Gold is trading at $1,358.08/oz, €1,009.72/oz and £849.12/oz.

Silver

Silver is trading at $30.13/oz, €22.40/oz and £18.84/oz.

Platinum Group Metals

Platinum is trading at $1,820.50/oz, palladium at $819.00/oz and rhodium at $2,450/oz.

News

(Financial Times) Gold ETF outflows and shifts in investor sentiment

Large outflows from precious metals exchange traded funds since the start of the year have left some analysts questioning if investor sentiment towards gold and silver could be shifting.

“Heavy redemptions from the gold and silver ETFs in early 2011 may be a sign of things to come,” said Daniel Major, precious metals analyst at the Royal Bank of Scotland.

A decline in safe haven buying interest for gold and the prospects for interest rates returning to more normal levels in the US and Europe could mean that “positive sentiment towards [gold and silver] ETFs may be fading”, according to Mr Major.

He added that if ETF inflows were to dry up or reverse, then it would be difficult for gold and silver prices to make further gains and the silver market would be “particularly vulnerable to a price correction”.

Mr Major said he did not expect “large scale selling” but he estimated that the value of holdings in all precious metals ETFs has dropped almost $10bn so far this year with withdrawals mainly coming from the gold and silver products.

Other analysts acknowledge that ETF outflows have weighed on sentiment but say that the fundamentals supporting the gold price remain intact.

Suki Cooper, precious metals analyst at Barclays Capital said that the gold market was facing “short-term headwinds”.

However, Ms Cooper also said that longer-term investment demand remains intact, given low interest rates, concerns about currency debasement, inflationary risks and rising geopolitical tensions as demonstrated by the situation in Egypt.

According to Barclays, holdings in gold ETFs ended 2010 at $98bn, a record, even though last year’s inflows at 330 tonnes were down by almost half compared with 614 tonnes in 2009.Total gold ETF holdings were 2,142 tonnes at the end of 2010, slightly below the all-time high of 2,155 tonnes reached in the middle of December.

The latest available data suggests total gold ETF holdings have fallen to around 2,166 tonnes after a record monthly outflow in January.

With the gold price down around 4 per cent so far this year, the value of gold ETF holdings has retreated to around $90.4bn.

Michael Lewis, commodity strategist at Deutsche Bank said that the rally in gold prices has gradually run out of steam over the past five months due to concerns about a turn in the global interest rate cycle.

But Mr Lewis also said these concerns were overdone and that ongoing weakness in the US dollar and further diversification by central banks should sustain a positive outlook for the gold market.

Edel Tully, precious metals analyst at UBS, noted that outflows from gold ETFs were “relatively modest” so far in February, in contrast to the heavy selling seen in January.

“This suggests to us that the bulk of the ETF holders who wanted to exit gold have already done so,” said Dr Tully.

She also warned against assuming that outflows from gold ETFs represented “absolute selling” as there was evidence to suggest that some institutional investors had been switching their exposure from ETFs into “allocated” gold (numbered bars held in bank vaults in a separate allocated account).

“The picture painted by recent persistent ETF outflows is not wholly accurate,” cautioned Dr Tully.

(Bloomberg) -- Investors Boost Bullish Gold Bets as Egypt Turmoil Fuels Demand

Hedge funds are piling back into New York gold futures and options as turmoil in Egypt sent bullish bets on the metal to the highest since April 2010, government data show. Holdings in silver also increased.

Managed-money funds held net-long positions, or wagers on rising prices, totaling 145,846 contracts on the Comex as of Feb. 2, U.S. Commodity Futures Trading Commission data showed on Feb. 11. The holdings jumped 17 percent, after five straight weeks of declines.

Gold rallied 0.8 last week, the biggest price gain since December, as protests in Egypt forced President Hosni Mubarak to flee the country after 30 years in power. In January, the metal dropped 6.1 percent as an improving world economy eroded gold’s appeal as a haven investment. Prices have rallied for 10 straight years, touching a record $1,432.50 an ounce on Dec. 7.

“You’re seeing a renewed interest in gold from speculative money who put the brakes on the metal earlier this year,” said Adam Klopfenstein, a senior market strategist at Lind-Waldock in Chicago. “There’s turmoil in Egypt, and inflation is heating up. Investment advisers and money managers are ready to put their money back to work. People are more comfortable jumping back into gold after a correction.”

Gold futures for April delivery settled on Feb. 11 at $1,360.40, after rallying to a three-week high of $1,369.70 during the session.

Investments in exchange-traded products backed by gold fell to 2,019.4 metric tons as of last week, down 0.6 percent since January, when holdings plunged 3.1 percent, the biggest decline since April 2008, data compiled by Bloomberg show. ETPs trade on exchanges, with each share representing metal held in a vault. They accounted for 21 percent of investment demand last year, according to GFMS Ltd., a London-based research firm.

Silver Holdings

Bullish silver holdings by managed-money funds totaled 29,742 contracts, up 27 percent from the previous week and the highest total since November, CFTC data show. Silver settled Feb. 11 at $29.995 an ounce on the Comex, capping three straight weeks of gains.

This year, silver rose to $31.275 on Jan. 3, the highest in 30 years, before dropping as low as $26.30 on Jan. 28.

“We’re more bullish on silver than gold because of its industrial component,” said Barry James, the president of James Investment Research Inc. in Xenia, Ohio, which manages about $2.5 billion.

“After silver’s dipsy doodle, it’s creeped right back to where it started the year,” said James, who has reduced the fund’s holdings of silver and gold to about 2.5 percent from 7.5 percent in the fourth quarter. “We’re more neutral than bullish on gold and don’t expect it to pick up steam and race to a new record. The dollar will probably recover and show some strength.”

Managed-money positions include hedge funds, commodity- trading advisers and commodity pools. Analysts and investors follow changes in speculator positions because such transactions may reflect an expectation of a shift in prices.

(Bloomberg) -- Gold Stalls in ‘Tug of War’ Moving Average: Technical Analysis

Gold, which has rebounded this month from the worst January since 1997, is stalling near a key moving-average, signaling a “tug of war,” said Matthew Zeman, a trader at LaSalle Futures Group.

April gold futures have closed near the exponential 50-day moving average for four straight days as a move below or above this level may signal the metal’s next direction, Zeman said by telephone from Chicago. The average is near $1,361 an ounce.

If the commodity can “breach” the level by closing higher, it can climb above the record $1,432.50 reached on Dec. 7, Zeman said. If prices don’t rally above the resistance, they will likely fall to the 200-day moving average near $1,291, he said.

“Technical traders will initiate short positions below this level, and gold can’t stage a rally until it vaults above this level,” said Zeman. “Gold is staging a tug of war.”

The last time gold posted consecutive closes near the average was in early January. After falling below the level, the metal tumbled 6.1 percent that month, the worst start to a year since 1997. Prices have rebounded as unrest in Egypt spurred investors to buy gold, historically used as a hedge against geopolitical risk.

On Feb. 11, prices erased early gains after Hosni Mubarak stepped down as president of Egypt and handed power to the military, bowing to the demands tens of thousands of protesters who have occupied central Cairo.

Gold futures for April delivery dropped $2.10, or 0.2 percent, to $1,360.40 on Feb. 11. The metal was still up for a third week, gaining 0.8 percent.

Economic Outlook

Bullion has dropped 5 percent since touching the all-time high in December, partly as improving U.S. economic data eroded demand for the precious metal as an alternative to equities.

“Gold is getting a lot of competition from other products,” Zeman said. “Equities are at multiyear highs, and interest rates and the dollar continue to rise.”

The metal jumped 30 percent in 2010, a 10th straight annual gain, as escalating European and U.S. debt boosted haven demand. The decade-long surge attracted fund managers from John Paulson to George Soros, and is now spurring central banks to add to their reserves for the first time in a generation.

Prices have also been able to stay above the 150-day moving average, near $1,315, even after the January slump, a signal that the decline was a “a healthy break,” not the start of a bear market, David Hightower, the president of the Hightower Report, said last month.

In technical analysis, investors and analysts study charts of trading patterns and prices to predict changes in a security, commodity, currency or index. The exponential moving average is a technical indicator that displays the average value of a security over a specified period of time, giving more weight to recent data.

(Bloomberg) -- Gold Investment Demand in South Korea May Climb, Hyundai Says

Investment demand for gold in South Korea may advance as investor awareness increases and the price climbs to a record, according to the manager of the nation’s first gold-backed exchange traded fund, or ETF.

Investors “want it as a store of value with governments in advanced countries still having fiscal-debt problems,” said Cha Jong Do, chief fund manager of the alternative investment team at Hyundai Investments Co. The Hyundai Hit Gold ETF, which listed in November 2009, is worth $5.3 million.

Bullion soared 30 percent in 2010, advancing for a 10th year, as investors sought a haven from the European sovereign- debt crisis and weakening currencies. Lion Fund Management Co. said last month it raised $483 million for China’s first gold fund to be invested in overseas exchange-traded products.

“South Korean demand for gold-related investment products will gain steadily, and we expect gold ETFs to become a major investment product,” Cha said in a Feb. 11 interview. Gold may advance to $1,600 an ounce this year, Cha said.

Gold for immediate delivery was little changed at $1,357.63 an ounce at 10:45 a.m. in Seoul. The price, which touched a record $1,431.25 an ounce on Dec. 7, has dropped more than 4 percent this year amid signs of a global economic recovery.

Exchange-traded funds allow investors to hold assets such as precious metals without taking physical delivery and they trade like stocks on exchanges. Holdings in the 10 gold ETFs tracked by Bloomberg have dropped 3.7 percent this year.

(Forbes) -- Chinese Demand For Gold Surges To Around 25% Global Production

It’s hard to believe that ordinary Chinese citizens are responsible for an increase in gold imports to China– some 5 times larger than in the recent past. But, that is what the Financial Times of London reported this past week.

For one thing China is already the globe’s largest producer. So, it has its own domestic supply of gold. Also, it suggests that possibly the Chinese are utilizing far greater amounts of their savings to purchase gold, rather than increase domestic consumption. Or that official figures of Chinese wealth are being under-stated.

Gold prices have been in a consolidation phase, trading between $1325 an ounce and $1375 an ounce for the past few months, as the dollar has been somewhat stronger in reaction to improving statistics on the US economy.

Another positive for gold is last week’s recommendation from the IMF that $2 trillion in the form of a new international currency be created out of a weighted average of several currencies to begin the replacement of the dollar as the globe’s chief reserve currency.

Gold experts point out that the recent weakness in gold has hit the price of the small mining company shares worse than the majors as speculation in gold has quieted down. The speculative interests in gold futures on the Comex has been substantially reduced. And net redemptions in the ETF GLD, has reduced its gold holdings by $2 billion or almost 4%.

So, you might say that the Americans are slightly retreating from gold as the Chinese holdings show record increases.

(FT Money) -- Silver set for gains

I suggested on October 23 – when silver was trading at around $23.50 – that $31.75 was one obvious place for its next sell-off to begin, with December 22 a likely date for turns. The semi-precious metal peaked at $31.28 on January 3, within seven trading sessions of my target date.

While I would have preferred its subsequent sell-off to have gone deeper, I retain my view that silver is in for substantial gains. I reiterate my targets of $39.62 and perhaps $45.69.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.