Gold and Silver Rise Immediately on Higher than Expected UK Inflation

Commodities / Gold and Silver 2011 Feb 15, 2011 - 09:03 AM GMTBy: GoldCore

Silver and particularly gold rose sharply on the release of the higher than expected UK inflation data. It showed that UK inflation quickened to 26 month highs at 4.0%. Currency debasement and higher food and energy prices are leading to an inflation surge in both developed and emerging markets.

Silver and particularly gold rose sharply on the release of the higher than expected UK inflation data. It showed that UK inflation quickened to 26 month highs at 4.0%. Currency debasement and higher food and energy prices are leading to an inflation surge in both developed and emerging markets.

Gold in British Pounds - 1 Day (Tick)

The extent of the surge is being masked as the figures in the UK and internationally underestimate real inflation. Increasingly many economists are concerned that official statistics are misleading and hide the true increase in the cost of living (see ‘Official statistics hide true increase in cost of living' in News today). A double-digit jump in food prices pushed China's inflation higher in January - seeing consumer prices rise 4.9 percent, driven by the 10.3 percent jump in food costs.

The Chinese inflation data appears to be even more misleading and manipulated than that in western economies. Many governments are attempting to manage consumers perceptions regarding the significant increase in the cost of living as fiat currencies are debased.

Silver is now less than 2% from its 30 year nominal high of $31.25/oz seen at the start of the year and looks set to challenge and surpass this level in the coming days due to continued robust physical demand (both investment and industrial) and the fact that the futures market is seeing some big money go long again after the recent correction.

Silver remains in backwardation with spot trading at $30.68/oz while the July 11 contract trades at $30.55/oz and the December 14 at $30.40/oz.

Gold

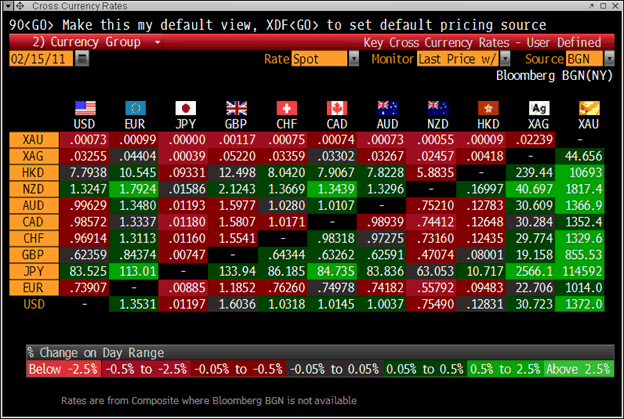

Gold is trading at $1,372.60/oz, €1,013.66/oz and £851.08/oz.

Silver

Silver is trading at $30.67/oz, €22.65/oz and £19.01/oz.

Platinum Group Metals

Platinum is trading at $1,832.00/oz, palladium at $833.00/oz and rhodium at $2,400/oz.

News

(Bloomberg) -- Soros Cuts Stake in Monsanto, Leaves Gold Shares Unchanged

Billionaire investor George Soross hedge fund cut its stake in Monsanto Co. and left its bet in gold unchanged, according to a quarterly filing with the Securities and Exchange Commission.

The $27 billion Soros Fund Management, based in New York, cut its shares in the St. Louis, Missouri-based agricultural company to 3.29 million shares from 6.52 million in the previous quarter, according to the regulatory filing. As of Dec. 31, the shares were worth $229 million.

Soros, who called gold "the ultimate asset bubble," left his gold bet little changed.

(Bloomberg) -- Paulsons SPDR Gold Holdings Unchanged at 31.5 Million Shares

Paulson & Co.s SPDR gold holdings were unchanged at 31.5 million shares as of Dec. 31 compared with three months earlier, according to a U.S. Securities and Exchange Commission filing.

(Bloomberg) -- Soros Raises SPDR Gold Holding 0.5% in Fourth Quarter (Update2)

Investor George Soros increased his SPDR Gold Trust share holding by 0.5 percent in the fourth quarter and John Paulson kept his investment unchanged, filings with the U.S. Securities and Exchange Commission show.

Soros Fund Management LLC held 4,721,808 SPDR Gold Trust shares as of Dec. 31, compared with 4,697,008 shares at the end of the third quarter, according to the filing. Soross call options on 705,000 shares in the trust as of Sept. 30 were not listed in the latest report. Paulson & Co.s holding, the largest in the SPDR fund, was 31.5 million shares.

A decade-long surge in gold has attracted investors seeking better returns than equities or bonds, and helped boost holdings in exchange-traded products backed by the metal to a record in December. The metals climb last year to an all-time high was more than triple the gain in global equities, and bullion beat shares in five of the past six years.

"Investment demand remains the most important driver for the gold market," said Daniel Brebner, an analyst at Deutsche Bank AG in London. "The entrance or exit of large funds in and out of exchange-traded products can give an idea of the conviction by these investors as to the prospects for gold."

Investors in 10 gold-backed exchange traded products own metal valued at $88.6 billion as of yesterday, according to Bloomberg calculations, even after cutting assets in tons by 4.5 percent since Dec. 20 when holdings peaked. Immediate-delivery gold traded at an all-time high of $1,431.25 an ounce on Dec. 7 and erased more than 4 percent since then to $1,365.47 today.

Soros, Paulson

Michael Vachon, a spokesman for Soros, declined to comment on gold investments and the filing, when asked before its release. Armel Leslie, a Paulson spokesman, declined to comment.

Soros Fund Management LLC manages about $27 billion. The companys SPDR Gold Trust holding was worth $655 million as of Dec. 31, the filing showed, representing 8.5 percent of the $7.7 billion total in the SEC filing.

The firms holdings in the iShares Gold Trust of 5 million shares, also backed by the metal, remained unchanged as of Dec. 31 from the preceding quarter.

Soros described gold at the World Economic Forums meeting in Davos, Switzerland, in January last year as "the ultimate asset bubble." In a Nov. 15 speech in Toronto the 80-year-old said conditions for the metal to keep rising were "pretty ideal" and at this years Davos forum he said the boom in commodities may last "a couple of years" longer.

Platinum Investment

The firms holdings of Platinum Group Metals Ltd., a Vancouver-based miner, jumped to 12.7 million shares worth $34 million as of Dec. 31, from 1.5 million shares as of Sept. 30, filings showed. Platinum Group Metals said Feb. 9 it began developing a mine in northern South Africa with first production scheduled to start in 2013. The mine will produce platinum, palladium, rhodium and gold.

Palladium jumped 42 percent in the fourth quarter and platinum gained 6.8 percent.

Eric Mindichs Eton Park Capital Management LP added 5 million put options on the SPDR Gold Trust as of Dec. 31 to bring the total to 8 million, its filings show. The company owned 4.5 million shares in the trust at the end of the year.

A put option gives the holder the right to sell the security at a set price and date. Bullion has declined 3.9 percent this year as signs the global economy is strengthening curbed demand for the metal.

Touradji Capital

Touradji Capital Management LP, founded by Paul Touradji, held 173,000 shares in the SPDR Gold Trust as of Dec. 31, according to an SEC filing. There was no holding listed in the filing as of Sept. 30.

Money managers who oversee more than $100 million in equities must file a Form 13F with the Securities and Exchange Commission within 45 days of each quarters end to show their U.S.-listed stocks, options and convertible bonds. The filings dont show non-U.S. securities or how much cash the firms hold.

(Bloomberg) -- Gold Advances in Asia as Chinas Inflation Fuels Hedge Demand

Gold advanced in Asia on speculation rising inflation across the globe will fan demand for the metal as a store of value after Chinas consumer prices exceeded the governments 2011 target for a fourth month.

Immediate-delivery bullion rose 0.3 percent to $1,365.43 an ounce at 1:46 p.m. Singapore time after falling as much as 0.2 percent. Gold for April delivery was little changed at $1,365.70 after weakening as much as 0.3 percent to $1,361.30 an ounce.

"The market is directionless given that theres no immediate incentive to influence traders," said Paul Yamamura, Tokyo-based trader with Sumitomo Corp. "Gold prices may gain steam after some consolidation on inflation fears."

China last week joined India, Indonesia, Thailand and South Korea in boosting interest rates as Asian policy makers sought to cool the economies leading a global rebound. Chinese consumer prices advanced 4.9 percent in January from a year earlier after a 4.6 percent gain in December, todays report showed.

Asian stocks were little changed after yesterdays biggest jump in more than two months and the Dollar Index, a six- currency gauge of the dollars value, fell 0.2 percent after rising for three days. Gold usually moves counter to the dollar.

Assets in gold-backed exchange traded products stood at 2,020.19 metric tons, snapping six-day decline, according to data compiled by Bloomberg from 10 providers. Holdings have shrunk 4.5 percent from the record 2,114.6 tons on Dec. 20.

Platinum for immediate delivery rose 0.4 percent to $1,836.25 an ounce and spot palladium increased 0.2 percent to $836.30 an ounce. Silver was little changed at $30.64 an ounce.

(Financial Times) -- Largest bond fund cuts US government holdings

The worlds largest bond fund sharply cut its exposure to US government-related debt in January, before US bond yields rose this month to their highest level in almost a year.

Pimcos Total Return Fund, run by Bill Gross, a founder of Pimco, reported that its holdings of US government-related securities fell from 22 per cent in December to 12 per cent in January.

The proportion of US government-related holdings, which includes US Treasuries, is at the lowest level held by the $239bn fund since January 2009 when it held 15 per cent of its assets in the category.

(Financial Times) -- Silver miners start hedging on price falls

For a decade, hedging has been a dirty word among precious metals miners.

After committing to sell much of their future gold production at fixed prices when the market was in the doldrums, some of the largest gold miners have since spent billions of dollars buying their hedges back.

"I am pleased I will never have to answer another question about the hedge book again," said AngloGolds chief executive, Mark Cutifani, when he completed the process of closing the companys legacy hedges last autumn.

Not so fast. Hedging has made a comeback.

In the past two months, at least five miners have executed silver hedges to protect against a fall in prices, bankers say.

Deutsche Bank estimates that in excess of 100m ounces may have been hedged. That is several times the size of total outstanding hedges in late 2010, estimated at about 20m ounces, and 15 per cent of annual silver production.

Does the rash of activity herald a return to widespread hedging for precious metals miners?

That question is of critical importance for investors in gold and silver, as well as the miners own shareholders.

Large-scale gold and silver hedging would be a bearish signal for the precious metals, because it directly increases selling pressure in the market and indicates a lack of confidence in the sustainability of prices.

Advisers and bankers have been warming to the idea of hedging.

Editor's note: This is misleading. A minority of advisers and bankers are warming to the idea

Amid a growing consensus that a more positive economic outlook and rising interest rates in developed economies will damp investment demand for precious metals, some are counselling miners to start looking for cover.

Editor's note: The is a very questionable non evidence based assertion

"Id certainly advocate gold and silver miners doing some prudent hedging at these higher prices," Nick Moore, head of commodity strategy at RBS, says.

A return to hedging may seem to be a natural shift in the cycle.

The number of gold and silver hedges outstanding - called the global "hedge book" - has been in decline for years as miners bought back unprofitable hedges.

That activity, known as "de-hedging", has been one driver of golds stellar performance over the last decade, since the buy-backs have effectively added to gold demand.

Last year, though, de-hedging came to an end, with AngloGold the last major gold miner to close out its hedge book.

However, the hedging activity seen in recent months has been limited in two important ways.

First, it has been confined to the silver market.

Second, only those miners who produce silver as a by-product have been seen in the hedging.

Bankers say large-scale hedging remains some way off for miners who produce gold and silver as their main product (called "primary producers") such as Barrick Gold, AngloGold and Newmont in gold and Fresnillo, Pan American Silver and Hochschild in silver.

The reason? Shareholders remain resolutely opposed, burnt by years of bitter experience in which mining equities underperformed gold and silver prices because of bad hedging.

William Tankard, senior analyst at precious metals consultancy GFMS, says investors in primary gold and silver producers are "often looking for a leveraged play" on price increases in the metals and so would "face a great deal of pressure not to hedge from their shareholders".

Evy Hambro, co-head of natural resources at BlackRock, one of the largest institutional investors in the mining sector, confirms that view.

"With regards to hedging we as a general rule do not like companies doing it as we can do it ourselves," he says.

Bankers and consultants say gold and silver miners are aware that, when prices make a decisive move south, they will need to think again about hedging.

But until then, their hands are tied.

"Miners are under pressure to not hedge, which in the good times is fair enough," says David Wilson, metals analyst at Société Générale.

"But to all intents and purposes, shareholders are not letting mining companies manage a mining company as they see fit."

For the time being, the bulk of hedging is likely to come from miners that produce precious metals as a by-product, bankers say.

The implication is bearish for silver, since 70 per cent of the metal is produced in conjunction with other metals.

Raymond Key, head of metals trading at Deutsche Bank, says: "Given that most silver is produced as a by-product and where the price is, the whole theme of by-product hedging is definitely back."

Editor's note: This article is quite selective and ignores the primary economic fundamentals of the silver market especially concerning supply and demand with huge demand, both industrial and investment, being seen in China, wider Asia and internationally. Mines that hedge their silver production forward (by selling in the futures market) are at risk of incurring sharp losses should the silver price rise to its 1980 nominal high of $50/oz or higher. The nominal high of more than 30 years ago will likely be reached given the current global macroeconomic situation of geopolitical instability, rising inflation, negative real interest rates and global currency debasement and given the tiny size of the physical silver market.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.