Gold and Silver ETFs Investor Warning

Commodities / Gold and Silver 2011 Feb 16, 2011 - 04:09 AM GMTBy: GoldSilver

Gold Exchange Traded Funds ( ETFs ) are expensive!

Gold Exchange Traded Funds ( ETFs ) are expensive!

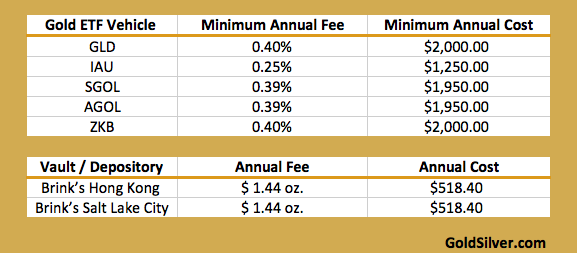

Gold ETF fees vs. Brink’s Segregated Vault Storage costs

Example: $500,000 or 360 oz gold bullion with $ 1356.70 gold spot.

Silver Exchange Traded Funds ( ETFs ) are expensive!

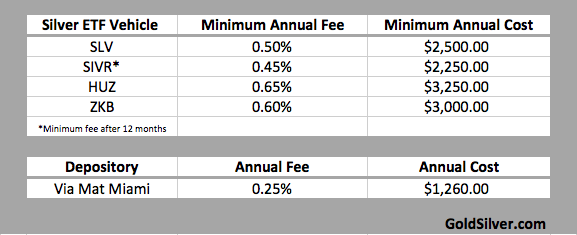

Silver ETF fees vs. Via Mat Segregated Vault Storage costs

Example: $500,000 or 15,940 oz silver bullion with current $ 29.94 silver spot.

Investors must search long and hard to uncover the total annual expenses associated with gold ETF and silver ETF vehicles. Gold and silver exchange traded funds, or ETFs, are designed to deduct fees and expenses from investor shares, thus they reduce one’s paper holdings over time.

Investors who hold physical bullion at Brink’s or Via Mat never have their physical gold or silver holdings reduced due to storage nor management fees. Customers are simply charged their respective vault storage fees in fiat dollars, this helps them maintain their safe haven money which we believe matters most over the long haul.

With GoldSilver.com you can always find the current segregated vault storage costs per depository by simply visiting our dedicated vault storage webpage ---> http://goldsilver.com/storage/

Gold ETFs & Silver ETFs are not Safe Haven Investments!

At GoldSilver.com we believe serious gold and silver investors should not own ETFs.

Sophisticated and illuminated gold and silver investors understand that bullion in hand coupled with accounts in fully insured segregated vault storage depositories are the keen one two punch for investing in silver and gold.

As you have seen in the tables posted above, ETFs are almost always more expensive than what the industry regards as the safest method of storing gold and silver, that being private fully insured segregated vault storage.

Gold ETFs and silver ETFs do not offer investors the benefits or protections of physical silver and gold bullion ownership. ETFs offer very little protection for investors seeking financial safety.

Almost all gold or silver ETFs do not allow redemptions or physical delivery of gold and or silver holdings. The ETF prospectuses which do allow possible physical redemptions, allowing fund share for physical bullion swaps, typically have requirements which are next to impossible to meet for most main street investors.

With segregated vault storage holdings in Brink’s or Via Mat, the average gold and silver investor can take physical delivery of their gold and silver holdings both domestically or internationally to the more than forty countries GoldSilver.com currently delivers to.

Exchange Traded Funds, or ETFs, do not offer returns over the future’s spot price of gold and or silver; they attempt to track the spot price and they can potentially fail to track it all together. In contrast, physical owners of silver and gold bullion can reap large sellback premiums with current and future physical silver shortages and lacking gold bullion market supplies.

ETFs are beholden to brokerage accounts, banking laws, and financial market regulations; they are not undisclosed private segregated vault storage accounts like Brink’s or Via Mat which remain open regardless of bank holidays or financial failures.

Silver and gold bullion provides 24-hour liquidity while a silver or gold ETF can only be exchanged during market trading hours.

In summary, intelligent investors know that physical silver and gold ownership is not beholden to fiat currency failures, bullion assets stand apart from the fractional reserve banking model currently at a cross roads of another crisis. One of the main reasons for physical gold and silver ownership is to have a safe haven asset outside of the financial institutions, one without counter-party risk.

For us, paper ETF promises can never stack up against real physical silver and gold.

- Mike Maloney

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2011 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.