Gold Phenomenon Surging Demand, Chinese Voracious Demand for Silver

Commodities / Gold and Silver 2011 Feb 17, 2011 - 08:53 AM GMTBy: GoldCore

Israeli comments led to dollar weakness and gold, silver and oil rallying yesterday. The Israeli government described the Iranian warships move into the Suez canal as a “provocation” and hinted at a possible response.

Israeli comments led to dollar weakness and gold, silver and oil rallying yesterday. The Israeli government described the Iranian warships move into the Suez canal as a “provocation” and hinted at a possible response.

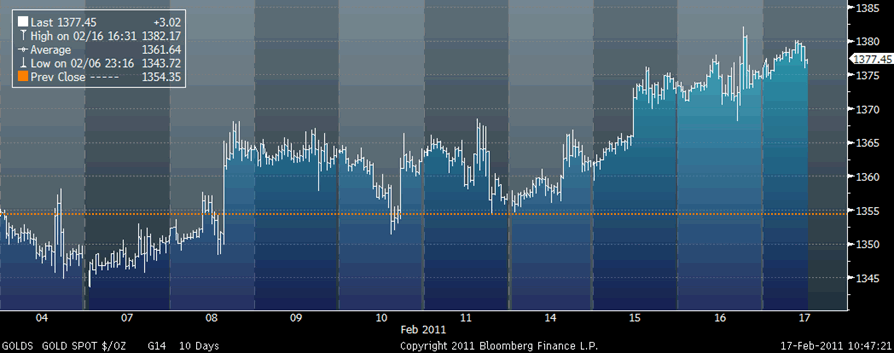

Gold in USD – 10 Day (Tick)

An example, if one was needed, about how precarious the geopolitical situation in the Middle East is and how markets continue to underestimate the risk of military conflict.

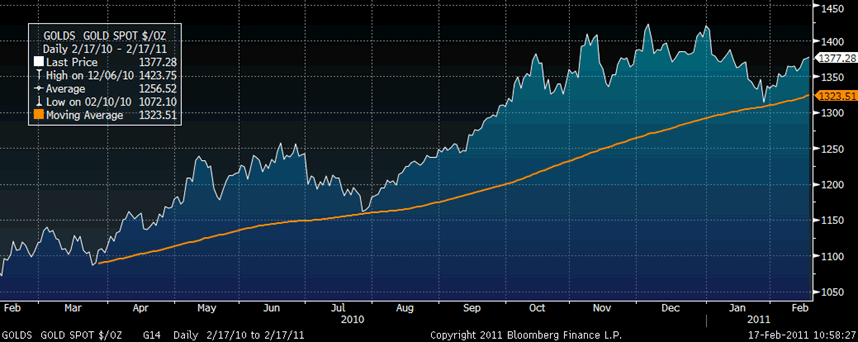

Besides the very strong fundamentals, gold is looking better and better technically. After a 4 month period of correction and consolidation gold remains below levels seen last October (see chart below).

Gold bounced off support seen at the 150 day moving average and is now above the 100 day moving average. It is only 3.5% below the nominal record high of $1,423.75/oz seen in early December 2010.

Gold in USD – 1 Year (Daily) and 150 Day Moving Average

Even more important is the significant increase in demand seen in India, China and globally as people buy gold to protect themselves from macroeconomic risk and deepening inflation.

The World Gold Council reports that the increase in investment demand is a 'global phenomenon', reporting a 19% year-on-year rise across the world in its most recent report this morning.

In China alone, gold investment demand jumped 70% last year as Chinese people bought gold as a store of value. Demand is projected to grow a further 40 percent to 50 percent this year and jewelry demand will expand by 8 percent to 10 percent this year.

Gold imports by India, the largest buyer of gold in the world, climbed to a record of 918 metric tonnes in 2010, driven by a surge in jewelry demand with Indians continuing to buy jewelry as a store of value.

Reuters quoted a leading Chinese executive from Industrial and Commercial Bank of China (ICBC) (1398.HK)(601398.SS), the world's largest bank by market value, as saying that demand for gold was growing at a voracious pace due to surging inflation.

Zhou said that the huge increase in Chinese demand seen last year would happen again in 2011 due to a “choppy stock market” and concerns about how rising interest rates will affect property markets.

Perhaps most importantly and rarely mentioned in the western media is the fact that the Chinese government is encouraging their citizens to buy physical gold and silver bullion having banned gold ownership from 1950 to 2003 (see video).

"Unlike the property market, investment in the gold sector is something the government is encouraging," Zhou said.

Zhou said there was also voracious demand for silver, with ICBC bank alone selling about 13 tonnes of physical silver in January alone, compared with 33 tonnes in the whole of 2010. Were that demand to continue then demand for silver from ICBC alone could be as high as 156 tonnes this year. This would be a 370% increase on 2010.

Given the degree of demand for silver in China and internationally the forecast that silver could reach $36 an ounce this year, by Bloomberg analysts, is looking very conservative.

Those continuing to calling gold and silver “bubbles” continue to ignore the facts and the many, many extremely important developments in the gold and silver bullion markets.

Gold

Gold is trading at $1,377.75/oz, €1,017.01/oz and £854.68/oz.

Silver

Silver is trading at $30.59/oz, €22.58/oz and £18.98/oz.

Platinum Group Metals

Platinum is trading at $1,825.50/oz, palladium at $835.00/oz and rhodium at $2,400/oz.

News

(Bloomberg) -- China Investment Gold Demand to Grow 40-50% This Year, WGC Says

China’s gold investment demand will grow 40 percent to 50 percent this year, Wang Lixin, the China representative for the World Gold Council, said today. The country’s jewelry demand will expand by 8 percent to 10 percent this year, he said.

(Bloomberg) -- China’s Gold Investment Demand Jumps 70%, Council Says

Gold investment in China jumped 70 percent last year and consumption by the jewelery sector gained to a record as investors stepped up purchases of the precious metal as a store of value, said the World Gold Council.

Investment demand jumped to 179.9 metric tons last year, surpassing Germany and the U.S., as buyers sought out gold bars and coins, according the London-based industry group. Demand from the jewelry sector was 400 tons, it said.

Gold reached a record $1,431.25 an ounce on Dec. 7 and soared nearly 30 percent last year as the dollar dropped and investors sought a store of value amid currency debasement. China’s consumer prices increased 4.9 percent in January from a year earlier, exceeding policy makers 4 percent inflation ceiling for a fourth month, data showed this week.

“The main motivation behind this demand has been concern over domestic inflation pressure and poor performance of alternative investments, combined with expectations of further gold price gains,” the council’s report said.

Bullion gained 0.3 percent to $1,379.50 at 3:34 p.m. in Shanghai.

Consumption in China, the second-largest buyer, may gain 15 percent in the first half, fueled by growing demand for alternative investments and a hedge against inflation, the China Gold Association’s deputy chairman Zhang Bingnan said last month.

China displaced South Africa as the world’s biggest gold producer in 2007. Imports through October rose almost fivefold from the total shipped in the previous year to 209 tons, according to the Shanghai Gold Exchange. Mine output reached a record 340 tons last year, the China Gold Association said.

The Industrial and Commercial Bank of China Ltd, the world’s biggest lender by market value, started physical-gold linked savings accounts in December in an initiative with the World Gold Council. Account openings surpassed 1 million with over 12 tons of gold stored on behalf of investors, it has said.

(Bloomberg) -- Gold, Silver ‘Appealing’ as Long-Term Investments, Burns Says

Gold and silver look “extremely appealing” for long-term investments as world currencies struggle to maintain their value, Pan American Silver Corp. Chief Executive Officer Geoff Burns said.

Pan American expects Argentina’s Chubut province to overturn a ban on open-pit mining this year to be able to develop the company’s Navidad silver deposit, Burns said today on a conference call.

(Bloomberg) -- Pan American Silver Shifts Assets to Canadian Dollars

Pan American Silver Corp., the world’s fourth-largest silver producer, said it’s shifting its currency holdings into Canadian dollars, betting the U.S. dollar may fall further.

The world’s reserve currencies are struggling to maintain their value amid “ridiculous” debt levels, Chief Executive Officer Geoffrey Burns said today on a conference call with analysts. Gold and silver look “extremely appealing” as alternative long-term investments, he said.

“We diversified some of our currency holdings into Canadian dollars away from U.S. dollars to provide more stability in the event we do see continued weakness in the U.S. dollar,” Burns said. “It’s not just the U.S. dollar -- the euro, the Japanese yen are going to have extreme difficulty hanging onto their long-term values as a commodity of trade.”

The dollar fell against most of its major counterparts today, while gold rose to the highest price in almost five weeks on speculation that the accelerating pace of inflation will boost demand for the precious metal as an investment hedge. Wholesale prices rose for a seventh straight month in the U.S., led by higher prices for fuel.

Gold futures for April delivery rose $1, or 0.1 percent, to settle at $1,375.10 an ounce at 1:34 p.m. on the Comex in New York. Silver futures for March delivery fell 6.7 cents, or 0.2 percent, to $30.629 an ounce.

Vancouver-based Pan American expects Argentina’s Chubut province to overturn a ban on open-pit mining after local elections in March, allowing the company to develop its Navidad silver deposit, Burns said. The company’s silver output will fall to 23 million ounces this year from 24 million ounces in 2010, he said. Industria Penoles SA, BHP Billiton Ltd. and KGMH Polska Miedz SA are the world’s largest silver producers.

(FT) -- Investors look for a silver lining

The mint ratio, which shows how many ounces of silver it takes to buy an ounce of gold, is close to its lowest levels since 1998, currently about 45. Why?

With gold near a record high the simple explanation is that silver has been performing even better of late, driven by increased demand rather than any supply contraction.

Silver tends to hang on to gold’s coat tails when gold is stronger, during periods of inflation or political turmoil, perhaps. But gold’s recent gains have come at a time of improving economic fundamentals, so silver, which has a tight industrial demand correlation, has enjoyed extra impetus.

Another boost has come from retail investors who would rather spend their $200 on roughly five 1-ounce American Eagle silver coins, than one 10th-of-an-ounce gold coin. Doubtless the “penny-share syndrome” also applies a bit here too – when smaller priced assets are perceived as providing better opportunity for gains.

This is possibly why the US mint sold a record 6.4m Eagle silver coins in January, a 78 per cent increase on the previous year, when silver was more than 40 per cent cheaper. Gold sales were up 57 per cent over that period.

(Bloomberg) -- Impala Platinum Sees 2011 Palladium Deficit of 560,000 Ounces

Impala Platinum Holdings Ltd. said global palladium demand may outstrip supply by about 560,000 ounces this year. Platinum supplies may exceed demand by about 20,000 ounces in 2011 while the rhodium market may have a 55,000 ounces surplus, Impala said in a copy of a presentation posted on its website today.

(Bloomberg) -- Gold Jewelry Demand Is ‘Still Very Strong,’ Council’s Grubb Says

Gold jewelry demand is “still very strong,” after rising last year, World Gold Council managing director Marcus Grubb said on Bloomberg TV today.

“I certainly think we will see another very strong year for gold” this year, he said.

(Bloomberg) -- Gold Jewelry Demand in India is Strong, World Gold Council Says

Gold demand in India for jewelry is “outstanding” and high prices are no longer “a barrier” for consumers in the world’s largest user of bullion, according to Ajay Mitra, managing director of the World Gold Council for India and the Middle East.

Demand will stay “robust” this year, he told reporters in Mumbai today.

(Bloomberg) -- Gold Imports by India Reach Record on Jewelry Sales

Gold imports by India, the largest user, climbed to a record in 2010, driven by a surge in jewelry demand and amid expectations that the 10-year rally in prices would extend, according to the World Gold Council.

Purchases totaled 918 metric tons, according to provisional data released by the producer-funded group today. That exceeds the projection of about 800 tons made last month by Ajay Mitra, the group’s managing director for India and the Middle East.

Bullion advanced 30 percent last year, reaching a record $1,431.25 an ounce on Dec. 7, as investors bought the metal as a protector of wealth. Jewelry demand in India jumped 69 percent in the year to the highest ever, helping drive global demand to a 10-year peak, according to the council.

“India was the strongest growth market in 2010,” said the report. “The rising price of gold, particularly in the latter half of the year, created a ‘virtuous circle’ of higher price expectations among Indian consumers, which fuelled purchases, thereby further driving up local prices.”

Fourth-quarter imports rose to 265 tons from 204 tons a year earlier, the group said. Jewelry demand gained 47 percent to 210.5 tons and investment demand grew 15 percent to 74.40 tons. Total demand in the period climbed 37 percent to 284.9 tons, according to the report.

Consumer demand for bullion in India rallied 66 percent in 2010 to 963.1 tons by volume from a year earlier and more than doubled in value to $38.2 billion, the council said.

(Reuters) -- China gold demand growing at "explosive" pace: ICBC

Demand in China for physical gold and gold-related investments is growing at an "explosive" pace and its appetite for the yellow metal is poised to remain robust amid inflation concerns, said an Industrial and Commercial Bank of China (ICBC) executive.

ICBC (1398.HK)(601398.SS), the world's largest bank by market value, sold about 7 tonnes of physical gold in January this year, nearly half the 15 tonnes of bullion sold in the whole of 2010, said Zhou Ming, deputy head of the bank's precious metals department on Wednesday.

"We are seeing explosive demand for gold. As Chinese get wealthy, they look to diversify their investments and gold stands out as a good hedge against inflation," Zhou told Reuters.

"There is also frantic demand for non-physical gold investments. We issued 1 billion yuan worth of gold-price-linked term deposits in 2010, but we managed to sell the same amount over just a few days in January this year," Zhou said, adding that such deposits would easily exceed 5 billion yuan ($759 million) this year.

Gold imports into China soared in 2010, turning the country, already the largest bullion miner, into a major overseas buyer for the first time.

The surge, which comes as Chinese investors look for insurance against rising inflation and currency appreciation, puts the country on track to overtake India as the world's top gold consumer and a significant force in global gold prices.

Gold prices jumped 30 percent in 2010 and struck an all-time high of $1430.95. Spot silver surged 83 percent last year and is currently hovering at around $30 per ounce.

Zhou said China's gold demand could grow at a stronger pace this year compared with 2010, as a choppy stock market and moves by Beijing to rein in property speculation and purchases means more investors will pile their cash in bullion investments.

"Unlike the property market, investment in the gold sector is something the government is encouraging," he said.

Beijing has encouraged retail consumption and announced last August measures to promote and regulate the local gold market, including expanding the number of banks allowed to import bullion.

"China has a centuries-long cultural attraction to gold and because we have started at such a low base, I think demand growth will likely stay strong for quite some time," he said.

Zhou said there was also voracious demand for silver, with the bank selling about 13 tonnes of physical silver in January alone, compared with 33 tonnes in the whole of 2010.

The scale of China's gold demand, which has increased on average at a double-digit clip over the past decade, has caught the market by surprise. Data showed China imported 209 tonnes of gold the first 10 months of last year, versus 333 tonnes by India for the whole year.

The bank on Tuesday launched its second physical gold investment product, which sells gold bars to investors, which can be resold for cash through ICBC based on real-time gold prices.

The WGC said ICBC's introduction of this gold investment could lift China's gold retail investment by 10 to 15 percent in 2011 from about 170 tonnes last year.

(Bloomberg) -- U.S. Mint’s Silver Suppliers Treasure Precious Metal’s Rally

The value of contracts for supplying silver to the U.S. Mint has surged along with the precious metal’s rise in the world market, according to data compiled by Bloomberg.

The federal agency that makes coins for circulation and investment paid at least $693.1 million to two of its main silver suppliers in the 2010 fiscal year, a 66 percent increase over 2009, the data show.

“For a small company, the government’s a good long-term customer to have,” Tom Power, chief executive officer of Sunshine Minting Inc., said in a Feb. 4 telephone interview. The Coeur d’Alene, Idaho-based company is the Mint’s primary supplier of silver blanks for bullion coins, which are sold to investors.

The increase in payments to Sunshine Minting and Stern Leach Co. of Attleboro, Massachusetts, a unit of London-based Cookson Group Plc, has coincided with silver’s rally as investors bought precious metals in the economic decline and to protect against Europe’s financial crisis. Spot silver has more than tripled to $30.785 an ounce through Feb. 15 from $8.967 on Nov. 20, 2008, its lowest settlement in the last five years.

Over the past 11 years, the U.S. Mint has spent at least $2.1 billion on contracts with its two main suppliers of silver blanks, or unstamped coins, according to data compiled by Bloomberg. About 80 percent of that was paid to Sunshine Minting.

Little Competition

Sunshine Minting works on five-year rolling competitive-bid contracts with the Mint, said Power. All 58 unique contracts the agency exercised in fiscal year 2010 to buy silver from the Idaho company were open to competition, according to the Federal Procurement Data System. In 24 cases, Sunshine was the only bidder, the data show.

“The production of blanks for the Mint is not easy, so there’s not a lot of competition,” Leonard Kaplan, president of Prospector Asset Management in Evanston, Illinois, said in a telephone interview Feb. 10. “It’s only two or three companies that have the equipment to do this and are willing to jump through all the loops that the U.S. Mint wants,” such as product specifications and payment schedules, he said.

The Mint purchases silver on the open market “at prevailing prices” to produce bullion, Mint spokesman Michael White said in an e-mail Feb. 8.

“The volume of bullion coins, gold and silver, produced and sold by the U.S. Mint are at peak levels since 2008,” White said. “As the price of gold and silver fluctuate, the value of blanks orders reflects that fluctuation.”

The Mint sold 35.8 million ounces of gold and silver bullion coins last year, up 30 percent from 2009, according to the agency’s annual report.

Sunshine’s Rise

Sunshine Minting’s sales to the Mint totaled $10.2 million in fiscal year 2000, the start of a rapid escalation in federal contracts that reached $579.1 million last year, according to the data compiled by Bloomberg.

Stern Leach, another major silver supplier to the Mint, experienced a similar upswing in sales to the federal government. The company’s contracts totaled $114 million last year compared with $70.4 million in 2009 and $10.7 million in 2005.

A spokesman for Stern Leach in Attleboro, Massachusetts, who refused to be identified, said Feb. 3 it is company policy to decline interviews with the news media.

Bullion Boom

The Mint’s sales of silver bullion coins jumped 77 percent to $660 million in fiscal year 2010, according to the annual report. Bullion products made of gold brought in $2.2 billion last year, up 69 percent from the previous year.

“They try to balance their supply and demand, and demand has been very, very strong, so of course they buy more,” Kaplan said. “Right now they’re making a fortune.”

White said the Mint is required by law to pass its metals costs onto the buyers of products such as bullion coins so that it can operate at no net cost to taxpayers.

“By law, the U.S. Mint must sell silver bullion coins at a price equal to the bullion value of the coin at the time of the sale, plus production costs,” White said.

The agency’s more public role is to produce coins and sell them to the Federal Reserve’s district banks at face value, yielding a so-called seigniorage profit that is sent back to the Treasury’s general fund.

Higher metal costs and a shift to production of less profitable, lower denomination coins brought the Mint’s seigniorage from circulation down 30 percent in fiscal year 2010, from $428 million to $301 million, according to its annual report.

Silver could reach $36 an ounce this year, according to a Bloomberg survey of analysts.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.