What Economics is Not

Economics / Economic Theory Feb 18, 2011 - 12:31 PM GMTBy: Andy_Sutton

It is starting again. It is a phenomenon that occurs more regularly now, especially with daily talk of massive imbalances right along with a massive boost in activity. More and more people are scratching their heads wondering what gives. Once again, economics has become a debating society. There are Keynesians, Austrians, the Classic folks, and those who will use ridiculous rationale and textbook, but not applicable accounting definitions to try to assert that we’re really getting rich every time the government borrows another dollar. It is no wonder people are confused. Like so many other areas of our society, particularly morality, the definitions have been skewed, the lines, blurred, and the waters made muddy.

It is starting again. It is a phenomenon that occurs more regularly now, especially with daily talk of massive imbalances right along with a massive boost in activity. More and more people are scratching their heads wondering what gives. Once again, economics has become a debating society. There are Keynesians, Austrians, the Classic folks, and those who will use ridiculous rationale and textbook, but not applicable accounting definitions to try to assert that we’re really getting rich every time the government borrows another dollar. It is no wonder people are confused. Like so many other areas of our society, particularly morality, the definitions have been skewed, the lines, blurred, and the waters made muddy.

I am not going to sit here and explain the difference between the schools of economic thought because it isn’t necessary. I’m not going to sit here and tell you what you already know, because you already know it. What I am going to do is spend a few minutes giving you some good reasons why you should follow the laws of economics and tune out the nonsense from politicians, the pundits, and the bank-financed media.

Economics is not a debating society. There are laws. These laws are immutable. This is not just my opinion; rather, it is a fact that has been borne out time and time again throughout history. Obey the laws of economics and you will fare well; cross them and you’re in trouble. The biggest caveat in all of this is that the punishments are often not immediate. If you put your hand on a hot stove you’ll know instantly the consequences of your actions. The same goes for jumping in a cold lake in the middle of January. However, when it comes to money and economics, it is often possible, and very normal, to get away with bad behavior for a time. This is dangerous because people often forget that their proverbial hand is an inch above the hot stove.

This is precisely the point we are at in the progression of America and most of the world. Our hand is an inch above the stove and we’re clueless because we’ve gotten away with breaking the laws of economics long enough that we are convinced that we have a free pass and can continue our behavior in perpetuity. We look at our television sets and the massive social unrest in other parts of the world and feel insulated because we live in America. We’re watching others partake in the negative consequences of violating the laws of economics yet we’re secure in the naïve notion that it can’t happen here.

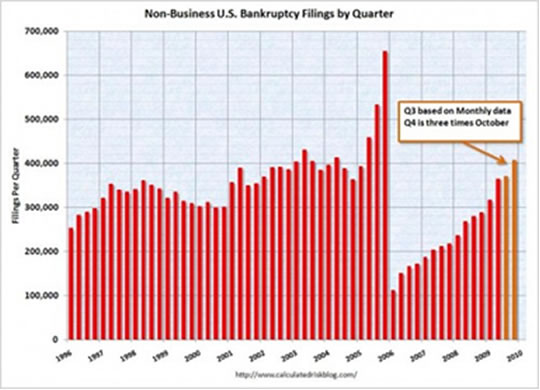

It is a simple law of economics that if you consume more than you produce that you’re going to become poor, not rich. Our government and media would have you believe the exact opposite and so many of you have tried it their way and lost badly. Think of the family who month after month consumes beyond their production. They go into debt and become a slave to the creditor. They become destitute, insolvent, and eventually go bankrupt. It is happening all the time. Why is a nation any different? It isn’t. Sure, a nation has more resources than the individual to kick the can down the road a little longer, but in the end, the result is the same. The law has been violated and the consequence awaits.

Wealth doesn’t come from a printing press or a credit card. This is another intellectual fraud that has been perpetrated on people the globe over. Wealth is a result of work, foregoing of consumption, and investment of the resultant savings. Notice it starts with work, not Bernanke’s printing press or VISA. We earn a living from the sweat of our brow, not by being wards of the government printing press. We have been told the exact opposite though. We’ve been told that we’re prosperous even while our debts balloon. We’ve been told we have a healthy economic recovery without putting the unemployed back to work. These claims are fraudulent and should be ignored.

We’ve also been conditioned to believe that we are exempt from the consequences of economic malfeasance because we issue the world’s reserve currency. This is another prevarication. First of all, the Dollar is not issued by the US government, the people of America, or any other American institution. The Dollar is issued by a privately owned, privately held corporation that has its own best interests in mind, not America’s. And even if the US Treasury did issue the Dollar and there was no Fed, it still would not cloak us in immunity from a sound economic beating for over issuing currency and spreading inflation around the world.

We did get a little bit of truth from Mr. Ben a few weeks back when he was asked about near record high global food prices and what affects quantitative easing (another fraud) was having in the commodities markets. Ben answered, essentially admitting that QE has been holding up our financial markets. QE is just another tool being used to kick the can down the road and push the consequences of our poor decisions another day into the future when another Congress and another generation will have to deal with it. And guess what? They won’t be any better equipped to handle it than we are today. They won’t be any smarter. The only real thing we’ve learned from history is that we don’t learn from history. Our best hope at dealing with our economic problems is now, on both a personal level and in the aggregate.

Economics is not some Pandora’s black box of evil-looking equations, charts, and terms that are not meant to be understood. On the surface all you really need to know is what has been stated in the past two pages. The laws of economics are common sense. Sure, we can get detailed in trying to explain and analyze that common sense, but the explanations are not economics, the common sense is. Keep that in mind as you follow what is going on and make decisions in your own life.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.