Inflation and the Value of Gold Explained

Economics /

Gold and Silver 2011

Mar 02, 2011 - 01:00 PM GMT

By: MISES

Rod Rojas writes: As the story goes, someone asked an economist how his wife was doing, and the economist answered "compared to what?"

Rod Rojas writes: As the story goes, someone asked an economist how his wife was doing, and the economist answered "compared to what?"

Joking aside, this is one of the most important questions one can ask when dealing with many economic problems.

In recent times, with gold reaching all-time highs, we have seen people question the valuation of assets in dollars. Basically, the yardstick used to measure your assets — your house, car, or stock portfolio — is a steadily shrinking one. This makes you wonder whether your savings are really growing in value. In other words, if the value of your savings has doubled, but the price of milk and everything else has roughly doubled, you are not getting ahead. If anything, you will likely have to pay taxes on your supposed "gain," which is no gain at all.

In recent times, with gold reaching all-time highs, we have seen people question the valuation of assets in dollars. Basically, the yardstick used to measure your assets — your house, car, or stock portfolio — is a steadily shrinking one. This makes you wonder whether your savings are really growing in value. In other words, if the value of your savings has doubled, but the price of milk and everything else has roughly doubled, you are not getting ahead. If anything, you will likely have to pay taxes on your supposed "gain," which is no gain at all.

The way the dollar yardstick is being shrunk is by increasing the stock of money, which means that there are more dollars in circulation. Governments do this.

Why would governments want to decrease the value of our money? Well, there are many reasons why this is very advantageous to our masters.

First, creating more dollars is an easy way to pay for government expenditures. If the government wants to pay for wars, bailouts, or their own cushy salaries and perks, they can print the money instead of taking it away from us by force through taxation.

Second, we all know that scarce, desirable goods are more expensive than abundant ones. On the other hand, some goods are so abundant that they are free in spite of their desirability, such as the air we breathe. So by increasing the number of dollars — by inflating the stock of money — the state reduces its exchange value. This is very bad if you are saving money, but it's great for governments because they are usually big debtors.

Unfortunately for us, this process of devaluation can be done until money is completely worthless. It happens easier than you might think, and not only to banana republics but also to mighty countries.

Usually, cheap goods are a good thing. If you increase the amount of wheat available, we will have cheaper bread. The progress of humanity is based on making economic goods more abundant and affordable. The difference with money is that you cannot consume it in the same way you eat bread. Money is there for the sole purpose of exchange, especially when talking about our modern paper currencies. Given this fact, the cheapening of money does not bring about any well-being.

But wouldn't more money make us richer? Not really.

You see, if you were thrown in the middle of the desert, a pile of money wouldn't do you any good. Money only facilitates the exchange of goods and services, but underneath it all, it is the goods and services themselves that are being exchanged. Think of it as a highly efficient and improved barter. If you are a plumber, you don't really need money to live (you can't eat money); money just makes it possible for you to indirectly exchange your plumbing services for groceries. If money weren't there, each time you needed food you would have to find a grocer that was in need of plumbing services so that you could barter your services for food.

So if the amount of money does not determine how rich a society is — if that's determined instead by the actual goods it produces and possesses — why should we object to the government's creation of money? What does it matter to me if milk is $1 per gallon and I make $10 per hour, or if milk is $10 and I make $100 per hour?

The answer to that question is that the creation of money does not affect all prices and wages simultaneously. Analogies are never perfect, but imagine that you have a pool of water (representing the money already in circulation), and that you add additional water to it (representing new money), but to keep track of the new money you add red dye to it. Obviously the red dye will not affect the pool all at once. At first you will have a very visible spot of concentrated red color in the area where the water was added, and it will take awhile for the entire pool to have a uniform color. If the amount of red dye is not huge and the pool is big enough, the final color of the water may not even be very red.

This is basically how new money makes its way into the economy. The initial recipients of the new money — the government and its friends — get to spend it first with the old, more concentrated purchasing power, and as the money makes its way into the economy it gradually dilutes the purchasing power of the entire pool of money. So, in effect, because of this uneven readjustment of prices, in some segments of the population the price of goods will go up before wages do, making these people much poorer.

This creates a shift of capital from some segments of the population to others, while not increasing the total amount of capital.

But, don't we need to make our exports cheaper? No, we don't.

By making exports cheaper through a weakened currency we subsidize our exports. The buyer of our goods in the importing country gets a good deal, the producer of exports sells more products, but this is all paid for by the population at large. Once again, the policy itself produces no increase in capital but only a transfer of it.

But if it creates export-based jobs, it must be good, right?

The problem is that you are subsidizing those jobs, not creating real productive jobs. To pay for those jobs you had to take resources from someone else. That other person was going to consume, save, or invest that money anyway. Shifting resources does not lead to increased capital, which is what ultimately leads to higher real wages.

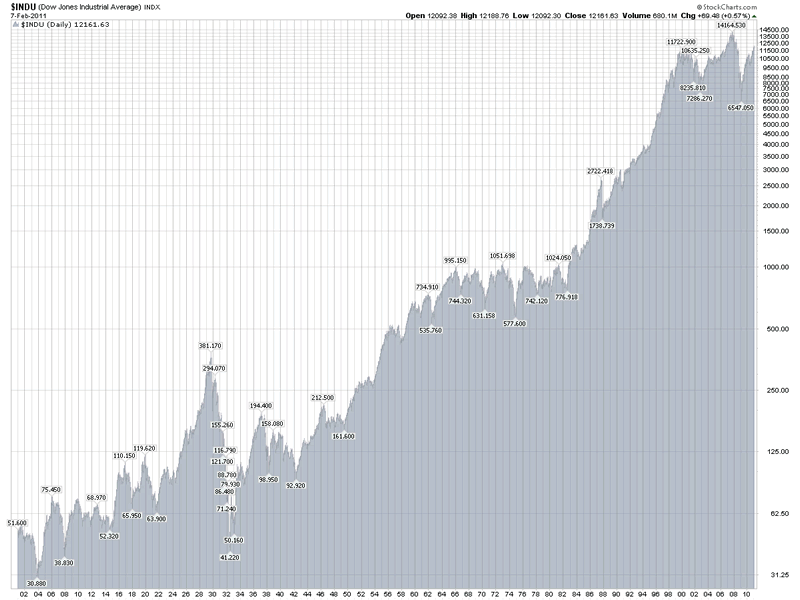

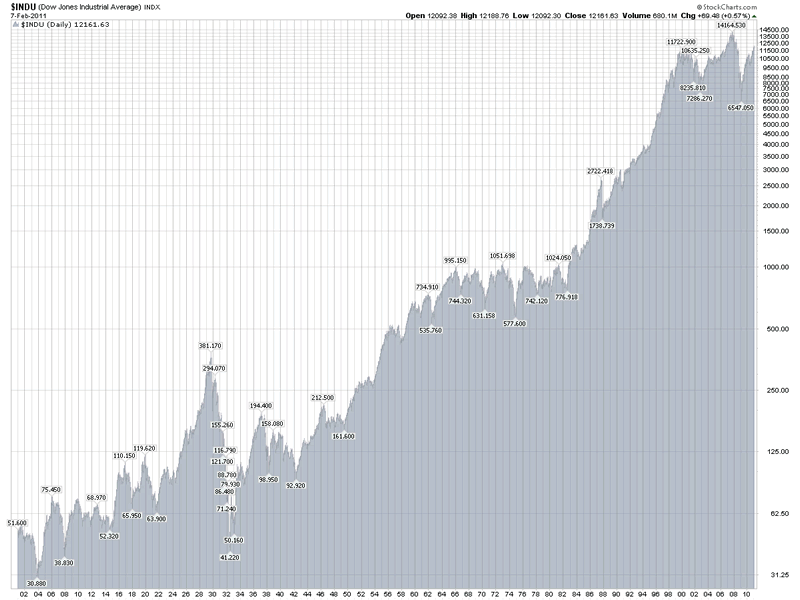

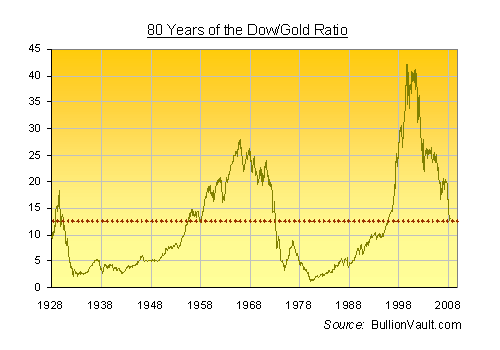

Until the population realizes what is really taking place, politicians and the mainstream media will get away with rejoicing every time real-estate prices rise, or when the Dow Jones Industrial Average reaches a new milestone. Now, this graph shows the Dow priced in US dollars, our shrinking yardstick. It sure looks good.

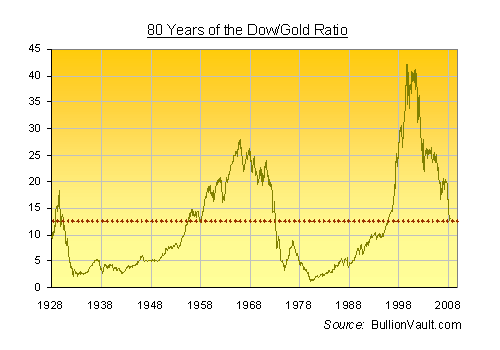

How about changing the yardstick for a more stable one? You could use milk, paper clips, or anything you like. Let's use ounces of gold.

The picture is very different indeed. For one thing it shows that the rise in stock prices or any other good denominated in paper currency may not say much about the real value of your investments. You may have invested your money — in any venture — and be thinking that you are making a nice profit when in fact you might be suffering huge losses. This is one of the dangerous consequences of inflation: by distorting prices it increases the amount of entrepreneurial mistakes. Inflation can mask huge losses.

The other important thing that can be learned from this graph is that gold itself varied in its purchasing power. These variations are greatly amplified by the government-created boom-and-bust cycle.

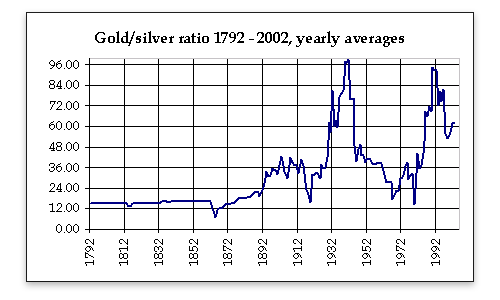

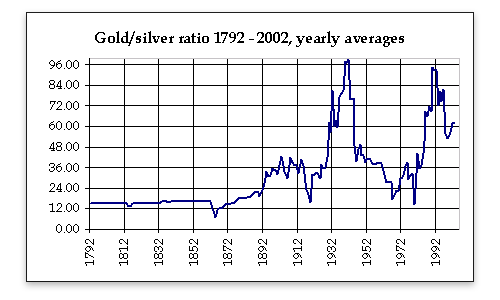

Let's look at gold priced in ounces of silver; this is a historical chart. Look at how erratic the price of gold becomes in the 20th century with the appearance of central banking.

It is commonly said that gold is a stable yardstick, that its purchasing power has not changed since Roman times. It is said that back then an ounce of gold bought you a full outfit with sandals, and that today an ounce of gold will buy you a full suit, shirt, and shoes. It is claimed by many that gold's purchasing power does not change at all, that paper currencies depreciate against it.

While I agree that gold is much more stable than any modern paper currency, I cannot agree that it has stable exchange value. It is true that paper currencies depreciate against gold, but so does any other good whose supply increases.

At times in history, gold itself has seen its supply increase dramatically, as during the Spanish conquest of the Americas. And silver has at times been more valuable than gold, as in ancient Egypt.

The other claim regarding the value of gold is that it has what is called "intrinsic value," which basically means that the essence of gold itself, its nature, gives it value. It is also claimed that because it is hard and costly to mine, this makes it expensive and gives it a "price floor."

Nothing could be further from the truth. All prices are a product of subjective valuations. If nobody wants it, regardless of how much work it takes to produce, or how amazing its properties are, the good will have no value. It is actually the other way around. Because people are willing to pay a high price for gold, it is economically viable to embark in costly mining and production schemes.

The opposite is also true: regardless of how useless a good is, if people want it, its price will be high. Take jewelry-grade diamonds as an example.

The point that is being missed is that gold is a commodity as well as a monetary metal. There is a market for gold outside the monetary realm, and this is an additional component to its value that modern paper currencies do not have. In that sense one could say that gold's value as a commodity gives it that "price floor," or downside protection.

But above all, gold has value because people want it and because it is scarce. It is that simple.

Rod Rojas is a holder of the Canadian Securities Course designation and performs as a financial adviser in personal, corporate, and public-policy matters. He is a proud member of the Ontario Libertarian Party. Send him mail. See Rod Rojas's article archives..

© 2011 Copyright Rod Rojas - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

sisterT

03 Mar 11, 11:02

|

gold as a safe investment?

It seems to me that gold is just another part of the big ponzi scheme. My understanding is that our government has the right to seize any US treasury minted gold at any time it sees fit. Or, it can simply declare gold an illegal form of trade. This would seem particularly true since Nixon de-coupled the value of the dollar from gold back in 1971. So, aren't we all just chasing illusions?

|

Shelby Moore

03 Mar 11, 16:02

|

confiscation

How can the government confiscate something they can not find? What is your alternative? Let govt steal it more easily if you keep your savings in anything other than gold & silver. Are you think the govt can control the price of gold? Wrong. Not until they let interest rates go skyhigh. Are you afraid you will have no place to sell your gold? Yes that will come one day when the government controls every transaction with digital money. But do you really think we will be there in 5 years? I don't think so.

|

Rick

04 Mar 11, 18:29

|

Gold & Silver Confiscation Is Coming Now!

sisterT: I couldn't have said it better myself. Gold in fact is similar to a Ponzi scheme: Those on top (Rothschilds, Rockefellers, Morgans, DuPonts, etc.etc.) are absolutely guaranteed to come out the de facto winners, while those on the botton (Shelby Moore, Nadeem Wylatt, and other pundits who swallowed the bait hook, line and sinker) are doomed to forfeit all. And yes, there is nothing at all to prevent President Obama from confiscating all private holdings of gold, silver, platinum, market securities, real estate, etc. etc. That's just another reason why it's absolutely fruitless to try to bet against the House (Of Rothschild). One is just chasing his own tail (and losing the crown jewels in the process). Shelby: You really have to be naive to believe that Uncle Sam will not locate your gold and silver holdings. I can assure you that the U.S. government has very long tentacles (and not to mention very large ears). FDR had no trouble at all in confiscating the people's holdings of gold and silver in 1933. The penalty for refusing the government directive was simply too stiff for anyone to refuse to comply.

|

Shelby Moore

05 Mar 11, 00:07

|

1934 confiscation failed

As far I know, only about 1% of the private gold was confiscated due to the 1934 executive order, because most people refused. Mostly only the gold & silver in safety deposit boxes was confiscated. The govt does not have the resources to search every nook & cranny on planet earth. No even all the ants of the world have enough resources. If the govt confiscates a few examples, they will simply drive the price of gold & silver skyhigh, because then it will be obvious (to the other 99.9% of the people who don't know yet) that gold & silver is what is valuable. http://silverstockreport.com/2011/storm.html The link above has more under the section "CONFISCATION RUMORS".

|

Rick

05 Mar 11, 14:22

|

All Hands On Deck! Gold & Silver Confiscation!

Well of course only a small percentage of gold was confiscated in the 1930's. And do you know why? John Q. Public typically stashed what few coins that he had in his possession either in a safety deposit box (as you alluded to) or in some pickle jar buried in the backyard. In the case of the latter, most 'average' Americans dutifully complied with the presidential directive as the penalty for not doing so was simply too terrible to contemplate. But more about that later. As I previously mentioned, most 'average' Americans followed the presidential directive, but the vast majority of the gold held by Americans was never confiscated. So why was that you ask? It was only because most of that privately held gold was controlled by wealthy businessmen, bankers and social elites. So now we're finally getting around to the Rothschilds, Morgans, Rockefellers and the like. Most of that gold which was held by such wealthy socialites was conveniently tucked away in Swiss vaults. Lest you be deceived still further, these wealthy power brokers wrote the rules, and were by no means subject to any presidential decree. Now as for John Q. Public, FDR needed not to raise a hand in order to get them to comply willingly. A U.S. president with the dubious reputation for encarcerating all Japanese-Americans in concentration camps because of the color of their skin, for indiscriminately bombing civilian targets in Tokyo and summarily hanging accused German saboteurs (through military tribunal---alias 'hanging judge') was obviously no one to fool with. But you and Nadeem can just continue to delude yourselves for now, until the Secret Service and Homeland Security bust open the front door one day soon. A pleasant journey sir!

|

Onc' Scrooge

05 Mar 11, 15:00

|

PM forever !

To All together, you are all bad investors one has fear of the big wolf, others think of global conspiration but change your fiat into PM now - burry it - dig it up in save times - or give the secret to your children - once upon a time PM will be usefull. Triangular investors think of the coming generations first!! If you can profit of your own PM in lifetime it's good and if it will be you grandsons it will be even better or not?! No gouvernment will catch you - only if you are stupid anxious or greedy they will get you. Greetings Onc' Scrooge

|

Nadeem_Walayat

05 Mar 11, 16:36

|

Gold Silver and Life

Rick I currently don't hold any gold. Also, one can either live life like a mouse or a lion, I know which I prefer ;) FIGHT THE POWER ! Best NW

|

Shelby Moore

06 Mar 11, 17:36

|

confiscation facts

Rick, You unware of the facts. 1. No silver was confiscated in 1934. The executive order for that was rescinded before it took effect. The reason is because it would revealed how impotent the govt is. There is 15-20 billion oz of silver in jewelry and silverware: http://www.coolpage.com/commentary/economic/shelby/Silver%20Up%20To%205x%20More%20Rare%20Than%20Gold.html 2. Less than 22% of the common people turned in their gold in 1934, and it was legal to keep up to 5oz per person (so figure 25oz for a family of 5): http://www.gold-eagle.com/editorials_08/watson052809.html Nadeem, I am shocked to read that you own no physical precious metals. P.S. Preparing for exit strategy from silver as we approach the $45 - $60 range, which remember I predicted back in Oct 2010: http://www.marketoracle.co.uk/Article23786.html Meanwhile we have the precious metals rocket fuel of first sparks of unrest near the massive Saudi Ghanwar oil field. Banking a +400% profit (overall net worth, not just a minor speculative stock play) is sobering. Cheers.

|

Onc' Scrooge

07 Mar 11, 05:25

|

Paper Gold Confiscation !?

Hi Shelby, you are right the gold confiscation of 1933 is more a myth than a reality. In Mr Watson article he refers the White House has stated the 5 April 1933 that ".. over $600.000.000 in the form of gold and gold certificates" had been returned to the FED banks. Do you know what that really means ? In 1933 there were gold certificates (legal banknotes with a promise of redeemption in gold coin with the text "IN GOLD COIN PAYABLE TO THE BEARER ON DEMAND') in circulation for the total amount of: $3.385.640.000 !!! in $10, $20 and $50-Notes for $1.963.640.000 in $100-Notes for $324.000.000 in $500, $1.000, $5.000 and $10.000-notes for : $1.098.000.000 !!!! The notes greater > $100 were automatically out of circulation by the confiscation act because 5 Oz of gold (to keep legally by any person) was about $103,35 ($20 gold coin has .9707 Oz fine gold). But there were for $1.1 bn of these high value notes in circulation !! AND ONLY $0.6 bn WAS RETURNED IN ANY FORM !!! What do you think ? I think that most of the returned $0.6 bn in gold were high value gold certificates and NOT GOLD COINS OR BULLION!! Because nobody would be able to use these notes after 1. of May 1933. These gold certificate notes were legally changed before the 1. of May into National Currency (FED notes). People changed a bank note against another - loosing only the theoretical right of redeemption in gold !! I think for most of them it doesn't matter. Today's situation is much more different - if we talk about gold confiscation we think more or less of bullion. But isn't it today's ETF-Paper-Gold which is in danger of confiscation - it plays the same role in the system like the gold certificates before ? You are also right silver was not confiscated. The act says that holdings in silver coins are legal without limitations and other silver (bars..) held more than 500 Oz per person was to be confiscated - but this was never exercised. Cheers Onc' Scrooge

|

Onc' Scrooge

07 Mar 11, 10:37

|

Gold of Fort Knox

Hi, in addition to my former comment some facts: It' s a myth that the (supposed) content of Fort Knox (some 8100 metric tons of gold - around 260.000.000 Oz) is coming from the confiscation of private gold holdings in 1933. In reality only about 500 metric tons (16.000.000 Oz) where "confiscated" from the public in 1933 (see http://en.wikipedia.org/wiki/Executive_Order_6102). We must see this in relation to the amount of gold in circulation. In the US up to 1930 gold coins for an amount of $4.800.000.000 have been minted (230.000.000 Oz) only 6% of them entered Fort Knox by confiscation! Where did the Fort Knox gold really come from ? 1. 1933 most of the gold certificates (legal bank notes) where exchanged to Fed-Notes - 1934 private possession of gold certificates was forbidden and those in possession of the banks where changed into not redeemable gold certifcate notes (issue of 1934). The gold certificate notes were backed at 100% by the local FED's with gold which was stored in their vaults. This gold went to Fort Knox. We don't know how much gold certificates were in circulation but it must be at least the sum of the so-called "small-size" notes of 1928. The former "large-size" notes (issues 1882-1922) were also in circulation but in part replaced by the 1928 issue. As I told in the former comment the 1928 issue was about $3.385.640.000 alone - this means at least some 168.000.000 Oz of gold had to be stored in the local FEDs. After the Gold Reserve Act of 1934 all gold of the FED's had to be given to the Department of treasury. 2. After the Gold Reserve Act of 1934 all gold mine companies had to sell their mined gold to the gouvernment - that the second big source of the Fort Knox gold. As we see the 1933 confiscation was in reality a "confiscation" of the right of redeemption of bank notes and only in a very little part a "confiscation" of real physical bullion! Just another myth which I hear very often to give an example that gold confication is a normal behaviour of gouvernments in crisis not only in the US of 1933: Many people pretend that in Hitler's Germany Gold was also confiscated - this is not right (at least for German private people). Private possession was not forbitten nor limited (for Germans). The only problem was that all trade had to be made over an agency of the gouvernment which fixed the price and never sold anything to private people (only some grams for marriage rings...). But people were not forced to sell their gold. Access to gold for commercials was forbitten and was only possible with a licence of the agency. For Jews and citizen of "conquered countries" PM possession was later on prohibited which might be the reason for this myth. Cheers Onc' Scrooge

|

Rick

07 Mar 11, 15:13

|

Gold & Silver Confiscation Is At Hand

You know. I wish that you all were right, and I wouldn't be at all surprised either that you pundits (and lest we forget Onc' Scrooge) must likewise believe that you also 'own' your homes too. Well, allow me to enlighten you. You are only "squatting" in your homes, and only until at such time that any developer, municipality, oil or gas exploration company et al suddenly lay claim on your 'property' (Please review the 1995 U.S. Supreme Court decision on 'eminent domain'). And so it follows with gold, silver, and the like. You pundits (and Onc' Scrooge) only paid for the 'privelege' of holding these precious metals, but by no means do you 'own' them. I can certainly guarantee you all of one thing. When push comes to shove, the federal government will not only have all the statutory authority it needs to confiscate anything at whim, but you can be rest assured that they will have all the necessary tools at their disposal to absolutely guarantee full universal compliance. It's just plain foolhardy to play games with these people; you would do better winning the Irish sweepstakes. In sum, it's just best to take whatever crumbs that fall on the floor, and make the best of it.

|

Paul_B

08 Mar 11, 12:57

|

Sour Gold Grapes

Rick, you are increasingly sounding like someone with severe sour grapes who missed the gold bandwaggon and now rants his resentment against the few that didn't.

|

Shelby Moore

08 Mar 11, 13:06

|

is that survival?

Rick, if you were correct that the govt is so powerful, then we might as well be dead, because the govt would control everything we do. Fortunately, holding silver & gold is an allodial title (unlike all other assets, which are really liabilities), as proven by the failure of prior confiscations. The govt absolutely does not have the power to go find every gram of metal in the world. And we don't have to sell our metal if we don't want to. Personally I don't need much cash flow to survive, so I can play a game of attrition against the socialism. Socialism will collapse as it always does eventually.

|

Rod Rojas writes: As the story goes, someone asked an economist how his wife was doing, and the economist answered "compared to what?"

Rod Rojas writes: As the story goes, someone asked an economist how his wife was doing, and the economist answered "compared to what?" In recent times, with gold reaching all-time highs, we have seen people question the valuation of assets in dollars. Basically, the yardstick used to measure your assets — your house, car, or stock portfolio — is a steadily shrinking one. This makes you wonder whether your savings are really growing in value. In other words, if the value of your savings has doubled, but the price of milk and everything else has roughly doubled, you are not getting ahead. If anything, you will likely have to pay taxes on your supposed "gain," which is no gain at all.

In recent times, with gold reaching all-time highs, we have seen people question the valuation of assets in dollars. Basically, the yardstick used to measure your assets — your house, car, or stock portfolio — is a steadily shrinking one. This makes you wonder whether your savings are really growing in value. In other words, if the value of your savings has doubled, but the price of milk and everything else has roughly doubled, you are not getting ahead. If anything, you will likely have to pay taxes on your supposed "gain," which is no gain at all.

![]()