Stock Markets and Crude Oil Prices

Stock-Markets / Stock Markets 2011 Mar 03, 2011 - 02:55 AM GMTBy: Asha_Bangalore

The turmoil in the Middle East and North Africa has led to higher oil prices (see Chart 1, data plotted up to 3/1/2011). Brent crude oil was trading at $116.99 ($113.07 on 3/1/2011) as of this writing and West Texas Crude was quoted at $101.68 ($99.63 on 3/1/2011). The Libyan crisis has raised oil prices significantly in the last three trading days. The crisis in the region commenced the day after a Tunisian man set fire to himself on January 21, 2011.

The turmoil in the Middle East and North Africa has led to higher oil prices (see Chart 1, data plotted up to 3/1/2011). Brent crude oil was trading at $116.99 ($113.07 on 3/1/2011) as of this writing and West Texas Crude was quoted at $101.68 ($99.63 on 3/1/2011). The Libyan crisis has raised oil prices significantly in the last three trading days. The crisis in the region commenced the day after a Tunisian man set fire to himself on January 21, 2011.

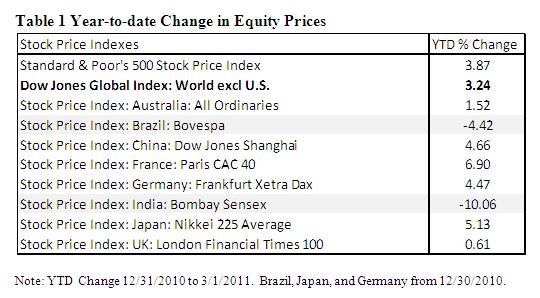

However, equity prices have moved up since January 1 in the entire world, with the Dow Jones World ex-US index up 3.2% year-to-date. Brazil and India have not joined the equity market party, but equity prices in Australia, U.S., China, France, Germany, Japan, and UK have posted year-to-date gains since December 31, 2011 (see Table 1 and Chart 2).

In the case of the U.S, equity and oil prices have a strong positive correlation (see Chart 3). Oil prices, for now, are a high relative price, with contained overall inflation in the U.S. The Fed is watching closely to apply the monetary policy brake, if signs of higher energy prices seeping into prices of others consumer goods and services emerge.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.