Stock and Currency Market Triangle Price Patterns Pending Breakouts

Stock-Markets / Financial Markets 2011 Mar 04, 2011 - 07:29 AM GMTBy: John_Hampson

Stock indices in Asia and major currency pairs are closing in on the conclusions of large triangles that have been in formation since around 2008.

Stock indices in Asia and major currency pairs are closing in on the conclusions of large triangles that have been in formation since around 2008.

Hang Seng:

Shanghai Composite:

Source: Yahoo Finance

Nikkei:

Australian index:

Are these indices lagging the West and about to break out upwards? Or have Western indices begun a topping process which will be accompanied by a breakdown in Eastern indices?

--------------------------------------------------------------------------------

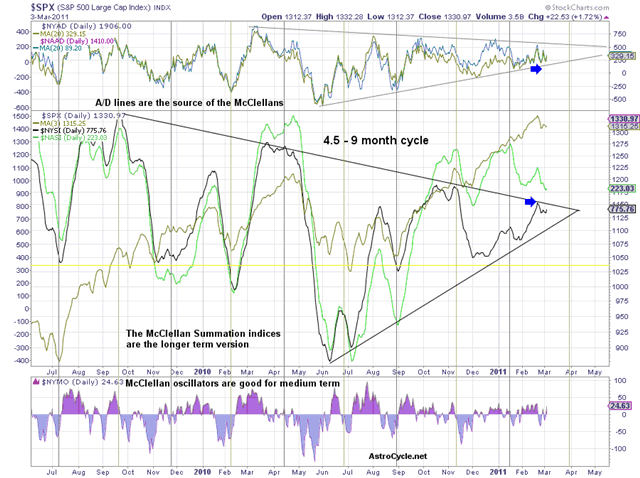

We see a similar formation behind the scenes of the S&P500 action, looking at market breadth:

Source: Astrocycle / Stockcharts

The Mclellan oscillator typically produces a positive or negative divergence ahead of a move in the stock market. It has been teasing us for some time by narrowing in its range, and it has been one indicator diverging from the rally. Keep an eye on it for a lead move, particularly downwards.

--------------------------------------------------------------------------------

Turning to the major currency pairs, and relations between USD, GBP and Euro:

Euro / GBP:

Euro / USD:

GBP / USD:

Breakout against the dollar? Is the big move coming to be a breakdown of the US dollar, associated with a breakout for long term treasury yields and a big move up in gold?

Source: Yahoo Finance

Source: Gold Scents

--------------------------------------------------------------------------------

In all the above scenarios, a safe strategy is to await a breakout, then a successful backtest of the breakout (to ensure it is not a fakeout), before trading in the direction of the breakout.

John HampsonJohn Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation / Site launch 1st Feb 2011

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.