Hyper-inflation Means Gold Is A Win – Win Proposition

Stock-Markets / Financial Markets Nov 05, 2007 - 12:54 PM GMTBy: Captain_Hook

Needles to say, Friday was not a good day for stock market bulls. Media types are attributing the fall in stocks to the market finally waking up to the fact the credit crunch is worse than previously thought , and in a sense they are correct. In being more specific about the context of why stocks are actually falling however, from a technical / market internals perspective, with the supportive influence of stock indices puts to support prices having expired Friday, prices fell to better reflect dire circumstances in the economy is a better explanation of what is actually happening. But you will not hear media talking about the options related scam Wall Street is perpetuating on the investing public. This would be bad for business.

Needles to say, Friday was not a good day for stock market bulls. Media types are attributing the fall in stocks to the market finally waking up to the fact the credit crunch is worse than previously thought , and in a sense they are correct. In being more specific about the context of why stocks are actually falling however, from a technical / market internals perspective, with the supportive influence of stock indices puts to support prices having expired Friday, prices fell to better reflect dire circumstances in the economy is a better explanation of what is actually happening. But you will not hear media talking about the options related scam Wall Street is perpetuating on the investing public. This would be bad for business.

Below is an excerpt from a commentary that originally appeared at Treasure Chests for the benefit of subscribers

As discussed both Sunday and last week however, while the above is true, index put / call ratios are still too high in the November series to expect stocks to be ‘out for the count' just yet, meaning another short squeeze of some strength should be expected as the next options expiry approaches in November. Moving past this point things don't look so rosy for stocks from an internals / sentiment perspective, but for November, we are anticipating a rally into the third Friday in November (16th), especially considering administered rates will be coming down further in the States at month's end with stocks in the tank. (Also short sellers are still alive as well.) And of course monetary debasement rates will also accelerate in support of our bubble economies, which should work to support prices, so short sellers are advised to be careful as trade into November matures. Below we discuss a likely bounce point for the S&P 500 (SPX) in this regard, along with why accelerating global inflation rates (the rates at which fiat currency is introduced into the financial system) will be good for gold in all currencies.

More than this, it should be recognized gold is a discounting mechanism for predicting accelerating monetary debasement policy, and that the fact its been rising strongly means we should have been expecting more trouble that needed fixing. In terms of what is happening right now, the proverbial ‘second shoe' has dropped in the credit markets, which gold has been forecasting then, and is the ‘raison d'tere' media types are attributing the stock market's decline. Of course we know stocks are declining because of changing market internals / sentiment related reasons, as per above, where it appears the bears may finally be approaching exhaustion in terms of their willingness to place bearish bets against the market. And whether it be due to a natural exhaustion, or the fact semi-informed speculators think the man behind the curtain (Wizard Of Oz) will magically support stocks into the Presidential Election next year doesn't really matter. The only thing that matters is US index related put / call ratios are set to fall post options expiry next month, which will put more pressure on authorities to print even more money as process takes hold. In terms of attempting to paint you a picture in this regard, why don't we take a tour through a few pictures that bring to life story line.

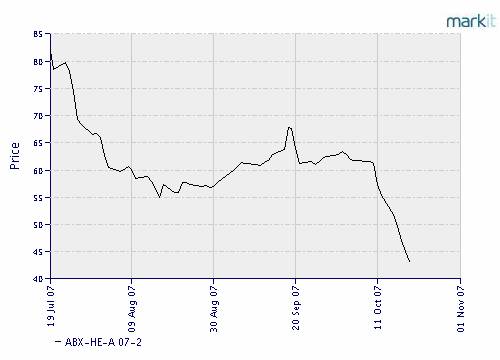

The first of these pictures is the ABX Indices series of credit prices, which are reflective of broad liquidity conditions. Here, when prices are high general liquidity conditions are fluid, meaning central authorities need do nothing past normal (less intense) currency debasement policy to keep economic wheels greased. Why we are showing you the entire series below and not just pricing of lower grade credit is because it appears even higher income earners are now becoming increasingly strained by their debt loads as well, where AAA rated securities are threatening to break down below lows witnessed in summer. (See Figure 1)

Figure 1

Source: Markit Group

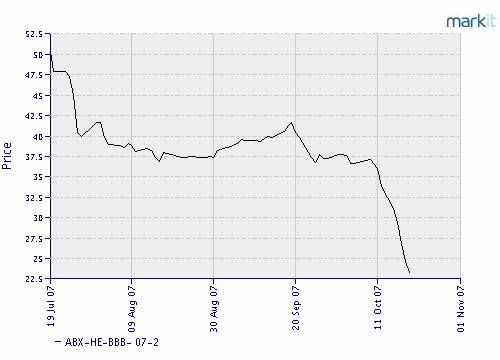

Of course this has already occurred to all other subordinated varieties of credit out there these days, where delinquencies are going through the roof as middle class America quickly disappears. We know this because even AA rated securities have already taken out summer lows. (See Figure 2)

Figure 2

Source: Markit Group

In moving further down the food chain, given the degree of deterioration in pricing that is occurring at the lower end of the scale, it appears gold's prospects in discounting Armageddon are quite bright as this stuff is falling off a cliff. Remember now, this is still A rated debt, better than the likes of Ford or GM credit. Old Henry would be rolling over in his grave if he knew what was happening to his company. (See Figure 3)

Figure 3

Source: Markit Group

That's because Ford credit is now rated junk, in the ranks of subprime debt. In terms of pricing, if the above were to progressively mirror the pattern here, one would need to seriously consider the possibility deflation could grip macro-conditions soon, becoming a certainty once official hyperinflationary counter-measures are exhausted. (See Figure 4)

Figure 4

Source: Markit Group

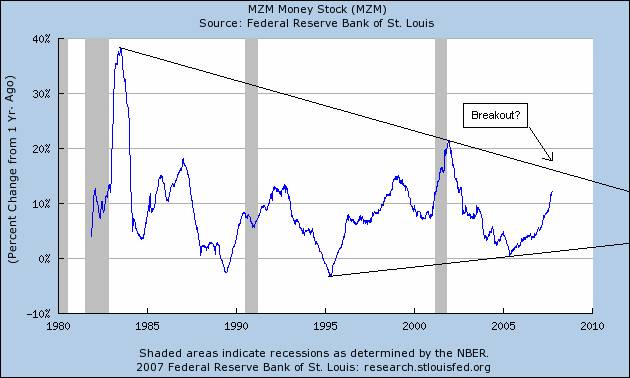

And make no mistake about it, just because a bunch of bells and whistles aren't going off announcing hyperinflation is dead ahead doesn't mean it isn't happening. A little bit here and a lot there , and pretty soon all this largesse begins to add up to something. In this regard, just a quick glance at a chart of Money At Zero Maturity (MZM) should have one thinking money supply growth rates are about to go off the scale, and you would be right for thinking this because it's true. (See Figure 5)

Figure 5

Source: Federal Reserve Bank Of St. Louis

It's much easier to see what's really happening, or the point we are at, by looking at a plot of annualized change in this regard, attached below for your convenience. (See Figure 6)

Figure 6

Source: Federal Reserve Bank Of St. Louis

It's either that, with ‘that' being hyperinflation, or our precious equity bubbles will burst. This potential reality becomes apparent in viewing the next series of pictures, which are updates of our analog based comparisons of the 30's Dow echo-bubble to current patterning in the modern Dow and SPX. And for the finale today, there is even a comparative overlay of the SPX against the post bubble Nikki throughout the 90's that possess a potentially ominous message. But to start, here is an exact pattern match of the NASDAQ against the 30's Dow that is suggestive one should be very careful with respect to long equity positions at the moment. (See Figure 7)

Figure 7

Source: The Chart Store

In cutting the scale in half, which will bring us closer to the action, along with switching our comparison to the SPX in an attempt to match pattern recognition as closely as possible, below we have yet another scarily compelling comparison suggestive it's hyperinflation or die baby. (See Figure 8)

Figure 8

Source: The Chart Store

Based on these comparisons what's more scary in my eyes is even if equity indices only correct here, which appears likely (more on this below), the subsequent rally should be quite meager (under 10% from correction lows), but possibly lasting until March options expiry next year, just like in the 2000 sequence. The stars certainly appear aligned in this regard at present, with tech leading and monetary debasement rates set to take off, which again, is a repeat of what we saw in 2000. (See Figure 9)

Figure 9

Source: The Chart Store

Of course the real bonus for the still meager ranks of the observant in all of this is the fact our precious metals investments should outperform, as indicated here in viewing not only the infamous Dow / Gold Ratio , but also the Dow / XAU Ratio (representing precious metals shares), which is also set to break down. Of course if the Dow were to break down itself here, these ratios would represent significantly muted bullish outcomes for the metals than would be anticipated otherwise. Such an outcome would not be consistent with what one should expect if monetary debasement rates take off from here however, so we will reserve such thoughts in the less likely category, along with the other more sobering observations taken from the Chart Room below.

In this regard it should be noted the Dow has reached an important (Super-Cycle) linear time line turn date as shown here on the weekly plot . This in itself does not mean much today considering the brokers / bankers / government have successfully rigged the market for so long cyclical considerations have been distorted for some time. However, on a Super-Cycle basis, it's now possible such forces can become realigned, where in this case the bearish speculator becomes exhausted in spite of dire circumstances, and prices fall with the bad news. Here, as mentioned last week, a possible seasonal inversion could be developing because speculators elect not to short an expected Santa Claus rally. I bring this up again because options distributions are still poised to produce such a result, falling off considerably across the board (OEX, SPX, SPT, DIA, DJX, NDX, NMX, QQQQ) in December. What's more in terms of the above, one should notice the Money Force Index (MFI) is set to break down structurally on the weekly, meaning the increasing money flow necessary to keep prices rising is absent (think lack of foreign buying combined with inertia), which of course can only lead to one result, that being lower prices.

What's more with respect to the SPX, one should make note that a monthly close below 1480ish (the daily 200-day moving average) will trigger an MFI sell signal on the monthly plot, which could be equated to the ‘kiss of death' as this pertains to hopes for higher prices later on. Therein, this does not necessarily mean counter trend rallies will not occur, but a monthly sell signal of this magnitude after the longest uninterrupted rally in history is serious stuff. Combine this with the potential bubble bursting party in Asia , along with the parallels from the 30's (See above), and these signals must be taken seriously. How seriously? In relation to the post echo-bubble top in the 30's, it should be remembered the Dow sold off 50-percent over the next six-months – that's how serious. Here is a comparative picture of the SPX set against the post bubble Nikki that does a good job of showing that a significant divergence in human behavior exists between the two cultures, but that if the American people were to find some humility (voluntarily or not), the divergence shown below could be abruptly closed. (See Figure 10)

Figure 10

Source: The Chart Store

To finish on the stock market for today, along with providing you with the bounce target we promised to touch on above, we will employ yet another ratio for this task, which interestingly brings us into the same price range Dave arrived at in his analysis presented yesterday , that being the 1450 area. In this regard then, you should know the CBOE Volatility Index (VIX) simply has too many bullish bets (just type in the symbol VIX and click Submit) on it to remain at lofty levels in November, so any spike higher in coming days should be retraced back below 20 as options expiry approaches on the third Friday of the month. This means that any spike higher than 30 corresponding to a move in the SPX below 1450 should be faded with extreme prejudice, with a spike low of 1420 set against a reading of 35 on the VIX a worst case outcome in reaching the 140 target denoted on the monthly SPX / VIX Ratio plot found in the Chart Room. Of course this target could also be met in December, so if you have short positions on here and the prices continue to squeeze higher don't fret, as relief should arrive sooner or later as another stab at support denoted in the picture below is experienced. (See Figure 11)

Figure 11

On to a few comments and pictures focusing on precious metals now in order to wrap things up in total for this review. As mentioned above, if monetary debasement rates accelerate here any weakness in equities experienced in coming days should dissipate quite quickly, leading to potentially significantly higher prices for precious metals if a hyperinflationary scenario develops, as suggested by a potential breakout in Figure 6 above. Here, as you can see in this chart, if we are to relive the experience seen in the early 80's (the last top), MZM annualized growth rates should top 40-percent in the end, which would be something considering the numbers we are talking about today, not too mention the lobotomy some bond traders will need afterwards. And of course it's in this respect gold is a winning proposition these days, because we know from previous study in just catching up to prior inflation it should be trading in excess of $2000, not to mention the targets that are possible in consideration of future inflation. (See Figure 12)

Figure 12

Unfortunately we cannot carry on past this point, as the remainder of this analysis is reserved for our subscribers. However, if the above is an indication of the type of analysis you are looking for, we invite you to visit our newly improved web site and discover more about how our service can help you in not only this regard, but on higher level aid you in achieving your financial goals. For your information, our newly reconstructed site includes such improvements as automated subscriptions, improvements to trend identifying / professionally annotated charts , to the more detailed quote pages exclusively designed for independent investors who like to stay on top of things. Here, in addition to improving our advisory service, our aim is to also provide a resource center, one where you have access to well presented ‘key' information concerning the markets we cover.

On top of this, and in relation to identifying value based opportunities in the energy, base metals, and precious metals sectors, all of which should benefit handsomely as increasing numbers of investors recognize their present investments are not keeping pace with actual inflation, we are currently covering 71 stocks (and growing) within our portfolios . And more recently we have been focusing on the Red Lake gold camp, hosting some very interesting emerging opportunities. In this regard I have just returned from a due diligence trip and will be providing a report to subscribers later this week. This is another good reason to drop by and check us out.

And if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line . We very much enjoy hearing from you on these matters.

Good investing all.

Captain Hook

http://www.treasurechestsinfo.com/

Treasure Chests is a market timing service specializing in value-based position trading in the precious metals and equity markets with an orientation geared to identifying intermediate-term swing trading opportunities. Specific opportunities are identified utilizing a combination of fundamental, technical, and inter-market analysis. This style of investing has proven very successful for wealthy and sophisticated investors, as it reduces risk and enhances returns when the methodology is applied effectively. Those interested in discovering more about how the strategies described above can enhance your wealth should visit our web site at Treasure Chests

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, as we are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence.

Copyright © 2007 treasurechests.info Inc. All rights reserved.

Unless otherwise indicated, all materials on these pages are copyrighted by treasurechests.info Inc. No part of these pages, either text or image may be used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

Captain Hook Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.