Inimical Inflation, Why we are Bearish

Stock-Markets / Financial Markets 2011 Mar 05, 2011 - 03:07 PM GMTBy: PhilStockWorld

Why are we bearish?

Why are we bearish?

We like to go bearish when the market is testing the top of its channel as there is generally a higher percentage probability that we drop than we pop back over. Secondly, as I mentioned yesterday, it's not just the Federal Reserve that is in denial but the commodity speculators, the equity investors and even the bond investors as the ALL believe they are going to get paid while MATH says that's not even remotely possible.

What is math? I know - thanks to cutbacks in our education budgets over the past 30 years, that is a question that vexes many Americans and it also creates a perfect environment for the people who CAN do math, those in the Financial sector perhaps, to design endless levels of complex instruments that are all designed to con people who have lower math skills than they do.

Complexity is good. Just like the legal scam, complexity forces you to seek assistance with your finances - the more money you have, the more complex your finances become and the more you need help and this allows swarms of leeches or, to be kind, remoras to attach themselves to you and feed endlessly off your earnings and savings (they don't care which as they will happily destroy the host and simply move on to the next big fish).

Personally, I prefer simplicity. My Grandpa Max was a Depression kid who built a business from scratch and invested his money well and had a nice life for himself. He taught me how to invest when I was a little kid and, as you can imagine, he did not ask a "financial adviser" what to do with his money as he had seen where that had gotten his parents generation when he was young (he was 24 when the Global markets collapsed).

Our investing days would begin by reading the papers (not just one - they all say different things, don't they) together and pointing out things that looked interesting. Not just the Business Section but whatever seemed like an important World event or a trend worth watching that would help us get ahead of the curve with our stock selections. I will share with you what I consider the most important and simplest thing going on in the world today - something I have been pointing out for quite some time and the number one reason we remain very cautious on the markets - Inflation:

This is not complicated. This isn't the hypothetical elephant in the room and it's not the 800-pound gorilla we avoid talking about. This is a FACT! These are 12-month price hikes and this is also a 12-month decline in the dollar of 6.5-17.13% against other currencies and that is NOTHING compared to how far our buying power has fallen when measured in things we consume every day like cows (20.36%), oil (21.24%), hogs (22.8%), cocoa (27.8%), gasoline (33.52%), milk (35.69%), wheat (36.96%), sugar (38.98%), oats (41.6%), corn (71.44%), coffee (95.97%) and cotton (168.01%). THAT IS INFLATION FOLKS - no matter what lies your Government chooses to tell you.

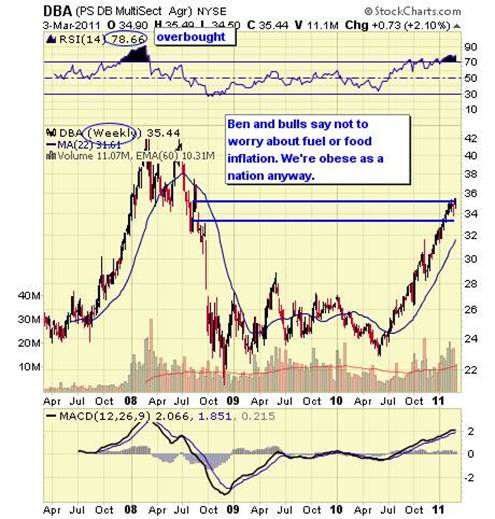

As David Fry points out in his chart - That's OK because we are a nation of fat, spoiled bastards anyway and we can all afford to cut back a little. That's why a lot of inflation has been passed through to you in the form of smaller package portions at the store and smaller portions of lower-quality food at restaurants and maybe at your kitchen table. When you see 12-month price trends like this - it is kind of hard to imagine it's all a temporary spike and will all be "back to normal" by summer, right?

So let's accept, for a moment, that Ben Bernanke is wrong and inflation is a real thing. Just yesterday, ECB President, Jean Claude Trichet said the Bank "will exercise "strong vigilance" over rising inflation, signaling that a rate rise was only a month away." This sent our Dollar even lower and gave our markets, which are priced in dollars, a huge boost as it takes even more of our worthless currency to buy the same stocks we bought yesterday.

In fact, if we were to put the S&P 500 on that inflation chart above, we'd see that it has inflated 15.65% since last March, performing just about as well as platinum but quite a bit behind gold and barely half as well as copper. Does this mean we should abandon equities and all invest in commodities? Sounds good (and this is how we force a massive transfer of wealth from the non-investor to investor classes) but - No....

Here's where the ghost of Grandpa Max comes back to haunt us. Max Davis owned a dress shop in London with a high-end clientele. When I would visit him in the summers he would take me on buying trips around Europe where he would negotiate with designers and sellers of cloth and buttons and bows and he would, God bless him, explain to me exactly what he was trying to accomplish and would take me through the whole supply chain, right up to the point where my Grandma Lucy would take the people's money for the finished dress back in England and my Grandpa and I would head to the bank (banks, actually, as only a fool keeps all his money in one!) to make the deposits.

Exchange rates were very important in the business, of course, and our trips would often be planned around currency fluctuations. When the Pound was strong against the Lira - we were off to Italy and there would be Italian dresses featured in the Fall and when the Pound was up against the Franc in July, French fashions would be all the rage in September. That is how the World works and even the high-end clientele that would pull up in limos to visit Lucia's on the High Street in London would haggle over prices and it was always hoped the Pound would be weak when we sold and strong when we bought.

Today, the Dollar has been weak for almost a year. The buying power of the Dollars you own, the ones you have saved you whole life, has dropped from 88 to 77 (12.5%) since last June and yesterday was one of the worst day's in months so it's hard to say things are improving. If Americans had roughly $100Tn worth of assets at the beginning of last summer - they have $87.5Bn today - UNLESS they invested in the things that went up like oil, gold or the S&P, which also beat the devaluation of the dollar by an entire 3.15%.

That all sounds like a great idea, right? Of course we invest in the things that are going up. No says Grandpa Max - who was born in 1903 and has seen his share of speculative bubbles. While speculators can drive prices up to extreme levels for what may seem to be extended periods of time - in the end, these commodities have to be made into goods that have to be sold.

What happened in the housing crisis? Land went up, lumber went up, builder margins went up, prices went up and, when people could not afford the homes anymore, rather than let that put a natural break on the price of homes - the mortgages were repackaged and the rates were lowered and the lending requirements were waived along with the pom-poms of the "analysts" on the Financial News Networks as they encouraged everybody with a job and a pulse to buy a home. Why? Because it was the final sale of all those jacked up commodity prices and because the Banksters collected some very fat fees as did the complicity local Realtors and mortgage brokers, who enabled the lunacy by shoving suckers consumers into homes they clearly couldn't afford based on ridiculous extrapolations that the gains in the value of the home would outweigh potential rises in taxes and utilities and, of course, everyone expected to get raises over time as well.

That didn't happen did it? But think how many years it took us to realize that and think of how quickly it all fell apart once we did. Now we are in a very similar situation. Cotton is perhaps 20% of the cost of your clothing, so we won't worry about that one as up 168% means a $10 T-shirt now costs $13.60 - so "just" 36% clothing inflation assuming all the other costs stay the same. The $2 cup of coffee you get in the diner actually uses about .20 worth of coffee so now it's .40 and your cup "only" goes up 20% on the 95% increase in the commodity. This is how these insane prices are able to be passed through but - small increments though they may be - they do add up over the course of a consumer's average day - especially on those days when a 15-gallon tank of gas costs an extra $15 to fill.

As noted in Wednesday's Beige Book (my commentary for Members available on Seeking Alpha), to a large extent "non-wage input costs" (Fed-speak for the inflation noted above) have not yet been passed on to the consumers. From that we can assume that the Q1 margins are taking a beating but the Fed is enthusiastic that manufacturers and retailers will be able to shove high prices down the throats of US consumers in Q2 and that "optimism" gave the commodity bulls a green light to jack things up to new highs - boosting the market like a rocket since the 2pm release:

I added the titles of my morning posts to give you an idea of our daily positioning on this very stormy week. On the whole, "everything is proceeding as I have freseen" - which is always fun - but that doesn't mean I have to be happy about it because it is an unfolding disaster!

EVERYTHING can't go up unless wages go up. Hiring people (and we added a healthy 191,000 jobs this month - only 8.5M to go to get back to the 2007 highs) does not solve the problem because each person's wages still have to be divided up among the various things they need to survive. If anything, it exacerbates the problem for the already strapped consumers as one may choose not to buy a $13.60 T-Shirt in order to pay $60 for a tank of gas but another (city dweller) may not need the gas and will pay the $13.60 for the T-shirt. That means each consumer is inadvertently keeping the price pressure high on the other through the aggregate (demand) choices they make.

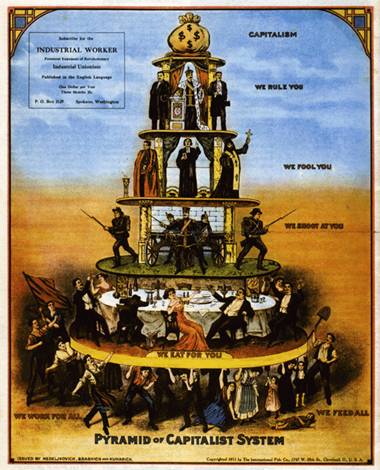

What this does, ultimately, is lead to a lower standard of living for the workers - even as there are more of them in total - as each additional worker hired is unable to put his money to work on the local level and continues to funnel money up to the speculator class, who make up in volume what they can't accomplish anymore in price action. This is what happened at the peak of the housing bubble as homes were selling as fast as they could be built (even faster with pre-sales) and that caused a massive mis-allocation of resources. as predicted by Hayek, who tells us that the easy-money Fed policies lead us to mistake inflation for demand. By pushing that money UP from the workers to the top, all we are doing is funneling more money from the lower to the upper classes which, ultimately, leads to a much greater crash in the next wave.

Of course it was Keynes himself who pointed out that "the markets can remain irrational A LOT longer than you and I can remain solvent" and he should know, having gone bust himself as a speculator. I don't mind inflation - inflation was MY IDEA, way back in December of 2006, I wrote "Burning Dollars to Fight Gravity" suggesting the only way out of our debt crisis was going to be massive inflation and I felt that Hank Paulson's appointment to Treasury Secretary was a clear signal that the Bush Administration planned on putting my plan into action. In early 2008, I once again extolled the benefits of inflation with my "Inflation Nation" article.

Unfortunately, the path we have taken to inflation is not the "good kind," where Keynesian stimulus pushes wages higher, creating jobs and boosting prices from the bottom up, leading to better Corporate profits while devaluing the debt. As I had noted in my "2010 Outlook - A Tale of Two Economies," the Government was creating the BAD kind of inflation - top down inflation in which stimulus is handed to the speculator class as that $100Tn of National Wealth was being squeezed away from the bottom 90% (who owned just 65% of it), who could not participate in the equity and commodity rally and thus lost that 15% of their 65% asset share to inflation (9.75%) while the top 10% kept pace or got ahead and raised their portion of the Nation's wealth from 35% to 44.75% - a transfer of another $10Tn from the bottom 90% to the top 10% since the crash.

All sounds great so far, if you are in the top 10% (really the top 1% because those guys in the 10-1% range are just the suckers we rope into the markets because they THINK they are one of us, right?). We degraded the quality of life of 270M people by 15% ($65Tn to $55Tn) and boosted our own assets by 28% ($35Tn to $65Tn) - what can be better than that. As we point out to the plebes, over and over again until their brains are thoroughly washed - even down 15%, the workers of our country still enjoy a better standard of living than the workers we outsource our labor to.

In fact, if they would just get the Government off our backs and stop the unions from demanding fair treatment for American workers and stop confiscating our record profits through record low taxation - I'm sure we would throw them a bone and open up an unsafe sweatshop with poor working conditions, low wages and no benefits at wages that a Bangladeshi goat herder would consider very good!

Really, when they put in 40 years for us, toiling away in our factories since we got rid of Kennedy - they didn't really believe we would honor our commitment to fund their retirement did they? Why should 2010 me pay for what 1970 me promised? That is just downright unAmerican! No, it is every man for himself because that is the American way and, if they don't believe it, then they are not watching enough of the television networks we own...

Unfortunately, there is one small problem with this whole scam we are running on the bottom 90%. Most of our profits, so far, are on paper. The stock market is up 100% but have you seen what happens on days when anyone tries to sell volume? Scary stuff. Not as scary as oil in the Middle of February, which fell from $93 to $86 (7.5%) in 10 sessions - wiping out $7Bn on the NYMEX in just two weeks!

We have loads of money and we can keep trading gold, silver, copper, cotton, coffee, NetFlix, Chipolte, etc. back and forth with each other at any price we choose but can we really sell 25% of Netflix for $2.7Bn or is the price pretty much a joke with a p/e ratio of 68 to 1? How about gold? What if someone actually tries to find buyers for even 10% of the World's $6Tn in holdings (4Bn ounces). Gold has jumped $3Tn since it bottomed out at $681 an ounce in October of 2009 and even that was up $2Tn from where it was just a few years earlier.

Actual consumers only bought about $100Bn of gold in the past two years and the rest was just speculators hoarding it and us top 1%'ers passing bits of paper back and forth with each other, just crossing out the last price and putting on a higher price each time. This game of "hot potato" is how us commodity speculators get rich but let's just make sure we have chairs when the music stops (and it always does).

How long can the markets remain irrational in this cycle? We're already seeing some major bears go "insolvent" (poor Whitney Tilson and his NFLX shorts for one) and what we're not seeing in this "exciting" jobs report is rising wages and that means you damn well better have your hands on a chair - even as we dance around to the music!

Have a great weekend,

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.