Silver and Gold Remain Near Record Highs as Greek and Portuguese Debt Hammered

Commodities / Gold and Silver 2011 Mar 08, 2011 - 12:37 PM GMTBy: GoldCore

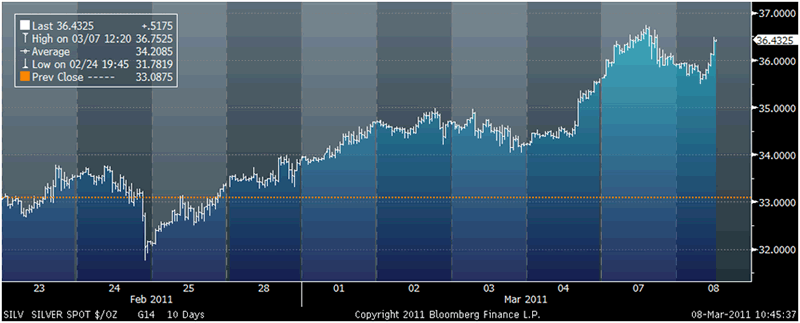

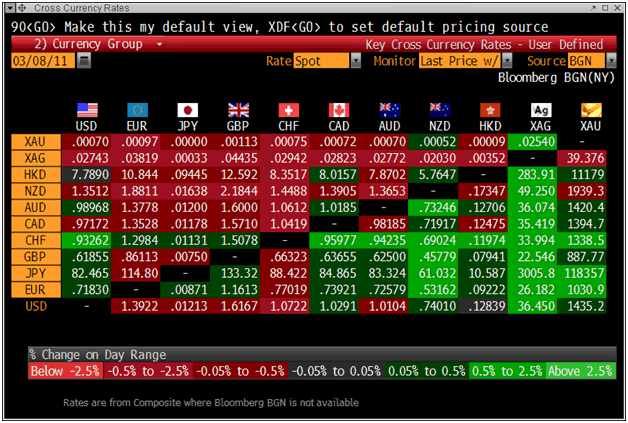

Silver is higher against all currencies today and remains near yesterday’s 31 year high of $36.75/oz. Gold is slightly higher against most currencies, especially the Swiss franc and euro.

Silver is higher against all currencies today and remains near yesterday’s 31 year high of $36.75/oz. Gold is slightly higher against most currencies, especially the Swiss franc and euro.

While most of the focus continues to be on North Africa and the Middle East, the not inconsequential matters of the European sovereign debt crisis and the US’ dire fiscal situation continue to bubble away beneath the radar.

Greek and Portuguese bonds have taken another hammering this morning. The Greek 10-Year yield has surged to 12.44%, up another 35 basis points today alone, and Portuguese 10-Year has surged to 7.58%, another 22 basis points. The recent “bailouts” and failure to properly restructure the debt shows that the sovereign debt crisis is far from contained.

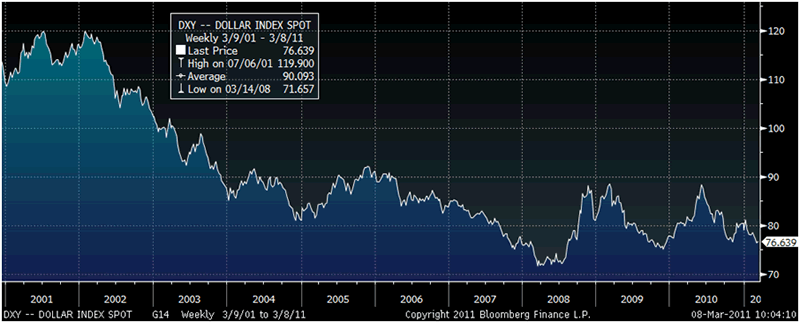

The US recorded its biggest monthly deficit in history yesterday with a $223 billion deficit for February alone, the 29th straight month of deficits – a modern record. This does not bode well for the beleaguered dollar and could result in further sharp falls in the value of the dollar.

The dollar is increasingly out of favour with traders and central banks internationally and the real risk of a US debt crisis could see the dollar’s reserve currency status challenged sooner than even the more bearish dollar bears expect.

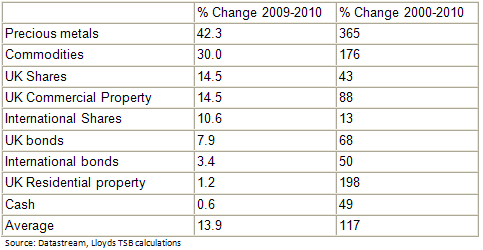

Lloyds TSB's Assetwatch survey finds gold and silver beat all other assets in 2010 due to investors looking to “protect the value of their investments amid the renewed uncertainty over the global economic outlook including the debt concerns in the eurozone and rising inflation.”

Gold

Gold is trading at $1,434.21/oz, €1,029.73/oz and £886.46/oz.

Silver

Silver is trading at $36.36/oz, €26.10/oz and £22.47/oz.

Platinum Group Metals

Platinum is trading at $1,800.95/oz, palladium at $780.00/oz and rhodium at $2,350/oz.

News

(Financial Times) -- Silver prices rise by 80% (Lloyds TSB Precious Metals ‘Top Investment’)

Precious metals were the top performing investment for the second consecutive year, after their value jumped by 42 per cent as people sought a safe haven from inflation, according to new research published by Lloyds TSB on Monday.

It is the fourth time in the past five years that precious metals have topped the tables for the best asset class, as continuing uncertainty over the prospects for the global economy pushed people into buying gold, silver and platinum.

The value of precious metals has risen by 365 per cent over the past decade, nearly double the increase for the next best performing asset during the same period - residential property, which made a gain of 198 per cent.

Silver outperformed the other precious metals in 2010 with prices rising by 80 per cent, more than two and a half times the increase in gold prices and four times the 20 per cent rise in the value of platinum.

As well as being seen as a safe haven investment, pressures on the supply side and high demand for industrial uses contributed to the strong rise in the price of silver, said Lloyds TSB.

Commodities were the second best performing asset class during 2010 returning 30 per cent, while they were the third best during the past decade, with a 176 per cent increase in value.

This outperformance has continued into 2011, driven by a 38 per cent jump in the price of cotton since the start of the year, driven by a combination of increasing demand from Asia and greater supply side pressures as flooding affected some of the major cotton producing countries.

All nine asset classes produced a positive return during the past year, although people who held their money in cash would have seen it rise by just 0.6 per cent, while residential property did little better with a gain of 1.2 per cent.

UK shares and commercial property both returned 14.5 per cent, while the value of international shares increased by 10.6 per cent.

Suren Thiru, economist at Lloyds TSB, said: “Going forward, the level of demand from emerging economies, particularly from China and India, is likely to remain an important determinant of many assets prices as well as the pace at which the global economic recovery continues.”

Asset Class Returns, Dec 2009-Dec 2010

(Press Association) -- Precious metals 'top investment'

Precious metals were the top performing investment for the second consecutive year during 2010 with their value soaring by 42% as people sought a safe haven from inflation, research indicates.

It is the fourth time in the past five years that precious metals have topped the tables for the best asset class, as continuing uncertainty over the prospects for the global economy caused investors to flock to gold, silver and platinum, according to Lloyds TSB.

The value of precious metals has surged by 365% during the past 10 years, nearly double the increase for the next best performing asset during the same period - residential property, which made a gain of 198%.

The steep increase in precious metal prices seen during 2010 was driven by silver, with its value jumping by 80%, significantly outstripping the 29% rise in the price of gold and the 20% increase for platinum.

The group said the price of silver had been boosted by pressure on the supply of the metal, as demand remained high from both investors and industries which use it.

Commodities were the second best performing asset class during 2010, offering returns of 30%, while they were the third best during the past decade, with a 176% increase in value.

They were also the best performing asset during the first two months of 2011, driven by a 38% jump in the price of cotton since the start of the year, due to a combination of rising demand from Asia and falling supply as some of the major cotton producing countries were hit by flooding.

All nine asset classes produced a positive return during the past year, although people who held their money in cash would have seen it rise by just 0.6%, while residential property did little better with a gain of 1.2%.

UK shares and commercial property both returned 14.5%, while the value of international shares increased by 10.6%.

Suren Thiru, economist at Lloyds TSB, said: "Going forward, the level of demand from emerging economies, particularly from China and India, is likely to remain an important determinant of many assets prices as well as the pace at which the global economic recovery continues."

(Telegraph) -- 'There Is a Danger That People Are Buying Gold Now When Prices Are Overheated'

Following a spectacular 10-year bull run, some say buying gold has become too risky for private investors.

Patrick Connolly, of the financial adviser AWD Chase de Vere, said: "There continue to be bullish statements and bold predictions about gold and the assumption that the returns seen over the past decade are now the norm. There were similar sentiments in 1999 about technology stocks, and the belief that the only way was up."

As he pointed out, there is a real danger that this could be a "gold bubble", and when prices do fall – which they will at some point – the correction could be far sharper and last longer than many people expect. He added: "It's easy to forget that gold prices can go through prolonged downturns. During the Eighties and Nineties, the price of gold fell by 70pc."

Although gold is a good inflation hedge over the long term, this isn't always the case over shorter, more realistic time frames over which the typical investor is more likely to hold the asset. If you bought gold in the Eighties, for example, it hasn't proved to be the most effective hedge against inflation since then. If it had kept pace with prices, it would now be worth about $2,600 an ounce.

Martin Bamford, a chartered financial planner with Informed Choice, said: "Investors are understandably concerned about inflation at present. But there is a real risk that those now buying gold are doing so at the top of the market and will end up making losses when prices fall."

He added that investors should remember that gold does not produce any income, in terms of either interest or dividends, so returns are based solely on capital growth. He said: "It can also be difficult to access as an asset class: many people end up buying funds that are largely invested in mining stocks, which don't always reflect gold prices accurately."

Other options include buying gold bullion or coins, or investing in an exchange-traded fund (ETF), which basically follows the price of gold.

Mr Bamford said: "I'd be wary about getting into gold at present. The price may still rise further, but the gains are unlikely to be so significant. When prices fall, it is those who got in near the end who will suffer the biggest losses."

He added that there were also investment costs to consider, such as the cost of storing, trading and insuring bullion, or dealing charges on ETFs. "A diversified investment portfolio, containing shares, property and bonds, may be a better way to protect against inflation," Mr Bamford said.

"And about a third of the stocks in the FTSE 100 are commodity-related stocks, whose performance will be correlated to gold prices. There is a danger that people are buying now when prices are overheated and becoming overexposed to one asset class."

Discover the top-selling ISAs and get 0% commission when you order online with Telegraph ISA-fund Supermarket.

(Coin News) -- US Mint Reviews Product Pricing for Silver Coins and Sets

The United States Mint is reviewing the pricing of its products due to soaring silver prices, according to a US Mint official. Sales of at least one of its sets have been suspended until the review process is complete.

The Mint currently has a pricing policy in place for its numismatic gold coins. Based on it and the prevailing cost of gold, the US Mint may adjust collector gold coin prices weekly. It does not have a similar pricing system in place for its numismatic silver products.

"Recently, the market price of silver has risen substantially. As a result, the United States Mint is reviewing the prices of current products containing silver to make sure the market value of the silver contained in them is not now higher than the cost of the products themselves," US Mint spokesman Michael White said on Monday.

A recent CoinNews.net article noted how 31-year high silver prices have resulted in exploding silver coin values. On Friday, coins like the 1964 quarter had a melt value of $6.39. The 2010 America the Beautiful Quarters Silver Proof Set was valued at $31.95, which was only $1 less than its US Mint pricing.

On Monday the precious metal surged as high as $36.75 an ounce, bringing the 1964 quarter’s melt value to an astounding $6.98. The set’s melt value went up to $33.23, which is above the original US Mint pricing for the product. It is this set which the US Mint has suspended, presumably to raise its price at some point. Customers who visit its product page at http://www.usmint.gov/catalog will now see a Mint message saying "the product is temporarily unavailable."

As of this writing, all 2011-dated products are still available. These products were already priced substantially higher than 2010-dated issues in response to silver which soared nearly 84 percent last year. Obviously, their prices could go higher if the metal continues its streak of gains.

(Zero Hedge) -- No Silver? No Problem: US Mint Would Like To Know If You Will Accept Brass, Steel, Iron Or Tungsten Coins Instead

United States Mint Seeks Public Comment on Factors to be Considered in Research and Evaluation of Potential New Metallic Coinage Materials

WASHINGTON - The United States Mint today announced that it is requesting public comment from all interested persons on factors to be considered in conducting research for alternative metallic coinage materials for the production of all circulating coins.

These factors include, but are not limited to, the effect of new metallic coinage materials on the current suppliers of coinage materials; the acceptability of new metallic coinage materials, including physical, chemical, metallurgical and technical characteristics; metallic material, fabrication, minting, and distribution costs; metallic material availability and sources of raw metals; coinability; durability; sorting, handling, packaging and vending machines; appearance; risks to the environment and public safety; resistance to counterfeiting; commercial and public acceptance; and any other factors considered to be appropriate and in the public interest.

The United States Mint is not soliciting suggestions or recommendations on specific metallic coinage materials, and any such suggestions or recommendations will not be considered at this time. The United States Mint seeks public comment only on the factors to be considered in the research and evaluation of potential new metallic coinage materials.

The recently enacted Coin Modernization, Oversight, and Continuity Act of 2010 (Public Law 111-302) gives the United States Mint research and development authority to conduct studies for alternative metallic coinage materials. Additionally, the new law requires the United States Mint to consider certain factors in the conduct of research, development, and solicitation of input or work in conjunction with Federal and nonfederal entities, including factors that the public believes the United States Mint should consider to be appropriate and in the public interest.

(Bloomberg) -- Gartman Jumps Back Into Gold; Selling Was ’A Mistake’

Newsletter writer, fund manager Dennis Gartman reinstating gold positions he sold last week;

“Our little experiment on the sidelines did not work.”

Long again of gold in euro, yen and dollar terms.

Weaker dollar more supportive of commodity prices generally.

"We congratulate those who have the wisdom or the temerity to have remained bullish of gold’’, sold when gold was ~$1,432, it’s at $1,442 today.

Says sold gold following his trading rules; would do so again.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.