FCX Recovers Off Spike Low

Commodities / Company Chart Analysis Mar 08, 2011 - 03:38 PM GMTBy: Mike_Paulenoff

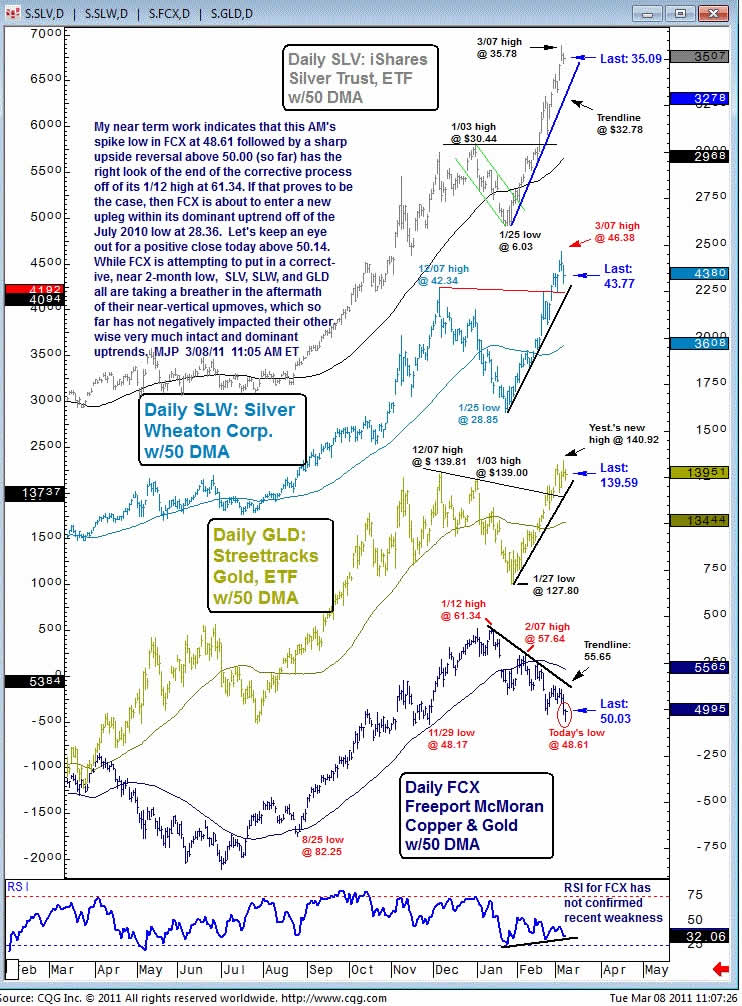

My near-term work indicates that this morning's spike low in Freeport-McMoRan Copper & Gold (NYSE: FCX) at 48.61 followed by a sharp upside reversal above 50.00 (so far) has the right look of the end of the corrective process off of its 1/12 high at 61.34.

If that proves to be the case, then FCX is about to enter a new upleg within its dominant uptrend off of the July 2010 low at 28.36.

Let's keep an eye out for a positive close today above 50.14. While FCX is attempting to put in a corrective near two-month low, the iShares Silver Trust (SLV), Silver Wheaton (SLW) and the SPDR Gold Shares (GLD) all are taking a breather in the aftermath of their near-vertical upmoves, which so far has not negatively impacted their otherwise very much intact and dominant uptrends.

Sign up for a free 15-day trial to Mike's ETF & Stock Trading Diary today.

By Mike Paulenoff

Mike Paulenoff is author of MPTrader.com (www.mptrader.com), a real-time diary of his technical analysis and trading alerts on ETFs covering metals, energy, equity indices, currencies, Treasuries, and specific industries and international regions.

© 2002-2011 MPTrader.com, an AdviceTrade publication. All rights reserved. Any publication, distribution, retransmission or reproduction of information or data contained on this Web site without written consent from MPTrader is prohibited. See our disclaimer.

Mike Paulenoff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.