Gold and Silver Profit Taking At New Highs

Commodities / Gold and Silver 2011 Mar 11, 2011 - 02:34 AM GMTBy: Jeb_Handwerger

Gold (GLD) is breaking into new 52 week highs and silver (SLV) is at its highest point in more than thirty years as Libya one of the largest oil producers faces a civil war. Libya is not following Tunisia and Egypt with a somewhat moderate transition. This revolt has been extremely violent and bloody. A lot of the fear at the moment is if protests spread to Saudi Arabia. Already there are reports of police opening fire on protestors and banning peaceful protests. This could be a game changer.

Investors are fearing the rapid rise in oil (OIL) prices may be the spark that may hurt a questionable global economic recovery as equities (SPY) sell off bringing down some miners to extremely cheap levels considering the high price of gold and silver bullion.

Countries which have created easy monetary policies and whom are still struggling with high unemployment are finding it extremely difficult to face soaring gas prices and rising fuel costs. Now Eurozone debt fears are resurfacing as Spain (EWP), Portugal, Greece, Italy and Ireland face soaring deficits. Within the United States you have troubled states with government workers demanding their benefits as states face empty treasuries.

The U.S. dollar (UUP) has a hit a new low and is in danger of significantly selling off as precious metals gain safe haven appeal. The one thing that has saved the U.S. dollar this week is Eurozone debt fears. However, next week we may hear more talk of QE3 as jobless claims remain high and as Eurozone fears resurface.

Investors have moved back into precious metals, however the gold miners (GDX) have not yet confirmed this move due to the weak equity market. All eyes are on the S&P 500 (SPY) and maintaining the 50 day moving average. If equity markets can hold up and reverse here then some of the miners should follow bullion into new highs. There may be pullbacks and occasional sell off days, however the precious metals markets remain one of the strongest multi-year trends in the market and one must be careful of being shaken off a secular bull trend and misinterpret profit taking from institutional selling.

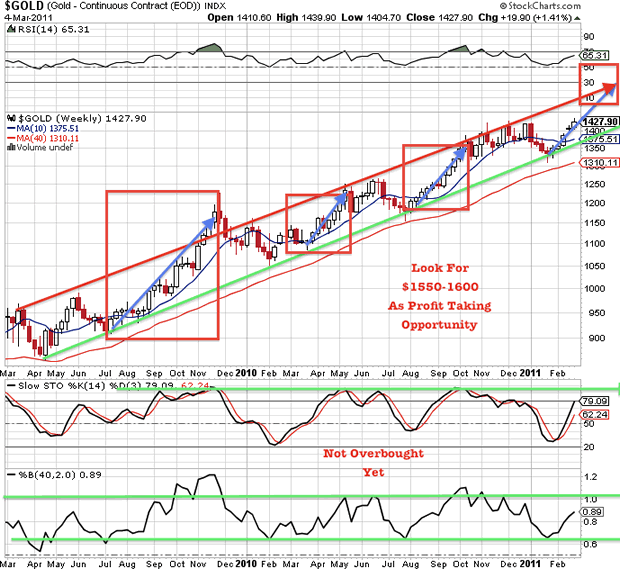

Gold (GLD) has a lot of cash on the sidelines from investors who got shaken out in January. This should lead to a measured move to at least the $1550-$1600 area on gold and the $38-40 area for silver. I believe that gold and silver will follow a similar path of its upward moves in August of 2010, March of 2010 and July of 2009. Now we must ride this wave and uptrend in precious metals and we must not forget that there may be occasional sell offs and profit taking. After 5 consecutive weeks higher, it is only natural and healthy to have some profit taking, but it shouldn't make you lose sight of the big picture and uptrend in precious metals and the danger of currencies backed by governments with soaring deficits.

Grab your free 30-day trial of my Members-Only Premium Stock Analysis Service NOW at:

http://goldstocktrades.com/premium-service-trial

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.