The Commodity Price Rollercoaster and the CRB Golden Ratio Failure

Commodities / CRB Index Mar 12, 2011 - 09:03 AM GMT Commodity prices have been on a rollercoaster ride as central banks have pumped trillions in liquidity into the global system, trying to prevent a deflationary long wave debt collapse from delivering the economic coup de gras, and driving the global economy into a natural Kondratieff (aka Kondratiev) long wave winter season bottom. Commodities are the ingredients of global economic production; they go into almost everything you buy. Investors in commodities, stocks, bonds and gold should all take note of the most powerful resistance line the CRB Index has encountered since the 2009 bottom.

Commodity prices have been on a rollercoaster ride as central banks have pumped trillions in liquidity into the global system, trying to prevent a deflationary long wave debt collapse from delivering the economic coup de gras, and driving the global economy into a natural Kondratieff (aka Kondratiev) long wave winter season bottom. Commodities are the ingredients of global economic production; they go into almost everything you buy. Investors in commodities, stocks, bonds and gold should all take note of the most powerful resistance line the CRB Index has encountered since the 2009 bottom.

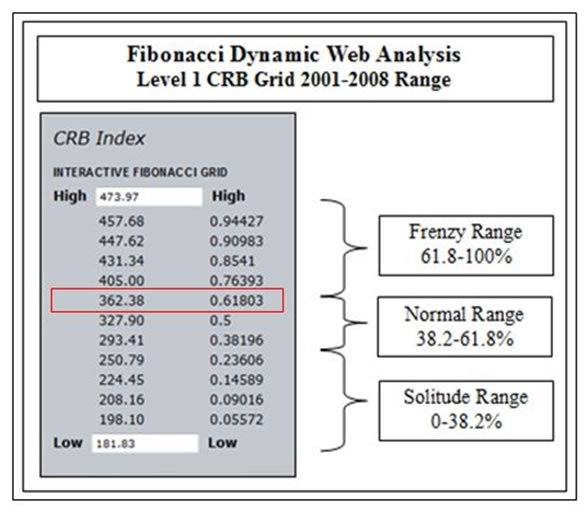

The 362.38 price target in the CRB is the golden ratio of the entire 2001-2008 commodity price edifice. It is extremely important that Mr. Market’s golden ratio just repelled the liquidity driven assault sponsored by the central banks of the developed world. Commodities ultimately have an impact all global markets, including equities and bonds, so they will have a major impact on the global economy, for better or worse.

The goal of the central banks is rather straightforward. They are trying to cajole the global economy and commodities away from the global debt driven deflationary abyss and into the arms of inflation. Their objective is to inflate away the value of the mountains of debt. Debt is an albatross hanging around the neck of the global economy. Excessive debt threatens the stability of national governments, states, municipalities, businesses and individuals that took on too much of it over the past few decades.

In recent months, it has appears as if the central bankers have succeeded with their inflationary objectives. Deflationists would be less than honest if they try to convince you that their deflationary convictions have not wavered a bit. The inflationary arguments are very convincing and the markets have been agreeing with higher prices. Commodity prices have surged, driving the cost of goods higher for producers and manufacturers world over.

However, after this weeks market action, the score is now the Fibonacci golden ratio 1, the central bankers zero. The commodity rally was turned back. Deflationists have been dining daily on humble pie as inflationists have taken the wheel of global markets, since the rally in commodities off the 2009 low at 200.16. From the 2001 intraday low at 181.83 to the 2008 intraday high at 473.97, global commodities have ridden wave after wave of central bank injected liquidity, but now the commodity rally suddenly looks fragile.

Unfortunately, in all the central banker’s calculations, they forgot about supply and demand and the fact that labor supplies are abundant, food not so much, so inflation flowed into the food prices of the emerging markets where it can be least afforded by workers. Inflation is threatening to flow down the entire global economic food chain, except for labor rates and housing prices, and spill into your gas tank, cereal bowl, and even pop out of your toaster. A mouse jumped out of our toaster the other morning, but that is another story that comes with the joys of a hundred plus year old farmhouse, and a fat cat that is a slacker. The moral here must be that when fat cats are slackers troubling things can happen.

Where the economic food chain is short, such as in most emerging countries, commodity price increases flow rapidly through the real food chain and onto dinner tables. In developed economies food processing and labor costs mute the affect of the rise in commodity prices. The anger resulting from the central bank’s inflationary objectives has now spilled into the streets. The central bankers have set the political world on fire.

It is rather odd that while hundreds of billions are being pumped by the central banks, everyone seems to need more money, but from street vendors in Egypt to the commodity pits in Chicago this week, money is increasingly in short supply. Even with central bank liquidity supposedly pouring into markets, the actual amount of money available appears to be shrinking. Global debt is a great sponge, soaking up all the liquidity the centrals banks can pump and more.

The stresses produced by the great commodity price boom engineered by central banks, and laid on the backs of hard working bread winners world over, threatens the very foundations of civilization. Of course, theory only goes so far, price is where the rubber hits the road and all the theory puts up or shuts up with prices paid, and the CRB golden ratio just sent a massive heads-up signal as the inflation vs. deflation battle rages around the globe. The central banks may be able to pump trillions more and breach the golden ratio in their battle against forces of debt deflation. If they do, inflation is back in the driver’s seat. Observing the CRB, investors and traders in commodities have a front row seat in the fight of the century. Mr. Market, on the advice of his manager the Kondratieff long wave, just landed a hard right to the inflationary policies of Chairman Bernanke.

The inflationist’s arguments are brilliant. Money supply, multiplier affects, electronic printing presses, the death of the dollar, they all make so much sense. What I can’t seem to figure out is how after all that pumping, all the trillions, why did the CRB just recoil from the golden ratio like it had touched the third rail of inflation theory. The 2008 high is still miles away.

Just remember that Mr. Market has the last word and he speaks in the language of markets called price. Right now, he is standing on the Fibonacci golden ratio in the CRB and telling the central banks and inflationists to go ahead and make his day. Inflation may yet take Mr. Market down and leave him bleeding in the back alley of some emerging market, where struggling entrepreneurs are just trying to earn enough profit to feed their families. They are fighting against the fat cat slackers that are trying to take the easy way out and slowly make all the debts go away, but they just keep getting bigger. Just watch price, especially in the CRB, this is where all the theories of inflation and deflation meet reality.

Speaking of price, if you are not observing the Fibonacci grids in the market in which you invest and trade, along with time and sentiment, you are investing and trading blindfolded. You create Level 1 grids by identifying the most important high and low in any market or security. Drilling into those grids to the next level between any two adjacent Fibonacci grid targets and on down, you can observe a detailed roadmap of intraday market action. A reader recently recognized the drill-down Fibonacci grids are “the holy trading grail” for day traders. Long-term investors are more interested in the Level 1 and Level 2 moves, like that failure that just occurred in the CRB at the golden ratio. The CRB tried to break into the Frenzy range but failed.

Until the central banks can reload their QE canons, which is now questionable due to the rising political opposition expected at this stage in the long wave winter season, the inflationist better have a Plan B. A commodity price crash is not out of the question, since the attempted breach of the golden ratio has failed. A retest of the floor of the Normal range at 293.41 is now in the cards.

Political revolts have begun sweeping the globe, freedom and liberty from central planning is the cry, including freedom from the failing market manipulation efforts of the central banks. The age of human design is ending. Human action is stepping up to the challenge and filling the void, creating order out of the chaos created by human design.

It is only now coming into focus, but objective reason is winning the day. The Internet is triggering human action and spontaneous order is trumping the chaos of human design; you are observing the objectivation of the world unfold. The looters are on notice. Ayn Rand would recognize what is occurring, as the chaos in the cities is growing and darkness threatens. Unlike the novel Atlas Shrugged, the prime movers remain hard at work, they did not leave the scene of the looters crime and head for the mountains of Colorado. Atlas is refusing to shrug. He has dropped into the heart of the action and is fighting back.

Listen to Mr. Market, who speaks the language of price, he can be manipulated, but he never lies. A modern day Jubilee has come to Wall Street. The unfolding global debt collapse will force the old order to pass away. The central banks want inflation, but their objective of global inflation has just failed a major test. A new economy will rise on the other side of the global debt disaster that looms.

Price convulsions indicate that major global change is in the wind. The central bankers are keeping their options open. They have stopped selling their gold. They are now gold buyers. Digital gold currency (DGC) is in its infancy and ascendency. The global economy is convulsing into something new. The Great Republic is dawning. All the world is the stage, enjoy the drama, and have a great weekend!

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2011 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.