In the Silver Pit No One Can Hear You Screaming

Commodities / Gold and Silver 2011 Mar 13, 2011 - 04:40 AM GMTBy: Jesse

The Bankmistress and her merry band of pranksters threw a major hissy fit this morning, smacking down the precious metals sector and related trades, like the miners, to such an extent that I put out a special notice about what I was seeing in the markets. In fear and trembling I actually stepped in and bought position in size and leverage more than ordinary, since the miners had been discounted so badly, even given the decline in the equity markets which also seemed like a trading gambit. It seems like a no-brainer now, but let me assure you at the time it seemed a bit wanton, falling knife-wise.

The Bankmistress and her merry band of pranksters threw a major hissy fit this morning, smacking down the precious metals sector and related trades, like the miners, to such an extent that I put out a special notice about what I was seeing in the markets. In fear and trembling I actually stepped in and bought position in size and leverage more than ordinary, since the miners had been discounted so badly, even given the decline in the equity markets which also seemed like a trading gambit. It seems like a no-brainer now, but let me assure you at the time it seemed a bit wanton, falling knife-wise.

As I said, I took quite a bit of that risk back off the table in the afternoon through some sales and hedging as the news from Japan appeared more grim. All too brief, but sweet nonetheless, as the Blythemaster 2000 had the metalheads backed up against the wall, and then succumbed to their uncouth charms, and gave it all up, and more. Thanks again for breakfast, sugar buns.

So now what? This is delivery time, and I will be reading the information from the Comex and also from experienced commodity traders and commentators in this area like Dan Norcini, Bill Murphy, Denver Dave, and Harvey Organ along with my own efforts to try and puzzle out where we stand with the March delivery process, and how things are shaping up for April.

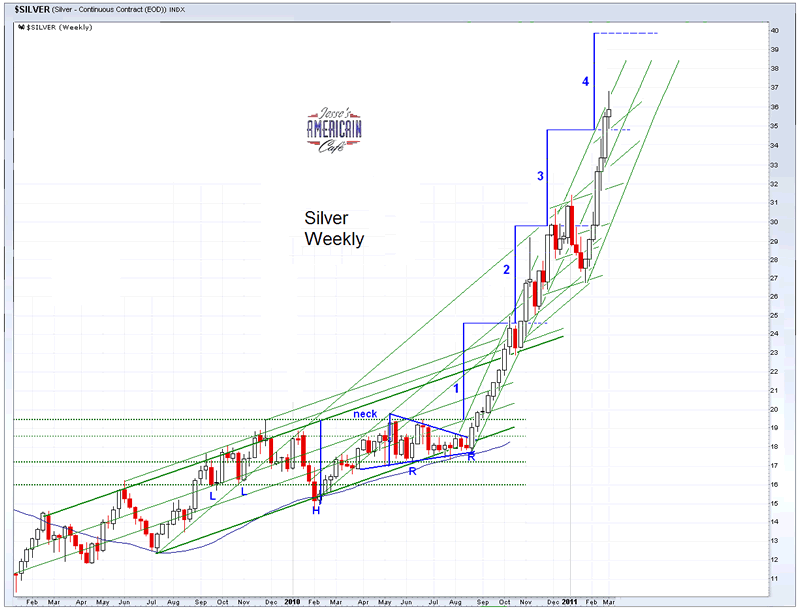

It seems to me that the shorts are just trapped, and there are no two ways about it. The bullion banks are hoist on their own petard in silver, because the central banks cannot lend it to them as they can with gold, and they are down to scraps and shell games with existing supplies.

And with this movement to take physical bullion off the market, it appears that things will only get worse for the shorts before it gets better. I would imagine that unless they can bluff their way out of this, someone is going to try and stop their twisting in the wind, as it causes too much attention to be paid to all the other antics going on with equities and key commodities.

Someone might actually demand legitimate reform. Oh, they already did. Well, perhaps they might actually do something to force the issue, like pick a key vulnerability like the silver market, and take these jokers to the wall. Oh, they're doing that as well. This is going to be quite the ride then.

This is shaping up to be an interesting year to say the least, and we may as well enjoy it while we can, because I remain very concerned about what will happen this summer in the West, if the pigmen start losing their grip on the masses, and reach for the forbidden excesses of the powerful.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.