Will Japan Earthquake Send Gasoline to $5

Commodities / Gas - Petrol Mar 15, 2011 - 03:26 AM GMTBy: Dian_L_Chu

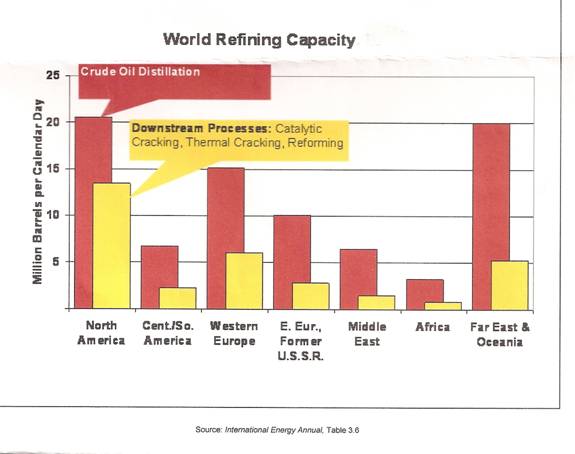

Bob van der Valk & Dian L. Chu write: The fallout on the fuel market will be severe following the 9.0 Japanese earthquake on Friday, March 11. 2011, since Japan will have to supplement their nuclear energy power production with coal, natural gas and oil-fired power plants.

Bob van der Valk & Dian L. Chu write: The fallout on the fuel market will be severe following the 9.0 Japanese earthquake on Friday, March 11. 2011, since Japan will have to supplement their nuclear energy power production with coal, natural gas and oil-fired power plants.

Information is short and hard to obtain about the status of the nuclear power plants in Japan. Not being a nuclear physicist it is hard to sort the facts from the hysteria. However, we are now hearing and seeing different versions between watching the live feeds on T.V. and Twitter as events enfold. From multiple sources, here is some information we have at the moment.

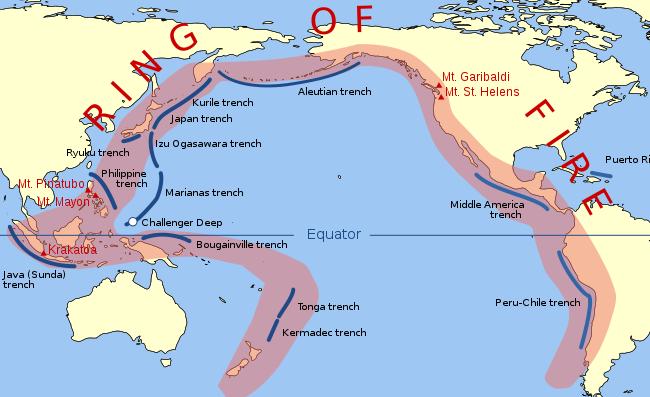

Japan is the third largest country in the world in terms of nuclear energy production, following France, and the U.S. which is in first place (see table). The country gets about 30% of its power from nuclear sources. Reportedly, 11 nuclear reactors and 21 thermal power plants where shut down after the earthquake, and BBC News put the reduction in output at Japan's nuclear power generators at anything from 25% to 50%.

On top of the loss in the power generation capacity, the Wall Street Journal reported that about 1.2 million barrels per day refining capacity in Japan is also shut down after the earthquake disaster. With this much capacity off line, Japan needs to secure alternative means of generating power and petroleum products as well.

Meanwhile, diesel fuel and coal are readily available. Cargoes of diesel fuel can be shipped almost immediately from the U.S. West Coast refineries to meet up with this new found Japanese demand.

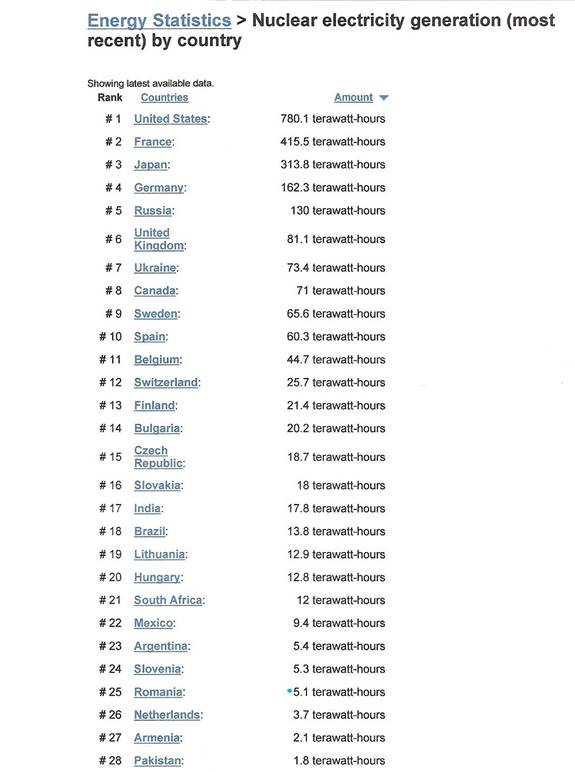

The following graph shows the world refining capacity and how much North America and Far East Asia use crude oil for fuel production:

More refineries will have to be brought into production with economics justifying their running at full capacity. It may not cause crude oil to spike up, but it will most likely test whether consumers are going to be willing to pay $5 per gallon for gasoline and diesel fuel in the U.S.

San Antonio-based refiner Valero Energy Corp. (VLO) closed their 235,000 barrels per day located on the island of Aruba in the Caribbean in July 2009, after the plant had been losing tens of millions of dollars a month.

Valero re-started their refinery near the end of 2010 because of improving economic conditions. Valero has since completed refinery wide maintenance at the plant and is ready to go at full capacity. It will be “just in time” to make up the anticipated shortfall in middle distillate demand expecting to increase after the powerful 9.0 earthquake in Japan.

Closer to Japan, one of China’s largest refineries, Sinopec, recently suspended refining operations in Maoming due to high crude oil prices. The 270,000 barrels a day plant stopped delivering fuel and petroleum products in March 2011, because the Chinese government establishes the price for fuels delivered to the market by their local refineries.

Those fuel prices set by Beijing are equivalent to crude oil prices at $85 a barrel versus today’s Brent ICE posting of $113 a barrel. The difference in the allowed fixed price for fuels and the cost of crude oil leaves privately owned refineries in China with a negative crack spread.

PetroChina Co Ltd, which is Asia’s largest oil and gas company, has been having similar difficulties. It has been losing money in their oil refining segment resulting from an increase in crude oil prices due to the unrest in North Africa and the Middle East.

Now, diesel fuel prices on the U.S. West Coast are already amongst the highest in the country, and will be impacted by the March 11th earthquake in Japan. The bulk of the price action will likely fall on diesel fuel, but crude oil could be affected as well.

In the end it will not be about the price of Brent or West Texas Intermediate (WTI) crude oil, but refineries being geared up to keep up with new found demand from Japan for their fuel products.

About Bob van der Valk - Mr. ven der Valk is a Petroleum Industry Analyst with over 50 years of experience in the oil industry. He has been often quoted by news media, most recently by Los Angeles Times, and his opinions solicited by government entities, in addition to his daily business of managing large scale supply and marketing operations

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://econforecast.blogspot.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.