Silver Bullion Coin Premiums Rise; Asian Demand for Gold Robust

Commodities / Gold and Silver 2011 Mar 16, 2011 - 06:56 AM GMTBy: GoldCore

Markets have recovered somewhat from the recent sharp sell offs despite the worsening nuclear situation in Japan. Gold and silver have made very tentative gains from the falls seen yesterday as commodity and equity markets (and the Nikkei in particular) have stabilised somewhat after the recent sharp falls.

Markets have recovered somewhat from the recent sharp sell offs despite the worsening nuclear situation in Japan. Gold and silver have made very tentative gains from the falls seen yesterday as commodity and equity markets (and the Nikkei in particular) have stabilised somewhat after the recent sharp falls.

Precious metals experienced margin-related selling yesterday as traders on the COMEX liquidated contracts. This again shows gold's benefit as an important source of liquidity to financial markets in a crisis.

Today could see further selling on the COMEX, but physical demand for bullion remains robust with continuing safe haven demand due to geopolitical, macroeconomic and now real environmental concerns.

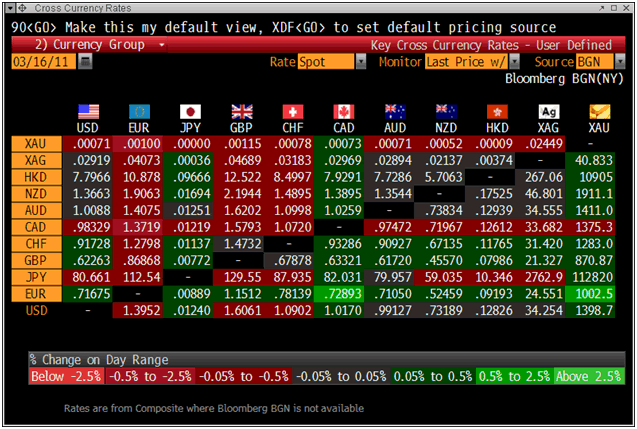

While gold and silver fell by more than 2% and 4% respectively yesterday, physical demand remains very robust - particularly in Asia. Premiums on gold bars in Shanghai were quoted at $5.43 over spot yesterday and Indian ex duty bullion bar premiums were $5.16 (London AM fix) and $4.08 (London AM fix). In Vietnam gold traded at $33.08 premium to world gold.

While Singapore spot prices remained at $1.00 over world gold, one dealer told Reuters that "supplies are still limited". In Hong Kong, premiums for gold bars were offered in a wide range from 90 cents over spot London prices to as high as $1.70. Reuters comments that this is "reflecting an illiquid market".

Premiums on silver eagles (1 ounce) in the wholesale market have been rising gradually in recent days which suggests that the surge in demand seen for silver bullion coins (partly due to Max Keiser's 'buy silver' campaign) continues and may be leading to a less liquid market for silver bullion coins.

Japan is struggling to avert a full blown nuclear meltdown and it is highly imprudent to suggest that there will not be serious economic ramifications from the tragedy.

It is already leading to further currency debasement with the Japanese having injected trillions of yen into markets in recent days and further damaging their already precarious national balance sheet. Japan doubled an asset-purchase program to 10 trillion yen ($124 billion) on March 14.

The Bank of Japan added 5 trillion yen ($62 billion) to the system again today after pouring in a record 15 trillion yen on March 14 and 8 trillion yen yesterday in one-day funding. That comes to some $360 billion in the last 3 days.

It seems almost certain that Japanese investors and institutions will sell a large quantity of their US Treasurys (nearly $900 billion) which will lead to higher US interest rates. The last thing the over indebted, fragile US economy can handle. This may explain the dollar's recent sickly performance and failure to make any gains in recent days despite market panic.

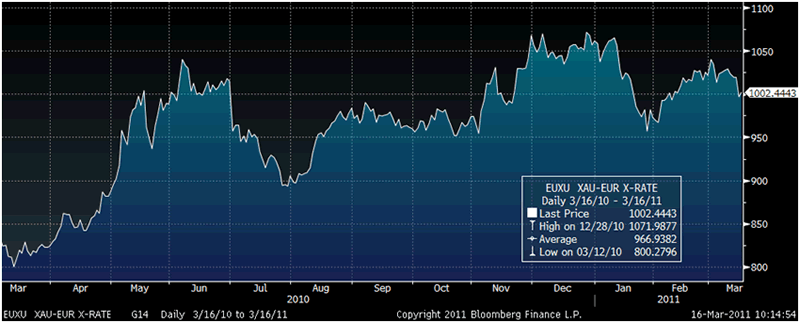

Concerns of contagion in Eurozone debt markets are now rightly being superseded by concerns of nuclear contagion in Japan. However, Portugal's downgrade and Ireland's 10-year government debt hovering over 9.5% strongly suggests that the worst is far from over in the eurozone debt crisis which should lead to higher gold in euro terms in the coming months.

Gold

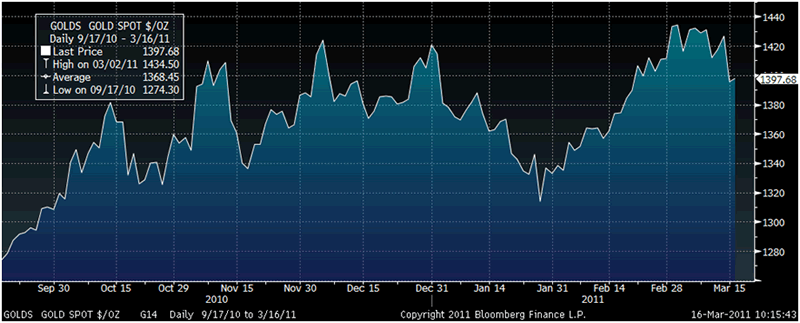

Gold is trading at $1,400.11/oz, €1,004.67/oz and £871.58/oz.

Silver

Silver is trading at $34.38/oz, €24.67/oz and £21.40/oz.

Platinum Group Metals

Platinum is trading at $1,709/oz, palladium at $705/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- Gold Bulls Likely to Return on Price Dips: Technical Analysis

Gold will probably attract buyers on declines toward $1,325 an ounce with the medium-term bull trend targeting a record $1,460 to $1,500 an ounce, according to technical analysis from Barclays Capital.

"Failure to hold above support in the $1,390 area was not unexpected," according to a report from analysts including Phil Roberts. "We would look to buy any dips toward support in the $1,325 area. Our greater view remains bullish."

Bullion for immediate delivery traded little changed at $1,396.63 an ounce today after dropping to $1,381.22 yesterday, the lowest level in a month. The price climbed to a record $1,444.95 an ounce on March 7. Asian shares climbed for the first time in five days, rallying from declines stoked by the risk of geopolitical tensions in the Middle East and radiation leaks from a nuclear power station after Japan's strongest earthquake on record.

"A close back above $1,405 would encourage our bullish view, although breaking above $1,435 is needed to confirm new highs through $1,445," the report said. "Breaking below the 50- and 100-day averages near $1,380 would increase the risk of a deeper fall toward $1,360."

In technical analysis, analysts study charts of trading patterns to try to predict changes in a security, commodity, currency or index.

(Bloomberg) -- Gold Advances From One-Month Low as Asian Shares, Crude Recover

Gold advanced, recovering from the lowest level in a month, as Asian equities and oil rebounded after the twin risks of geopolitical tensions in the Middle East and Japan's strongest earthquake shook investor confidence.

Immediate-delivery bullion rose 0.4 percent to $1,401.63 an ounce at 3:13 p.m. in Singapore, after slumping as much as 3.2 percent to $1,381.22 yesterday, the lowest level since Feb. 17. The April-delivery contract in New York added 0.6 percent.

"There's some bargain-hunting after not only gold but commodities saw a sharp sell-off across the board as investors sought the safety of cash," said Park Jong Beom, senior trader with Tongyang Futures Co. in Seoul. "A rebound in stocks also brought some relief to investors."

The Standard & Poor's GSCI Index of 24 commodity futures tumbled 3.8 percent yesterday, the biggest drop since July 29, 2009, on concern that a nuclear accident outside Tokyo may threaten the global economy. Asian stocks jumped 3 percent after a 5 percent decline yesterday, the most since November 2008, while oil in New York rebounded from a two-week high.

"Financial markets stay focused on Japan's nuclear power crisis and the impact it could have on the global economy," said Ong Yi Ling, Singapore-based analyst with Phillip Futures Pte. "While gold could be caught in a widespread sell-off of risk assets as investors convert holdings to cash, the safe- haven properties of gold could help support prices."

A second fire in as many days broke out at a Japanese reactor hours after more quakes struck a country battling to avert a nuclear meltdown following last week's 9.0-magnitude temblor and tsunami.

Bahrain Protests

The Saudi Arabian-led military intervention in Bahrain failed to end demonstrations in the island-kingdom, while in Libya, Muammar Qaddafi, appearing with a small group of supporters on state-run television, vowed to fight rebel "rats" and said "we are going to destroy them."

"Geopolitical tensions are likely to continue to set the tone of trading in the near term," Barclays Capital's analysts including Gayle Berry wrote in a report yesterday. "We retain a positive view on gold as many of the long-term investment drivers remain intact amid low interest rates."

The Federal Reserve yesterday reaffirmed its plan to buy $600 billion of Treasuries through June. In an upgrade of the central bank's economic outlook, Chairman Ben S. Bernanke and his colleagues removed language that the recovery is "disappointingly slow" and that "tight credit" is holding back consumer spending.

Palladium for immediate delivery increased as much as 1.2 percent to $712.75 an ounce before trading at $705. The metal slumped 5.6 percent yesterday. Platinum dropped 0.8 percent to $1,685.73 an ounce, following a 3 percent loss. Cash silver rose 0.6 percent to $34.44 an ounce after sliding 4.7 percent. Prices touched $36.7525 on March 7, the highest since 1980.

(Bloomberg) -- Yen Libor Jumps to Highest Since December 2008 on Quake Damage

Yen borrowing costs between banks in London jumped to the highest level in more than two years as lenders hoarded the currency after the nation's worst earthquake.

The London one-day interbank offered rate, or Libor, for yen loans climbed 38 basis points to 0.491 percent yesterday, the highest level since Dec. 9, 2008, according to the British Bankers' Association. Libor for one week gained 9 basis points to 0.206 percent, the most since April 16, 2009, while the rate for three-month loans added about one basis point to 0.2 percent.

"During yesterday's London trading, pressure increased to swap currency from dollars to yen," Yoichi Muto, director at the Tokyo branch of Commerzbank AG. "Some foreign banks couldn't help but raise rates and secure funds because certain financial institutions were hoarding yen and not investing."

The yen was at 80.85 per dollar as of 1:47 p.m. in Tokyo from 80.72 yesterday in New York.

The Bank of Japan added 5 trillion yen ($62 billion) to the system today after pouring in a record 15 trillion yen on March 14 and 8 trillion yen yesterday in one-day funding. It doubled an asset-purchase program to 10 trillion yen on March 14.

(Bloomberg) -- Vietnamese May Be Holding 500 Tons of Gold, Lao Dong Reports

Vietnamese people may be holding about 500 tons of gold at home, Lao Dong newspaper reported, citing the Vietnam Gold Council.

Economic instability may have prompted people to keep gold, according to the report.

Our prayers and good wishes are with the people of Japan in this tragic time.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.