Risk of Full Blown Financial Crisis - Technicals at a Critical Juncture

Stock-Markets /

Financial Markets

Nov 10, 2007 - 12:35 AM GMT

By: Brian_Bloom

What we are now watching is no longer an intellectual game for the purpose of making money. It is real, and the stakes are far higher than just money.

What we are now watching is no longer an intellectual game for the purpose of making money. It is real, and the stakes are far higher than just money.

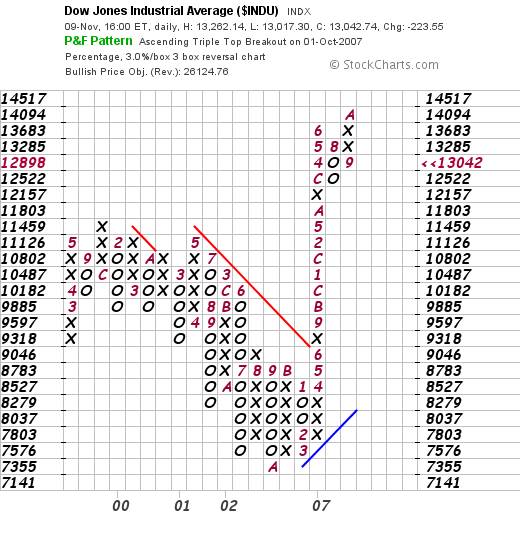

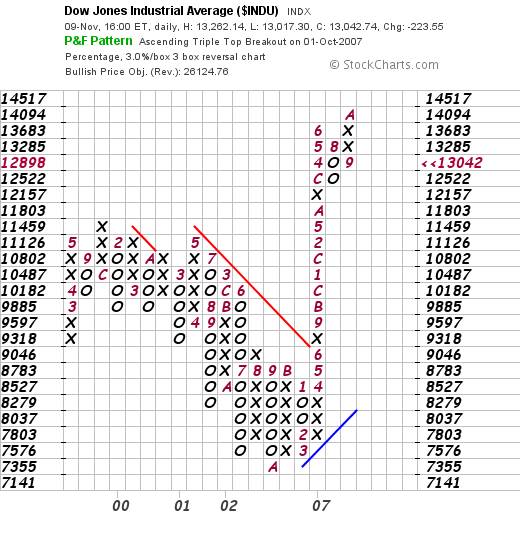

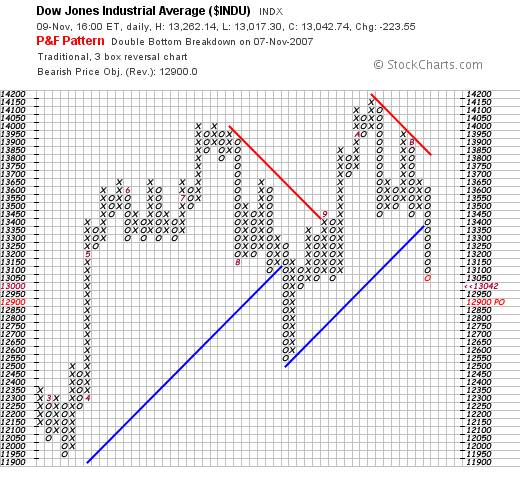

In context of my most recent article a couple of days ago, the following two charts show just how critical the juncture is that we have reached:

If the target of 12,900 in the latter chart is achieved, and holds, then the Dow will come to rest above the Dow Theory “sell signal”, and the first chart will remain bullish.

If it bounces “up” from that (or any higher) level, the bear market will be avoided (for the time being)

If it breaks “down” from there then it's all over bar the shouting.

Will it break up or down?

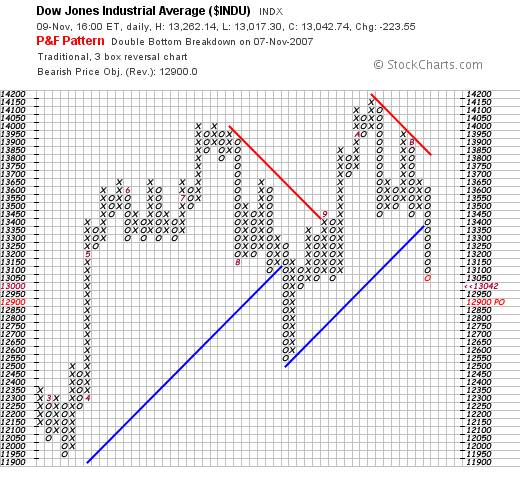

The market is indecisive – as can be seen from the following chart of gold divided by the Dow, which has reached a double top

If I had to guess, I would guess that the various markets will bounce rather than break. (This time around)

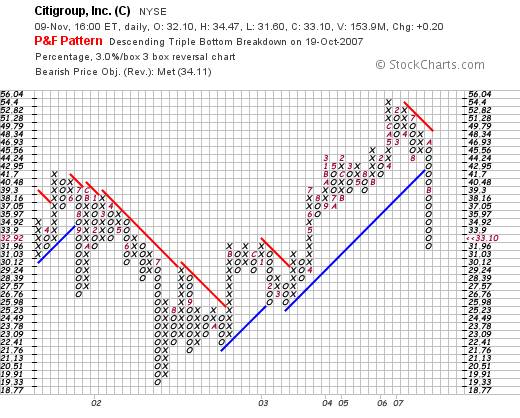

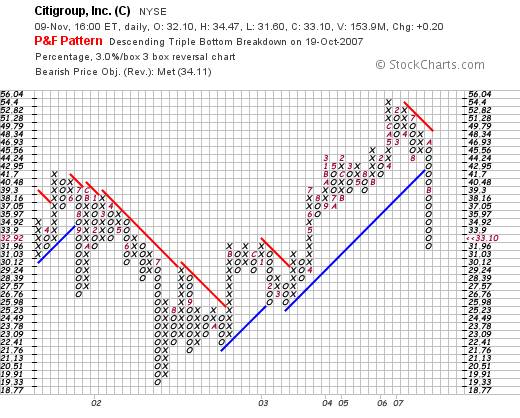

Another really worrying chart is this one of Citigroup:

This chart has reached its measured move based on vertical count

Further, the less sensitive 5% X 3 box reversal shows Citi still in a bull trend

The $29 level has to hold.

Will it hold?

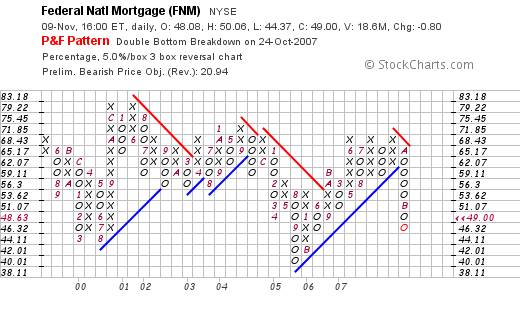

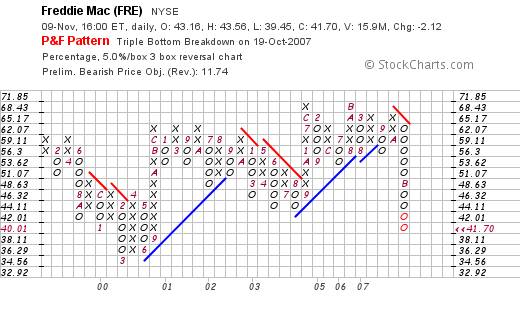

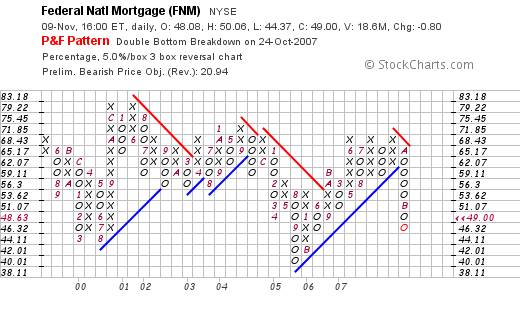

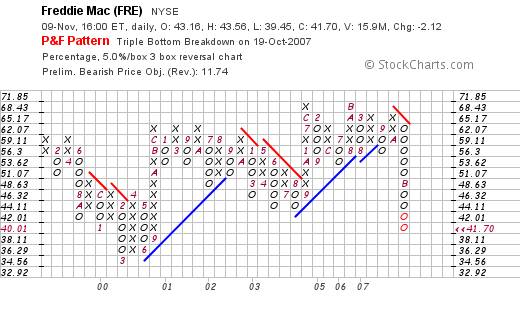

Not sure. The following two charts of Fannie Mae and Freddy Mac suggest not

Fannie Mae has a measured move target of $20.94

Freddy Mac has a measured move target of $11.74

If the US property market dies, it's hard to see how the banks will be able to hold up. If the banks can't hold up then it's hard to see how the Dow Industrials will hold up.

Conclusion

Any “bounce” from these levels will likely represent an opportunity to get out.

The Goldollar Index below suggests that the “inverse” move between gold and the US Dollar is now shifting to favour gold.

The “key” question is whether or not the Euro price of gold will break to a new high (chart up to date to November 5 th 2007 )

My “gut feel” (unsubstantiated) is that if the Dow breaks down, the ratio of Gold:$Indu will break up and, if that happens, the Euro price of gold will rise to new highs.

Under those circumstances, we will likely experience a full blown crisis of confidence in the financial markets.

Probabilities of that happening? Subjectively and unsubstantiated, 60:40

This is no longer an intellectual game. It's real. This is not business as usual. If the markets collapse, the entire infrastructure of society will likely come under threat because, for example, we have passed ‘peak oil'. If investment confidence goes, how will we adapt to that particular problem? Guys, it's not about making money this time around. It's about survival.

I for one do not want to witness a full blown crisis of confidence. We absolutely need to hold it all together in order to allow time for a migration to new energy paradigms.

Cheers

By Brian Bloom

www.beyondneanderthal.com

Since 1987, when Brian Bloom became involved in the Venture Capital Industry, he has been constantly on the lookout for alternative energy technologies to replace fossil fuels. He has recently completed the manuscript of a novel entitled Beyond Neanderthal which he is targeting to publish within six to nine months.

Author's comment - It appears that the authorities have not yet come to understand the subtleties and/or the nuances of the statement that “energy drives the world economy”. An unholy alliance between the Banking Industry, the Fossil Fuel Industries, Big Business and the Politicians has given rise to a life-threatening accident that is now waiting to happen.

The time has come for the world to begin migrating to a new platform of industrial, consumer and transport technologies which will be driven by electromagnetic energy. There are three such energy technologies which are introduced in my novel, Beyond Neanderthal , which is targeted for publication in March 2008. The logic which underpins these technologies is compelling. If embraced, they have the capacity to usher in a new era of human evolution.

By means of its entertaining storyline, Beyond Neanderthal explains both the logic and the technologies themselves, and also articulates a clear pathway forward. If taken, this pathway will enable us to extricate ourselves from the quagmire into which we have been led by the unholy alliance of self-interested groups. There is still a window of opportunity to act – but the evidence suggests that this window will begin to close around 2012. Please register your interest to acquire a copy of the novel at www.beyondneanderthal.com .

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

Greg Price

11 Nov 07, 14:57

|

Gold Stocks

Brian; If we do indeed get a big market meltdown, I think gold will Gap up ; however I am not sure about the gold stocks and I have to think they will also get smashed, what do you think? Thanks Greg

|

Brian_Bloom

11 Nov 07, 15:03

|

Gold Price to Head North With a Vengence

Hi Greg, The monthly chart below shows that gold shares are in a Primary Bull market – having risen to new highs. http://www.marketoracle.co.uk/images/bloom_11_11_07image001.jpg This next chart shows gold shares have been consolidating relative to gold http://www.marketoracle.co.uk/images/bloom_11_11_07image002.gif Arguably there is a head and shoulders top – but it is relatively “tame”. The ratio might fall to 0.20 There is also a “high pole warning on gold shares on the following P&F chart http://www.marketoracle.co.uk/images/bloom_11_11_07image003.jpg But in context of the first (opening) chart – and the next (less sensitive) P&F chart I think the pull back will be restricted to a “technical reaction” http://www.marketoracle.co.uk/images/bloom_11_11_07image004.jpg Bottom line: “If” the Industrial markets tank (which I suspect will not happen this week, but might well happen at some time in the future) the gold shares will probably get caught in the down draught. However, I agree with you that “if” the industrial market tanks, the gold price will likely head North with a vengeance. It would follow that, under such circumstances, gold shares will ultimately start to rise again. There is one caveat: If the Industrial markets tank, the capital markets are likely to become frozen. Banks will pull back savagely on their lending, and new equity raisings will dry up. There are a lot of undercapitalised little mines that will find it impossible to raise the capital they need to stay alive. Hope this helps. Note: I’m not making any recommendations here; merely telling you what the charts “seem” to be telling me. Cheers BB

|

John Willing

11 Nov 07, 15:08

|

how defensive should an investor be right now?

Hello Mr. Bloom, Thank you so much for your excellent article you have posted on Market Oracle. I sense your urgency about the markets, and wonder how defensive we should be with our assets? I'm not in debt anywhere, but our assets are most heavy in stocks (mainly precious metals) and I'm hearing we should get our stock certificates out of the internet brokers in paper form and put them in safekeeping. How do you feel about that? Of course there is expense involved, and a lot of bookkeeping too, but having something is a lot better than nothing! Thanks for your thoughts. JW

|

Brian_Bloom

11 Nov 07, 15:11

|

High Risk of Industrials Crashing

Hi John, Thanks for your query. I think its important to focus on the fact that, this time around, the financial environment is different from (say)1929 in one way: Consumers have come to depend on credit. In 1929, although the primary cause of the crash then was a debt implosion, the Fed was only 15 odd years old and debt was really a "surface" problem. This time around, debt is a cancer in society. If the capital markets dry up, it will be like a terminally ill patient that has been taken off oxygen. For example, marginal gold mines will find themselves unable to get funding to stay alive. Therefore, in answer to your question (which is not a recommendation, and I cannot accept responsibility) if it was me, I would not only get title to my shares, I would get out of any listed shares where the underlying company is seriously undercapitalised. Having said all this, I am not calling for a crash. I am merely flagging the increasing risk of its occurrence. Frankly, if the industrial markets do crash, I am not sure what the 'final' outcome will be. For one thing, whilst I am certain in my mind that electromagnetic energy is the way to go; and I have identified a couple of seemingly plausible and compellingly sensible technologies, they will require upwards of half a billion dollars to commercialise across the planet - provided the purchasers of the "Personal Electricity Generators" that these technologies will facilitate are given credit to fund the purchases of these PEGs. If capital markets dry up, where will the consumers get the funds to buy the generators? The economy will spiral downwards. Given both Peak Oil and Climate Change, it follows that the very last thing in the world we can afford right now is a market crash and it must be avoided at all costs. Please tell your friends about Beyond Neanderthal, my forthcoming novel. I have been thinking about these problems for over 20 years and I can see no other answer. Humanity must migrate from fossil fuels; and Nuclear Fission is not the answer. Nuclear Fission will just bring with it a whole raft of different problems. As a starting point to healing, we also have to put in a screening mechanism for political candidate eligibility. Politics is the only “profession” in the world where there are no barriers to entry, because no qualifications are required other than personal charisma. That is nothing short of ridiculous. Kind Regards, Brian Bloom www.beyondneanderthal.com

|

What we are now watching is no longer an intellectual game for the purpose of making money. It is real, and the stakes are far higher than just money.

What we are now watching is no longer an intellectual game for the purpose of making money. It is real, and the stakes are far higher than just money.

![]()