Silver Set For All Time Record Quarterly Close - Gold to Silver Ratio On Way to 17 to 1 as per 1980?

Commodities / Gold and Silver 2011 Mar 31, 2011 - 05:34 AM GMTBy: GoldCore

Gold and silver have consolidated on yesterday’s gains as inflation, geopolitical and eurozone debt concerns support. Silver has risen above its 31 year record closing price of yesterday and looks set to target new record nominal intraday highs above $38.16/oz.

Gold and silver have consolidated on yesterday’s gains as inflation, geopolitical and eurozone debt concerns support. Silver has risen above its 31 year record closing price of yesterday and looks set to target new record nominal intraday highs above $38.16/oz.

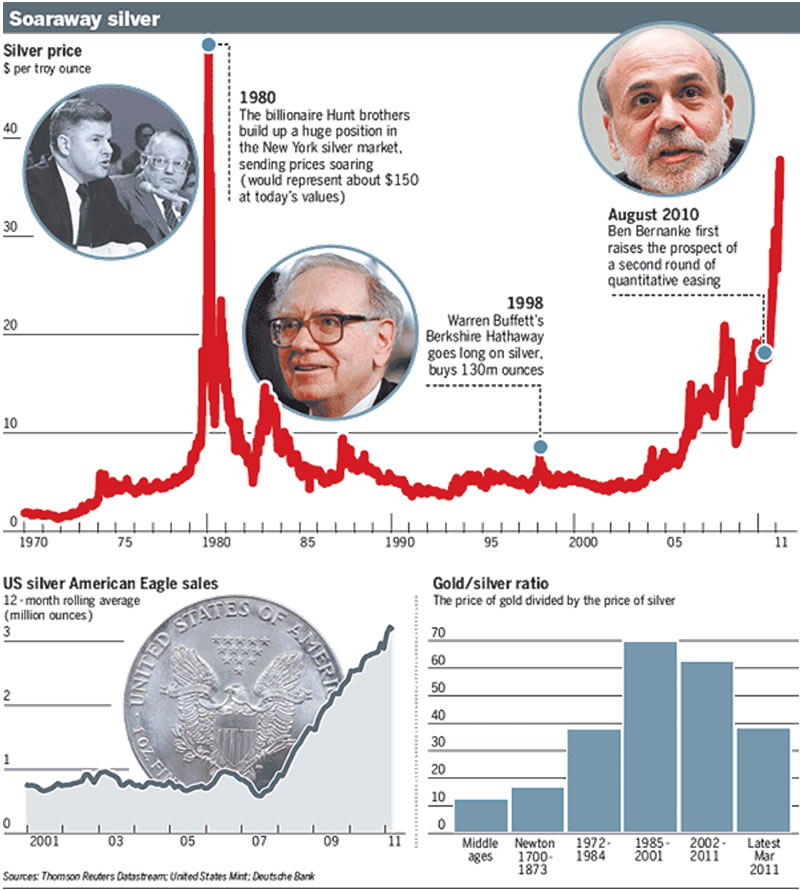

‘Poor man’s gold’ is set for a record nominal quarterly close which will be bullish technically and set silver up to target psychological resistance at $40/oz and then the nominal high of $50.35/oz . Silver’s record quarterly close was $32.20/oz on December 31st, 1979.

While silver is up 22 percent this year and is heading for a ninth straight quarterly advance, its fundamentals remain very sound. With gold above its nominal record of 1980, poor man’s gold continues to be seen as offering better value. To the masses in India, China and Asia, silver is the cheap alternative to gold and an attractive store of value and hedge against inflation and debasement of paper currencies.

Increasing global investment and industrial demand in the very small and finite silver bullion market is a recipe for higher prices. Thus, as we have long asserted the gold silver ratio is likely to revert to its long term average of 16 to 1.

A return to a ratio of 16 to 1 is likely due to basic supply and demand and the geological fact that there are 16 parts of silver for every one part of gold in the earth’s crust.

The fact that a huge amount of silver has been used in industrial applications and consumer items since the industrial revolution of the 19th century makes a return to the 16 to 1 ratio likely in the long term.

$40/oz silver may offer psychological resistance and could see profit taking but those buying silver are strong hands who rightly believe that silver will very likely reach its 1980 nominal high of $50.35/oz. Real silver bulls believe that silver may reach its inflation adjusted high of $150/oz (see Financial Times Infographic below).

A tiny minority of retail investors have begun to look at silver but it remains largely the preserve of the smart money, a very small amount of hard money advocates in the U.S. and of store of value buyers in Asia. Much of the price gains seen recently may be due to banks closing out some of their massive concentrated short positions which are being investigated by the Commodity Futures Trading Commission (CFTC).

NEWS

(Bloomberg) -- Faber Says Investors Should Hold Gold Amid U.S. Monetary Policy

Marc Faber, publisher of the Gloom, Boom & Doom report, said investors should have from 10 to 20 percent of their portfolio in gold as an inflation hedge.

“I want to buy more gold,” said Faber in an interview in Mexico City today. “Each time that I see Mr. Bernanke, and each time Mr. Tim Geithner opens his mouth, I feel like buying more gold and silver.”

Federal Reserve Chairman Ben S. Bernanke kept plans to buy $600 billion of Treasuries through June. Bernanke said last month the U.S. needs faster employment growth for a sufficient time before policy makers can be assured the economic recovery has taken hold. Meanwhile the bank will seek to hold borrowing costs “exceptionally low.”

Under current U.S. monetary policy “gold will go up substantially,” Faber said. “I own gold as an insurance policy, because I think the whole system will collapse one day.”

(Bloomberg) -- China January Gold Production Rose 6.7% (Table)

The following table shows China gold output

in January, according to Beijing-based Ministry of Industry and

Information Technology.

*T

=======================================================================

Year-to-date Jan. Dec. Nov. Oct.

2011 2010 2010 2010

=======================================================================

--------------- Tons ----------------

Total Gold Production 23.3 340.9 308.4 277.0

From Gold Concentrate 19.3 280.0 254.0 227.5

From Base Metal Smelting 4.0 60.8 54.4 49.5

------------- YTD YoY% --------------

Total Gold Production 6.7% 8.6% 9.2% 8.8%

From Gold Concentrate 8.4% 7.3% 8.5% 7.5%

From Base Metal Smelting -0.6% 15.0% 12.4% 15.3%

=======================================================================

Note: The top 5 domestic companies include China National Gold Group,

Zijin Mining Group, Shandong Gold Mining, Shandong Zhaojin Group

and Lingbao Gold.

Sources: Ministry of Industry and Information Technology.

(Reuters) -- FACTBOX-Top mines in mineral-rich Bolivia

An ongoing labor strike has forced Bolivia's San Cristobal mine to halt output and exports of silver, zinc and lead, and the conflict will likely persist since company managers and union leaders have not begun formal talks.

Mining strikes are common in mineral-rich Bolivia, a leading global supplier of zinc, silver, tin and lead.

Following are some of the biggest mines and mining groups operating in the Andean country, with output in tonnes:

NAME OWNER SILVER LEAD ZINC

San Cristobal Sumitomo 618 73,700 293,900

Manquiri* Coeur D'Alene 261

Sinchi Wayra Glencore 105 3,600 64,100

Pan American Pan American Silver 55

* Manquiri controls San Bartolome and also buys ore from

(Bloomberg) -- Bolivia Protesters Halt Operations at San Cristobal Silver Mine

Sumitomo Corp.’s silver, zinc and lead mine in Bolivia has been halted since last week by a strike, the mining ministry said. Workers at the San Cristobal mine are demanding better health care, a government official, who can’t be named because of ministry policy, said today by telephone.

Sumitomo’s San Cristobal, in southwestern Bolivia’s mineral-rich region of Potosi, is the world’s third-largest silver mine and the sixth-biggest zinc mine.

(Bloomberg) -- Gold Heads for 10th Quarterly Gain on Investment Haven Demand

Gold headed for a 10th straight quarterly rise, the longest in three decades, as turmoil in the Middle East, fighting in Libya and Japan’s nuclear crisis increased demand for an investment haven. Bullion for immediate delivery advanced 0.3 percent to $1,427.13 an ounce at 5:28 p.m. in Melbourne, taking the quarterly gain to 0.5 percent. The June-delivery contract in New York rose 0.3 percent to $1,428.50, heading for a 0.5 percent quarterly rise.

“There is a lot of uncertainty around the globe in terms of political events,” David Lennox, a Sydney-based resource analyst at Fat Prophets, said by phone today. Fighting could escalate in Libya, while there is uncertainty surrounding Bahrain and the nuclear crisis in Japan, he said.

Gold reached a record $1,447.82 an ounce on March 24 amid tension in northern Africa and the Middle East and after a March 11 earthquake and tsunami in Japan killed thousands and caused radiation to leak from a nuclear plant. Libyan rebels were forced to retreat this week by troops loyal to Muammar Qaddafi after earlier advances were helped by U.S.-led air strikes.

“We are now starting to see that the air strikes may not be completely effective against Qaddafi, and that’s going to raise the next bar,” Lennox said.

Gold advanced for nine consecutive quarters through Dec. 31, 2010, partly because investors bought the metal as a hedge against dollar and euro weakness. Gains were limited this quarter on signs the U.S. economy is improving, boosting investor appetite for higher-yielding assets like stocks.

‘Upward Advance’

“In nominal terms it has been a pretty steady upward advance, but it has come off a period prior to 2000 where we basically had 20 years of flat gold prices,” Ben Westmore, an analyst at National Australia Bank Ltd. in Melbourne, said today.

Companies in the U.S. added 201,000 workers in March, a sign the labor market may be strengthening, according to figures from ADP Employer Services yesterday. Employment increased by a revised 208,000 in February, said the report, which is based on payrolls.

Economists project a Labor Department report tomorrow will show the jobless rate held at 8.9 percent. It has fallen by 0.9 percentage point over the last three months, the biggest decline since 1983.

The Standard & Poor’s 500 index rose 0.7 percent yesterday and is up 5.6 percent this quarter. “Buoyant equities and a positive U.S. ADP employment report removed some of the safe-haven premium” in the gold market, Mark Pervan, head of commodity research at Australia & New Zealand Banking Group Ltd., wrote in a note today.

Silver for immediate delivery climbed 0.4 percent to $37.62 an ounce, heading for a 22 percent rise this quarter, the ninth straight quarterly gain. The metal has more than doubled in the past year and reached a 31-year high of $38.165 on March 24. Immediate-delivery platinum was little changed at $1,773.90an ounce and palladium gained 0.7 percent to $758.75 an ounce.

(Bloomberg) -- Six Arrested in Bundesbank Euro Coin-Forgery Scam, Prosecutors Say

Six people were arrested in a probe over 29 metric tons of forged euro coins that were cashed in at the Bundesbank, German prosecutors said.

The suspects received 1-euro and 2-euro coins from workshops in China where destroyed coins were remade, Doris Moeller-Scheu, a spokeswoman for Frankfurt prosecutors, said in an e-mailed statement today. No employees of Germany’s central bank are suspected of wrongdoing.

The Bundesbank is the only central bank in Europe that exchanges damaged coins without charging a fee, according to Moeller-Scheu. The money must be returned in bags that hold 1,000 euros worth of coins.

“The Bundesbank controls the value mainly by weighing, and does occasional visual sample test,” Moeller-Scheu said. “Then the money value is transferred to an account of the presenter or he can withdraw it from a Bundesbank account.”

Four suspects are of Chinese descent, according to the statement. They were helped by flight attendants who transported the coins in their hand luggage, for which no weigh limit applies, Moeller-Scheu said.

Lufthansa was informed that some individual employees are being investigated, Deutsche Lufthansa AG spokesman Peter Schneckenleitner said in an interview. He said the company wouldn’t comment on prosecutors’ probes.

The 29 metric tons of coins were imported between 2007 and 2010, representing a nominal value of 6 million euros, Moeller- Scheu said.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.