China Room to Increase Gold Reserves, Silver Backwardation Correction

Commodities / Gold and Silver 2011 Apr 05, 2011 - 06:09 AM GMTBy: GoldCore

Gold and silver have consolidated after yesterday’s gains although gains have been made in the Japanese yen which has fallen due to a growing realisation that the nuclear disaster is far from over and will pose massive challenges to the Japanese economy and challenges to the global economy.

Gold and silver have consolidated after yesterday’s gains although gains have been made in the Japanese yen which has fallen due to a growing realisation that the nuclear disaster is far from over and will pose massive challenges to the Japanese economy and challenges to the global economy.

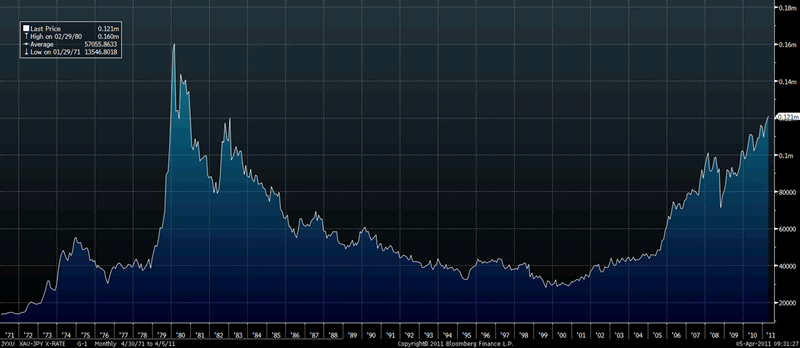

Gold in JPY – 1971 to Today (Weekly)

Gold at $1,435/oz is less than 1% from its record nominal dollar high at $1,447.82/oz. Gold for immediate delivery rose to 121,287.1 Japanese yen an ounce, the highest price since Feb. 1, 1983 (see chart above). Technically and fundamentally the yen looks very vulnerable and the record nominal high from February 1980 of over 160,301 yen is the next level of resistance.

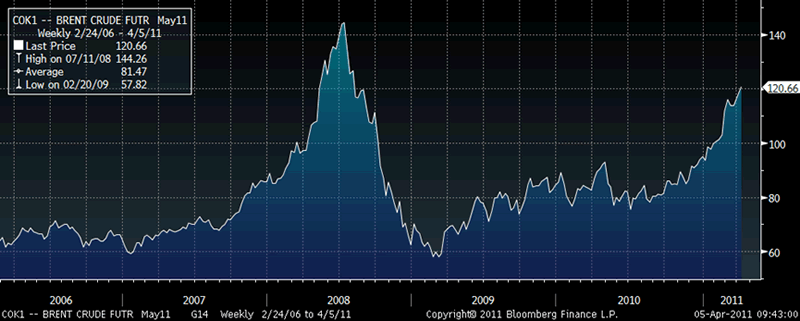

Brent Crude (USD) – 5 Years (Weekly)

With oil at new record highs in sterling and euro terms and corn and other commodities rising to record highs or close to record highs, investors are becoming increasingly wary of inflation and are buying the precious metals to hedge inflation risk.

The euro looks set to come under pressure again as the peripheral bond markets remain under real pressure and Portugal looks certain to be the next country to have to accept a “bailout”. Indeed, there is increasing speculation that certain member nations may leave the monetary union.

Silver Backwardation Correction

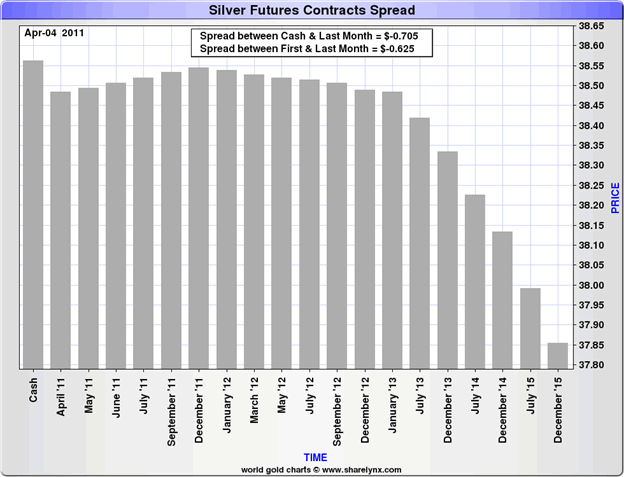

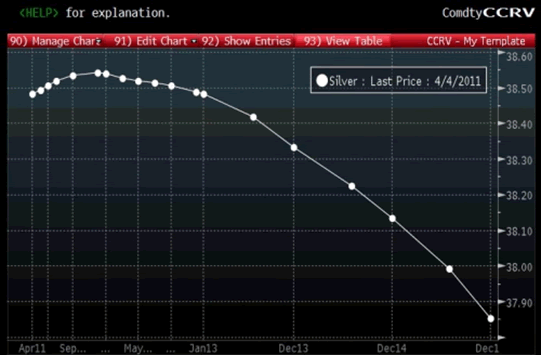

Yesterday we said that the silver futures market was no longer in backwardation based on data from Bloomberg. Nick Laird of Share Lynx sent us an excellent table that shows that silver remains in backwardation especially when one goes beyond the December 2012 contract which was as far as the Bloomberg terminal was showing.

Zero Hedge posted the excellent table below showing the extent of the backwardation out to December 2015. While, backwardation has eased somewhat, contango has only returned in the near term.

Sprott Asset Management Chairman Eric Sprott said yesterday that investment demand for silver has been enormously underestimated even as much more gold is available for sale than silver is.

Many dealers including ourselves are seeing large flows into silver and there is definitely a growing interest and a level of interest which is usually reserved for gold. Premiums are beginning to edge up again and there are reports of some dealers being unable to source enough silver coins and bars to satisfy demand.

Given the small size of the silver bullion market vis-a-vis the gold market, this level of demand is likely to lead to markedly higher prices and the psychological level of $40/oz is the next level of resistance.

JP Morgan China Chairwoman: China Room to Increase Gold Reserves - "Gold is Seen as an Alternative to Paper Currencies"

JP Morgan China managing director Jin Ulrich, told Reuters, that it is not the end of the gold rally.

Gold is seen as an alternative to paper currencies, she said. Increasing political uncertainties and rising prices would keep gold as a hedge.

"I don't think this is the end of the gold rally," Ulrich said. "Gold is seen as an alternative to paper currencies."

Ulrich said there is strong demand for gold from investors in China and that China has room to increase its gold reserves.

The remarks are interesting as shows that JP Morgan China is bullish on gold. JP Morgan have recently opened vaults for gold storage in Singapore.

Meanwhile JP Morgan retains a concentrated short position in gold on the COMEX which is being investigated by the CFTC. This is a curious dichotomy and an explanation by JP Morgan’s Head of Commodities, Blythe Masters, would be interesting. Is JP Morgan long gold in China and Asia and short on the COMEX and to what purpose? This could be some form of hedging strategy or a way to accumulate bullion on the cheap in Asia.

Gold

Gold is trading at $1,431.84/oz, €1,010.54/oz and £881.78/oz.

Silver

Silver is trading at $38.26/oz, €27.00/oz and £23.55/oz.

Platinum Group Metals

Platinum is trading at $1,777.50/oz, palladium at $776/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- JPMorgan’s Ulrich Says China Has Room to Increase Gold Reserves

China has room to increase gold reserves, Jing Ulrich, chairwoman of China equities and commodities at JPMorgan Chase & Co., said at a briefing today.

(Commodity Online) -- It is not the end of gold rally: JP Morgan Chief

J.P. Morgan China managing director Jin Ulrich, said to Reuters, that it is not the end of gold rally.

Gold is seen as an alternative to paper currencies, he said. Increasing political uncertainties and rising prices would keep gold as a hedge.

June delivery gold on the Comex in New York rose $4.10, or 0.3 per cent, to close at $1433. Yellow metal has jumped 27 per cent in the past year.

Gold rally was termed a bubble when skeptics yelled at gold way back in time, when prices stood at $250 an ounce. This continued for a while and kept on amassing followers even as gold broke through $1,000, $1,200 and now $1,400 an ounce, according to Frank Holmes in IB Times.

The director is also bullish on China, but cautious on investment risks brought forth by social tensions.

In the proposed five year plan, the country plans to build 36 million units of houses for low-income communities. Additionally, it may spend $400 billion to develop its power grid and another $750 bn to build its high-speed rail network.

The country would import coal and copper in large quantities and would also import corn and soybeans.

The director pointed out that Chinese fundamentals remain strong.

(Reuters) - JP Morgan bullish on China commodity demand, warns on social tension

Social tension in China remains an investment risk as strong demand for coal, grains and copper pushes up commodity raw material prices, Jin Ulrich, J.P. Morgan China managing director, told a conference on Tuesday.

"Investors are always looking for the potential risks that have not been discounted," Ulrich said.

"One area that we need to pay attention to is social tension. That's why the government is targetting low-income housing and inflation control to try to ease the social tension that exists."

China plans to build 36 million units of low-income housing units, Ulrich said, citing the country's latest five-year plan. In addition, China plans to spend $400 billion developing its power grid over the next five years and $150 billion annually to build its high-speed rail network. [ID:nTOE72603Y]

"By all accounts, strong infrastructure spending will be maintained during this five-year plan," Ulrich said.

"China will continue to lead commodity demand growth."

The public infrastructure spending and related higher incomes should boost demand for imports of copper and coal for the power sector and increase demand for grains like soybeans and corn, Ulrich said.

China became a net corn importer in 2010, and purchases from abroad of the grain should continue to escalate, Ulrich said.

"People are getting wealthier and they need to eat soybeans and corn."

Corn Cc1 stayed near record highs on Tuesday on continued worries over tight supplies from top exporter the United States and expected demand from China.

MONETARY POLICY

China has moved to tackle rising inflation by raising interest rates and hiking the amount of cash banks must hold as reserves as it attempts to cool the economy gradually. [ID:nL3E7F10R5]

But the tighter monetary policy is not expected to dim near-term demand for commodities, Ulrich said.

"Commodities will still be a very bright spot for the near future, despite the uncertainty brought by the restructuring of the economy, we must not forget that China's fundamentals remain very strong." Ulrich said.

Still, higher prices in China and around the globe along with political uncertainty, should keep gold in investor sights as an inflation hedge.

Gold hit a record high above 1,447 an ounce in late March.

"I don't think this is the end of the gold rally," Ulrich said. "Gold is seen as an alternative to paper currencies."

Ulrich said there is strong demand for gold from investors in China.

(Bloomberg) -- Gold Rises to 121,287 Yen An Ounce, Highest Since February 1983

Gold for immediate delivery rose to 121,287.1 Japanese yen an ounce, the highest price since Feb. 1, 1983, by 5:50 a.m. in London.

(Bloomberg) -- Wing Hing to Pay Up to $580 Million for South African Miner

Wing Hing International Holdings Ltd., a Hong Kong building contractor, will swap an 84 percent stake in itself for an 87 percent holding in South African gold miner Taung Gold Ltd. in a deal valued at $580 million. Wing Hing will issue 10.98 billion shares to investors in Taung, which has interests in two gold mining projects in South Africa with estimated combined reserves of 12 million ounces, according to a Hong Kong stock exchange filing yesterday. The company is shifting its focus to gold mining, completing the purchase of an exploration license in China’s Hebei province in July. The stock, suspended since Jan. 31, will resume trading in Hong Kong tomorrow.

The South African purchase shows “Wing Hing’s commitment to continue operating in the gold mining business,” the company said in yesterday’s statement. Taung’s managers have “depth of relevant experience,” easing execution risk, Wing Hing said.

Taung Chief Executive Officer Neil Herrick, 47, is a former manager at Anglo American Plc, Anglo Platinum Ltd. and OAO GMK Norilsk Nickel’s South African unit, according to the statement.

(Bloomberg) -- Silver Advances to Most Expensive Versus Gold Since 1983

Silver climbed to its most expensive level versus gold since 1983 as rising inflation spurred by commodity shortages, economic recovery and turmoil in the Middle East bolstered demand.

An ounce of gold bought 37.15 ounces of silver at 2:32 p.m. in Singapore, compared with an average of 62 in the past 10 years. Silver for immediate delivery has more than doubled in the past year while gold gained 27 percent, cutting the ratio from a high of 70 in June.

“Silver has yet to hit a record which means the ratio will decline further” to levels unseen since 1980, when the billionaire Hunt brothers hoarded the metal, said Hwang Il Doo, Seoul-based senior trader with KEB Futures Co. “Investor and industrial demand is strong as the economic recovery is under way and inflation becomes a worry.”

The jobless rate in the U.S. unexpectedly fell to a two- year low in March. The European Central Bank may boost interest rates this week to damp inflation that is likely to exceed its target through 2011 as the regional economy strengthens.

A United Nations index of world food prices jumped to a record in February, contributing to riots across northern Africa and the Middle East that toppled leaders in Egypt and Tunisia. Corn prices traded near a 33-month high today, while crude oil in New York hovered near the highest level since September 2008.

Silver Outperforms

Silver for immediate delivery gained as much as 0.6 percent to $38.7875 an ounce, the highest since 1980, and traded at $38.6575 an ounce in Singapore. The cash metal reached a record $49.45 an ounce in January 1980. Gold advanced 0.2 percent to $1,436.97 an ounce.

Silver is the second-best performer in the UBS Bloomberg CMCI commodity index in the past year. Holdings in exchange- traded products backed by the metal climbed for a second day on April 4, rising 22.9 metric tons to 15,395.52 tons, according to data compiled by Bloomberg.

“Funds are very bullish on silver,” said Ng Cheng Thye, Singapore-based director with Standard Merchant Bank Ltd. “It looks like silver will approach $45 an ounce quite soon. Gold will find it difficult to cross the $1,460 level because the momentum is not there.”

Investors have bought precious metals to protect their wealth against risks spurred by civil unrest in the Middle East, the Japanese nuclear crisis and financial turmoil in Europe.

Sales Double

Muammar Qaddafi’s diplomatic outreach failed to entice European leaders, as Italy rejected a reported cease-fire proposal and recognized the rebels’ interim council as the nation’s only legitimate government. In Japan, Tokyo Electric Power Co. began dumping radioactive water from its crippled plant into the sea so that it would have a place to store more highly contaminated water.

Silver will rise to $60 an ounce in the next three years, while gold will climb to $2,000 an ounce, according to Aaron Smith, managing director of Superfund Financial (Hong Kong) Ltd. and Superfund USA Inc. Smith correctly predicted record copper prices in November and a month later rightly anticipated that silver would outperform gold.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.