Silver, The Canary In The Gold Mine

Commodities / Gold and Silver 2011 Apr 12, 2011 - 05:19 AM GMTBy: Darryl_R_Schoon

Silver, the Canary in the Gold Mine was my talk at a Gold Standard Institute symposium in Canberra, Australia in November 2008. The topic could well describe today’s gold and silver markets.

Silver, the Canary in the Gold Mine was my talk at a Gold Standard Institute symposium in Canberra, Australia in November 2008. The topic could well describe today’s gold and silver markets.

Today, both silver and gold are achieving record highs but silver’s accelerating price indicates silver may indeed be the canary in the gold mine, the leading indicator for gold’s long-awaited explosive move upwards, a move the Fed and major bullion banks have colluded since the 1980s to prevent.

WHEN ELEPHANTS FLY, IT WILL BE TOO LATE TO BUY

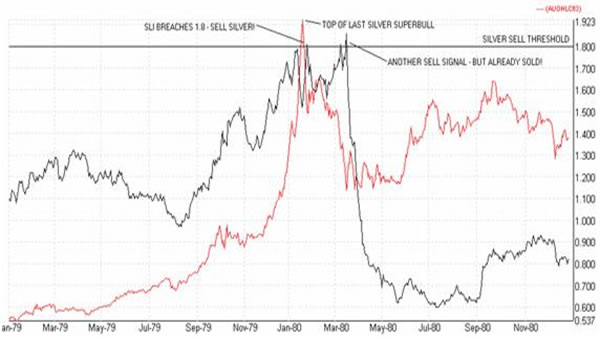

In 1979, the price of silver accelerated along with the price of gold. Silver had spent 1977 and 1978 hovering between $4 and $5 but in 1979 silver began to move upwards—as did gold.

In late January, silver moved to $5.94. Six months later, silver tripled, trading in the $16-$18 range before beginning a meteoric ascent in December, doubling from $17 to $34 , rising 33% on the first trading day in 1980 and peaking January 21st in intraday trading at over $50 per ounce, almost a 1,000 % rise in a year.

Silver (black): gold (red)

http://news.silverseek.com/SilverSeek/1174871399.php

On January 21st, gold also peaked at $850. The simultaneous top of both gold and silver is all the more metaphysically coincidental because the factors driving the two metals were far different, i.e. the gold price was being driven by inflation while the Hunt Bros.’ squeeze attempting to corner the silver market was responsible for the spectacular ascent of silver.

Now, three decades later, a similar scenario is about to unfold, albeit with a different ending. The current decade will not only repeat what happened in the 1970s but it will bring to its inevitable end that which was set in motion in 1971.

The end of paper money is now in sight.

1970s REDUX

History does not repeat itself, but it does rhyme.

Mark Twain

On August 15, 1971 President Nixon announced that the US would no longer convert US dollars to gold. For the first time in history, money was no longer gold or silver or convertible to either. On that day, because of Nixon’s actions all money everywhere became but government issued coupons with unknown expiration dates.

The reason behind Nixon’s extraordinary action was that US gold reserves had been virtually emptied by US overseas military spending. The massive outflow of US dollars needed to maintain America’s global military presence had far outweighed any corresponding inflow from America’s significant positive balance of trade.

By 1971, it was clear the US owed more far gold than it possessed. The closing of the gold window by Nixon constituted the largest monetary default in history. Now, thirty years later, the final consequences of that default are unfolding.

After 1971, governments everywhere borrowed, printed and spent even more money as gold no longer was a constraint on the global money supply. Additionally, gold was no longer exchanged in order to rectify global trade imbalances.

It was Milton Friedman—the monetary poster boy of the right—who advised Nixon to cut all ties between the dollar and gold. Friedman, like Keynes—the monetary poster boy of the left—was a strong believer in fiat money and Friedman advised Nixon that floating exchange rates would balance global trade flows. Friedman was wrong.

The 1971 cutting of ties between money and gold instead led to increasingly unbalanced trade flows, rapid increases in government debt, and by the late 1970s, increasingly high rates of inflation.

In January 1978, US inflation measured 6.84 %. In January 1979, it was 9.28 % and by January 1980 inflation had risen to 13.91 %. Gold, the traditional refuge from monetary inflation, rose accordingly. In 1978, the average gold price was $193.40. In 1979, it was $306; and in January 1980, gold spiked to $850 with inflation peaking two months later at 14.76 % in March.

In August 1979, President Jimmy Carter appointed Paul Volker to head the Fed hoping to control inflation. Volker’s aggressive rate increases brought down both inflation and the price of gold (note: Volker was also responsible for the demonetization of gold in 1971).

Today, aggressive rate increases to prevent high inflation are almost impossible. As inflation moves higher—and irrespective of distorted US figures, it is already doing so—higher Fed rates would end the Fed’s liquidity-driven recovery and cause payments on the now astronomical US debt to rise to unsustainable levels.

Expect, then, that gold will move far higher before the Fed is finally forced, if ever, to raise rates. This long-delayed reaction will cause gold to move even higher as a slowing US economy would more than offset any potential rise in the US dollar until the US dollar crashed; and, in such an event, gold would be the only safe haven left standing.

The reason why gold is not rising as rapidly as silver as in the 1970s is because since the 1980s the Fed has focused on keeping the price of gold low à la Gibson’s paradox; and, as a consequence, instead of rising equally with silver, gold is lagging and silver is leading.

Silver, however, is clearly the canary in the gold mine and as the below chart shows, silver has now broken out.

http://jessescrossroadscafe.blogspot.com/

Such a breakout of silver indicates gold could soon follow. This time gold’s explosive rise would again be fueled by rising inflation and an unexpected variant of the Hunt Bros. silver squeeze in the 1970s.

Inflation is already here. Excessive central bank liquidity and loose monetary policies since 2008/2009 have unleashed global inflationary pressures that cannot easily be controlled.

Just as inflation drove gold to a high in 1980, it will do so again today, three decades after Nixon literally pulled the gold out from under the world’s monetary foundation. Inflation is now about to finish what Nixon started, the end of fiat money is in sight.

Increasingly consumed by inflation, today’s paper currencies will worthlessly inflate ad infinitum and disappear like cotton candy into monetary oblivion like all fiat currencies. This time is no different. Gold and silver will again soar and, as in the 1970s, a short squeeze will again be a factor.

Unlike the 1970s, however, it will not be silver that is squeezed. This time it will be the bullion banks who have colluded with central banks to keep prices of gold and silver low; for as silver and gold rise, at a certain point the bullion banks will be forced to cover their enormous short positions (see below) driving gold and silver higher.

CAPITALISM’S COMING CAULDRON

THE PARADIGM SHIFTS

The collapse of paper money will make the 2008 collapse of financial markets seem like the prelude it is. Capitalism, i.e. economies based on the substitution of debt-based capital for gold, is possible only when capital, i.e. paper money issued by a central bank, is itself tied to the precious metal. In 1971, that changed.

It was the removal of gold from capitalism’s monetary foundation that sent capitalism’s endgame into motion. Thirty years later, it is reaching its destined end. What will also end is the vast inequities the system encouraged and abetted.

Nobel winner Joseph Stiglitz recently observed that the top 1 % in the US now receives 25 % of America’s income and controls 40 % of its wealth. This is to be expected as capitalism rewards those closest to the spigots of credit, i.e. bankers, and those who employ them.

All others are but temporary winners as over time the house cannot be beat—at least not until the house burns down. However, the fire has been lit—the house itself did it in 1971—and the banker’s house of cards has been burning ever since. Paper burns, gold and silver don’t.

Last week, I received an email from an 8th grade middle-school student. His school project was to interview an expert on his chosen subject, the 2008 financial collapse. He discovered that most experts had not foreseen the collapse. As I had, he approached me for some answers.

On my TV show, http://www.youtube.com/user/SchoonWorks#p/a/u/0/S2vUXrmt1tU, I provided some insights about the collapse and our present circumstances. The student was sincere and intelligent and his generation will be among those who will have to deal with the coming economic rendering. They will also be among those who will help rebuild this country.

On February 8th, the title of my blog was “Severe Earth Changes Coming”. On February 19th, a 6.3 earthquake struck New Zealand. On March 11th, a massive 9.0 earthquake devastated Japan and was followed by a 7.4 quake on April 8th. These are only the beginning. More changes are on the way.

Humanity is in the midst of a momentous paradigm shift. Governments will fall, natural disasters will increase and the present world will pass away, paving the way for the better world that is to come.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.